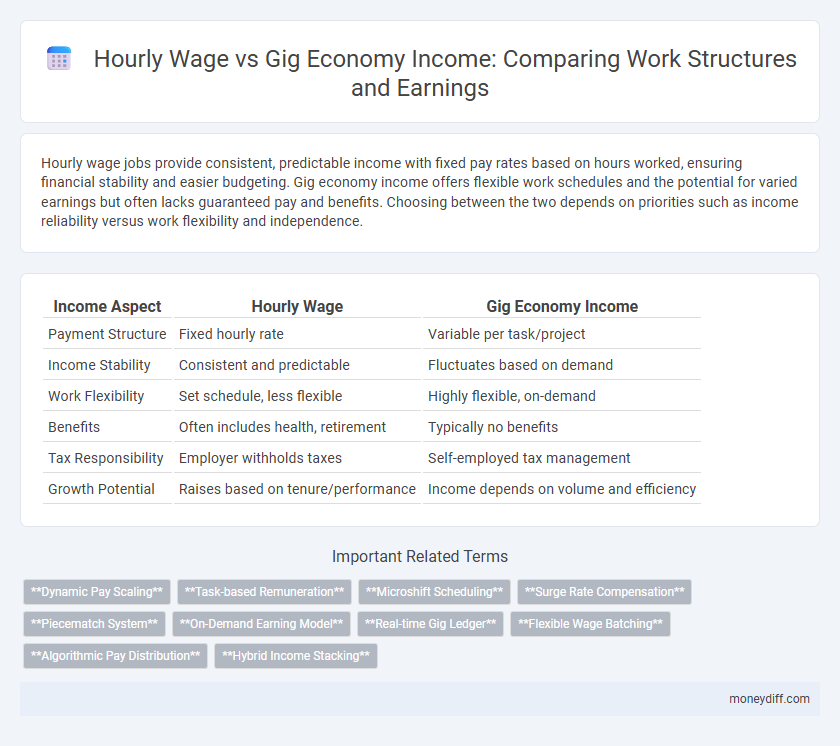

Hourly wage jobs provide consistent, predictable income with fixed pay rates based on hours worked, ensuring financial stability and easier budgeting. Gig economy income offers flexible work schedules and the potential for varied earnings but often lacks guaranteed pay and benefits. Choosing between the two depends on priorities such as income reliability versus work flexibility and independence.

Table of Comparison

| Income Aspect | Hourly Wage | Gig Economy Income |

|---|---|---|

| Payment Structure | Fixed hourly rate | Variable per task/project |

| Income Stability | Consistent and predictable | Fluctuates based on demand |

| Work Flexibility | Set schedule, less flexible | Highly flexible, on-demand |

| Benefits | Often includes health, retirement | Typically no benefits |

| Tax Responsibility | Employer withholds taxes | Self-employed tax management |

| Growth Potential | Raises based on tenure/performance | Income depends on volume and efficiency |

Understanding Hourly Wage Structures

Hourly wage structures provide a consistent payment model based on the number of hours worked, ensuring predictable income and benefits like overtime pay and workers' compensation. In contrast, gig economy income fluctuates with task availability and completion rates, often lacking traditional employee protections and steady scheduling. Understanding hourly wage dynamics is essential for evaluating job security, financial stability, and labor rights within different work structures.

Defining Gig Economy Income Models

Gig economy income models typically involve freelance, contract, or project-based work where individuals earn money per task or assignment rather than receiving a fixed hourly wage. These models offer flexible work structures, allowing workers to choose projects and hours but often lack consistent income and benefits associated with traditional hourly wage employment. Key examples include ride-sharing, food delivery, and freelance digital services, each with variable pay rates influenced by demand and worker ratings.

Pros and Cons of Hourly Wages

Hourly wages offer consistent and predictable income, providing financial stability through regular paychecks based on time worked. They include benefits like overtime pay, legal protections, and eligibility for employer-sponsored benefits but can limit earning potential due to fixed hours. However, hourly wage jobs may lack flexibility, creating challenges for workers seeking varied schedules or additional income streams.

Flexibility in Gig Economy Earnings

Hourly wage jobs offer predictable income based on fixed hours, while gig economy income varies with task availability and demand. Gig workers enjoy greater flexibility in choosing when and how much to work, enabling better work-life balance and adaptability. However, this variability requires careful income management to navigate potential fluctuations in earnings.

Income Stability: Hourly vs Gig Work

Hourly wage jobs provide consistent income with predictable paychecks, offering greater financial stability and budgeting ease. Gig economy income fluctuates based on task availability and demand, resulting in irregular earnings and potential income gaps. Workers seeking stable financial planning generally prefer hourly wages over the variable nature of gig work compensation.

Predictability of Earnings Streams

Hourly wage jobs offer a consistent and predictable income stream, with set rates and scheduled hours that provide financial stability. Gig economy income, however, fluctuates based on task availability, client demand, and market conditions, resulting in variable earnings. This unpredictability requires gig workers to manage income volatility and plan finances carefully to maintain economic security.

