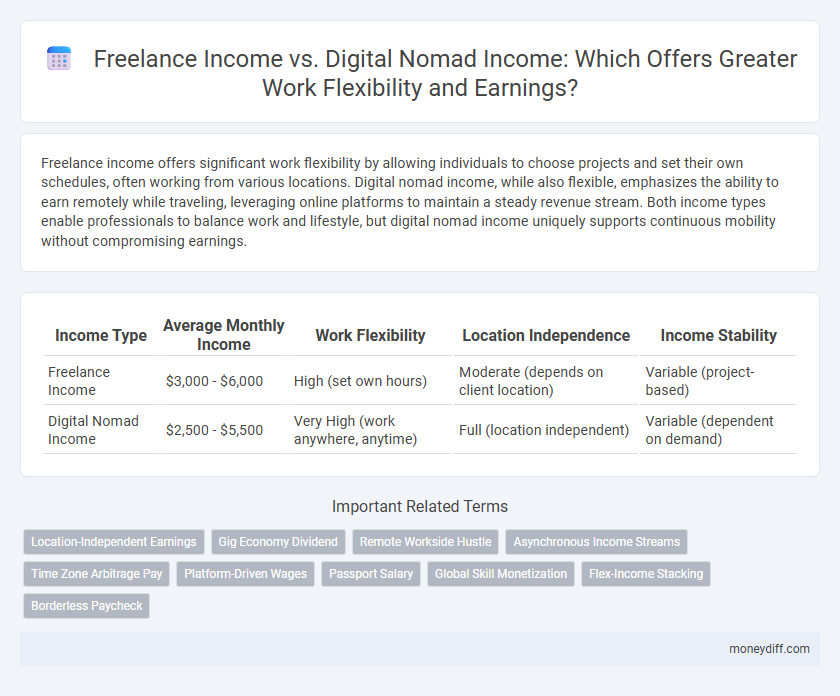

Freelance income offers significant work flexibility by allowing individuals to choose projects and set their own schedules, often working from various locations. Digital nomad income, while also flexible, emphasizes the ability to earn remotely while traveling, leveraging online platforms to maintain a steady revenue stream. Both income types enable professionals to balance work and lifestyle, but digital nomad income uniquely supports continuous mobility without compromising earnings.

Table of Comparison

| Income Type | Average Monthly Income | Work Flexibility | Location Independence | Income Stability |

|---|---|---|---|---|

| Freelance Income | $3,000 - $6,000 | High (set own hours) | Moderate (depends on client location) | Variable (project-based) |

| Digital Nomad Income | $2,500 - $5,500 | Very High (work anywhere, anytime) | Full (location independent) | Variable (dependent on demand) |

Defining Freelance Income and Digital Nomad Income

Freelance income is earned through independent contracts or projects, allowing workers to offer specialized services without long-term employer commitments. Digital nomad income typically derives from remote work or online businesses, enabling individuals to generate earnings while traveling or living in various locations worldwide. Both forms of income emphasize work flexibility, but digital nomad income prioritizes geographic mobility alongside financial independence.

Key Differences in Earning Models

Freelance income typically depends on project-based payments or hourly rates, offering variable earnings based on client demand and workload. Digital nomad income often combines remote job salaries, affiliate marketing, or passive income streams, allowing for more consistent revenue while traveling. The key difference lies in income stability; freelancers experience fluctuating cash flow tied directly to active projects, whereas digital nomads leverage diversified income sources for enhanced financial flexibility.

Flexibility in Work Hours and Locations

Freelance income offers significant flexibility in work hours, allowing professionals to tailor their schedules to peak productivity times and personal commitments. Digital nomad income extends this flexibility by enabling work from diverse global locations, leveraging internet connectivity rather than a fixed office space. Both income types emphasize autonomy, but digital nomad income uniquely supports constant geographic mobility without compromising earning potential.

Financial Stability and Income Streams

Freelance income often offers diverse income streams by working with multiple clients, providing greater financial stability through project variety and reduced dependence on a single source. Digital nomad income can vary widely depending on location and cost of living, with some relying on passive income or remote jobs that offer consistent pay but less client diversification. Balancing freelancing and digital nomad strategies enhances work flexibility while maximizing financial resilience by combining active and passive income sources.

Tax Implications for Freelancers vs. Digital Nomads

Freelancers often face complex tax obligations tied to a fixed tax residence, requiring diligent local income reporting and potential self-employment taxes. Digital nomads benefit from tax advantages by leveraging multiple jurisdictions, often utilizing territorial tax systems or tax treaties to minimize liabilities. Understanding the nuanced differences in tax residency rules is crucial for optimizing income retention and maintaining compliance.

Tools and Platforms for Managing Remote Work Income

Freelancers often rely on platforms like Upwork and Fiverr to secure projects and manage payments efficiently, while digital nomads utilize tools such as Payoneer and TransferWise to handle multi-currency income seamlessly. Both income types benefit from accounting software like QuickBooks and FreshBooks, which streamline invoicing, tax tracking, and financial reporting. Mobile apps like Expensify and Xero enable real-time expense management and income monitoring, essential for maintaining cash flow in flexible work environments.

