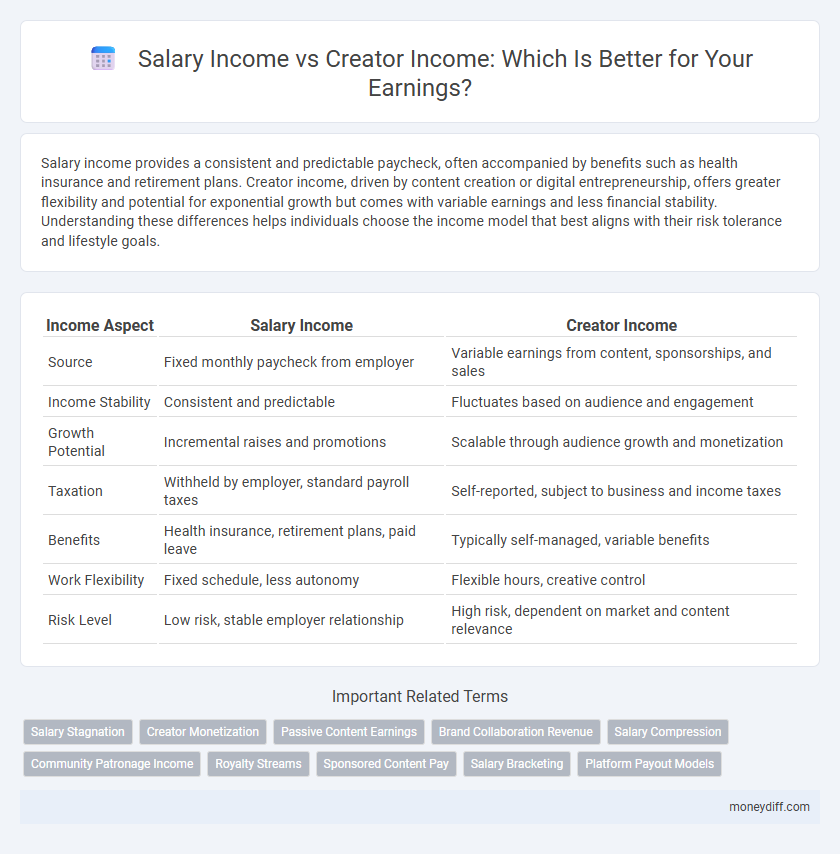

Salary income provides a consistent and predictable paycheck, often accompanied by benefits such as health insurance and retirement plans. Creator income, driven by content creation or digital entrepreneurship, offers greater flexibility and potential for exponential growth but comes with variable earnings and less financial stability. Understanding these differences helps individuals choose the income model that best aligns with their risk tolerance and lifestyle goals.

Table of Comparison

| Income Aspect | Salary Income | Creator Income |

|---|---|---|

| Source | Fixed monthly paycheck from employer | Variable earnings from content, sponsorships, and sales |

| Income Stability | Consistent and predictable | Fluctuates based on audience and engagement |

| Growth Potential | Incremental raises and promotions | Scalable through audience growth and monetization |

| Taxation | Withheld by employer, standard payroll taxes | Self-reported, subject to business and income taxes |

| Benefits | Health insurance, retirement plans, paid leave | Typically self-managed, variable benefits |

| Work Flexibility | Fixed schedule, less autonomy | Flexible hours, creative control |

| Risk Level | Low risk, stable employer relationship | High risk, dependent on market and content relevance |

Understanding Salary Income vs Creator Income

Salary income is a fixed and predictable source of earnings typically received through regular paychecks from an employer, providing financial stability and often including benefits like health insurance and retirement plans. Creator income, by contrast, is variable and generated through content creation platforms, sponsorships, and merchandise sales, relying heavily on audience engagement and digital presence. Understanding the fundamental differences between salary income and creator income is crucial for effective financial planning, tax management, and long-term wealth building strategies.

Key Differences Between Salary and Creator Earnings

Salary income offers consistent, predictable compensation typically based on fixed monthly payments and benefits, providing financial stability and job security. Creator income, generated through content creation, brand partnerships, and audience monetization, is often variable and depends on engagement metrics, platform algorithms, and market demand. Key differences include the stability and structure of salary earnings versus the fluctuating, performance-driven nature of creator revenue streams.

Income Stability: Salaried Jobs vs Creative Ventures

Salary income provides consistent monthly earnings with predictable tax deductions, offering financial stability and easier budgeting. Creator income, often variable and project-based, can lead to fluctuating cash flow but allows for higher earning potential through diverse revenue streams like sponsorships and merchandise. Understanding the trade-off between steady paycheck reliability and the unpredictable yet scalable nature of creative income is crucial for effective financial planning.

Potential for Income Growth: Salaried Employees vs Creators

Salaried employees typically experience steady income growth through annual raises and promotions based on company structure and tenure, providing predictable financial stability. Creators, such as content producers and influencers, have higher potential for exponential income growth leveraged by audience expansion, brand partnerships, and monetization strategies. However, creator income can be highly variable and dependent on market trends and platform algorithms, making its growth less predictable than salaried income.

Flexibility and Autonomy: Traditional Employment vs Creator Economy

Salary income from traditional employment offers stable monthly earnings and structured benefits but limits flexibility and autonomy in work schedules and creative decisions. Creator income, driven by platforms like YouTube, Instagram, and Patreon, provides greater control over content, work hours, and revenue streams, enabling individuals to adapt quickly to market trends. This shift highlights a growing preference for self-directed income models that emphasize personal brand development and diversified monetization.

