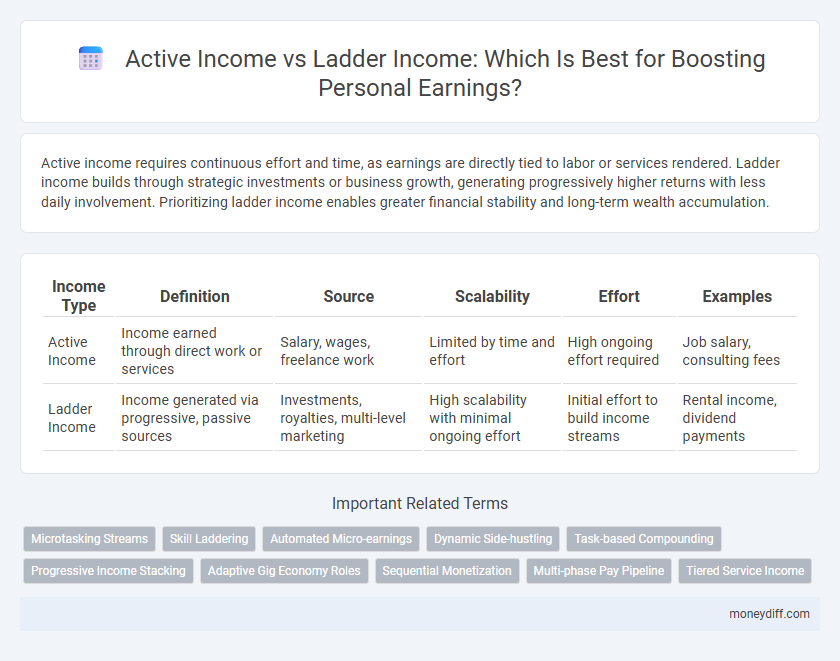

Active income requires continuous effort and time, as earnings are directly tied to labor or services rendered. Ladder income builds through strategic investments or business growth, generating progressively higher returns with less daily involvement. Prioritizing ladder income enables greater financial stability and long-term wealth accumulation.

Table of Comparison

| Income Type | Definition | Source | Scalability | Effort | Examples |

|---|---|---|---|---|---|

| Active Income | Income earned through direct work or services | Salary, wages, freelance work | Limited by time and effort | High ongoing effort required | Job salary, consulting fees |

| Ladder Income | Income generated via progressive, passive sources | Investments, royalties, multi-level marketing | High scalability with minimal ongoing effort | Initial effort to build income streams | Rental income, dividend payments |

Understanding Active Income: Definition and Sources

Active income refers to earnings generated through direct involvement in work or services, including salaries, wages, commissions, and tips. This type of income requires continuous effort and time investment, making it dependent on one's active participation. Common sources of active income encompass employment income, freelance work, and business operations where owner involvement is essential.

What is Ladder Income? Key Concepts Explained

Ladder income refers to a strategic approach to personal earnings where income sources are diversified in a tiered structure, often combining active and passive streams to create financial stability and growth. This method emphasizes building multiple levels of income, such as salary, freelance projects, investments, and royalty payments, allowing for incremental increases and reduced dependency on a single source. Understanding ladder income helps individuals design a sustainable income portfolio that minimizes risk and maximizes long-term wealth accumulation.

Main Differences: Active Income vs Ladder Income

Active income requires direct effort and time, such as salaries, wages, and freelancing fees, where earnings depend on continuous work. Ladder income, often referred to as passive or residual income, involves earnings generated from investments or business structures that scale over time without constant involvement. The main difference lies in the dependence on active participation for active income versus the growth potential and leverage in ladder income streams.

Pros and Cons of Active Income

Active income generates earnings through direct effort such as wages, salaries, or freelance work, offering immediate and predictable cash flow. It allows for skill development and control over work schedules but requires continuous time investment and ceases once labor stops. The downside includes limited scalability and potential vulnerability to job loss or burnout without passive revenue streams.

Advantages and Disadvantages of Ladder Income

Ladder income offers the advantage of generating passive earnings through investments or assets that appreciate over time, providing financial stability without continuous active effort. However, it carries the disadvantage of requiring significant initial capital and carries risks related to market volatility and asset management. Unlike active income, which directly compensates labor or services, ladder income can build wealth more sustainably but demands patience and strategic planning.

Building a Ladder Income: Strategies and Tips

Building ladder income requires diversifying earnings streams by investing in assets that generate passive income, such as dividend-paying stocks, real estate rentals, or peer-to-peer lending. Regularly reinvesting returns and escalating contributions over time compound wealth, enhancing financial stability beyond active income sources like salaries or freelancing. Employing tax-efficient vehicles like IRAs or 401(k)s further optimizes ladder income growth while minimizing liability.

