Consulting fees provide a direct and often higher immediate income by charging clients for expert advice on a per-project or hourly basis. Membership subscription income generates a steady, recurring revenue stream by offering exclusive content or services to subscribers over time. Balancing both can maximize service monetization, with consulting fees delivering short-term gains and subscriptions ensuring long-term financial stability.

Table of Comparison

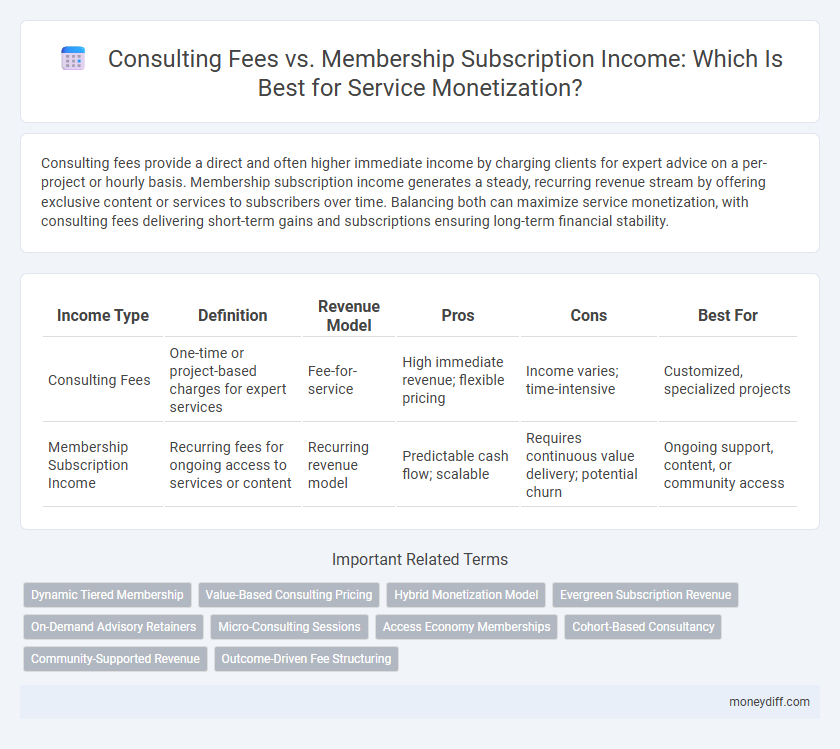

| Income Type | Definition | Revenue Model | Pros | Cons | Best For |

|---|---|---|---|---|---|

| Consulting Fees | One-time or project-based charges for expert services | Fee-for-service | High immediate revenue; flexible pricing | Income varies; time-intensive | Customized, specialized projects |

| Membership Subscription Income | Recurring fees for ongoing access to services or content | Recurring revenue model | Predictable cash flow; scalable | Requires continuous value delivery; potential churn | Ongoing support, content, or community access |

Understanding Consulting Fees and Membership Subscriptions

Consulting fees represent direct revenue generated from personalized, project-based advisory services tailored to client needs, often billed hourly or per project scope. Membership subscription income derives from recurring payments granting clients continuous access to exclusive resources, support, or services within a defined period. Distinguishing these income streams enables businesses to optimize service monetization by balancing one-time consulting engagements with stable, predictable subscription revenue.

Key Differences Between Consulting and Subscription Models

Consulting fees generate income through one-time, project-based engagements that provide tailored expertise and solutions, often yielding higher immediate revenue per client. Membership subscription income offers predictable, recurring revenue streams by granting ongoing access to exclusive content or services, fostering long-term customer relationships. The consulting model emphasizes customized, high-value interactions, while subscription models prioritize scalability and continuous engagement.

Pros and Cons of Consulting Fees for Service Providers

Consulting fees provide service providers with immediate, high-value income reflective of expertise and time spent, allowing tailored solutions that often command premium rates. However, reliance on consulting fees can lead to income unpredictability due to project-based work and client availability, creating cash flow challenges. Service providers may also face scalability limitations, as revenue directly depends on billable hours rather than recurring payments.

Membership Subscription Income: Benefits and Challenges

Membership subscription income offers predictable, recurring revenue streams that enhance cash flow stability and customer lifetime value compared to one-time consulting fees. This model fosters stronger client relationships through ongoing engagement, increasing retention rates and upsell opportunities. Challenges include the need for continuous content or service delivery to justify the subscription cost and potential initial resistance from clients accustomed to pay-per-service pricing.

Revenue Stability: Consulting Fees vs Membership Subscriptions

Consulting fees often deliver high-value, project-based income but create revenue fluctuations due to their irregular nature. Membership subscription income provides steady, predictable cash flow by relying on recurring payments from a loyal customer base. Companies seeking financial stability prioritize membership models to smooth revenue cycles and improve forecasting accuracy.

Client Relationship Dynamics in Both Income Models

Consulting fees generate income through personalized, project-based interactions that foster deep, trust-driven client relationships focused on problem-solving and expert guidance. Membership subscription income cultivates ongoing engagement by offering consistent value through exclusive content or services, enhancing client loyalty and long-term retention. These income models differ in client relationship dynamics, with consulting emphasizing tailored service delivery and subscriptions prioritizing continuous connection and community building.

