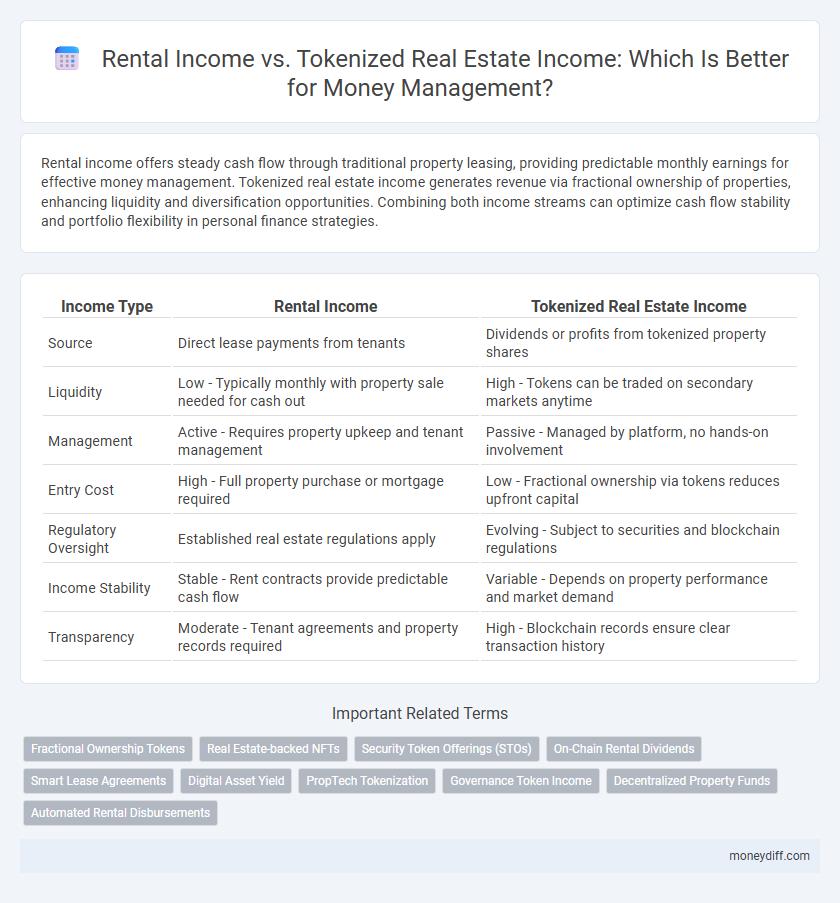

Rental income offers steady cash flow through traditional property leasing, providing predictable monthly earnings for effective money management. Tokenized real estate income generates revenue via fractional ownership of properties, enhancing liquidity and diversification opportunities. Combining both income streams can optimize cash flow stability and portfolio flexibility in personal finance strategies.

Table of Comparison

| Income Type | Rental Income | Tokenized Real Estate Income |

|---|---|---|

| Source | Direct lease payments from tenants | Dividends or profits from tokenized property shares |

| Liquidity | Low - Typically monthly with property sale needed for cash out | High - Tokens can be traded on secondary markets anytime |

| Management | Active - Requires property upkeep and tenant management | Passive - Managed by platform, no hands-on involvement |

| Entry Cost | High - Full property purchase or mortgage required | Low - Fractional ownership via tokens reduces upfront capital |

| Regulatory Oversight | Established real estate regulations apply | Evolving - Subject to securities and blockchain regulations |

| Income Stability | Stable - Rent contracts provide predictable cash flow | Variable - Depends on property performance and market demand |

| Transparency | Moderate - Tenant agreements and property records required | High - Blockchain records ensure clear transaction history |

Understanding Rental Income: Traditional Real Estate Approach

Rental income from traditional real estate involves leasing physical properties to tenants, providing a steady cash flow based on monthly rent payments and property occupancy rates. This income is directly tied to property management, maintenance costs, and local market conditions, impacting overall profitability. Understanding these factors is crucial for effective money management and assessing the long-term viability of rental investments.

What is Tokenized Real Estate Income?

Tokenized real estate income generates returns by representing property assets as digital tokens on a blockchain, enabling fractional ownership and streamlined transactions. Unlike traditional rental income, which depends on direct property management and tenant payments, tokenized income offers liquidity and reduced entry barriers for investors through decentralized platforms. This innovative approach also enhances transparency and security by leveraging smart contracts to automate income distribution.

Pros and Cons of Rental Income Streams

Rental income offers consistent cash flow and potential tax benefits, making it a reliable source of passive income for money management. However, it requires active property maintenance, tenant management, and exposure to market fluctuations that can impact occupancy rates and rental prices. Unlike tokenized real estate income, rental income lacks liquidity and can involve significant upfront costs and regulatory compliance challenges.

Advantages and Risks of Tokenized Real Estate Investments

Tokenized real estate investments offer enhanced liquidity and fractional ownership, allowing investors to diversify portfolios with lower capital requirements compared to traditional rental income properties. These digital assets provide access to global markets and automated transactions via blockchain, increasing transparency and operational efficiency. However, risks include regulatory uncertainty, platform security vulnerabilities, and potential market volatility that can impact token value and income stability.

Liquidity Comparison: Rental Income vs Tokenized Assets

Rental income provides a steady cash flow but often ties up capital in illiquid physical properties, limiting quick access to funds. Tokenized real estate income offers enhanced liquidity through fractional ownership and blockchain-based trading platforms, enabling faster conversion to cash. This liquidity advantage supports more flexible money management and portfolio diversification strategies.

