Active income requires continuous effort and time, typically earned through wages or salaries from a job, while passive income generates earnings with minimal ongoing work, often from investments or rental properties. Balancing active and passive income streams can provide financial stability and long-term wealth growth. Prioritizing passive income allows for greater financial freedom and reduced dependence on daily work hours.

Table of Comparison

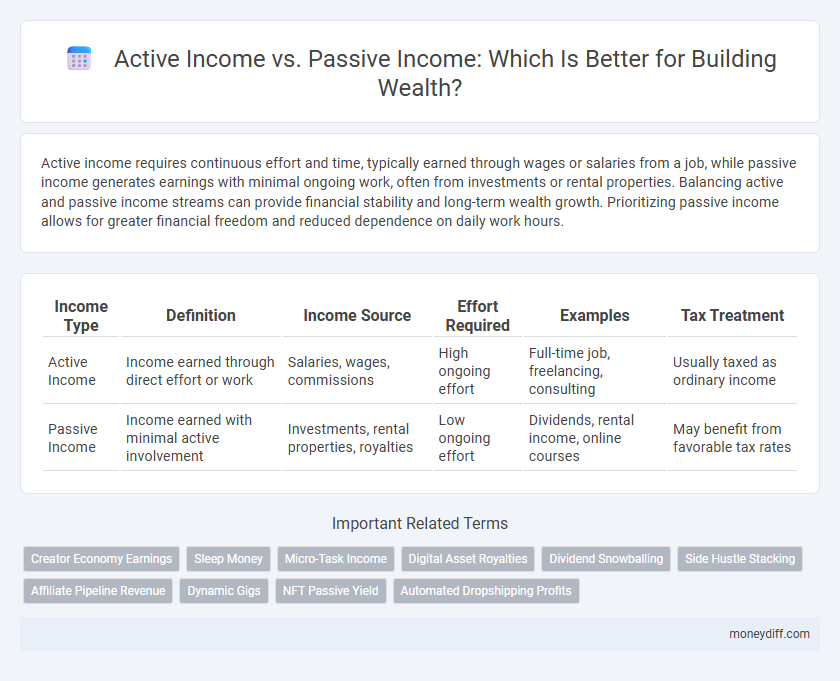

| Income Type | Definition | Income Source | Effort Required | Examples | Tax Treatment |

|---|---|---|---|---|---|

| Active Income | Income earned through direct effort or work | Salaries, wages, commissions | High ongoing effort | Full-time job, freelancing, consulting | Usually taxed as ordinary income |

| Passive Income | Income earned with minimal active involvement | Investments, rental properties, royalties | Low ongoing effort | Dividends, rental income, online courses | May benefit from favorable tax rates |

Understanding Active and Passive Income Streams

Active income is earned through direct participation in work or services, such as salaries, wages, or business profits, requiring continuous effort and time investment. Passive income originates from investments or activities that generate earnings with minimal ongoing involvement, including rental properties, dividends, royalties, and interest income. Understanding the distinction helps in financial planning by balancing immediate earnings with long-term wealth growth through diversified income streams.

Key Differences Between Active and Passive Income

Active income requires continuous effort and time involvement, typically earned through wages, salaries, or freelance work, where income generation stops when work ceases. Passive income stems from investments like rental properties, dividends, or royalties, generating earnings with minimal ongoing effort after the initial setup. The key difference lies in the relationship between time invested and income earned: active income depends on active participation, while passive income builds wealth through consistent, low-maintenance cash flow.

Advantages of Active Income

Active income generates immediate cash flow through direct work such as salaries, commissions, or freelance payments, providing consistent financial stability. It offers control over earnings by allowing individuals to influence income through skill development, performance, and work hours. Additionally, active income can enhance career growth opportunities, professional networking, and marketable experience, which contribute to long-term financial security.

Benefits of Passive Income

Passive income generates earnings with minimal ongoing effort, such as rental income, dividends, or royalties, providing financial stability and freedom. Unlike active income, which requires continuous work, passive income streams offer scalability and the potential for long-term wealth accumulation. This type of income enhances cash flow resilience, reducing dependence on a single job or paycheck.

Time Commitment: Active vs Passive Income

Active income requires consistent time commitment as earnings are directly tied to hours worked or effort invested, such as salaries, freelance work, or consulting. Passive income involves minimal ongoing time investment after initial setup, including rental income, dividends, or royalties, allowing earnings to accumulate with less daily involvement. Understanding time commitment differences helps individuals balance earning methods to optimize financial growth and lifestyle flexibility.

Income Stability and Risk Factors

Active income provides immediate earnings through direct labor, offering more control but higher risk due to job dependency and market fluctuations. Passive income generates revenue with minimal ongoing effort, promoting income stability but often involves upfront investment and potential market volatility. Balancing active and passive income streams mitigates risk while enhancing overall financial security.

