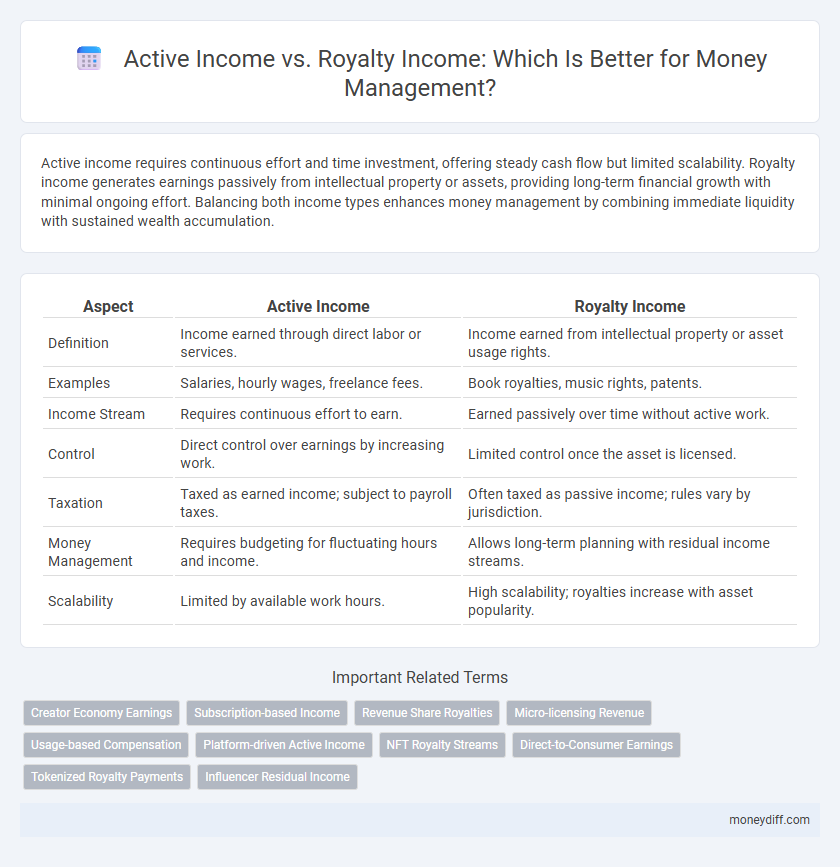

Active income requires continuous effort and time investment, offering steady cash flow but limited scalability. Royalty income generates earnings passively from intellectual property or assets, providing long-term financial growth with minimal ongoing effort. Balancing both income types enhances money management by combining immediate liquidity with sustained wealth accumulation.

Table of Comparison

| Aspect | Active Income | Royalty Income |

|---|---|---|

| Definition | Income earned through direct labor or services. | Income earned from intellectual property or asset usage rights. |

| Examples | Salaries, hourly wages, freelance fees. | Book royalties, music rights, patents. |

| Income Stream | Requires continuous effort to earn. | Earned passively over time without active work. |

| Control | Direct control over earnings by increasing work. | Limited control once the asset is licensed. |

| Taxation | Taxed as earned income; subject to payroll taxes. | Often taxed as passive income; rules vary by jurisdiction. |

| Money Management | Requires budgeting for fluctuating hours and income. | Allows long-term planning with residual income streams. |

| Scalability | Limited by available work hours. | High scalability; royalties increase with asset popularity. |

Understanding Active Income and Royalty Income

Active income refers to earnings generated through direct involvement in work or business activities, such as salaries, wages, and freelance payments, requiring continuous effort and time investment. Royalty income derives from intellectual property rights, including patents, copyrights, or mineral rights, providing passive revenue streams without active management. Understanding the distinctions between these income types is crucial for effective money management, as active income typically demands ongoing labor while royalty income offers potential long-term financial stability through residual earnings.

Key Differences Between Active and Royalty Income

Active income is earned through direct effort, such as salaries, wages, or freelance work, and requires continuous involvement to generate revenue. Royalty income comes from intellectual property rights, like patents, copyrights, or book royalties, providing ongoing payments without ongoing work. Understanding these differences is crucial for effective money management, as active income typically demands time investment, whereas royalty income offers a more passive, residual stream of earnings.

Pros and Cons of Active Income Streams

Active income, earned through direct labor or services such as salaries, freelance work, or business operations, provides consistent cash flow and immediate financial control, making budgeting and short-term planning straightforward. However, active income is often limited by time constraints, requiring continuous effort to maintain and lacking scalability compared to passive income sources like royalties. The dependency on active participation increases vulnerability to job loss or health issues, challenging long-term wealth accumulation and financial stability.

Advantages of Earning Royalty Income

Royalty income provides a passive revenue stream, allowing you to earn money continuously from intellectual property such as books, music, or patents without ongoing active work. This type of income offers long-term financial stability and the potential for exponential growth as the value of the underlying asset increases over time. Unlike active income, which requires consistent effort and hours worked, royalty income can scale with minimal additional input, enhancing overall wealth management strategies.

Managing Taxes for Active and Royalty Earnings

Active income, earned through direct labor or services, is typically taxed at higher ordinary income tax rates, requiring careful planning to optimize deductions and withholdings. Royalty income, derived from intellectual property or natural resources, often benefits from preferential tax treatments such as lower effective tax rates or specific deductions related to asset depreciation. Effective money management strategies should incorporate tax-saving opportunities unique to both income types to minimize liability and maximize after-tax earnings.

