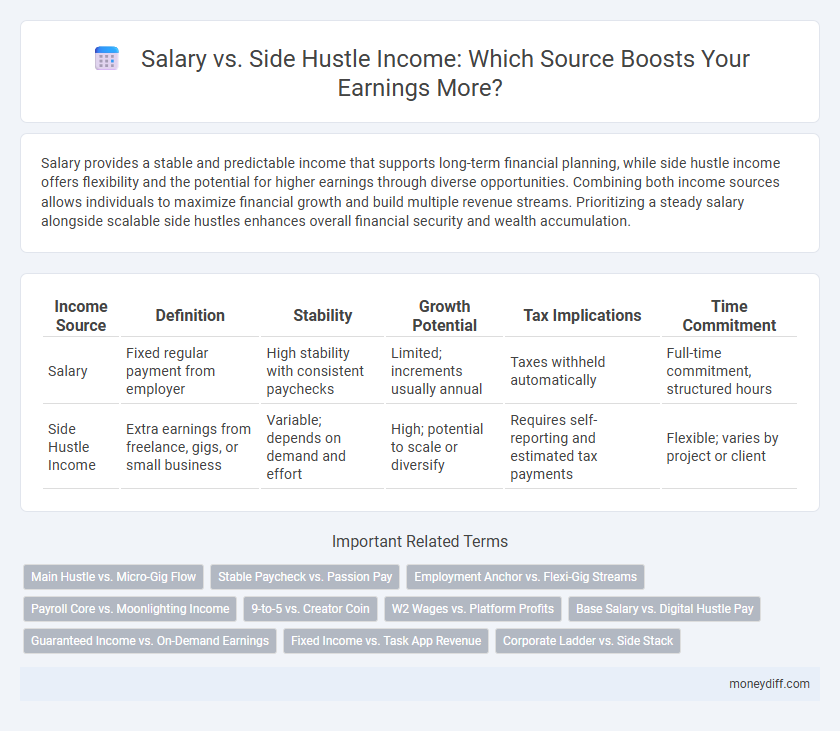

Salary provides a stable and predictable income that supports long-term financial planning, while side hustle income offers flexibility and the potential for higher earnings through diverse opportunities. Combining both income sources allows individuals to maximize financial growth and build multiple revenue streams. Prioritizing a steady salary alongside scalable side hustles enhances overall financial security and wealth accumulation.

Table of Comparison

| Income Source | Definition | Stability | Growth Potential | Tax Implications | Time Commitment |

|---|---|---|---|---|---|

| Salary | Fixed regular payment from employer | High stability with consistent paychecks | Limited; increments usually annual | Taxes withheld automatically | Full-time commitment, structured hours |

| Side Hustle Income | Extra earnings from freelance, gigs, or small business | Variable; depends on demand and effort | High; potential to scale or diversify | Requires self-reporting and estimated tax payments | Flexible; varies by project or client |

Comparing Salary and Side Hustle Income Sources

Salary offers stable and predictable monthly income with benefits such as health insurance and retirement plans, providing financial security for long-term planning. Side hustle income varies greatly, often lacking job protection and benefits but can significantly boost overall earnings and offer flexibility in work hours. Combining salary and side hustle income can optimize total cash flow and diversify financial risk, enhancing overall economic resilience.

Stability of Salaried Jobs vs Side Hustle Flexibility

Salaried jobs offer consistent monthly income and employee benefits, ensuring financial stability and predictable cash flow. Side hustles provide flexible hours and diverse revenue streams but typically lack guaranteed earnings and benefits, introducing income variability. Balancing a stable salary with side hustle flexibility can optimize overall financial security and growth potential.

Diversifying Income: The Power of Multiple Streams

Diversifying income through a combination of salary and side hustle income enhances financial stability by reducing dependence on a single earning source. Salary provides consistent, predictable cash flow, while side hustle income offers flexibility and potential for exponential growth. Multiple streams of income empower individuals to build wealth faster and mitigate risks associated with job instability or economic downturns.

Financial Security: Side Hustles as Backup Plans

Side hustle income provides a crucial financial safety net, supplementing primary salary earnings and enhancing overall financial security. Diverse income streams reduce dependence on a single source, mitigating risks associated with job loss or salary cuts. Leveraging side hustles as backup plans ensures continuous cash flow and supports long-term financial stability.

Time Investment: Full-Time Work vs Gig Opportunities

Salary income typically requires a consistent, full-time time investment with fixed hours and steady pay, offering financial stability and benefits. Side hustle income, derived from gig opportunities, offers flexibility with variable time commitment but often lacks predictability and benefits. Evaluating time investment priorities helps balance the reliability of salary work against the adaptable scheduling and potential earnings variability of side hustles.

Earning Potential: Ceiling vs Unlimited Growth

Salary income typically offers a fixed earning ceiling determined by job roles and company pay scales, limiting potential growth over time. Side hustle income provides unlimited growth opportunities as earnings scale directly with effort, innovation, and market demand. Diversifying income streams by combining both can maximize overall earning potential and financial stability.