Scalability Potential of Active and Passive Income

Active income relies on direct labor or services, limiting its scalability due to finite personal time and effort. Passive income streams, such as royalties, investments, or rental income, offer greater scalability by generating revenue with minimal ongoing work. Leveraging automation and digital platforms significantly enhances the scalability potential of passive income compared to active income sources.

Tax Implications: Active vs Passive Earnings

Active income, such as wages, salaries, and business profits, is typically subject to higher ordinary income tax rates and payroll taxes, including Social Security and Medicare. Passive income, generated from investments like rental properties, dividends, or royalties, often benefits from lower tax rates or exclusions, such as qualified dividends taxed at capital gains rates. Understanding the differing tax treatments between active and passive earnings is crucial for effective tax planning and maximizing after-tax income.

Combining Active and Passive Income for Financial Growth

Combining active income from regular employment with passive income streams such as dividends, rental properties, or royalties creates a diversified financial portfolio that enhances wealth-building potential. Active income provides consistent cash flow, while passive income generates earnings with minimal ongoing effort, accelerating financial growth and stability. Balancing both income types reduces dependency on a single source and maximizes long-term financial security.

Choosing the Right Income Strategy for Financial Goals

Active income, generated through direct labor such as salaried jobs or freelance work, provides immediate cash flow but requires continuous effort and time investment. Passive income, earned from investments like rental properties, dividends, or royalties, offers long-term financial stability with minimal daily involvement, ideal for wealth building. Selecting the right income strategy depends on aligning personal financial goals, time availability, and risk tolerance to balance immediate needs with future growth potential.

Related Important Terms

Creator Economy Earnings

Active income in the creator economy stems from direct work such as content creation, live streaming, and sponsored collaborations, demanding continuous effort and time investment. Passive income arises from monetizing digital assets like ad revenue, merchandise sales, and subscription memberships, enabling creators to earn with minimal ongoing input.

Sleep Money

Active income requires direct effort and time, such as salaries and freelance work, while passive income generates earnings with minimal ongoing involvement, exemplified by "sleep money" from investments or rental properties. Prioritizing passive income streams enables financial growth and stability without continuous active labor.

Micro-Task Income

Active income requires direct involvement in completing micro-tasks, generating earnings through consistent effort and time investment, while passive income from micro-tasks is typically limited, as most platforms demand ongoing active participation. Micro-task income primarily thrives as active income, relying on users to perform specific actions like data tagging or small online tasks rather than earning passively without continuous engagement.

Digital Asset Royalties

Digital asset royalties provide a form of passive income generated from ongoing sales or usage of digital content such as music, e-books, or software, requiring initial creative effort but minimal continuous work. Active income, in contrast, demands consistent labor or time investment, like freelancing or traditional employment, without the automated revenue streams afforded by digital royalties.

Dividend Snowballing

Active income requires continuous effort and time investment, whereas passive income, such as dividend snowballing, generates earnings through compounding dividend reinvestments that grow wealth exponentially over time. Dividend snowballing leverages consistent payouts from stocks to reinvest dividends, creating a self-sustaining income stream that increases without ongoing work.

Side Hustle Stacking

Active income requires continuous effort and time investment, typically earned through jobs or side hustle stacking, where multiple part-time gigs combine to increase overall earnings. Passive income generates revenue with minimal ongoing work, often through investments or businesses, providing financial stability while side hustle stacking maximizes active earning potential by diversifying income streams.

Affiliate Pipeline Revenue

Active income requires continuous effort and time investment, while passive income, such as affiliate pipeline revenue, generates earnings with minimal ongoing work by leveraging automated marketing funnels and consistent referral commissions. Affiliate pipeline revenue allows individuals to build scalable income streams through strategic partnerships and optimized sales processes without constant active participation.

Dynamic Gigs

Dynamic gigs generate active income by requiring continuous effort and time investment, contrasting with passive income streams that earn money with minimal ongoing involvement. Platforms like Uber, Fiverr, and TaskRabbit exemplify this model, where earnings depend directly on the gig worker's active participation.

NFT Passive Yield

Active income requires continuous effort through work or services rendered, whereas passive income generates earnings with minimal ongoing involvement, such as NFT passive yield derived from digital asset appreciation or royalties. NFT passive yield leverages blockchain technology to provide consistent revenue streams through leasing, staking, or royalties from secondary sales, offering a scalable and decentralized income model.

Automated Dropshipping Profits

Active income requires continuous effort and time investment, whereas passive income generates earnings with minimal ongoing involvement. Automated dropshipping profits exemplify passive income by leveraging automated systems to manage sales and fulfillment, allowing entrepreneurs to earn consistently without active daily work.

Active income vs Passive income for Income. Infographic

moneydiff.com

moneydiff.com