Business income often fluctuates based on sales, contracts, or project completions, requiring flexible budgeting and cash flow monitoring. Subscription-based income provides predictable, recurring revenue that simplifies financial forecasting and stabilizes cash flow management. Prioritizing subscription income can enhance financial stability, while balancing it with business income maximizes profitability and growth opportunities.

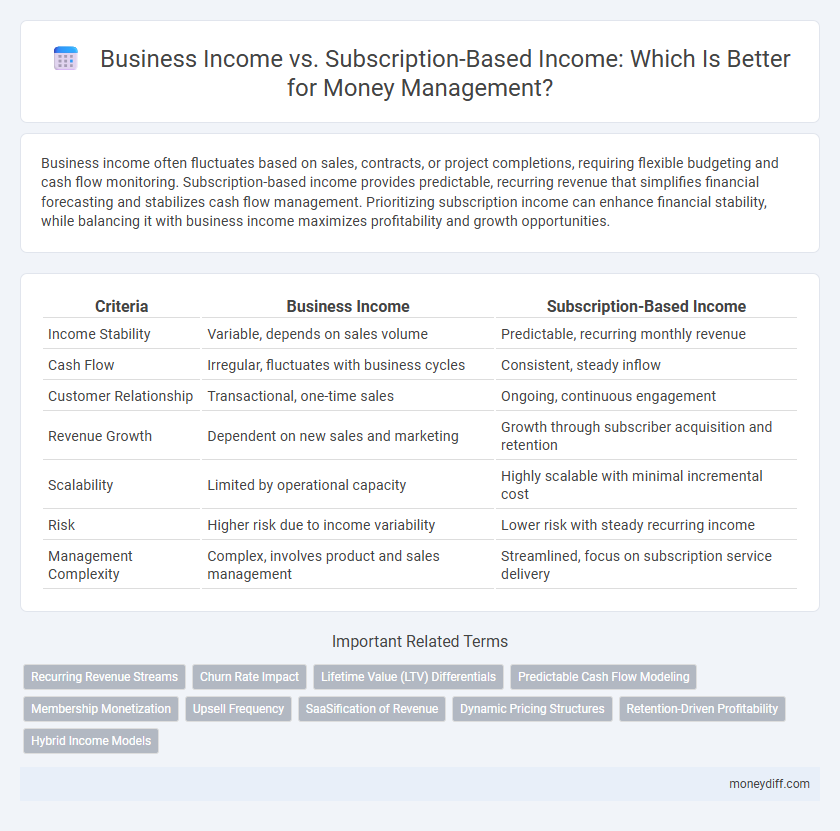

Table of Comparison

| Criteria | Business Income | Subscription-Based Income |

|---|---|---|

| Income Stability | Variable, depends on sales volume | Predictable, recurring monthly revenue |

| Cash Flow | Irregular, fluctuates with business cycles | Consistent, steady inflow |

| Customer Relationship | Transactional, one-time sales | Ongoing, continuous engagement |

| Revenue Growth | Dependent on new sales and marketing | Growth through subscriber acquisition and retention |

| Scalability | Limited by operational capacity | Highly scalable with minimal incremental cost |

| Risk | Higher risk due to income variability | Lower risk with steady recurring income |

| Management Complexity | Complex, involves product and sales management | Streamlined, focus on subscription service delivery |

Understanding Business Income Streams

Business income streams encompass diverse revenue sources such as product sales, services, and one-time contracts, generating fluctuating cash flows that require agile financial planning. Subscription-based income provides predictable, recurring revenue, enabling more stable cash flow management and long-term forecasting. Analyzing these income types helps optimize budgeting strategies and ensures sustainable business growth.

What is Subscription-Based Income?

Subscription-based income refers to recurring revenue generated from customers who pay a fixed fee at regular intervals, such as monthly or annually, for continuous access to products or services. This steady cash flow provides businesses with predictable financial planning and enables more accurate budgeting for expenses and growth. Unlike one-time business income, subscription-based models foster long-term customer relationships and enhance revenue stability.

Cash Flow Predictability: Business vs Subscriptions

Business income often fluctuates due to sales variability, seasonal demands, and client payment delays, leading to less predictable cash flow. Subscription-based income provides a steady, recurring revenue stream with predictable payments that enhance cash flow stability. Reliable subscription payments improve financial planning and reduce the risk of cash shortages compared to sporadic business sales.

Income Stability and Financial Planning

Business income often experiences fluctuations due to market demand, client acquisition, and project completion schedules, posing challenges for consistent cash flow management. Subscription-based income provides predictable, recurring revenue streams, enhancing income stability and facilitating more accurate financial planning. Prioritizing subscription models can improve budgeting accuracy, reduce financial risk, and support long-term business growth strategies.

Flexibility and Scalability of Revenue Models

Business income generated from one-time sales offers limited flexibility compared to subscription-based income, which provides predictable, recurring revenue streams that enhance cash flow stability. Subscription models enable scalability by allowing businesses to easily increase customer bases without proportional increases in operational costs. This scalability improves long-term financial planning and supports sustained growth through continuous customer engagement.

