Traditional pensions provide a stable, predictable income stream during retirement, backed by employer contributions and government regulations. Crypto annuities offer the potential for higher returns through decentralized finance but come with increased volatility and regulatory uncertainties. Choosing between the two depends on risk tolerance, income stability needs, and long-term financial goals.

Table of Comparison

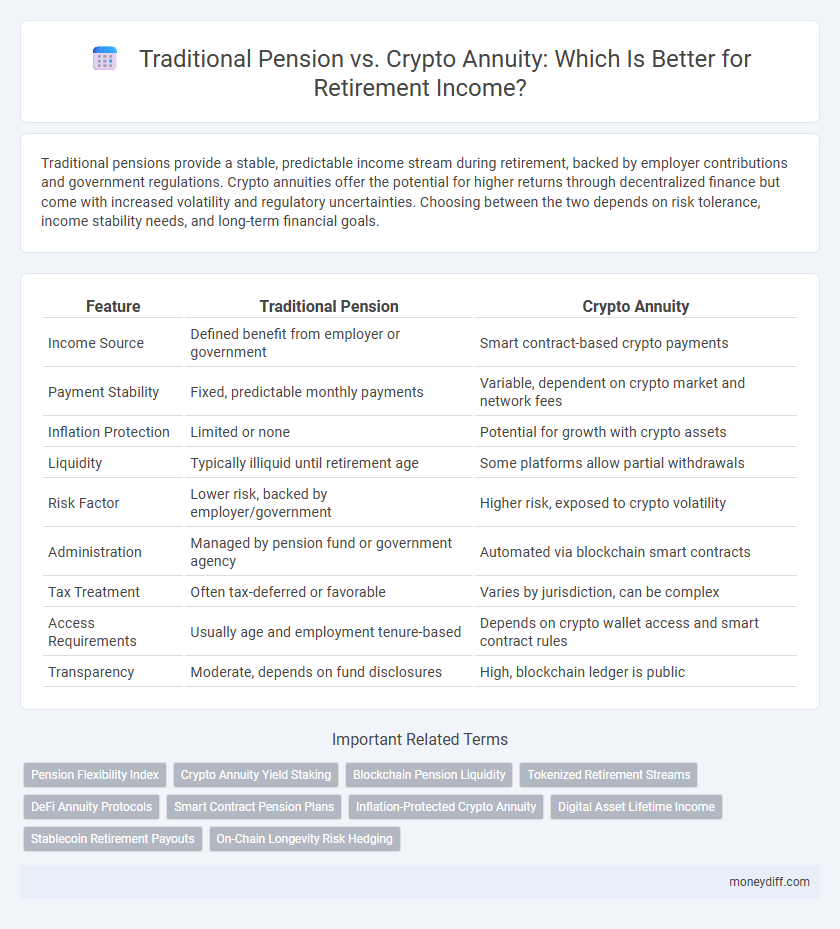

| Feature | Traditional Pension | Crypto Annuity |

|---|---|---|

| Income Source | Defined benefit from employer or government | Smart contract-based crypto payments |

| Payment Stability | Fixed, predictable monthly payments | Variable, dependent on crypto market and network fees |

| Inflation Protection | Limited or none | Potential for growth with crypto assets |

| Liquidity | Typically illiquid until retirement age | Some platforms allow partial withdrawals |

| Risk Factor | Lower risk, backed by employer/government | Higher risk, exposed to crypto volatility |

| Administration | Managed by pension fund or government agency | Automated via blockchain smart contracts |

| Tax Treatment | Often tax-deferred or favorable | Varies by jurisdiction, can be complex |

| Access Requirements | Usually age and employment tenure-based | Depends on crypto wallet access and smart contract rules |

| Transparency | Moderate, depends on fund disclosures | High, blockchain ledger is public |

Overview: Traditional Pension vs Crypto Annuity

Traditional pensions provide a predictable and regulated retirement income based on years of service and salary history, often funded by employers and government plans. Crypto annuities offer decentralized, blockchain-based income streams that leverage digital assets and smart contracts to provide potentially higher returns but come with greater volatility and regulatory uncertainty. Both options serve retirement income purposes but differ significantly in risk profiles, accessibility, and underlying asset structures.

How Traditional Pensions Guarantee Retirement Income

Traditional pensions guarantee retirement income through defined benefit plans that provide a fixed monthly payment based on salary history and years of service. These plans rely on employer contributions and actuarial calculations to ensure a stable income stream, reducing financial uncertainty for retirees. Unlike crypto annuities, traditional pensions are often insured by government agencies, adding an extra layer of security for beneficiaries.

Understanding Crypto Annuities for Modern Retirees

Crypto annuities offer modern retirees a decentralized alternative to traditional pensions by using blockchain technology to provide transparent, tamper-proof income streams. These digital annuities leverage smart contracts to automate payments, reducing administrative costs and enhancing security compared to conventional pension plans. Understanding the benefits and risks of crypto annuities enables retirees to diversify their income sources while capitalizing on the growing adoption of digital assets.

Security and Risk Comparison: Pension vs Crypto Annuity

Traditional pensions offer a guaranteed income stream backed by corporate or government entities, providing low risk and high security for retirement income. Crypto annuities, while offering potentially higher returns, involve significant volatility and regulatory uncertainty, increasing risk exposure for retirees. Assessing security and risk factors, traditional pensions remain a more stable option compared to the fluctuating landscape of crypto annuities.

Flexibility and Accessibility of Retirement Funds

Traditional pensions typically restrict access to retirement funds until a specific age, limiting flexibility and often imposing penalties for early withdrawal. Crypto annuities offer greater accessibility by enabling holders to manage and transfer assets through digital wallets, often without age-related access restrictions. This increased flexibility in crypto annuities allows for more personalized retirement income strategies, enhancing liquidity and control over funds.