Sustainability: Which Income Stream Lasts Longer?

Active income depends on continuous effort and time investment, making it less sustainable over the long term due to potential burnout or job loss. Ladder income, generated through passive streams like investments or royalties, offers greater sustainability by providing ongoing earnings without constant active involvement. Building ladder income increases financial stability and longevity, ensuring earnings persist even during periods without active work.

Risk Factors: Active vs Ladder Income

Active income depends heavily on continuous effort and time investment, exposing individuals to higher risk if they cannot maintain consistent productivity or face job loss. Ladder income involves multiple, progressively growing income streams, which mitigates risk through diversification and passive earnings stability over time. This approach reduces reliance on a single source, providing a more resilient financial foundation against market fluctuations or employment instability.

Combining Active and Ladder Income for Financial Growth

Combining active income, earned through direct labor or services, with ladder income, generated from passive sources like investments or royalties, creates a balanced financial portfolio that accelerates wealth accumulation. Active income provides immediate cash flow essential for daily expenses, while ladder income compounds over time, offering sustainable long-term growth and financial stability. Strategically blending these income streams enhances cash flow management, reduces financial risk, and maximizes earning potential.

Choosing the Right Income Approach for Your Goals

Active income requires continuous effort through work or services, making it ideal for those seeking immediate, consistent earnings tied to their time investment. Ladder income, often derived from diversified investments or passive revenue streams, supports long-term wealth building by generating earnings with minimal ongoing effort. Selecting the right income approach depends on your financial goals, risk tolerance, and desired balance between short-term cash flow and long-term financial security.

Related Important Terms

Microtasking Streams

Active income from microtasking involves direct work on platforms like Amazon Mechanical Turk or Appen, generating immediate earnings based on tasks completed. Ladder income emerges by scaling microtasking streams through skill development, automation tools, or building task-related services, creating a progressive increase in personal earnings over time.

Skill Laddering

Active income relies on direct work and time investment to generate earnings, while ladder income grows through skill laddering, progressively enhancing expertise to unlock higher-paying opportunities and passive revenue streams. Skill laddering enables individuals to build cumulative competencies, increasing income potential by transitioning from entry-level tasks to advanced roles with greater financial rewards.

Automated Micro-earnings

Active income requires continuous effort and time investment, whereas ladder income leverages automated micro-earnings through scalable digital assets and passive income streams. Implementing automated systems like affiliate marketing, subscription models, and micro-task platforms enables consistent, incremental earnings without constant active involvement.

Dynamic Side-hustling

Dynamic side-hustling transforms active income streams by leveraging diverse gigs and freelance opportunities, enabling individuals to scale earnings beyond traditional 9-to-5 work. Ladder income builds progressive revenue tiers through strategically aligned side projects and investments, fostering long-term financial growth and stability.

Task-based Compounding

Active income requires continuous effort and time investment, generating earnings directly linked to completed tasks, while ladder income builds progressively by leveraging prior efforts and compounding returns through structured, tiered systems. Task-based compounding in ladder income accelerates personal earnings by multiplying income streams from hierarchical activities or referrals, contrasting with the linear nature of active income.

Progressive Income Stacking

Active income requires continuous effort and time investment, limiting earnings to available working hours, while ladder income, through progressive income stacking, builds multiple revenue streams that increase wealth exponentially without proportional time input. Progressive income stacking combines diverse sources like side businesses, investments, and royalties to create scalable, passive returns that enhance long-term financial stability.

Adaptive Gig Economy Roles

Active income requires continuous work and time investment, as earnings are directly tied to hours or tasks completed, typical in adaptive gig economy roles like ridesharing or freelance projects. Ladder income, however, is generated through scaling efforts or multiple income streams within the gig economy, such as building a client base or leveraging digital platforms to increase earnings without proportional time increases.

Sequential Monetization

Active income requires continuous effort and time investment where earnings stop if work ceases, while ladder income involves building multiple income streams in a structured sequence that generate increasing earnings over time. Sequential monetization in ladder income optimizes personal earnings by leveraging initial active efforts to create scalable passive revenue sources.

Multi-phase Pay Pipeline

Active income relies on direct labor and time investment, generating earnings only while working, whereas ladder income leverages a multi-phase pay pipeline that builds successive revenue streams through strategic investments or network expansion. This structured approach maximizes long-term personal earnings by creating passive income layers that compound financial growth over time.

Tiered Service Income

Tiered service income offers a scalable approach to personal earnings by structuring active income into multiple levels based on service complexity and client engagement. This model enhances revenue potential by incentivizing progression through higher service tiers, maximizing overall active income compared to a flat income structure.

Active income vs Ladder income for personal earnings. Infographic

moneydiff.com

moneydiff.com