Tax Implications for Rental and Tokenized Real Estate Income

Rental income is generally subject to ordinary income tax rates, with allowable deductions for maintenance, property taxes, and mortgage interest reducing taxable income. Tokenized real estate income, often treated as capital gains or dividends depending on the structure, may benefit from favorable tax treatment and increased liquidity compared to traditional rental income. Understanding the tax implications, including reporting requirements and potential deductions, is crucial for effective money management between these income sources.

Diversification Strategies in Real Estate Income

Rental income provides a steady cash flow from physical properties, offering tangible asset ownership with potential for property appreciation. Tokenized real estate income leverages blockchain technology to create fractional ownership, enhancing liquidity and accessibility for smaller investments. Diversification strategies in real estate income blend traditional rental properties with tokenized assets to balance risk and optimize capital allocation across different market segments.

Accessibility: Barriers to Entry for Rental and Tokenized Investments

Traditional rental income often requires significant capital investment, complex property management, and geographic constraints, creating high barriers to entry for many investors. Tokenized real estate income lowers these barriers by enabling fractional ownership through blockchain technology, allowing smaller, more flexible investments accessible to a global pool of investors. This enhanced accessibility democratizes real estate investment, offering diversified income streams without the need for full property ownership or extensive management responsibilities.

Cash Flow Management in Rental vs Tokenized Real Estate

Rental income provides steady cash flow, typically subject to property maintenance costs, vacancy risks, and tenant management. Tokenized real estate income offers more liquidity and fractional ownership, allowing for diversification and potentially smoother cash flow through automated distributions. Effective cash flow management in tokenized real estate integrates blockchain transparency and reduced operational expenses compared to traditional rental income.

Future Trends: Evolving Real Estate Income Models

Rental income from traditional real estate offers steady cash flow but is often limited by geographic and tenant risks. Tokenized real estate income leverages blockchain technology to enable fractional ownership, liquidity, and diversified investment opportunities across global markets. Future trends indicate a shift toward hybrid models combining physical rental properties with digital tokens, enhancing transparency and accessibility in real estate income generation.

Related Important Terms

Fractional Ownership Tokens

Rental income provides steady cash flow from physical property leases, while tokenized real estate income leverages fractional ownership tokens to enable diversified investment with lower capital requirements and enhanced liquidity. Fractional ownership tokens represent proportional shares in real estate assets, facilitating efficient money management through easier portfolio diversification and faster transaction settlements compared to traditional rental income streams.

Real Estate-backed NFTs

Rental income from traditional real estate provides consistent cash flow through tenant payments, while tokenized real estate income leverages blockchain technology, enabling fractional ownership and liquidity via Real Estate-backed NFTs. These digital assets offer diversified investment opportunities with instant transferability and reduced entry barriers compared to conventional property rentals.

Security Token Offerings (STOs)

Rental income provides a steady cash flow from physical property leases, while tokenized real estate income through Security Token Offerings (STOs) offers fractional ownership and enhanced liquidity on blockchain platforms. STOs enable diversified investment with transparent, regulated transactions, improving access and security for money management in real estate portfolios.

On-Chain Rental Dividends

On-chain rental dividends from tokenized real estate provide transparent, automated income streams with reduced intermediaries, enhancing liquidity and real-time tracking for investors. Traditional rental income often involves delays, management overhead, and less liquidity, making tokenized on-chain dividends a more efficient option for diversified money management portfolios.

Smart Lease Agreements

Smart lease agreements in tokenized real estate provide automated, transparent rental income distribution, enhancing financial efficiency compared to traditional rental income methods. This innovation leverages blockchain technology to reduce management costs and increase security, optimizing income streams for investors in digital asset portfolios.

Digital Asset Yield

Rental income provides steady cash flow from physical properties, while tokenized real estate income leverages blockchain technology to offer fractional ownership and enhanced liquidity. Digital asset yield from tokenized real estate often exceeds traditional rental returns by enabling faster transactions and diversified portfolio management.

PropTech Tokenization

Rental income from traditional real estate offers steady cash flow but often requires active property management and incurs maintenance costs, limiting liquidity and scalability. Tokenized real estate income, enabled by PropTech tokenization platforms, provides fractional ownership with increased liquidity, lower entry barriers, and automated income distribution, transforming money management by integrating blockchain transparency and real-time asset valuation.

Governance Token Income

Governance token income from tokenized real estate offers fractional ownership benefits and enhanced liquidity compared to traditional rental income, enabling investors to participate in property management decisions and profit sharing. This decentralized model streamlines money management by providing transparent dividend distribution and real-time asset valuation through blockchain technology.

Decentralized Property Funds

Decentralized Property Funds offer a transformative approach to rental income by enabling fractional ownership through tokenized real estate, enhancing liquidity and accessibility compared to traditional rental property investments. This model streamlines money management by reducing intermediaries and allowing investors to diversify their income streams with blockchain-secured transactions and transparent dividend distributions.

Automated Rental Disbursements

Automated rental disbursements streamline cash flow management by providing consistent, real-time income directly from tokenized real estate investments, reducing delays and administrative overhead typical in traditional rental income processes. Tokenized real estate income offers enhanced liquidity and fractional ownership benefits, enabling investors to manage their money more efficiently compared to conventional rental income cycles.

Rental Income vs Tokenized Real Estate Income for money management. Infographic

moneydiff.com

moneydiff.com