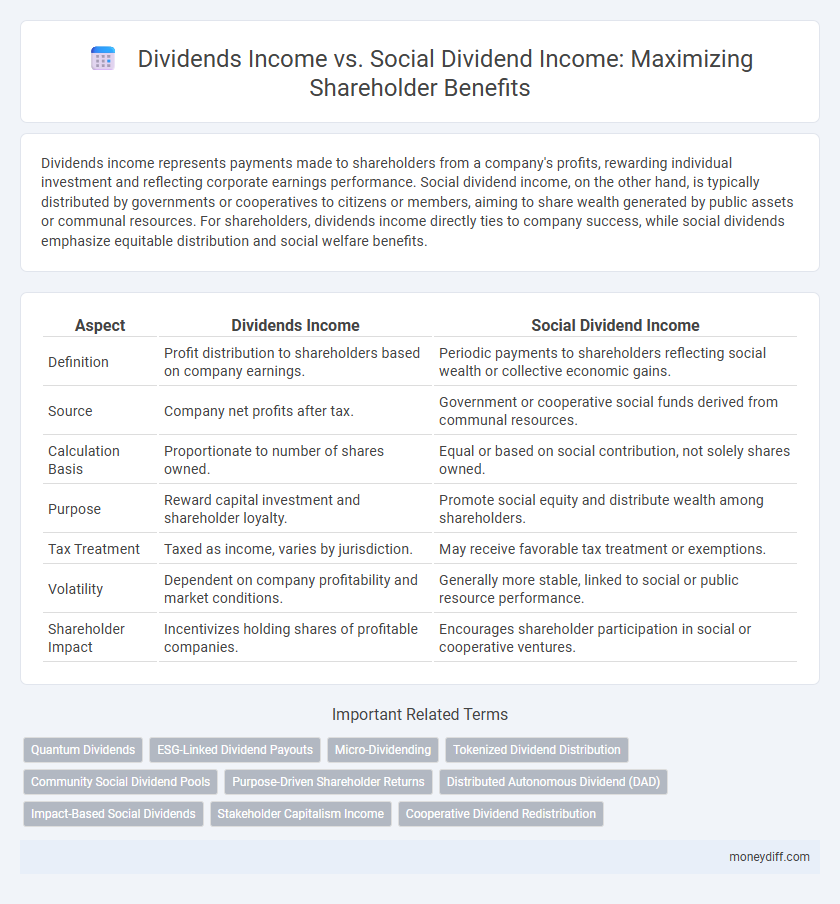

Dividends income represents payments made to shareholders from a company's profits, rewarding individual investment and reflecting corporate earnings performance. Social dividend income, on the other hand, is typically distributed by governments or cooperatives to citizens or members, aiming to share wealth generated by public assets or communal resources. For shareholders, dividends income directly ties to company success, while social dividends emphasize equitable distribution and social welfare benefits.

Table of Comparison

| Aspect | Dividends Income | Social Dividend Income |

|---|---|---|

| Definition | Profit distribution to shareholders based on company earnings. | Periodic payments to shareholders reflecting social wealth or collective economic gains. |

| Source | Company net profits after tax. | Government or cooperative social funds derived from communal resources. |

| Calculation Basis | Proportionate to number of shares owned. | Equal or based on social contribution, not solely shares owned. |

| Purpose | Reward capital investment and shareholder loyalty. | Promote social equity and distribute wealth among shareholders. |

| Tax Treatment | Taxed as income, varies by jurisdiction. | May receive favorable tax treatment or exemptions. |

| Volatility | Dependent on company profitability and market conditions. | Generally more stable, linked to social or public resource performance. |

| Shareholder Impact | Incentivizes holding shares of profitable companies. | Encourages shareholder participation in social or cooperative ventures. |

Understanding Dividends Income: A Shareholder’s Perspective

Dividends income represents the periodic payments shareholders receive from a company's profits based on the number of shares owned, reflecting a direct financial return on their investment. Social dividend income, on the other hand, is typically distributed by cooperative or community-focused entities and emphasizes equitable wealth sharing among members rather than profit maximization. Understanding these distinctions helps shareholders evaluate income sources, tax implications, and the long-term benefits tied to their investment strategies.

