Fixed income provides predictable, stable cash flow essential for consistent budgeting and financial planning, while variable revenue streams offer potential for higher returns but require flexible management to accommodate fluctuations. Balancing fixed and variable income sources optimizes money management by combining security with growth opportunities. Effective allocation between these streams mitigates risk and enhances overall financial stability.

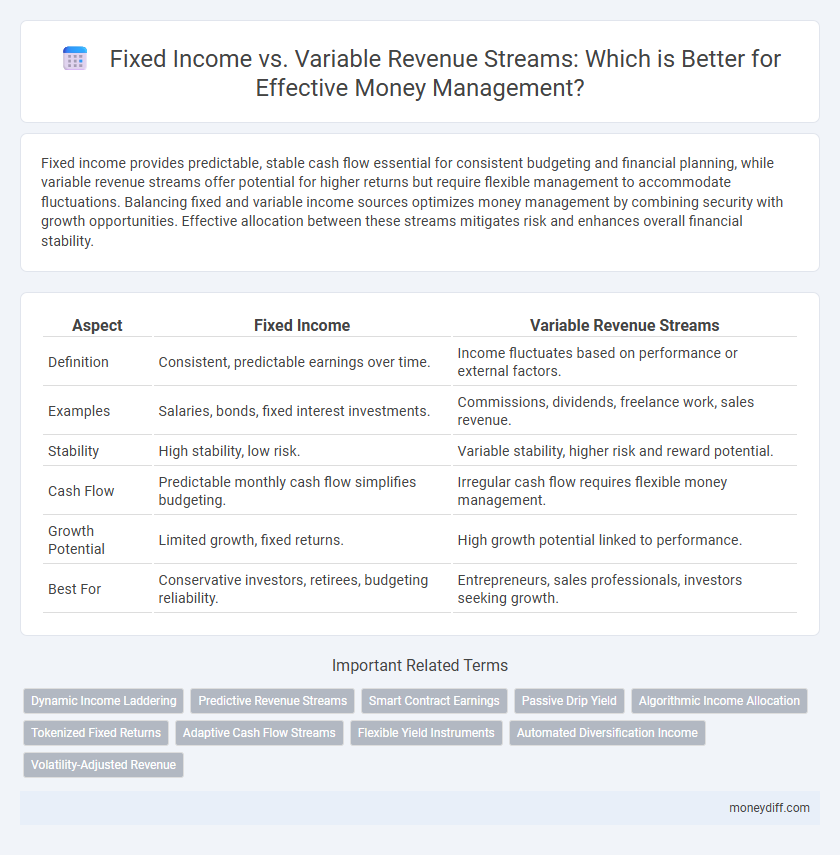

Table of Comparison

| Aspect | Fixed Income | Variable Revenue Streams |

|---|---|---|

| Definition | Consistent, predictable earnings over time. | Income fluctuates based on performance or external factors. |

| Examples | Salaries, bonds, fixed interest investments. | Commissions, dividends, freelance work, sales revenue. |

| Stability | High stability, low risk. | Variable stability, higher risk and reward potential. |

| Cash Flow | Predictable monthly cash flow simplifies budgeting. | Irregular cash flow requires flexible money management. |

| Growth Potential | Limited growth, fixed returns. | High growth potential linked to performance. |

| Best For | Conservative investors, retirees, budgeting reliability. | Entrepreneurs, sales professionals, investors seeking growth. |

Understanding Fixed Income vs Variable Revenue Streams

Fixed income refers to consistent, predictable revenue streams such as salaries, pensions, or bond interest payments that offer financial stability and ease of budgeting. Variable revenue streams fluctuate based on factors like commissions, freelance work, or sales performance, requiring more dynamic money management and careful cash flow monitoring. Understanding the distinction between these income types helps in effective financial planning and risk assessment.

Key Differences Between Fixed and Variable Income

Fixed income provides a predictable and stable cash flow, often sourced from salaries, pensions, or fixed-interest investments, ensuring consistent budgeting and financial planning. Variable income fluctuates based on performance, sales, or commissions, introducing uncertainty but offering potential for higher earnings. Understanding these differences is crucial for effective money management, as fixed income aids stability while variable income requires adaptive budgeting strategies.

Advantages of Fixed Income Sources

Fixed income sources provide reliable and predictable cash flow, essential for stable financial planning and budgeting. They reduce uncertainty by offering consistent payments, which helps in managing expenses and debt obligations effectively. This stability is particularly beneficial during economic downturns or market volatility, ensuring steady income regardless of external factors.

Benefits of Variable Revenue Streams

Variable revenue streams offer greater flexibility and potential for higher income growth compared to fixed income sources. They enable diversification of income, reducing dependence on a single source and enhancing financial resilience. Adapting to market trends and leveraging multiple revenue channels help optimize overall money management strategies for long-term wealth accumulation.

Risk Factors in Fixed vs Variable Income

Fixed income investments, such as bonds and fixed deposits, offer stable cash flows with lower risk due to predictable interest payments and principal repayment. Variable revenue streams, like dividends and rental income, carry higher risk influenced by market volatility, business performance, and economic fluctuations. Understanding these risk factors helps investors balance stability and growth potential in their money management strategies.

