Freelance income typically offers more consistent cash flow, enabling easier budgeting and financial planning, while influencer income can be sporadic due to fluctuations in brand deals and audience engagement. Managing freelance income often involves setting aside fixed percentages for taxes and savings, whereas influencer income requires flexible strategies to accommodate irregular payments and seasonal spikes. Prioritizing an emergency fund is crucial for both, but influencers may benefit more from diversified income streams to stabilize their finances.

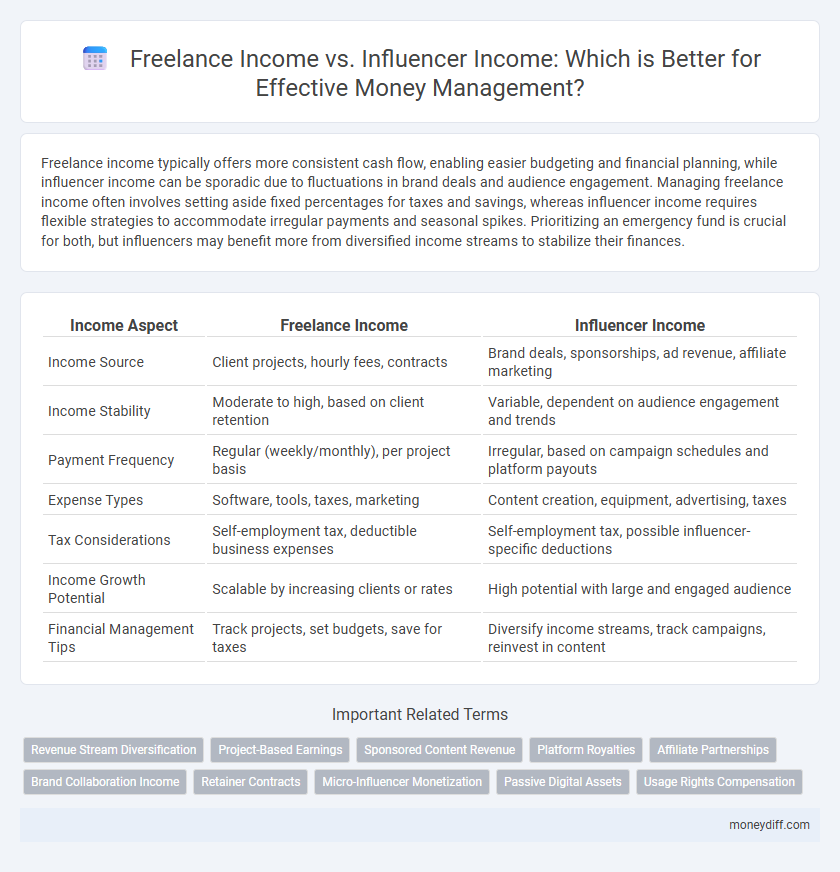

Table of Comparison

| Income Aspect | Freelance Income | Influencer Income |

|---|---|---|

| Income Source | Client projects, hourly fees, contracts | Brand deals, sponsorships, ad revenue, affiliate marketing |

| Income Stability | Moderate to high, based on client retention | Variable, dependent on audience engagement and trends |

| Payment Frequency | Regular (weekly/monthly), per project basis | Irregular, based on campaign schedules and platform payouts |

| Expense Types | Software, tools, taxes, marketing | Content creation, equipment, advertising, taxes |

| Tax Considerations | Self-employment tax, deductible business expenses | Self-employment tax, possible influencer-specific deductions |

| Income Growth Potential | Scalable by increasing clients or rates | High potential with large and engaged audience |

| Financial Management Tips | Track projects, set budgets, save for taxes | Diversify income streams, track campaigns, reinvest in content |

Overview: Freelance vs Influencer Income

Freelance income typically varies based on project quantity and client rates, providing more control but less predictability compared to influencer income, which relies heavily on brand partnerships, sponsored content, and audience engagement metrics. Influencer income can fluctuate rapidly due to changing social media algorithms and market trends, while freelancers often negotiate fixed fees or hourly rates, allowing for more consistent cash flow. Effective money management for both requires tracking diverse revenue streams, budgeting for inconsistent payments, and planning for tax obligations unique to their income structures.

Income Stability: Freelancers and Influencers

Freelance income often fluctuates based on project availability, client demand, and seasonal trends, leading to challenges in predicting monthly earnings and maintaining consistent cash flow. Influencer income can be more volatile due to reliance on sponsorship deals, audience engagement, and platform algorithm changes, resulting in unpredictable revenue streams. Effective money management for both requires creating emergency funds and diversifying income sources to mitigate the instability inherent in their earnings.

Revenue Streams: Diversifying Income

Freelancers typically generate income through varied project-based payments, offering flexibility but requiring active client acquisition for consistent cash flow. Influencers earn revenue from multiple streams such as sponsored content, affiliate marketing, and merchandise sales, leveraging audience engagement for diverse income sources. Diversifying income in both roles mitigates financial risk and enhances money management stability.

Payment Cycles: Managing Irregular Payments

Freelance income typically involves payment cycles that vary from project to project, requiring meticulous tracking of invoices and due dates to maintain cash flow stability. Influencer income often comes from multiple sources such as brand deals, affiliate marketing, and ad revenue, each with distinct payment schedules that can complicate financial planning. Effective money management for both requires establishing a budget that accounts for delayed or inconsistent payments, incorporating a buffer fund to cover periods without income.

Tax Implications: Freelancers vs Influencers

Freelance income and influencer income are both subject to self-employment taxes, but influencers may face additional tax complexities due to brand partnerships, sponsored content, and product sales requiring detailed record-keeping of expenses and revenue streams. Freelancers typically have clearer deductible business expenses related to services rendered, such as equipment and home office costs, which can simplify tax filings compared to influencers managing multiple income sources. Understanding the distinct IRS requirements for reporting income and deducting expenses helps maximize tax benefits and avoid audits for both freelancers and influencers.