Scalability of Consulting vs Subscription Services

Consulting fees generate income based on one-on-one service delivery, limiting scalability due to time constraints and client load. Membership subscription income offers recurring revenue by providing access to exclusive content or benefits, enabling scaling without proportional increases in effort. Subscription models leverage automation and digital platforms to maximize profitability over consulting's linear growth.

Pricing Strategies for Consulting and Membership Models

Consulting fees often rely on value-based or hourly pricing strategies that directly reflect the expertise and time invested, allowing for flexible income scaling tied to client demand. Membership subscription income leverages recurring revenue models with tiered pricing plans, encouraging long-term client retention and predictable cash flow. Pricing strategies for both models must consider market positioning, competitor rates, and customer willingness to pay to optimize profitability and sustainable growth.

Transitioning from Consulting Fees to Recurring Subscriptions

Shifting from consulting fees to membership subscription income enhances predictable cash flow and scales client engagement through recurring revenue models. Subscription services foster long-term relationships, increasing lifetime customer value compared to one-time consulting earnings. Businesses benefit from steady income streams and improved financial forecasting by emphasizing subscription-based monetization strategies.

Choosing the Right Monetization Model for Your Service Business

Choosing the right monetization model for your service business depends on the predictability and scalability of income streams. Consulting fees generate immediate revenue through one-time projects but often lack consistent cash flow, while membership subscription income provides steady, recurring revenue that improves financial forecasting and customer retention. Analyzing client demand and service delivery capacity helps determine whether a project-based or subscription-based model maximizes profitability and sustainable growth.

Related Important Terms

Dynamic Tiered Membership

Consulting fees generate immediate, project-based revenue often tied to specialized expertise, while membership subscription income from dynamic tiered memberships ensures steady, scalable cash flow by offering personalized service levels with varying access and benefits; leveraging dynamic tiers optimizes customer lifetime value and enhances long-term financial stability. Implementing dynamic tiered membership models improves service monetization by balancing premium consulting revenue with predictable subscription income streams tailored to diverse client needs.

Value-Based Consulting Pricing

Value-based consulting pricing maximizes income by aligning fees with client-perceived value rather than hours worked, often resulting in higher profitability compared to fixed membership subscription income. Consulting fees fluctuate based on project scope and outcomes, while membership subscriptions provide steady but typically lower recurring revenue streams.

Hybrid Monetization Model

Consulting fees generate direct, project-based revenue reflecting expertise and time investment, while membership subscription income provides recurring, predictable cash flow through ongoing access to exclusive content or services. A hybrid monetization model leverages both income streams, balancing high-value consulting engagements with stable subscription revenue to optimize financial sustainability and growth.

Evergreen Subscription Revenue

Evergreen subscription revenue provides a stable and predictable income stream compared to consulting fees, which often fluctuate based on project availability and client demand. Membership subscription income ensures continuous cash flow, enhancing long-term financial sustainability for service-based businesses.

On-Demand Advisory Retainers

On-demand advisory retainers generate predictable consulting fees by providing clients with tailored expertise as needed, offering higher revenue potential compared to membership subscription income, which typically relies on recurring, lower-tier access. Consulting fees from retainers capitalize on specialized services and timely interventions, driving greater value and monetization opportunities in service-based business models.

Micro-Consulting Sessions

Consulting fees from micro-consulting sessions generate immediate, project-specific revenue by charging clients per session, offering flexibility and high-value advice. Membership subscription income provides steady, predictable cash flow through recurring payments, ensuring long-term client engagement and access to ongoing support or resources.

Access Economy Memberships

Consulting fees generate one-time revenue through personalized expert services, while membership subscription income in the access economy ensures recurring, predictable revenue by providing ongoing value and exclusive access to resources. Access economy memberships leverage continuous engagement and community benefits to maximize customer lifetime value and stabilize cash flow.

Cohort-Based Consultancy

Consulting fees generate immediate revenue through personalized, high-value one-on-one or group advisory services, while membership subscription income provides a steady, predictable cash flow from ongoing access to exclusive content and community support in cohort-based consultancy models. Balancing these income streams optimizes monetization by leveraging the high engagement and retention rates typical of subscription memberships alongside the premium pricing of tailored consulting sessions.

Community-Supported Revenue

Consulting fees generate variable income based on individualized client projects, while membership subscription income offers predictable, recurring revenue streams that enhance financial stability for community-supported ventures. Leveraging membership subscriptions fosters deeper engagement and long-term value creation, making them a strategic choice for sustainable service monetization.

Outcome-Driven Fee Structuring

Outcome-driven fee structuring for consulting fees emphasizes payment based on measurable client results, aligning incentives and enhancing service value compared to traditional membership subscription income, which offers predictable but less performance-tied revenue. Consulting fees often yield higher profitability by directly reflecting project success, while membership subscriptions provide stable cash flow and customer retention through recurring access to services.

Consulting Fees vs Membership Subscription Income for service monetization. Infographic

moneydiff.com

moneydiff.com