Balancing Active Work and Passive Royalty Flow

Balancing active income from regular employment with passive royalty income helps diversify cash flow and financial stability. Active income requires continuous effort, while royalty income generates ongoing revenue from intellectual property or creative works without daily involvement. Effective money management involves allocating resources to nurture active work while leveraging royalties to build long-term wealth.

Building Sustainable Royalty Income Sources

Building sustainable royalty income sources involves creating assets like intellectual property, patents, or creative works that generate ongoing payments without continuous active effort. Actively investing in diverse royalty streams can provide long-term financial stability and reduce reliance on active income, which requires direct labor or time commitment. Prioritizing royalty income enhances cash flow predictability and supports passive wealth accumulation strategies.

Diversifying Income: Active Jobs vs. Royalties

Diversifying income streams by balancing active income from jobs and royalty income enhances financial stability and growth potential. Active income provides consistent cash flow through salaries or wages, while royalty income offers passive earnings from intellectual properties like books, music, or patents. Integrating both allows better money management by reducing reliance on a single source and leveraging long-term wealth creation opportunities.

Money Management Tips for Variable Income

Active income, earned through direct work such as salaries or freelance projects, requires diligent budgeting to manage fluctuating cash flow effectively. Royalty income, generated passively from intellectual property or investments, demands strategic reinvestment and tax planning to optimize long-term financial stability. Diversifying income streams and maintaining a reserve fund are essential money management tips for navigating the variability of active and royalty incomes.

Long-Term Wealth Strategies: Active vs. Royalty Streams

Active income requires continuous effort and time commitment, making it less scalable for long-term wealth. Royalty income generates passive revenue through intellectual property or investments, providing consistent cash flow without ongoing work. Prioritizing royalty streams enables diversified portfolios and sustainable financial growth, essential for effective money management.

Related Important Terms

Creator Economy Earnings

Active income in the creator economy involves direct engagement and time investment, such as revenue from freelance projects or sponsored content, while royalty income provides passive earnings through intellectual property like music, books, or digital assets. Balancing active income streams with royalty income enhances financial stability and long-term wealth growth by diversifying revenue sources and maximizing cash flow sustainability.

Subscription-based Income

Subscription-based income represents a form of royalty income that provides steady, recurring cash flow from intellectual property or digital products, contrasting with active income which requires continuous effort and time investment. Managing money from subscription-based royalty streams enables financial stability and scalability, leveraging automated payments rather than direct labor for income generation.

Revenue Share Royalties

Active income requires continuous effort and time investment to generate earnings, whereas royalty income, particularly revenue share royalties, provides ongoing passive revenue streams based on sales or usage without continuous work. Revenue share royalties optimize money management by creating scalable income through contractual agreements tied directly to product or intellectual property performance.

Micro-licensing Revenue

Active income, generated through direct labor or services, often requires continuous effort and time investment, whereas royalty income from micro-licensing leverages intellectual property to provide a scalable and passive revenue stream. Micro-licensing revenue, driven by permissions granted for short-term or limited use of digital content, offers diversified cash flow and more predictable financial management compared to the variability of active income.

Usage-based Compensation

Active income, earned through direct labor or services, offers immediate cash flow for daily expenses and budgeting, while royalty income, derived from intellectual property or asset usage, provides ongoing passive revenue streams that support long-term financial stability and investment growth. Managing money effectively involves balancing these usage-based compensations to ensure consistent liquidity from active income alongside the compounding benefits of royalties.

Platform-driven Active Income

Platform-driven active income generates immediate cash flow through tasks like freelancing, gig work, or digital content creation, directly tied to time and effort invested. Royalty income provides passive earnings from intellectual property but requires upfront investment and long-term strategy, making platform-driven active income preferable for regular money management and liquidity.

NFT Royalty Streams

Active income requires continuous effort and time investment, such as salaries or freelance work, whereas NFT royalty income provides passive revenue streams through automated, recurring payments whenever NFTs are resold, offering scalable money management opportunities. Utilizing NFT royalty streams enables diversification of income sources by leveraging digital assets that generate long-term cash flow without ongoing active labor.

Direct-to-Consumer Earnings

Active income from Direct-to-Consumer (DTC) sales requires ongoing effort and time investment, generating revenue through personal involvement in product creation or service delivery. Royalty income within the DTC model provides passive revenue streams by licensing intellectual property or content, allowing continuous earnings without daily operational involvement.

Tokenized Royalty Payments

Tokenized royalty payments transform traditional royalty income into liquid, tradable digital assets, providing a steady cash flow with passive income benefits compared to the labor-dependent nature of active income. This innovation enhances money management by offering diversified revenue streams, improved transparency, and fractional ownership, enabling investors to capitalize on intellectual property earnings without continuous active work.

Influencer Residual Income

Active income requires continuous effort and time investment, typical for influencers regularly creating content, while royalty income, such as residual earnings from licensed content or branded merchandise, provides influencers with passive revenue streams that enhance long-term financial stability. Leveraging royalty income allows influencers to build sustainable wealth beyond immediate active income fluctuations, optimizing money management with diversified revenue sources.

Active Income vs Royalty Income for money management. Infographic

moneydiff.com

moneydiff.com