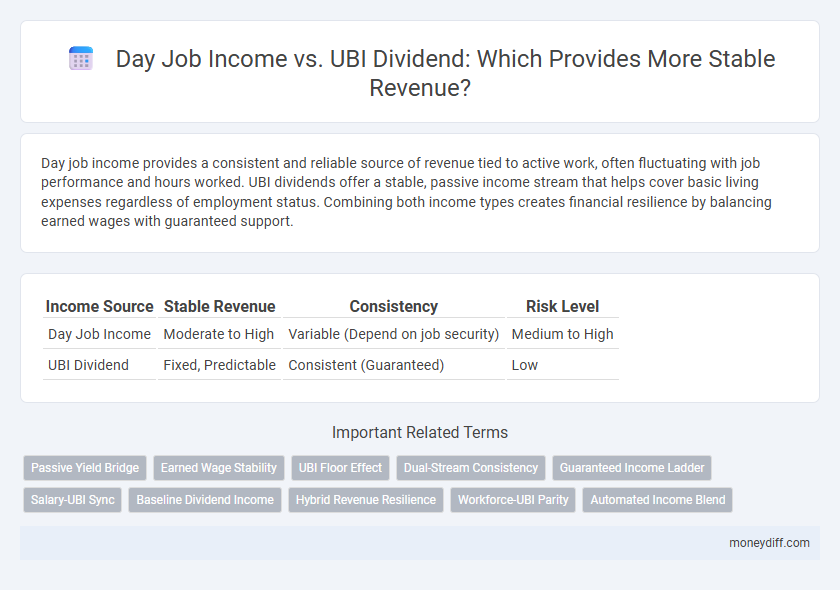

Day job income provides a consistent and reliable source of revenue tied to active work, often fluctuating with job performance and hours worked. UBI dividends offer a stable, passive income stream that helps cover basic living expenses regardless of employment status. Combining both income types creates financial resilience by balancing earned wages with guaranteed support.

Table of Comparison

| Income Source | Stable Revenue | Consistency | Risk Level |

|---|---|---|---|

| Day Job Income | Moderate to High | Variable (Depend on job security) | Medium to High |

| UBI Dividend | Fixed, Predictable | Consistent (Guaranteed) | Low |

Comparing Day Job Earnings and UBI Dividend Streams

Day job income typically provides a higher and more consistent revenue stream due to regular working hours and employer-based salary structures. In contrast, Universal Basic Income (UBI) dividends offer a steady but often lower baseline income designed to supplement financial stability without the need for active employment. Evaluating both sources highlights the trade-off between guaranteed minimal income from UBI and potentially greater but variable earnings from day jobs.

Income Stability: Day Jobs versus Universal Basic Income

Day job income provides variable stability dependent on employment status and market demand, often subject to layoffs or reduced hours, which can create financial unpredictability. Universal Basic Income (UBI) offers consistent, predictable payments independent of job performance, supporting baseline financial security regardless of economic fluctuations. Combining day job earnings with UBI dividends enhances overall income stability by mitigating risks associated with job loss or income variability.

UBI Dividend: A Reliable Alternative to Traditional Wages?

UBI dividends provide a steady income stream independent of conventional employment, offering financial stability without the constraints of a day job's fluctuating hours or layoffs. Unlike wages tied to hours worked or contract terms, UBI dividends are unconditional, reducing income volatility and enhancing economic security for recipients. This reliable revenue source can supplement or even replace traditional salaries, promoting consistent cash flow and greater financial freedom.

Evaluating Financial Security: Employment vs. UBI

Comparing day job income to UBI dividends reveals distinct financial security profiles, where employment income often fluctuates based on hours worked and job stability, while UBI provides consistent, unconditional payments regardless of work status. Employment income may offer higher earning potential and benefits like retirement contributions, but is prone to economic downturns and job displacement risks. UBI's stable revenue stream can buffer against sudden income loss, promoting baseline financial security, yet may lack the cumulative wealth-building capacity of steadier employment wages.

Predictability of Income: Salaried Jobs and UBI Compared

Salaried jobs offer predictable income through fixed paychecks that enable reliable financial planning and consistent budgeting. Universal Basic Income (UBI) provides a steady dividend designed to ensure a baseline revenue regardless of employment status, reducing income volatility. Combining salaried income with UBI dividends enhances financial stability by balancing earned wages with guaranteed support, minimizing income uncertainty.

Diversifying Revenue: Integrating UBI with Job Income

Diversifying revenue streams by integrating Universal Basic Income (UBI) with day job income enhances financial stability and reduces dependency on a single source. UBI provides a consistent baseline revenue, while job income contributes variable earnings that can increase overall cash flow. This combination strengthens economic resilience and supports sustainable personal finance management.