Tax Implications for Salary and Side Hustle Earnings

Salary income is typically subject to automatic withholding taxes, including federal, state, and Social Security contributions, simplifying tax compliance. Side hustle income, classified as self-employment income, requires quarterly estimated tax payments and may incur self-employment taxes, increasing the overall tax burden. Accurate record-keeping of side hustle expenses can reduce taxable income, whereas salary deductions are often limited to standard or itemized deductions.

Work-Life Balance: Navigating Dual Income Streams

Balancing salary and side hustle income requires strategic time management to prevent burnout and maintain work-life harmony. Prioritizing tasks and setting clear boundaries between primary employment and side ventures help optimize productivity without sacrificing personal well-being. Employing digital tools for scheduling and automation can enhance efficiency when navigating dual income streams.

Skill Development: Learning from Salaries and Side Hustles

Salary income offers structured skill development opportunities through formal training programs and consistent job responsibilities, enhancing expertise in a specific field. Side hustle income fosters entrepreneurial skills, adaptability, and creative problem-solving by requiring independent management and diverse task execution. Combining both income sources accelerates comprehensive skill growth, balancing stability with innovative experience.

Choosing Your Path: Factors in Income Source Decisions

Choosing between salary and side hustle income depends on stability, flexibility, and growth potential. Salary offers predictable monthly earnings and benefits, making it ideal for financial security, whereas side hustles provide diverse income streams and entrepreneurial opportunities but with variable earnings. Assessing personal risk tolerance, time availability, and long-term goals helps determine the optimal income source strategy.

Related Important Terms

Main Hustle vs. Micro-Gig Flow

Main salary income provides steady, reliable earnings essential for long-term financial stability, while side hustle income from micro-gigs offers flexible, supplementary cash flow that can boost overall monthly income. Diversifying income streams by balancing a primary job with micro-gig opportunities enhances financial resilience and accelerates wealth-building potential.

Stable Paycheck vs. Passion Pay

Stable paycheck income provides consistent financial security through regular, predictable earnings, making it ideal for covering essential expenses and long-term planning. Side hustle income often stems from passion-driven projects, offering flexibility and potential growth but with variable and less reliable cash flow.

Employment Anchor vs. Flexi-Gig Streams

Employment anchor provides stable, predictable salary income ensuring consistent cash flow and benefits, while flexi-gig streams offer variable earnings and greater flexibility, allowing diversification and potential for higher supplemental income through multiple side hustles. Balancing a dependable salary with flexible gig opportunities optimizes overall income stability and growth potential in dynamic job markets.

Payroll Core vs. Moonlighting Income

Payroll core income provides stable, consistent earnings with benefits such as health insurance and retirement contributions, forming the financial foundation for most individuals. Moonlighting income, generated through side hustles, offers flexible, supplementary revenue streams that diversify earnings and can accelerate financial goals without the security features of primary employment.

9-to-5 vs. Creator Coin

Salary income from a traditional 9-to-5 job offers stability and predictable earnings, while Creator Coin income provides dynamic revenue potential through digital asset ownership and community engagement. Diversifying income streams by combining a steady salary with Creator Coin earnings can enhance financial resilience and growth opportunities.

W2 Wages vs. Platform Profits

W2 wages provide steady, predictable income with employer benefits, while platform profits from side hustles offer flexible, scalable earning potential with variable cash flow. Diversifying income streams by combining stable W2 salaries and dynamic side hustle earnings can enhance overall financial security and growth.

Base Salary vs. Digital Hustle Pay

Base salary provides consistent, predictable income tied to a regular work schedule, ensuring financial stability through fixed monthly earnings. Digital hustle pay, generated from online ventures like freelancing or e-commerce, offers flexible, scalable income potential but varies significantly based on effort, market demand, and platform algorithms.

Guaranteed Income vs. On-Demand Earnings

Salary provides a guaranteed, consistent income with predictable paychecks and benefits, ensuring financial stability and long-term security. Side hustle income offers on-demand earnings that fluctuate based on effort and market demand, allowing for flexible, potentially higher returns but with less income certainty.

Fixed Income vs. Task App Revenue

Salary provides a predictable, fixed income that ensures financial stability through regular payments, while task app revenue from side hustles offers variable earnings dependent on the volume and complexity of completed gigs. Diversifying income by combining a steady salary with flexible task app revenue can enhance overall financial resilience and growth potential.

Corporate Ladder vs. Side Stack

Salary from climbing the corporate ladder offers stability and predictable growth through promotions and raises, making it a reliable primary income source. Side hustle income provides flexibility and diverse revenue streams, enabling faster wealth accumulation and financial independence beyond traditional employment limits.

Salary vs Side Hustle Income for earning sources. Infographic

moneydiff.com

moneydiff.com