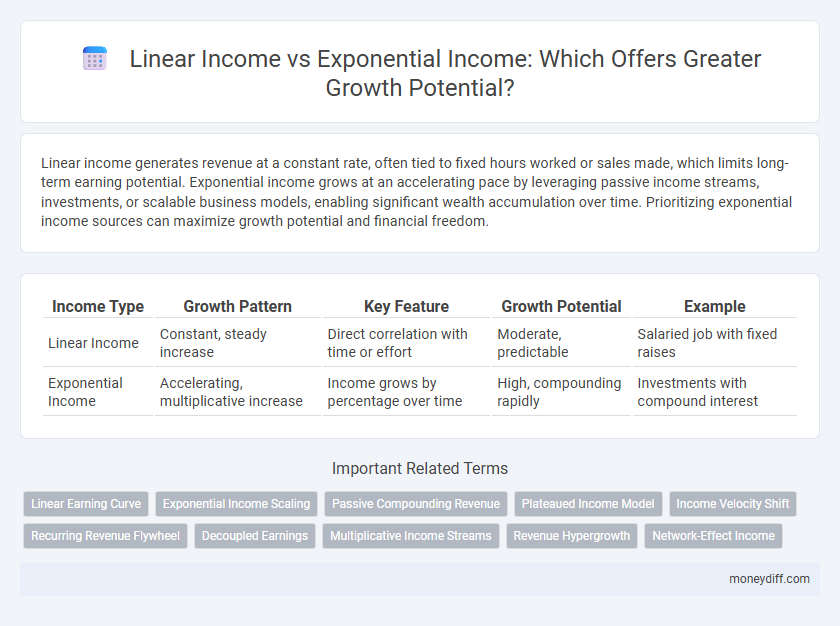

Linear income generates revenue at a constant rate, often tied to fixed hours worked or sales made, which limits long-term earning potential. Exponential income grows at an accelerating pace by leveraging passive income streams, investments, or scalable business models, enabling significant wealth accumulation over time. Prioritizing exponential income sources can maximize growth potential and financial freedom.

Table of Comparison

| Income Type | Growth Pattern | Key Feature | Growth Potential | Example |

|---|---|---|---|---|

| Linear Income | Constant, steady increase | Direct correlation with time or effort | Moderate, predictable | Salaried job with fixed raises |

| Exponential Income | Accelerating, multiplicative increase | Income grows by percentage over time | High, compounding rapidly | Investments with compound interest |

Understanding Linear Income: Definition and Examples

Linear income refers to earnings that increase by a fixed amount over consistent intervals, creating a steady and predictable revenue stream. Common examples include hourly wages or salaried positions where income grows proportionally with time or effort invested. Unlike exponential income, linear income lacks compounding effects and typically results in slower growth potential over the long term.

Exploring Exponential Income: What Sets It Apart?

Exponential income grows at an accelerating rate, often fueled by scalable systems such as investments, royalties, or business equity, unlike linear income which increases by a fixed amount over time, typically from wages or salaries. This compounding effect allows exponential income paths to generate substantially higher earnings with less incremental effort as time progresses. Understanding the mechanisms behind exponential growth, such as reinvestment and passive income streams, is key to unlocking its superior growth potential in wealth accumulation.

Income Growth Potential: Linear vs Exponential Comparison

Linear income growth increases by a fixed amount over time, resulting in steady but limited earning potential. Exponential income growth, driven by compounding factors or scalable revenue streams, accelerates earnings significantly, maximizing long-term wealth accumulation. Understanding the difference between linear and exponential income is crucial for strategic financial planning and maximizing growth potential.

The Advantages of Linear Income Streams

Linear income streams provide consistent and predictable earnings, making financial planning straightforward for individuals and businesses. These income sources, such as salaried jobs or fixed-rate contracts, offer stability without the volatility often associated with exponential income. The steady cash flow from linear income allows for easier budget management and reduces financial stress during economic fluctuations.

The Power of Exponential Income for Wealth Creation

Linear income grows by a fixed amount over time, limiting long-term wealth potential, while exponential income increases at a compounding rate, significantly accelerating growth. The power of exponential income lies in reinvestment and compounding effects, allowing wealth to multiply faster than linear gains. Emphasizing exponential income strategies, such as passive investments or business equity, maximizes financial growth and sustainability.

Risks and Drawbacks: Linear vs Exponential Income

Linear income offers stable and predictable earnings but struggles with limited growth potential and vulnerability to income plateau due to fixed hourly or salary rates. Exponential income, while capable of rapid growth through investments or scalable businesses, carries higher risks including market volatility, inconsistent returns, and potential for significant financial loss. Balancing these risks requires strategic planning to mitigate the vulnerabilities inherent in both income models.

