Salary income provides a stable and predictable cash flow, making it easier to plan a monthly budget with consistent expenses and savings goals. Creator economy income, often fluctuating due to content performance and audience engagement, requires flexible budgeting strategies to accommodate variable earnings and unexpected opportunities. Balancing both income streams can enhance financial security by combining steady monthly revenue with the potential for higher, though irregular, creative income.

Table of Comparison

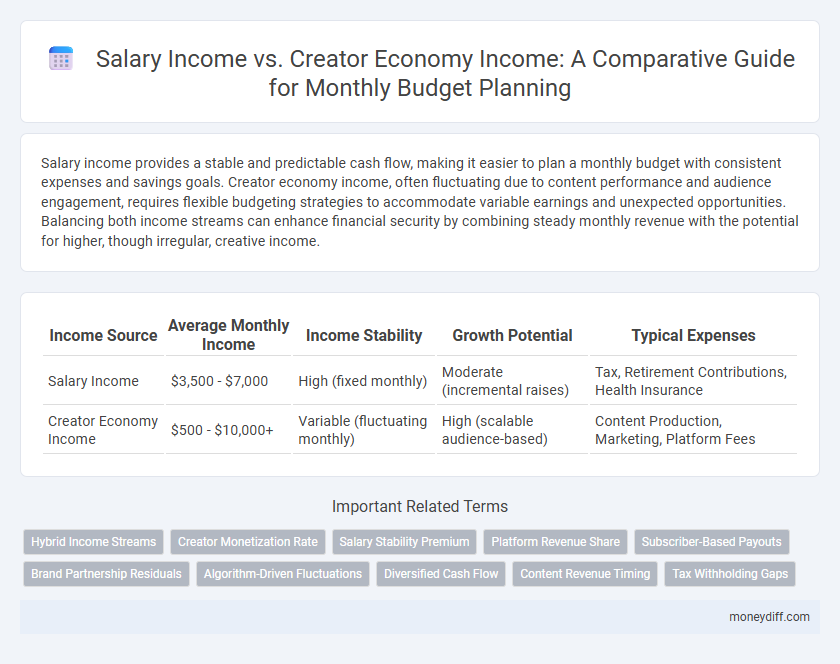

| Income Source | Average Monthly Income | Income Stability | Growth Potential | Typical Expenses |

|---|---|---|---|---|

| Salary Income | $3,500 - $7,000 | High (fixed monthly) | Moderate (incremental raises) | Tax, Retirement Contributions, Health Insurance |

| Creator Economy Income | $500 - $10,000+ | Variable (fluctuating monthly) | High (scalable audience-based) | Content Production, Marketing, Platform Fees |

Traditional Salary Income: Stability and Predictability

Traditional salary income provides consistent monthly cash flow, ensuring reliable financial planning for household expenses and savings. This steady income stream supports long-term commitments such as rent, mortgage, and bills without unexpected fluctuations. Stability in salary income allows for accurate budgeting and reduces financial stress compared to the variable earnings typical of the creator economy.

Creator Economy Income: Flexibility and Variability

Creator economy income offers significant flexibility and variability compared to traditional salary income, allowing individuals to adjust their work schedules and income streams based on demand and personal preferences. Unlike fixed monthly salaries, income from content creation, streaming, or digital products fluctuates due to factors like audience engagement, platform algorithms, and seasonal trends. This variability requires careful monthly budget planning, incorporating savings strategies to manage periods of lower earnings while maximizing opportunities during peak income months.

Comparing Monthly Budgeting Approaches

Salary income offers consistent monthly cash flow, simplifying budgeting with predictable expenses and savings allocations. Creator economy income, characterized by fluctuating earnings from platforms like YouTube, Patreon, or TikTok, requires dynamic budgeting strategies to manage irregular cash inflows. Effective monthly budgeting in the creator economy often involves building cash reserves and leveraging financial tools to smooth income volatility.

Fixed vs. Variable Earnings: Impact on Expenses

Salary income provides a stable and predictable monthly budget with fixed earnings, facilitating consistent expense planning and long-term financial commitments. Creator economy income is often variable and fluctuates based on content performance, audience engagement, and market trends, requiring flexible budgeting strategies to manage irregular cash flow. Understanding the impact of fixed versus variable earnings is crucial for effective expense management and financial stability in diverse income scenarios.

Income Streams: Single Source or Diversification

Relying solely on salary income provides steady, predictable cash flow ideal for fixed monthly budgets, but limits financial growth potential. Diversifying income streams with creator economy earnings introduces variable but scalable revenue, enhancing financial resilience and flexibility. Balancing traditional salary and creator income supports more robust monthly budgeting through a blend of stability and growth opportunities.

Budgeting Strategies for Salary Earners

Salary income provides predictable cash flow, enabling more accurate monthly budgeting with fixed expenses and savings goals. Creator economy income is often variable and requires flexible budgeting strategies to manage irregular earnings and plan for taxes or business expenses. Salary earners should prioritize building an emergency fund and automating savings to maintain stability while exploring supplemental income from creator activities.