Tax Implications for Each Income Type

Hourly wage earners face straightforward tax reporting with consistent income statements and standard withholding, simplifying tax calculations and eligibility for benefits. Gig economy workers encounter complex tax scenarios due to irregular earnings, requiring careful tracking of income and expenses, and often needing to pay estimated quarterly taxes to avoid penalties. Understanding the distinct tax obligations for each income type is crucial for accurate filing and optimizing deductions.

Benefits and Drawbacks of Each Work Structure

Hourly wage jobs provide consistent income and access to benefits such as health insurance, retirement plans, and paid leave, promoting financial stability and worker protections. Gig economy income offers flexibility and autonomy, allowing workers to choose schedules and diversify income streams but often lacks employer-provided benefits and job security. The trade-off between predictable wages and the freedom of gig work significantly impacts overall financial planning and long-term economic resilience.

Financial Planning Strategies Based on Income Type

Hourly wage earners benefit from consistent earnings, enabling precise budgeting and regular contributions to savings or retirement plans. Gig economy workers face variable income streams, necessitating flexible financial strategies such as maintaining larger emergency funds and tracking expenses meticulously. Tailoring financial plans to each income type maximizes cash flow management and long-term wealth accumulation.

Choosing the Right Income Model for Your Lifestyle

Hourly wages provide a stable and predictable income structure, ideal for individuals seeking consistent earnings and benefits. Gig economy income offers flexibility and the potential for higher earnings by allowing workers to choose jobs and hours that fit their lifestyle. Selecting the right income model depends on personal priorities such as financial stability, work-life balance, and career goals.

Related Important Terms

Dynamic Pay Scaling

Dynamic pay scaling in hourly wage models ensures predictable income based on fixed rates and hours worked, whereas gig economy income fluctuates significantly with task availability and demand-driven pricing. This scalability allows gig workers to potentially maximize earnings during peak periods but also introduces income instability compared to traditional hourly wages.

Task-based Remuneration

Task-based remuneration in the gig economy offers flexible income opportunities where workers are paid per completed task rather than hourly, often resulting in variable earnings that depend on task availability and efficiency. Hourly wage structures provide predictable, steady income, while task-based pay emphasizes performance and volume, making it suitable for individuals seeking autonomy over their work schedule.

Microshift Scheduling

Microshift scheduling in the gig economy offers flexible, short-duration work segments that often result in variable hourly wages compared to traditional hourly wage structures with fixed schedules. This flexibility allows gig workers to optimize income by selectively choosing shifts, but may lead to inconsistent earnings and lack of steady income typical in microshift models.

Surge Rate Compensation

Surge rate compensation significantly boosts gig economy income by increasing hourly wages during high-demand periods, providing flexible earning potential unmatched by traditional fixed hourly wages. This dynamic pay structure allows gig workers to maximize earnings in real time, contrasting with the static pay model of standard employment.

Piecematch System

The Piecematch System revolutionizes income structure by enabling gig workers to earn hourly-equivalent wages through task-based compensation, balancing flexibility with financial stability. This method bridges the gap between traditional hourly wage models and gig economy unpredictability by matching workers to tasks that optimize their earning potential efficiently.

On-Demand Earning Model

The on-demand earning model in the gig economy offers flexible hourly wage opportunities that fluctuate based on real-time demand and task availability, often leading to variable income streams compared to traditional fixed hourly wages. This model prioritizes immediate job matching, enabling workers to optimize earnings by capitalizing on peak demand periods and diverse gig tasks.

Real-time Gig Ledger

Real-time Gig Ledger technology provides transparent tracking and instant updates of earnings, enabling gig workers to monitor hourly wage comparisons accurately within the fluctuating gig economy income landscape. This system enhances financial management by offering precise, up-to-date data on income streams, optimizing work structure decisions for gig-based labor.

Flexible Wage Batching

Flexible wage batching in the gig economy allows workers to accumulate earnings from multiple short-term tasks before receiving payment, contrasting with traditional hourly wage structures that provide consistent, scheduled pay. This batching approach maximizes income flow flexibility, enabling gig workers to optimize their work hours and payment frequency according to personal financial goals.

Algorithmic Pay Distribution

Algorithmic pay distribution in the gig economy dynamically adjusts hourly wages based on real-time demand, task complexity, and worker performance metrics, often resulting in variable income streams compared to the fixed hourly wage structure in traditional employment. This system leverages data-driven algorithms to optimize labor costs and maximize platform efficiency, influencing worker earnings unpredictably.

Hybrid Income Stacking

Hybrid income stacking combines hourly wages with gig economy earnings to maximize financial stability and flexibility by diversifying income streams. This work structure enables individuals to balance steady paychecks from traditional employment with variable, task-based revenue from gig platforms, optimizing overall earning potential.

Hourly Wage vs Gig Economy Income for work structure. Infographic

moneydiff.com

moneydiff.com