Managing Expenses with Different Income Sources

Managing expenses with business income involves variable cash flow tracking and allocating funds for fluctuating operational costs, while subscription-based income offers predictable cash inflows ideal for budgeting fixed expenses. Prioritizing emergency funds is essential to buffer business income variability, whereas consistent subscription revenue supports long-term financial planning and investment. Efficient money management requires separating accounts and categorizing expenses based on income source volatility and reliability.

Customer Retention and Lifetime Value Impact

Business income driven by one-time sales often faces volatility in customer retention rates, whereas subscription-based income ensures steady cash flow and enhances customer lifetime value (CLV) through recurring engagement. Higher customer retention in subscription models directly translates to increased CLV, reducing acquisition costs and stabilizing revenue forecasts. Effective money management leverages the predictability of subscription income, optimizing budgeting and investment strategies for sustained business growth.

Tax Considerations for Diverse Income Types

Business income is typically subject to self-employment taxes and may allow for deductible expenses such as operational costs, equipment, and employee wages, reducing overall taxable income. Subscription-based income, often categorized as recurring revenue, requires careful tracking of deferred revenue and may be taxed as ordinary income depending on the payment structure and contractual obligations. Tax planning for diverse income types involves understanding applicable tax codes, utilizing appropriate accounting methods, and consulting with tax professionals to optimize deductions and compliance.

Risk Assessment: Income Fluctuations and Security

Business income often exhibits significant fluctuations due to market demand variability, making cash flow prediction challenging and requiring robust risk management strategies. Subscription-based income provides greater security with predictable, recurring revenue streams that enhance financial stability and facilitate long-term planning. Evaluating the volatility and consistency of these income types is essential for effective money management and risk assessment.

Choosing the Right Income Model for Financial Goals

Selecting the appropriate income model hinges on aligning business income or subscription-based income with specific financial goals, as business income offers variable cash flow from sales, whereas subscription-based income provides stable, recurring revenue streams. Businesses aiming for predictable budgeting and long-term financial planning typically benefit from subscription models, which enhance cash flow visibility and customer retention. Analyzing cash flow stability, scalability, and growth objectives is critical in choosing between these income models for effective money management.

Related Important Terms

Recurring Revenue Streams

Business income often involves variable revenue from product sales or services, while subscription-based income provides predictable, recurring revenue streams that enhance cash flow stability and facilitate more accurate financial planning. Prioritizing subscription-based models can improve long-term profitability by ensuring consistent monthly or annual income, reducing revenue volatility common in traditional business income.

Churn Rate Impact

Business income typically depends on transactional sales, making cash flow more volatile, whereas subscription-based income ensures consistent revenue streams; however, high churn rates in subscriptions can significantly erode predictable earnings and complicate financial forecasting. Effective money management demands close monitoring of churn rates to maintain subscription growth and sustain reliable business income.

Lifetime Value (LTV) Differentials

Business income typically fluctuates with project completion and client acquisition, resulting in variable cash flow and unpredictable Lifetime Value (LTV) per customer. Subscription-based income offers consistent, recurring revenue streams with higher LTV due to sustained customer engagement and reduced churn rates, enhancing long-term financial stability.

Predictable Cash Flow Modeling

Subscription-based income offers predictable cash flow modeling by delivering consistent, recurring revenue streams, enabling more accurate financial forecasting and budgeting. Business income, often variable and project-based, requires flexible cash flow management strategies to accommodate fluctuations and maintain financial stability.

Membership Monetization

Business income from product sales often fluctuates with market demand, while subscription-based income from memberships provides predictable, recurring revenue streams that enhance cash flow stability and long-term financial planning. Effective money management leverages the consistent membership monetization to reduce reliance on one-time sales and supports sustainable growth.

Upsell Frequency

Business income generated through one-time sales tends to have lower upsell frequency compared to subscription-based income, where recurring payments create continuous opportunities for upselling premium tiers or add-ons. Higher upsell frequency in subscription models enhances cash flow predictability and long-term revenue growth, making it a crucial factor in effective money management strategies.

SaaSification of Revenue

Business income from traditional sales models often exhibits higher volatility, whereas subscription-based income, especially in SaaS (Software as a Service) models, generates predictable, recurring revenue streams that enhance cash flow stability and facilitate more accurate financial forecasting. The SaaSification of revenue transforms one-time transactions into continuous value delivery, improving customer retention rates and enabling scalable, long-term business growth.

Dynamic Pricing Structures

Business income often fluctuates due to dynamic pricing structures that adjust based on market demand, seasonality, and customer segmentation, resulting in variable revenue streams. Subscription-based income provides predictable cash flow with fixed or tiered pricing models, enhancing financial stability but limiting revenue flexibility compared to dynamic business income models.

Retention-Driven Profitability

Business income typically fluctuates with sales volume and client acquisition, whereas subscription-based income offers predictable recurring revenue that enhances retention-driven profitability by fostering long-term customer relationships and reducing churn. This stability allows for more accurate cash flow forecasting and strategic reinvestment, optimizing overall money management.

Hybrid Income Models

Hybrid income models combining business income and subscription-based income offer diversified revenue streams that enhance financial stability and cash flow predictability. Leveraging transactional sales alongside recurring subscription fees enables optimized money management by balancing upfront capital inflows with steady, long-term income.

Business Income vs Subscription-Based Income for money management. Infographic

moneydiff.com

moneydiff.com