What Are Social Dividend Incomes? Definition and Key Features

Social dividend incomes represent payments made to shareholders derived from a company's surplus profits distributed equitably to promote social welfare rather than solely based on capital investment. These dividends are often linked to state-owned enterprises or cooperative models, emphasizing collective benefit and social equity. Key features include redistribution of wealth, fixed or variable payment structures tied to social objectives, and reinvestment in community development initiatives.

Direct Payouts: How Traditional Dividend Income Benefits Shareholders

Traditional dividend income provides shareholders with regular direct payouts based on company profits, enhancing personal cash flow and offering tangible financial rewards for investment. These dividends are typically taxed at favorable rates, attracting income-focused investors seeking predictable returns. Unlike social dividend income, which is often distributed universally or based on broader social policies, traditional dividends are directly tied to corporate performance and shareholder equity.

Social Dividend Income: Mechanisms and Shareholder Impact

Social Dividend Income is distributed based on collective ownership or state-held shares, often reflecting profits from publicly owned enterprises and resources. This mechanism provides shareholders with a regular income stream that aligns with broader social and economic objectives rather than purely corporate profits. The impact on shareholders includes a more equitable wealth distribution, potential for stable returns independent of market fluctuations, and reinforcement of community investment in public assets.

Comparing Financial Returns: Dividends Income vs Social Dividend Income

Dividends income typically provides shareholders with regular, profit-based payments proportional to their equity stake, reflecting company performance and market conditions. Social dividend income, often distributed from community or cooperative enterprises, emphasizes equitable wealth sharing and reinvestment in social projects rather than maximizing individual financial returns. Comparing financial returns, dividends income tends to offer more consistent and quantifiable cash flow, whereas social dividend income prioritizes broader social value and collective benefits over immediate monetary gains.

Risk Factors: Stability and Predictability for Shareholders

Dividends income typically offers shareholders a more stable and predictable return, as it is based on corporate profits and regular payout policies. Social dividend income, often tied to government or community wealth-sharing programs, may fluctuate significantly due to political changes and economic conditions. Risk factors for shareholders increase with social dividends due to their variable nature and less consistent distribution compared to traditional dividends income.

Tax Implications: Dividends Income vs Social Dividend Income

Dividends income is typically subject to personal income tax rates and may incur withholding taxes depending on jurisdiction, reducing net returns for shareholders. Social dividend income, often distributed by cooperatives or social enterprises, may benefit from favorable tax treatment or exemptions designed to promote equitable wealth distribution. Understanding the specific tax codes applicable to each income type is essential for shareholders to optimize after-tax income and comply with regulatory obligations.

Wealth Distribution: Equity and Inclusion in Shareholder Benefits

Dividends income represents returns distributed to shareholders based on company profits, often favoring larger investors, while social dividend income aims to redistribute wealth more equitably among all citizens or stakeholders regardless of investment size. Social dividend income promotes financial inclusion by providing a baseline benefit that narrows income disparities and fosters broader economic participation. Emphasizing social dividends in shareholder benefits addresses equity concerns, ensuring a more inclusive allocation of wealth within the community or economy.

Long-term Growth: Reinvesting vs Social Impact Strategies

Dividends income provides shareholders with direct financial returns that can be reinvested to fuel long-term portfolio growth and compound wealth over time. Social dividend income, on the other hand, emphasizes redistributing profits to support community welfare and sustainable development, aligning shareholder benefits with broader social impact strategies. Balancing reinvestment for growth with social dividend allocations fosters both economic resilience and positive societal outcomes.

Strategic Choice: Which Dividend Model Maximizes Shareholder Value?

