Wages provide a steady and predictable income through regular salary payments based on hours worked or job responsibilities. Royalty streams offer passive income by earning a percentage from the sale or usage of intellectual property, such as books, music, or patents. While wages offer financial stability, royalties have the potential for scalable earnings over time without continuous active effort.

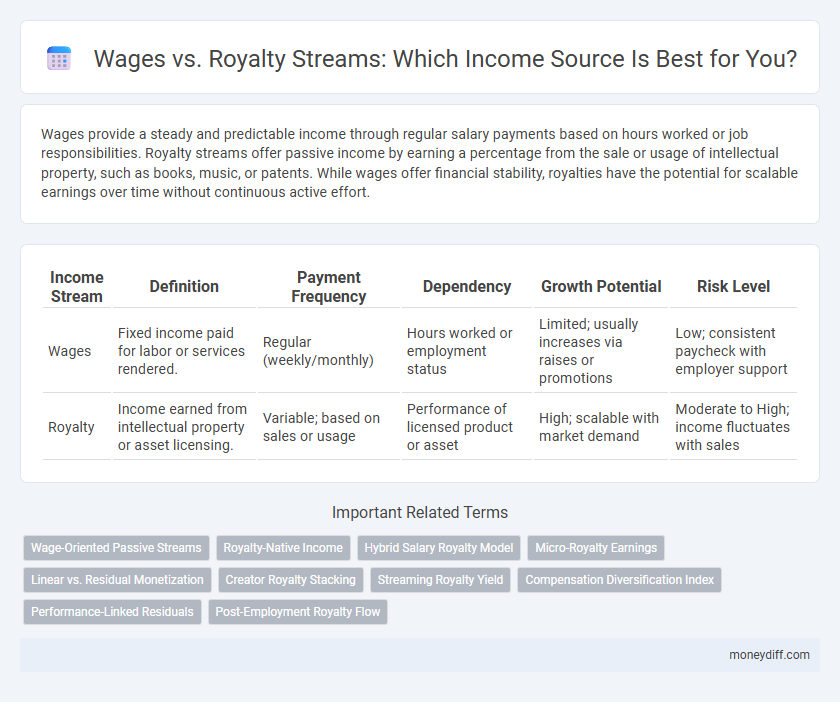

Table of Comparison

| Income Stream | Definition | Payment Frequency | Dependency | Growth Potential | Risk Level |

|---|---|---|---|---|---|

| Wages | Fixed income paid for labor or services rendered. | Regular (weekly/monthly) | Hours worked or employment status | Limited; usually increases via raises or promotions | Low; consistent paycheck with employer support |

| Royalty | Income earned from intellectual property or asset licensing. | Variable; based on sales or usage | Performance of licensed product or asset | High; scalable with market demand | Moderate to High; income fluctuates with sales |

Introduction to Income Streams: Wages vs Royalties

Wages represent a fixed, earned income paid regularly for labor or services, often influenced by hours worked or contractual terms. Royalty streams generate income through ongoing payments based on the use or sale of intellectual property, such as patents, copyrights, or natural resources, providing passive earnings over time. Understanding the distinction between active wage earnings and passive royalty revenues is essential for effective income diversification and financial planning.

Defining Wages: Traditional Earned Income

Wages represent traditional earned income derived from employment where individuals receive regular payments based on hours worked or a fixed salary. This income stream is consistent and predictable, typically governed by labor laws and employment contracts. Unlike royalty income, wages do not fluctuate with the success or sales of a product but are directly tied to personal labor and time invested.

Understanding Royalty Streams: Passive Income Explained

Royalty streams generate passive income by granting rights to use assets like intellectual property, music, or patents, providing ongoing payments without active involvement. Wages require continuous work in exchange for fixed or hourly compensation, making them an active income source. Understanding royalties enables investors to diversify income by leveraging creative or patented work to earn residual money over time.

Key Differences Between Wages and Royalty Income

Wages represent fixed compensation paid by an employer to an employee based on hours worked or a salary agreement, typically subject to regular income tax withholding. Royalty income derives from intellectual property, such as patents, copyrights, or natural resources, and is usually variable, tied to the generation or sale of the underlying asset. Unlike wages, royalties can provide a passive income stream without ongoing labor, but they often involve fluctuating payments and may be subject to different tax treatment.

Pros and Cons of Earning Wages

Earning wages provides a stable and predictable income stream with regular payments, making financial planning easier for employees. However, wages often have limited growth potential and are subject to taxation and deductions, reducing net earnings. Unlike royalty streams, wage earners typically do not benefit from passive income or residual earnings tied to asset performance.

Advantages and Challenges of Royalty Income

Royalty income offers the advantage of generating passive earnings from intellectual property, such as patents, copyrights, or trademarks, providing ongoing revenue without the need for continuous active work. This income stream can scale significantly if the underlying asset becomes widely adopted, creating long-term financial stability. Challenges include fluctuating payments based on market demand, complex contract negotiations, and potential legal disputes over rights and usage terms.