Budgeting Strategies for Each Income Type

Fixed income allows for precise budgeting through predictable monthly allocations, enabling systematic expense management and long-term savings plans. Variable revenue streams require flexible budgeting techniques such as creating emergency funds and adjusting discretionary spending based on income fluctuations. Combining these strategies helps optimize financial stability and maximize resource allocation.

Diversifying Income Streams for Financial Stability

Diversifying income streams by combining fixed income, such as salaries or pensions, with variable revenue sources like freelance work or investments enhances financial stability and risk management. Fixed income provides predictable cash flow, while variable streams offer growth potential and flexibility to adapt to market changes. Balancing these income types reduces dependence on a single source, ensuring resilience during economic fluctuations.

Impact on Long-Term Financial Planning

Fixed income streams provide predictable cash flow, which enhances stability and facilitates accurate long-term financial planning by enabling consistent budgeting and risk management. Variable revenue streams, while potentially higher, introduce uncertainty that complicates forecasting and may require larger financial buffers or diversified investments to mitigate volatility. Balancing fixed and variable income sources improves both resilience and growth potential in long-term financial strategies.

Managing Cash Flow with Mixed Revenue Streams

Managing cash flow with mixed revenue streams requires balancing fixed income, such as salaried wages or rental payments, with variable revenue streams from sources like commissions or freelance projects. Fixed income provides stability and predictable budgeting, while variable revenue demands flexible financial planning to accommodate fluctuations. Effective money management involves creating contingency funds and regularly monitoring cash flow to maintain liquidity and financial resilience.

Choosing the Right Income Structure for Your Goals

Choosing the right income structure depends on your financial goals, risk tolerance, and cash flow needs. Fixed income streams offer stability and predictability with consistent payments from sources like bonds, annuities, or rental income. Variable revenue streams, such as dividends, freelance work, or sales commissions, provide growth potential but with fluctuating amounts, requiring careful budget management and risk assessment.

Related Important Terms

Dynamic Income Laddering

Dynamic income laddering strategically balances fixed income, such as bonds or annuities, with variable revenue streams like dividends or freelance earnings to optimize cash flow stability and growth potential. This approach enhances financial resilience by aligning predictable payments with flexible, market-responsive income sources.

Predictive Revenue Streams

Fixed income provides predictable revenue streams through consistent payments like salaries or bonds, enabling precise budgeting and financial planning. In contrast, variable revenue streams fluctuate based on performance or market conditions, requiring adaptive strategies and risk management for effective money management.

Smart Contract Earnings

Smart contract earnings offer a fixed income stream by generating predictable returns through predefined blockchain protocols, reducing risk compared to variable revenue streams that fluctuate with market conditions. Integrating fixed income from smart contracts into money management strategies provides stable cash flow, enhancing portfolio resilience against the volatility of variable earnings.

Passive Drip Yield

Fixed income generates consistent returns through regular interest payments, offering stability for money management, while variable revenue streams fluctuate based on market performance and business profits. Passive DRIP yield leverages dividend reinvestment plans to compound returns over time, enhancing income growth without requiring active management.

Algorithmic Income Allocation

Algorithmic income allocation optimizes money management by dynamically distributing funds between fixed-income and variable revenue streams based on predictive analytics and market trends. This approach enhances financial stability by ensuring steady cash flow from fixed income while leveraging variable revenue for growth opportunities.

Tokenized Fixed Returns

Tokenized fixed returns provide a reliable, predictable income stream by leveraging blockchain technology to fractionalize assets and distribute consistent payments. Unlike variable revenue streams, tokenized fixed income enhances transparency, liquidity, and security in portfolio management, making it an efficient tool for risk-averse investors seeking stable cash flows.

Adaptive Cash Flow Streams

Adaptive cash flow streams blend fixed income stability with variable revenue flexibility, optimizing money management by balancing predictable earnings and growth potential. Strategically diversifying sources enhances financial resilience, enabling efficient allocation and risk mitigation in dynamic markets.

Flexible Yield Instruments

Flexible yield instruments offer a dynamic approach to money management by adjusting returns based on market conditions, unlike fixed income streams that provide a constant, predetermined flow. Investors seeking to balance risk and growth potential often prefer variable revenue streams, which can capitalize on interest rate fluctuations and economic trends for enhanced portfolio performance.

Automated Diversification Income

Automated diversification income leverages both fixed income sources, like bonds and annuities, and variable revenue streams such as dividends and rental income to optimize cash flow stability and growth potential. Integrating automated tools for reallocating assets balances risk and maximizes returns, enhancing overall financial resilience.

Volatility-Adjusted Revenue

Fixed income provides consistent, predictable cash flow with minimal volatility, making it ideal for stable budgeting and risk-averse money management. Variable revenue streams, while potentially offering higher returns, require volatility-adjusted strategies to balance fluctuating income against financial goals and risk tolerance.

Fixed Income vs Variable Revenue Streams for money management. Infographic

moneydiff.com

moneydiff.com