Earned income, derived from traditional employment or services rendered, offers consistent and predictable cash flow that simplifies budgeting and financial planning. Creator economy income, generated through digital platforms and content creation, often fluctuates and requires flexible money management strategies to accommodate variable earnings. Effective financial control in the creator economy hinges on tracking income streams closely and setting aside reserves for periods of lower revenue.

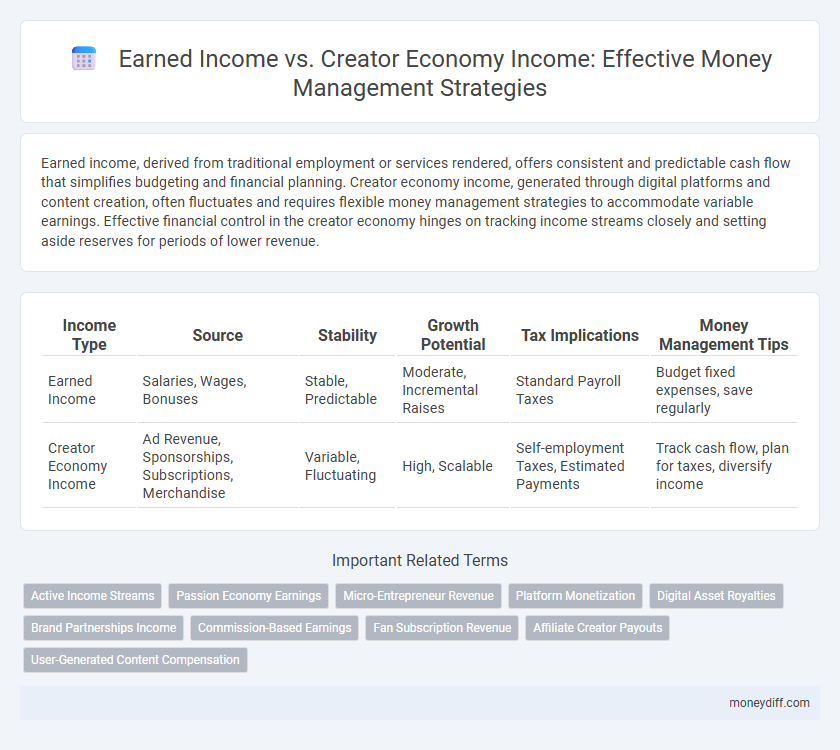

Table of Comparison

| Income Type | Source | Stability | Growth Potential | Tax Implications | Money Management Tips |

|---|---|---|---|---|---|

| Earned Income | Salaries, Wages, Bonuses | Stable, Predictable | Moderate, Incremental Raises | Standard Payroll Taxes | Budget fixed expenses, save regularly |

| Creator Economy Income | Ad Revenue, Sponsorships, Subscriptions, Merchandise | Variable, Fluctuating | High, Scalable | Self-employment Taxes, Estimated Payments | Track cash flow, plan for taxes, diversify income |

Introduction to Earned Income and Creator Economy Income

Earned income refers to wages, salaries, and tips received from traditional employment or self-employment activities, serving as the primary source of income for most individuals. Creator economy income, on the other hand, stems from digital content creation, influencer marketing, and monetization of online platforms, reflecting the evolving landscape of work and revenue streams. Effective money management requires understanding these distinct income types to optimize budgeting, tax planning, and investment strategies tailored to each revenue source.

Key Differences Between Earned Income and Creator Economy Income

Earned income typically comes from traditional employment, where wages or salaries are exchanged for labor, often subject to payroll taxes and predictable pay cycles. Creator economy income arises from content creation, digital products, or platform monetization, characterized by variable earnings, greater income volatility, and dependence on audience engagement. Effective money management requires understanding earned income's stability versus creator economy income's fluctuating cash flow and tax complexity.

Pros and Cons of Earned Income

Earned income, derived from wages or salaries, provides stability and predictable cash flow essential for effective money management. However, it often lacks scalability and flexibility compared to creator economy income, which can fluctuate based on market trends and content virality. Relying solely on earned income may limit wealth-building opportunities and the ability to leverage multiple income streams for financial growth.

Pros and Cons of Creator Economy Income

Creator economy income offers flexibility and multiple revenue streams, allowing creators to monetize content through sponsorships, merchandise, and subscriptions. However, this income is often irregular and unpredictable compared to traditional earned income, posing challenges for consistent budgeting and financial planning. Managing fluctuating cash flow and uncertain tax obligations are critical considerations for sustaining financial stability in the creator economy.

Income Stability: Earned Income vs. Creator Economy Income

Earned income typically offers greater stability through consistent wages and predictable paychecks, making it easier to manage budgeting and financial planning. In contrast, creator economy income fluctuates significantly due to variable factors like audience engagement, platform algorithms, and market trends, resulting in unpredictable cash flow. Effective money management in the creator economy requires building financial cushions, diversifying income streams, and leveraging tools for tracking irregular earnings.

Managing Taxes: Earned vs. Creator Economy Income

Managing taxes for earned income involves straightforward payroll deductions like income tax and Social Security, simplifying financial planning. Creator economy income, often derived from freelance work or platform earnings, requires careful tracking of irregular payments and understanding self-employment tax obligations. Differentiating these income streams ensures accurate tax reporting, maximizes deductions, and prevents audits.