Cost of Living Considerations Across Borders

Freelance income varies widely depending on local demand and can be supplemented by cost-effective living in lower-cost countries, enhancing overall financial flexibility. Digital nomads often prioritize destinations with affordable housing, transportation, and daily expenses, allowing their income to stretch further while maintaining work mobility. Understanding currency exchange rates and regional taxation is crucial for optimizing income relative to the cost of living across borders.

Strategies for Scaling Income in Flexible Work

Freelance income fluctuates based on project acquisition and client retention, requiring strategic diversification of services and continuous skill enhancement to scale earnings effectively. Digital nomad income benefits from location-independent opportunities such as remote consulting or digital products, leveraging global markets and time zone arbitrage to optimize revenue streams. Both models prioritize flexible work arrangements but scaling income depends on building strong personal brands, automating workflows, and utilizing multiple online platforms for client acquisition and passive income generation.

Challenges in Consistent Cash Flow Management

Freelance income often faces challenges in consistent cash flow management due to irregular client payments and project-based earnings, leading to unpredictable monthly revenue streams. Digital nomad income, while offering geographic flexibility, encounters similar financial instability caused by fluctuating contract durations and payment delays across different currencies and platforms. Effective cash flow strategies, such as diversified income sources and emergency funds, are essential to mitigate income volatility in both freelance and digital nomad work models.

Future Trends in Flexible Work and Income Generation

Freelance income offers project-based earnings with variable stability, while digital nomad income combines remote work with location independence, enhancing work flexibility through diverse revenue streams such as consulting, e-commerce, and online content creation. Emerging future trends emphasize automation tools, blockchain payments, and global gig platforms that increase access to international clients and real-time income tracking. The rise of AI-driven marketplaces and decentralized finance (DeFi) solutions will further empower freelancers and digital nomads to optimize income generation and adapt seamlessly to evolving flexible work models.

Related Important Terms

Location-Independent Earnings

Freelance income offers flexible work arrangements allowing professionals to choose projects and clients that fit their schedules, enabling a degree of location independence. Digital nomad income, however, emphasizes location-independent earnings by leveraging online platforms and remote job opportunities to sustain a lifestyle unrestricted by geographic boundaries.

Gig Economy Dividend

Freelance income typically offers more control over project selection and income diversification, which aligns closely with the gig economy dividend--allowing workers to capitalize on multiple revenue streams with flexible schedules. Digital nomad income emphasizes location-independent work, leveraging global opportunities to maximize earning potential while maintaining work-life balance through remote setups.

Remote Workside Hustle

Freelance income offers flexible remote work opportunities allowing individuals to tailor projects and schedules, while digital nomad income combines location-independent work with the freedom to travel globally without sacrificing earnings. Both income types enable diverse side hustles, leveraging online platforms for steady cash flow and work-life balance.

Asynchronous Income Streams

Freelance income often relies on synchronous tasks requiring fixed client interactions, while digital nomad income leverages asynchronous income streams such as passive digital products or automated online services, providing superior work flexibility. Asynchronous models enable digital nomads to generate revenue independent of time zones or real-time communication, enhancing location freedom and schedule autonomy.

Time Zone Arbitrage Pay

Freelance income often varies based on client location and project scope, while digital nomad income leverages time zone arbitrage pay by targeting higher-paying markets during off-peak local hours. This strategy enables digital nomads to maximize earnings by working asynchronously across global time zones, enhancing work flexibility and income potential.

Platform-Driven Wages

Freelance income primarily depends on platform-driven wages where clients directly control payment rates, often leading to variable and project-based earnings. Digital nomad income tends to be more diversified, combining remote salaried positions with freelance gigs, offering greater work flexibility and stability compared to solely platform-dependent freelance wages.

Passport Salary

Freelance income offers variable earnings based on project availability and client demand, while digital nomad income often relies on stable remote jobs or location-independent businesses, enabling consistent cash flow regardless of geographical constraints. Passport Salary platforms optimize work flexibility by connecting digital nomads with employers worldwide, facilitating seamless income generation without sacrificing mobility.

Global Skill Monetization

Freelance income offers flexible project-based earnings but often depends on local market demand, while digital nomad income leverages global skill monetization through remote work platforms, allowing professionals to capitalize on higher-paying international clients. Embracing global skill monetization enables digital nomads to diversify income streams and maximize work flexibility by accessing a broader range of opportunities beyond geographic limitations.

Flex-Income Stacking

Freelance income offers the flexibility of project-based earnings with varied client portfolios, while digital nomad income combines remote work opportunities and location-independent revenue streams for enhanced lifestyle freedom. Flex-income stacking leverages both models by integrating multiple freelance gigs and passive digital income sources, maximizing financial stability and work adaptability.

Borderless Paycheck

Freelance income offers variable earnings based on project availability, while digital nomad income emphasizes consistent borderless paycheck solutions that enable seamless work flexibility across multiple countries. Borderless paychecks facilitate tax optimization and currency diversification, empowering remote professionals to maximize income without geographic constraints.

Freelance income vs Digital nomad income for work flexibility. Infographic

moneydiff.com

moneydiff.com