Dividends income provides shareholders with regular cash payments based on company profits, incentivizing investment by offering predictable returns, while social dividend income distributes profits more broadly as a form of wealth redistribution, emphasizing social equity over direct financial gain. The strategic choice between these dividend models hinges on maximizing shareholder value through balancing immediate financial rewards with long-term socio-economic impacts that can influence company reputation and sustainability. Empirical data suggests traditional dividends enhance shareholder wealth in the short term, but integrating social dividends may foster stakeholder loyalty and sustainable growth, aligning with evolving investor priorities.

Related Important Terms

Quantum Dividends

Quantum dividends provide shareholders with variable income distributions based on company profits, often linked to performance metrics, offering potential for higher returns compared to fixed social dividend income. Social dividend income, typically distributed evenly among shareholders regardless of performance, emphasizes equitable wealth sharing but may result in lower individual gains than quantum dividends.

ESG-Linked Dividend Payouts

ESG-linked dividend payouts align shareholder benefits with sustainability performance, offering dividends tied to environmental, social, and governance targets rather than traditional social dividend income or standard dividend income. This approach incentivizes companies to meet ESG criteria while providing investors with returns that reflect long-term value creation and positive social impact.

Micro-Dividending

Dividends income represents earnings distributed to shareholders based on company profits, while social dividend income arises from government or community-shared wealth typically aimed at social equity. Micro-dividending enables shareholders to receive small, frequent dividend payments, enhancing cash flow and financial inclusion compared to traditional lump-sum dividends.

Tokenized Dividend Distribution

Tokenized dividend distribution enhances shareholder benefits by enabling transparent, real-time dividend income through blockchain technology, contrasting with traditional social dividend income that typically involves periodic, non-digital payouts linked to communal or governmental profit-sharing schemes. This digital approach streamlines income receipt, increases liquidity, and ensures precise allocation based on token ownership.

Community Social Dividend Pools

Dividends income typically originates from corporate profits distributed to shareholders based on stock ownership, whereas social dividend income derives from community social dividend pools designed to equitably share collective economic gains among members. Community social dividend pools prioritize reinvestment in local development and social welfare, enhancing shareholder benefits through sustainable, inclusive wealth distribution beyond traditional profit-sharing models.

Purpose-Driven Shareholder Returns

Dividends income provides shareholders with periodic financial returns based on company profits, rewarding ownership and incentivizing investment. Social dividend income, designed to support broad social goals, redistributes wealth from collective economic success, aligning shareholder benefits with community welfare and sustainable development.

Distributed Autonomous Dividend (DAD)

Dividends income traditionally derives from company profits shared among shareholders, while social dividend income represents payments distributed based on social wealth or resource ownership, often emphasizing equitable wealth redistribution. The Distributed Autonomous Dividend (DAD) innovates by leveraging blockchain technology to automate transparent, real-time social dividend distributions directly to shareholders, enhancing efficiency and fairness in income allocation.

Impact-Based Social Dividends

Impact-based social dividends prioritize equitable wealth distribution by allocating profits directly to shareholders as social benefits, unlike traditional dividends that emphasize purely financial returns. These dividends enhance social welfare by funding community projects and promoting sustainable development, thereby increasing long-term shareholder value through societal impact.

Stakeholder Capitalism Income

Dividends income reflects traditional shareholder returns based on company profits, while social dividend income emphasizes equitable wealth distribution aligned with stakeholder capitalism principles. Social dividend income promotes inclusive stakeholder benefits by integrating environmental, social, and governance (ESG) performance into shareholder payouts, fostering sustainable and socially responsible investment outcomes.

Cooperative Dividend Redistribution

Cooperative dividend redistribution emphasizes social dividend income, providing shareholders with benefits linked to the cooperative's overall social and economic impact rather than solely based on profit-driven dividend income. This approach enhances equitable income distribution and aligns shareholder returns with community development and sustainable growth objectives.

Dividends Income vs Social Dividend Income for shareholder benefits. Infographic

moneydiff.com

moneydiff.com