Stability and Predictability: Comparing Income Security

Wages provide a stable and predictable income stream due to fixed salary agreements and regular pay schedules, ensuring consistent financial security for employees. Royalty income, while potentially lucrative, is often variable and dependent on factors such as sales performance, market demand, and contract terms, leading to less predictable cash flow. Comparing income security, wages offer greater stability, whereas royalties present higher income variability with potential for growth but less financial certainty.

Scalability: Growing Your Earnings through Royalties

Royalty streams offer scalable income potential by generating ongoing payments from intellectual property, unlike wages which are capped by fixed hours or salary limits. As royalties continue to accumulate from each sale or usage, they enable exponential growth in earnings without additional time investment. This scalable nature of royalties makes them a powerful vehicle for passive income and long-term wealth building.

Tax Implications for Wages versus Royalty Streams

Wages are subject to standard income tax rates, Social Security, and Medicare taxes, resulting in higher overall tax liability compared to royalties. Royalty income is typically taxed as ordinary income but may qualify for specific deductions and credits, such as the Qualified Business Income deduction under Section 199A, potentially reducing taxable income. Understanding the distinct tax treatments helps optimize income strategies by leveraging lower payroll taxes on royalties versus the comprehensive withholding on wages.

Choosing the Right Income Stream for Your Financial Goals

Wages provide a stable, predictable income stream through regular paychecks, ideal for those seeking consistent financial security and budgeting ease. Royalty streams generate income based on the ongoing use of an asset, such as intellectual property or natural resources, offering potential for higher earnings but with increased variability and risk. Evaluating your risk tolerance, cash flow needs, and long-term financial objectives helps determine whether fixed wages or performance-based royalties align better with your financial goals.

Related Important Terms

Wage-Oriented Passive Streams

Wage-oriented passive income streams generate consistent cash flow by leveraging earned income from employment or contracted work, providing stability through regular paychecks without direct business ownership risks. These streams often include salary, hourly wages, and bonuses, distinguishing them from royalty income which depends on intellectual property rights and can fluctuate based on market demand.

Royalty-Native Income

Royalty income provides a passive revenue stream generated from intellectual property rights such as patents, copyrights, or trademarks, enabling continuous earnings without active labor. Unlike wages, which depend on fixed hours worked and are directly tied to personal effort, royalty-native income scales with the usage or sales of the protected asset, offering long-term financial stability and growth potential.

Hybrid Salary Royalty Model

The hybrid salary-royalty model combines fixed wages with performance-based royalty streams, maximizing income potential by providing stable earnings alongside scalable revenue from intellectual property or creative outputs. This dual approach incentivizes productivity and innovation while ensuring consistent cash flow for income diversification and financial security.

Micro-Royalty Earnings

Micro-royalty earnings offer a scalable income stream by leveraging digital content or intellectual property across multiple platforms, generating passive revenue with minimal active management. Unlike traditional wages that depend on hourly work or fixed salaries, micro-royalties provide continuous, diversified cash flow from sales, licensing, or streaming activities.

Linear vs. Residual Monetization

Wages provide linear income through fixed payments tied to hours worked or output, generating predictable but limited earning potential. Royalty streams offer residual monetization by delivering ongoing payments based on usage, sales, or licensing, enabling continuous income growth beyond initial efforts.

Creator Royalty Stacking

Wages provide fixed, predictable income based on hours worked or salary agreements, while royalty streams enable creators to earn ongoing revenue from intellectual property use, often increasing with market success. Creator Royalty Stacking maximizes income by combining multiple royalty agreements across various platforms and licensing deals, leveraging diverse revenue channels for amplified financial growth.

Streaming Royalty Yield

Streaming royalty yield offers a scalable and passive income stream by earning a percentage of revenue generated from digital content platforms, contrasting with wages that require fixed hours and active work. This recurring royalty inflow can provide long-term financial growth, especially as streaming services and content consumption continue to expand globally.

Compensation Diversification Index

Wages provide stable, predictable income through fixed salaries or hourly pay, while royalty streams generate variable earnings based on asset performance or sales, enhancing compensation diversification. The Compensation Diversification Index measures the balance between these income sources, indicating financial resilience and risk mitigation in personal income portfolios.

Performance-Linked Residuals

Performance-linked residuals in royalty streams offer ongoing income based on the success or usage of creative works, contrasting with fixed wages that provide a steady, predetermined salary regardless of performance. This model benefits artists and creators by aligning earnings with market demand and sustained engagement, resulting in scalable, long-term revenue beyond initial compensation.

Post-Employment Royalty Flow

Post-employment royalty streams provide ongoing income by leveraging intellectual property rights or creative works developed during employment, offering a passive revenue source beyond wages. Unlike fixed wage earnings, royalties can fluctuate based on usage, sales, or licensing agreements, creating potential for long-term financial growth tied to the value of the underlying asset.

Wages vs Royalty streams for income generation. Infographic

moneydiff.com

moneydiff.com