Impact on Cash Flow: UBI Dividend vs. Paycheck

UBI dividend provides a predictable, consistent cash flow that stabilizes monthly income regardless of employment status, reducing financial volatility. Day job income, while often higher, is subject to variability due to hours worked, job security, and market conditions, impacting cash flow reliability. The steady influx from UBI ensures better budget planning and emergency resilience compared to paycheck-dependent income streams.

Balancing Stability: Pros and Cons of Day Job and UBI

Balancing stability between day job income and Universal Basic Income (UBI) dividends involves weighing consistent wages against predictable, unconditional payments. Day jobs provide reliable earnings linked to labor efforts but may fluctuate due to employment risks, while UBI offers stable revenue regardless of work status but often lacks the sufficiency to cover all living expenses alone. Combining both income sources can enhance financial security by ensuring steady cash flow while reducing dependence on a single income stream.

Resilience Against Income Shocks: Job Loss vs. UBI Support

Day job income often fluctuates or ceases entirely during job loss, exposing individuals to significant financial instability and income shocks. Universal Basic Income (UBI) dividends provide a consistent revenue stream that enhances resilience by ensuring baseline financial support regardless of employment status. This steady UBI support reduces vulnerability to sudden income disruptions and strengthens long-term economic security.

Future-Proofing Finances: The Role of UBI in Income Planning

Day job income often fluctuates with market demands and job security challenges, making it less reliable for long-term financial stability. Universal Basic Income (UBI) dividend provides a consistent revenue stream that can buffer economic uncertainties and support essential living expenses. Incorporating UBI into income planning helps future-proof finances by creating a stable foundation that complements variable employment earnings and reduces vulnerability to economic shocks.

Related Important Terms

Passive Yield Bridge

Day job income provides a steady, active cash flow crucial for immediate financial needs, while the UBI dividend from Passive Yield Bridge generates a reliable passive revenue stream that stabilizes overall earnings. Combining these income sources diversifies revenue, reduces financial risk, and enhances long-term wealth sustainability.

Earned Wage Stability

Day job income provides earned wage stability through consistent paychecks tied to hours worked or salary agreements, ensuring reliable monthly revenue. UBI dividends offer a fixed, unconditional income stream that supplements earnings, but lack the variability and growth potential associated with active employment.

UBI Floor Effect

A day job provides variable income dependent on hours worked and employer stability, whereas a Universal Basic Income (UBI) dividend guarantees a fixed floor, ensuring minimum financial security regardless of employment status. This UBI floor effect stabilizes revenue streams, reducing poverty risk and enabling individuals to pursue long-term goals without income anxiety.

Dual-Stream Consistency

Maintaining dual-stream consistency between day job income and UBI dividends ensures stable revenue by balancing steady wages with guaranteed passive payments. This approach mitigates financial volatility and enhances long-term economic resilience through diversified income sources.

Guaranteed Income Ladder

The Guaranteed Income Ladder combines stable dividends from Universal Basic Income (UBI) with consistent earnings from a day job to create a reliable revenue stream. This hybrid approach reduces financial risk by ensuring a baseline income while allowing for income growth through employment.

Salary-UBI Sync

Balancing day job income with a Universal Basic Income (UBI) dividend creates a stable revenue stream by aligning regular salary payments with consistent UBI disbursements, reducing financial volatility. Salary-UBI sync enhances cash flow predictability, enabling better budgeting and long-term financial security for individuals.

Baseline Dividend Income

Baseline dividend income from a universal basic income (UBI) provides a stable revenue stream that can complement or partially replace day job income, reducing financial uncertainty. This steady cash flow ensures essential expenses are covered consistently, enabling individuals to pursue additional income opportunities without risking financial instability.

Hybrid Revenue Resilience

Combining day job income with Universal Basic Income (UBI) dividends enhances hybrid revenue resilience by diversifying cash flow sources and reducing dependency on a single income stream. This dual approach stabilizes personal finances by offsetting employment volatility with guaranteed UBI payments, promoting sustained economic security.

Workforce-UBI Parity

Day job income provides consistent wages tied to labor hours, while UBI dividends offer unconditional payments ensuring a baseline financial stability independent of employment status. Achieving Workforce-UBI Parity can stabilize revenue streams by blending earned income with universal dividends, reducing economic vulnerability and promoting sustained consumer spending.

Automated Income Blend

Automated income blend combines day job income with Universal Basic Income (UBI) dividends to create a stable revenue stream that balances active work earnings and passive support payments. Leveraging algorithm-driven allocation optimizes cash flow, minimizing financial risk and enhancing overall income stability.

Day job income vs UBI dividend for stable revenue. Infographic

moneydiff.com

moneydiff.com