Inflation Protection: Which Option Stands Out?

Traditional pensions provide guaranteed income but often lack robust inflation protection, risking diminished purchasing power over time. Crypto annuities leverage blockchain technology and can be designed to adjust payouts based on real-time inflation indexes or token value appreciation, offering potential resilience against inflation. Investors seeking retirement income with stronger inflation hedging may find crypto annuities more adaptable than fixed traditional pension plans.

Tax Implications: Pension Income vs Crypto Anuity

Traditional pension income is typically taxed as ordinary income, with rates varying based on the retiree's total income and tax bracket, while contributions to pensions may offer tax deferral benefits during the accumulation phase. Crypto annuities, depending on jurisdiction, may face complex tax treatments involving capital gains taxes on appreciation and potential reporting challenges due to the volatility and classification of digital assets. Understanding the tax implications of both options is crucial for optimizing retirement income and minimizing unexpected liabilities.

Longevity Risk: Managing Lifelong Income Streams

Traditional pensions provide stable, guaranteed income streams that effectively manage longevity risk by ensuring consistent payments throughout retirement. Crypto annuities offer innovative solutions with programmable payouts and potential growth linked to digital assets but come with higher volatility and regulatory uncertainties. Balancing these options can help retirees secure lifelong income while adapting to evolving financial landscapes.

Setup and Administration Differences Explained

Traditional pension plans require complex actuarial calculations and ongoing employer contributions, often involving fiduciary oversight and regulatory compliance. In contrast, crypto annuities leverage blockchain technology to automate payments through smart contracts, significantly reducing administrative costs and enhancing transparency. Setup for crypto annuities typically demands technical knowledge for wallet management, while traditional pensions rely on established financial institutions for administration and distribution.

Future Outlook: Evolving Retirement Income Strategies

Traditional pensions, backed by defined benefit plans and employer guarantees, provide stable, predictable retirement income but face sustainability challenges due to demographic shifts and funding deficits. Crypto annuities leverage blockchain technology and decentralized finance to offer customizable, transparent income streams with potential for higher returns and inflation hedging, though they carry regulatory and market volatility risks. Emerging retirement income strategies increasingly combine traditional frameworks with crypto-based solutions to enhance diversification, security, and adaptability in the evolving financial landscape.

Related Important Terms

Pension Flexibility Index

The Pension Flexibility Index rates traditional pensions low due to fixed payouts and limited access before retirement, while crypto annuities offer higher flexibility with customizable payout schedules and early access options. This increased adaptability makes crypto annuities a competitive alternative for generating retirement income tailored to individual financial needs.

Crypto Annuity Yield Staking

Crypto annuity yield staking offers higher potential returns compared to traditional pension plans by leveraging decentralized finance protocols that generate passive income through staking rewards. This innovative retirement income strategy provides liquidity, transparency, and flexibility, outperforming conventional pension schemes that rely on fixed interest and long-term employer contributions.

Blockchain Pension Liquidity

Traditional pensions often lack liquidity, restricting access to retirement income until specific age milestones, while crypto annuities leveraging blockchain technology enable continuous, transparent, and flexible access to funds. Blockchain pension liquidity enhances real-time asset management and reduces dependency on intermediaries, providing retirees with greater control over income streams.

Tokenized Retirement Streams

Tokenized retirement streams offer increased liquidity and transparency compared to traditional pensions, enabling retirees to access fractionalized crypto assets as steady income. These digital annuities leverage blockchain technology to provide customizable, secure, and potentially higher-yielding alternatives to conventional pension plans.

DeFi Annuity Protocols

Traditional pensions provide fixed retirement income based on employer contributions and predefined formulas, often lacking flexibility and transparency. DeFi annuity protocols leverage blockchain technology to offer programmable, decentralized income streams with potentially higher returns, enhanced security, and customizable payout structures for retirement planning.

Smart Contract Pension Plans

Smart Contract Pension Plans leverage blockchain technology to automate and secure pension distributions, offering enhanced transparency and reduced administrative costs compared to traditional pension schemes. These crypto annuities provide flexible, programmable retirement income streams, mitigating risks of mismanagement and enabling real-time adjustments based on market performance.

Inflation-Protected Crypto Annuity

Traditional pensions provide steady retirement income but often lack protection against inflation, reducing their real value over time. Inflation-protected crypto annuities leverage blockchain technology and smart contracts to adjust payouts based on inflation indices, offering enhanced purchasing power preservation for retirees.

Digital Asset Lifetime Income

Traditional pensions provide predictable, fixed retirement income based on years of service and salary history, while crypto annuities offer digital asset lifetime income through blockchain-based smart contracts, enabling decentralized, transparent, and potentially inflation-resistant payouts. Digital asset lifetime income leverages cryptocurrencies and tokenized assets to deliver programmable, secure cash flows that can adapt dynamically to market conditions and individual financial goals.

Stablecoin Retirement Payouts

Stablecoin retirement payouts offer a digital, inflation-resistant alternative to traditional pensions by providing predictable, transparent income streams secured on blockchain technology. Compared to conventional annuities, stablecoin-based solutions enhance liquidity and reduce counterparty risk while enabling seamless global access to retirement funds.

On-Chain Longevity Risk Hedging

Traditional pensions offer guaranteed monthly income relying on insurer solvency and actuarial models, while crypto annuities leverage blockchain technology for transparent, tamper-proof longevity risk hedging via smart contracts. On-chain protocols dynamically adjust payouts based on decentralized data, reducing counterparty risk and enhancing income security throughout retirement.

Traditional pension vs Crypto annuity for retirement income. Infographic

moneydiff.com

moneydiff.com