Risk Factors in Salary and Creator Income Streams

Salary income offers stable, predictable earnings with lower risk due to fixed monthly payments and often employer-provided benefits like health insurance and retirement plans. Creator income, while potentially higher, carries greater volatility because earnings depend on audience engagement, platform algorithms, and inconsistent content monetization. Risk factors for creators include fluctuating sponsorship deals, changes in algorithm visibility, and income unpredictability tied to market trends and consumer preferences.

Tax Implications: Salary Income vs Earnings as a Creator

Salary income is typically subject to withholding taxes, standard payroll deductions, and employer contributions, simplifying tax compliance for employees. Earnings as a creator, often classified as self-employment income, require reporting all revenue and can involve deductible business expenses, estimated tax payments, and self-employment taxes. Understanding the differences in tax treatment is crucial for accurate filing and maximizing deductions in both salary and creator income scenarios.

Time Investment: 9-to-5 Jobs vs Creator Work

Salary income from 9-to-5 jobs typically offers a stable and predictable paycheck in exchange for fixed hours, emphasizing consistent time investment. Creator income fluctuates based on content performance and audience engagement, requiring flexible and often irregular working hours with potential for exponential growth. The time investment in creator work demands ongoing content creation and community management, contrasting the structured schedule of salaried employment.

Diversification Opportunities in Creator and Salary Income

Salary income offers consistent earnings with predictable tax deductions and employer benefits, providing financial stability. Creator income, derived from various digital platforms and content monetization, enables diversification through multiple revenue streams like sponsorships, merchandise, and ad revenue. Combining salary income with creator income maximizes financial resilience by blending steady paychecks with scalable, performance-based earnings.

Financial Planning Strategies: Managing Income from Salary vs Creation

Salary income provides predictable cash flow and tax withholdings, facilitating straightforward budgeting and retirement planning. Creator income, often variable and project-based, requires strategic financial management including building emergency funds, diversifying revenue streams, and planning for irregular tax obligations. Effective financial planning for creators involves leveraging tools like quarterly tax payments and investment accounts to stabilize long-term wealth despite income fluctuations.

Related Important Terms

Salary Stagnation

Salary income often faces stagnation due to fixed raises and limited promotion opportunities, limiting earning potential over time. Creator income, driven by personal brand growth and multiple revenue streams, offers dynamic scalability and higher income diversification compared to traditional salary models.

Creator Monetization

Salary income provides stable, predictable earnings through fixed wages, while creator income relies heavily on monetization strategies such as ad revenue, brand partnerships, and direct fan support via platforms like Patreon. Effective creator monetization requires diversifying income streams and leveraging digital tools to maximize revenue potential in an often fluctuating market.

Passive Content Earnings

Salary income provides consistent monthly pay through employment, while creator income from passive content earnings generates revenue via digital assets like videos, podcasts, or eBooks. Passive content earnings leverage platforms such as YouTube, Patreon, and Amazon Kindle, allowing creators to monetize their work continuously without active daily involvement.

Brand Collaboration Revenue

Salary income provides a stable, predictable cash flow with fixed monthly earnings, while creator income, particularly from brand collaboration revenue, offers variable but potentially higher financial gains through sponsored content and partnerships. Brand collaborations often yield significant revenue growth for creators, leveraging audience engagement metrics that do not typically impact salaried positions.

Salary Compression

Salary compression occurs when the wage difference between experienced employees and entry-level workers narrows, often seen in traditional salary income structures. Creator income, driven by varied revenue streams like sponsorships and ad revenue, tends to offer more scalable earnings, reducing the impact of compression compared to fixed salary roles.

Community Patronage Income

Salary income provides a stable and predictable financial foundation based on fixed wages or hourly rates, whereas creator income, particularly from community patronage platforms like Patreon or Ko-fi, offers variable revenue that fluctuates with audience engagement and content monetization effectiveness. Community patronage income leverages direct support from followers, fostering a sustainable revenue model through subscriptions, donations, and exclusive content access, which can surpass traditional salary income for creators with strong and active audiences.

Royalty Streams

Salary income provides consistent, predictable earnings through fixed paychecks, whereas creator income often relies on variable royalty streams generated from intellectual property such as music, books, or digital content. Royalty streams can offer long-term passive income potential but fluctuate based on market demand, platform reach, and audience engagement.

Sponsored Content Pay

Sponsored content pay significantly boosts creator income compared to traditional salary income, as it allows creators to monetize their audience directly through brand partnerships. Unlike fixed salaries, sponsored content payments vary based on engagement metrics, audience size, and platform reach, offering higher earning potential for creators with strong online influence.

Salary Bracketing

Salary income is typically categorized into structured salary brackets based on role, experience, and industry standards, providing predictable financial growth and taxation levels. In contrast, creator income varies widely without fixed brackets, often fluctuating monthly due to variable content monetization, sponsorship deals, and platform algorithms impacting revenue streams.

Platform Payout Models

Salary income offers predictable, fixed earnings through regular paychecks, while creator income depends heavily on platform payout models such as ad revenue shares, sponsorship deals, and subscriber contributions, which vary widely in terms of stability and scalability. Platforms like YouTube, Patreon, and TikTok implement diverse algorithms and monetization policies that directly impact creators' income potential and cash flow consistency.

Salary income vs Creator income for Income. Infographic

moneydiff.com

moneydiff.com