Managing Irregular Income as a Creator

Managing irregular income as a creator requires diligent budgeting strategies compared to fixed salary income, which provides predictable monthly cash flow. Creators should track variable revenue streams, set aside a percentage of high-earning months for lean periods, and prioritize an emergency fund covering 3-6 months of expenses. Utilizing tools like zero-based budgeting can enhance financial stability despite fluctuating earnings in the creator economy.

Emergency Funds: Different Needs for Each Group

Salary income provides predictable monthly cash flow, making it easier to calculate and maintain emergency funds typically covering 3 to 6 months of expenses. In contrast, creator economy income tends to be irregular and fluctuating, requiring larger or more flexible emergency funds to account for periods of low or no revenue. Budgeting for emergency savings in the creator economy must prioritize liquidity and adaptability to offset income variability and ensure financial stability.

Savings Goals: Adapting to Income Patterns

Salary income provides a stable and predictable cash flow, making it easier to set consistent savings goals within a monthly budget. In contrast, creator economy income can be highly variable, requiring flexible budgeting strategies to adjust savings targets based on fluctuating earnings. Prioritizing emergency funds and variable expense management becomes crucial when balancing these differing income patterns to achieve long-term financial stability.

Building Financial Security in Both Income Types

Balancing salary income with creator economy earnings diversifies cash flow, enhancing monthly budget stability and reducing reliance on a single source. Consistent salary payments provide predictable financial security, while creator economy income offers growth potential through multiple monetization channels like sponsorships, merchandise, and digital content sales. Combining these income streams allows for strategic savings, investment, and debt management, strengthening overall financial resilience.

Related Important Terms

Hybrid Income Streams

Salary income provides a stable, predictable monthly budget foundation, while creator economy income introduces variable cash flow with opportunities for growth through digital content, sponsorships, and merchandise sales. Hybrid income streams combine the security of a fixed paycheck with the scalability and flexibility of creator earnings, enhancing financial resilience and budget diversification.

Creator Monetization Rate

Creator economy income often fluctuates due to variable Creator Monetization Rates, which directly impact monthly budget stability compared to fixed salary income. Understanding the average Creator Monetization Rate helps forecast realistic earnings and manage expenses within the dynamic income landscape of content creation.

Salary Stability Premium

Salary income provides a stable, predictable cash flow essential for consistent monthly budget planning, offering a reliability premium that creator economy income often lacks due to its variability and dependence on audience engagement. Creator economy income can fluctuate significantly month-to-month, making it challenging to rely on for fixed expenses despite its potential for higher overall earnings.

Platform Revenue Share

Salary income provides a predictable monthly budget with a fixed amount, while creator economy income varies significantly based on platform revenue share models such as YouTube's 45%, Instagram's integration incentives, and Twitch's 50% split. Understanding these revenue shares is crucial for creators to accurately plan cash flow and manage monthly expenses in comparison to traditional salary earnings.

Subscriber-Based Payouts

Subscriber-based payouts in the creator economy offer variable monthly income tied directly to audience engagement, contrasting with the fixed stability of traditional salary income. This model demands careful budgeting to accommodate fluctuations in revenue, emphasizing the importance of diversified income streams for financial security.

Brand Partnership Residuals

Salary income provides consistent monthly cash flow essential for budgeting stability, while creator economy income, particularly from brand partnership residuals, offers scalable revenue streams that can significantly enhance financial flexibility. Brand partnership residuals generate recurring earnings beyond initial collaborations, making them a valuable component for diversifying and supplementing monthly income sources in a creator's budget.

Algorithm-Driven Fluctuations

Salary income offers consistent monthly cash flow, providing stability for budgeting, while creator economy income experiences algorithm-driven fluctuations that can cause significant variability in earnings. These unpredictable changes require flexible financial planning to manage irregular revenue streams effectively.

Diversified Cash Flow

Salary income provides consistent and predictable cash flow essential for fixed monthly budget expenses, while creator economy income introduces diversified cash streams through sponsorships, ad revenue, and merchandise sales, enhancing financial resilience. Balancing traditional salary with dynamic creator earnings reduces dependency on a single income source and supports greater budget flexibility.

Content Revenue Timing

Salary income provides predictable monthly cash flow essential for budgeting, while creator economy income varies widely due to fluctuating content revenue timing and platform monetization cycles. Managing a monthly budget effectively requires factoring in delays from ad payouts, sponsorship payments, and audience engagement patterns inherent in creator economy earnings.

Tax Withholding Gaps

Salary income typically has consistent tax withholding based on standardized payroll deductions, ensuring predictable monthly budget management; creator economy income often faces irregular tax withholding or none at all, causing significant gaps that require proactive quarterly tax payments to avoid underpayment penalties. Managing these withholding disparities is crucial for accurate cash flow planning and minimizing unexpected tax liabilities in monthly budgeting.

Salary income vs Creator economy income for monthly budget. Infographic

moneydiff.com

moneydiff.com