Expense Tracking Methods

Freelance income requires meticulous expense tracking using invoicing software and spreadsheets to monitor project-based earnings and deductible costs. Influencer income often involves multiple revenue streams like sponsorships and ad revenue, necessitating integrated apps that track both expenses and platform-specific earnings. Both methods benefit from categorized expense records to optimize tax deductions and cash flow management.

Budgeting Strategies for Unpredictable Income

Freelance income often fluctuates monthly due to project-based payments, requiring strict budgeting strategies such as creating separate accounts for taxes and savings to manage cash flow effectively. Influencer income combines variable sources like sponsorships, ad revenue, and product sales, necessitating dynamic tracking and forecasting tools to anticipate periods of lower earnings. Implementing a zero-based budget helps both freelancers and influencers allocate every dollar purposefully, enhancing financial stability despite income unpredictability.

Savings and Emergency Funds

Freelance income typically fluctuates monthly, requiring meticulous savings strategies and a robust emergency fund that covers at least 3-6 months of variable expenses to ensure financial stability. Influencer income, often derived from sponsorships and ad revenue, can be inconsistent and seasonally dependent, making the establishment of a dedicated emergency fund critical for managing periods of low or delayed payments. Prioritizing automated savings and diversifying income streams enable both freelancers and influencers to build resilient financial buffers against income volatility.

Investment Opportunities for Freelancers and Influencers

Freelance income often provides a more stable cash flow, enabling freelancers to invest consistently in diversified portfolios such as index funds, real estate, or retirement accounts. Influencer income, characterized by volatility and peaks from sponsorships or content monetization, can be strategically allocated to high-growth assets like stocks, cryptocurrencies, or start-up equity to maximize returns. Both freelancers and influencers benefit from tailored financial planning that leverages their unique income patterns to optimize investment opportunities and long-term wealth accumulation.

Financial Tools and Apps for Money Management

Freelance income and influencer income require tailored financial tools to manage irregular cash flows and multiple revenue streams effectively. Apps like QuickBooks Self-Employed and Wave provide invoicing, expense tracking, and tax estimation features suited for freelancers, while platforms such as Patreon and Koji integrate influencer monetization with income analytics and budgeting tools. Utilizing specialized money management apps streamlines budgeting, expense categorization, and tax preparation, ensuring both freelancers and influencers maintain financial stability and growth.

Related Important Terms

Revenue Stream Diversification

Freelance income offers direct payments from clients, providing predictable cash flow, while influencer income relies heavily on brand partnerships and commissions, introducing variability; diversifying revenue streams between these models reduces financial risk and enhances long-term stability. Balancing steady freelance contracts with performance-based influencer deals ensures more resilient money management by spreading income sources across different platforms and market demands.

Project-Based Earnings

Freelance income often depends on project-based earnings, providing variable cash flow tied directly to completed contracts and deliverables, which requires diligent budgeting to manage irregular payments. Influencer income, while also project-based through sponsorships and campaigns, tends to fluctuate with audience engagement metrics, necessitating strategic financial planning to stabilize revenue streams amidst variable endorsements.

Sponsored Content Revenue

Freelance income often comes from diverse projects with predictable payments, while influencer income heavily relies on sponsored content revenue, which can fluctuate based on audience engagement and brand partnerships. Effectively managing these earnings requires tracking payment frequency and negotiating contracts to stabilize cash flow in both income streams.

Platform Royalties

Freelance income typically relies on direct client payments and project-based fees, while influencer income often depends heavily on platform royalties from ad revenue and sponsored content algorithms. Understanding the variability and timing of platform royalty payouts is crucial for effective money management in influencer careers compared to the more predictable freelance income streams.

Affiliate Partnerships

Freelance income often provides more predictable cash flow, whereas influencer income from affiliate partnerships can fluctuate based on audience engagement and commission rates. Effective money management requires tracking affiliate performance metrics and diversifying income sources to stabilize earnings.

Brand Collaboration Income

Brand collaboration income from influencers typically offers fluctuating payouts based on engagement metrics and campaign scope, while freelance income from brand partnerships provides more consistent project-based payments. Effective money management requires tracking these variable earnings separately to optimize budgeting, tax planning, and cash flow stability.

Retainer Contracts

Freelance income often relies on retainer contracts that provide consistent monthly revenue, enabling more predictable budgeting and financial planning compared to influencer income, which can be sporadic and campaign-based. Retainer contracts stabilize cash flow, making it easier to manage expenses, save, and invest, whereas influencers may face income volatility due to fluctuating brand deals and seasonal trends.

Micro-Influencer Monetization

Micro-influencer monetization typically generates more variable income streams compared to freelance work, requiring meticulous money management to stabilize cash flow and budget effectively. Prioritizing diversified revenue sources, from sponsored content to affiliate marketing, enhances financial resilience and optimizes income potential within micro-influencer careers.

Passive Digital Assets

Freelance income is typically active, dependent on hourly work or project completion, while influencer income often includes passive revenue streams from digital assets like sponsored posts, affiliate links, and digital products. Prioritizing passive digital assets allows for more consistent cash flow and scalable money management opportunities compared to the fluctuating nature of freelance earnings.

Usage Rights Compensation

Freelance income typically involves direct compensation for specific projects or services rendered, ensuring clear usage rights and licensing terms that protect the creator's work over time. Influencer income often includes payments tied to brand collaborations where usage rights can extend across multiple platforms and timeframes, requiring careful contract management to avoid unauthorized content exploitation.

Freelance Income vs Influencer Income for money management. Infographic

moneydiff.com

moneydiff.com