Real-World Cases: Linear and Exponential Income in Action

Linear income grows steadily through fixed increments such as hourly wages or fixed-salary jobs, reflecting predictable yet limited growth potential. Exponential income often emerges in real-world cases involving investments, royalties, or scalable businesses, where earnings multiply rapidly over time due to compounding effects. Examples include stock market dividends, digital product sales, and network marketing, demonstrating significant long-term wealth accumulation compared to linear income sources.

Strategies to Transition from Linear to Exponential Income

Shifting from linear to exponential income requires leveraging scalable strategies such as investing in digital products, automation, and network marketing to create multiple revenue streams that grow without proportional time input. Building assets like online courses, software, or intellectual property enables income generation beyond direct labor, accelerating growth potential. Prioritizing skill development in entrepreneurship and leveraging technology are critical for achieving sustained exponential income growth.

Money Management Tips for Maximizing Income Growth

Linear income grows steadily by fixed amounts over time, while exponential income compounds, accelerating growth through reinvestment and interest. Effective money management involves prioritizing investments with compound returns, such as dividend stocks or high-yield savings accounts, to maximize exponential growth potential. Consistently reinvesting earnings and minimizing unnecessary expenses amplify long-term wealth accumulation beyond linear income constraints.

Choosing the Right Income Path for Your Financial Goals

Linear income offers steady, predictable earnings through fixed salaries or hourly wages, ideal for consistent cash flow but limited growth potential. Exponential income grows by reinvesting profits or leveraging scalable models like investments or businesses, enabling accelerated wealth accumulation over time. Selecting the right income path depends on your risk tolerance, time horizon, and financial goals, balancing stability with long-term growth opportunities.

Related Important Terms

Linear Earning Curve

The linear earning curve generates consistent, fixed income over time, limiting growth potential compared to exponential income that leverages compounding returns or scalable revenue streams. Businesses relying solely on linear income face plateaued financial growth due to predictable, incremental gains rather than accelerated wealth accumulation inherent in exponential models.

Exponential Income Scaling

Exponential income scaling leverages compounding growth, enabling earnings to increase at an accelerating rate through investments, business reinvestment, or passive income streams. Unlike linear income, which grows by fixed increments, exponential income maximizes wealth potential by multiplying returns, harnessing the power of continuous growth over time.

Passive Compounding Revenue

Linear income generates consistent earnings with limited growth potential while exponential income leverages passive compounding revenue to accelerate wealth accumulation exponentially over time. Passive compounding revenue taps into reinvested earnings, enabling exponential income streams that outperform static linear earnings in long-term financial growth.

Plateaued Income Model

Linear income generates steady, fixed earnings over time, limiting growth potential due to its plateaued income model that caps revenue regardless of effort increase. Exponential income, in contrast, leverages scalable systems or investments, enabling earnings to grow multiplicatively and overcome income plateaus by tapping into compounding returns or network effects.

Income Velocity Shift

Linear income grows at a constant rate, limiting wealth accumulation over time, while exponential income leverages reinvestment and compounding to accelerate financial growth exponentially. Shifting income velocity from linear to exponential enables faster capital expansion by optimizing passive income streams and investment returns.

Recurring Revenue Flywheel

Linear income provides steady, predictable revenue streams with limited scalability, while exponential income leverages compounding growth through the Recurring Revenue Flywheel, multiplying customer lifetime value and accelerating business expansion. The Recurring Revenue Flywheel drives sustainable growth by reinvesting consistent cash flow to enhance product value, increase customer retention, and attract new subscribers, creating a self-reinforcing cycle of increasing income.

Decoupled Earnings

Linear income generates consistent, fixed earnings over time, limiting growth potential as earnings increase incrementally; exponential income, especially through decoupled earnings like royalties or dividends, enables income streams to grow autonomously without continuous active effort. Decoupled earnings amplify wealth creation by leveraging assets or investments, driving exponential compounding rather than relying solely on direct labor input.

Multiplicative Income Streams

Linear income grows at a constant rate, typically through fixed salaries, while exponential income leverages multiplicative income streams such as investments, royalties, and business equity that compound over time, significantly accelerating wealth accumulation. Harnessing multiple scalable income sources enables exponential growth potential beyond traditional linear wage increases.

Revenue Hypergrowth

Linear income grows at a constant rate, generating predictable revenue over time, while exponential income leverages compounding factors to accelerate revenue hypergrowth rapidly. Exponential income models, often fueled by scalable business strategies or investments, can multiply revenue streams and unlock significantly higher financial returns compared to linear growth paths.

Network-Effect Income

Linear income grows at a constant rate with each additional effort, whereas exponential income leverages network effects to multiply revenue rapidly through scalable, automated systems. Network-effect income harnesses the power of user interactions, referrals, and viral growth, creating sustainable, accelerating revenue streams beyond traditional linear models.

Linear Income vs Exponential Income for growth potential. Infographic

moneydiff.com

moneydiff.com