Financial Planning Strategies for Earned Income

Earned income, derived from wages, salaries, and tips, requires disciplined financial planning including budgeting, tax withholding optimization, and retirement savings through employer-sponsored plans like 401(k)s. In contrast to creator economy income, which is often irregular and variable, earned income provides stability that facilitates consistent emergency fund contributions and strategic debt payoff. Effective money management for earned income emphasizes maximizing employer benefits, automating savings, and planning for predictable expenses to ensure long-term financial security.

Financial Planning Strategies for Creator Economy Income

Creator economy income requires dynamic financial planning strategies that prioritize income variability management and tax optimization due to its often irregular and project-based nature. Unlike traditional earned income, which benefits from predictable paychecks and straightforward tax withholdings, creators must implement budgeting methods that accommodate fluctuating cash flows and set aside funds for self-employment taxes and retirement. Strategic tools include automating savings, leveraging tax-advantaged accounts, and maintaining meticulous records to maximize deductions and ensure long-term financial stability.

Budgeting Tips for Mixed Income Streams

Budgeting for mixed income streams requires tracking earned income from traditional employment alongside variable creator economy income to maintain financial stability. Prioritize setting a baseline budget based on consistent earned income and allocate fluctuating creator earnings towards savings, investments, or debt reduction. Utilize digital tools to monitor cash flow patterns and adjust spending habits dynamically, ensuring balanced money management across diverse income sources.

Which Income Type Suits Your Money Management Goals?

Earned income, derived from traditional employment or wages, offers predictable cash flow and structured tax benefits, making it ideal for conservative money management goals focused on stability and consistent budgeting. Creator economy income, sourced from content creation, digital platforms, and monetized personal brands, tends to be variable but offers scalable earning potential suitable for flexible, growth-oriented financial strategies. Evaluating your risk tolerance and long-term objectives helps determine whether stable earned income or dynamic creator economy income aligns best with your money management goals.

Related Important Terms

Active Income Streams

Active income streams in money management primarily stem from earned income, which includes wages, salaries, and tips obtained through direct labor or services. In contrast, creator economy income, although potentially lucrative, often fluctuates based on audience engagement and platform algorithms, requiring strategic financial planning to stabilize cash flow.

Passion Economy Earnings

Passion economy earnings often derive from creator economy income streams, which contrast with traditional earned income by emphasizing personal brand monetization through digital content and influencer marketing. Effective money management requires recognizing the variable, project-based nature of creator economy income versus the steady paycheck typical of earned income, allowing for strategic budgeting and financial planning tailored to fluctuating revenue patterns.

Micro-Entrepreneur Revenue

Micro-entrepreneur revenue in the creator economy often fluctuates due to project-based earnings and platform-driven monetization models, contrasting with the steady cash flow typical of traditional earned income from salaried jobs. Effective money management for micro-entrepreneurs requires strategies tailored to variable income streams, such as budgeting for irregular payments and prioritizing savings during high-earning periods.

Platform Monetization

Earned income typically comes from traditional employment and offers predictable wages, whereas creator economy income is generated through platform monetization methods such as content subscriptions, ad revenue, and brand partnerships. Effective money management in the creator economy requires tracking diverse revenue streams and managing irregular cash flow to optimize financial stability.

Digital Asset Royalties

Earned income typically derives from traditional employment or service contracts, whereas creator economy income, especially from digital asset royalties, originates from intellectual property such as NFTs, digital art, and online content monetization. Managing digital asset royalties requires understanding fluctuating royalty rates, blockchain transactions, and tax implications distinct from standard earned income, emphasizing diversified financial strategies and real-time income tracking.

Brand Partnerships Income

Brand partnerships income in the creator economy often provides a more variable yet potentially higher revenue stream compared to traditional earned income, requiring tailored money management strategies to handle fluctuating cash flow and tax obligations. Effective financial planning must incorporate inconsistent brand deal payments while optimizing for investment and savings to stabilize overall income security.

Commission-Based Earnings

Commission-based earnings, a subset of earned income, provide a predictable cash flow through direct compensation for sales or services rendered, distinguishing them from the variable and often unpredictable creator economy income driven by content monetization and audience engagement. Managing commission-based income requires strategic budgeting to balance steady inflows against fluctuating creator economy earnings, optimizing financial stability and growth opportunities.

Fan Subscription Revenue

Earned income from traditional employment provides stable, predictable cash flow, essential for reliable money management, while creator economy income, particularly fan subscription revenue, offers scalable yet variable earnings driven by audience engagement. Managing finances effectively requires balancing steady earned income with fluctuating fan subscription revenue, leveraging budgeting strategies to accommodate seasonal spikes and declines common in the creator economy.

Affiliate Creator Payouts

Earned income from traditional employment offers steady, predictable cash flow, while creator economy income, especially affiliate creator payouts, provides flexible but variable revenue streams dependent on audience engagement and affiliate sales performance. Effective money management for affiliate creators requires tracking commission cycles, setting aside taxes, and diversifying income sources to balance the volatility inherent in digital content monetization.

User-Generated Content Compensation

Earned income typically comes from traditional employment with predictable wages, while creator economy income often derives from user-generated content compensation through platforms like YouTube, TikTok, or Patreon, which can fluctuate based on engagement metrics and audience size. Effective money management requires budgeting for irregular payments and understanding tax implications unique to digital content monetization.

Earned Income vs Creator Economy Income for money management. Infographic

moneydiff.com

moneydiff.com