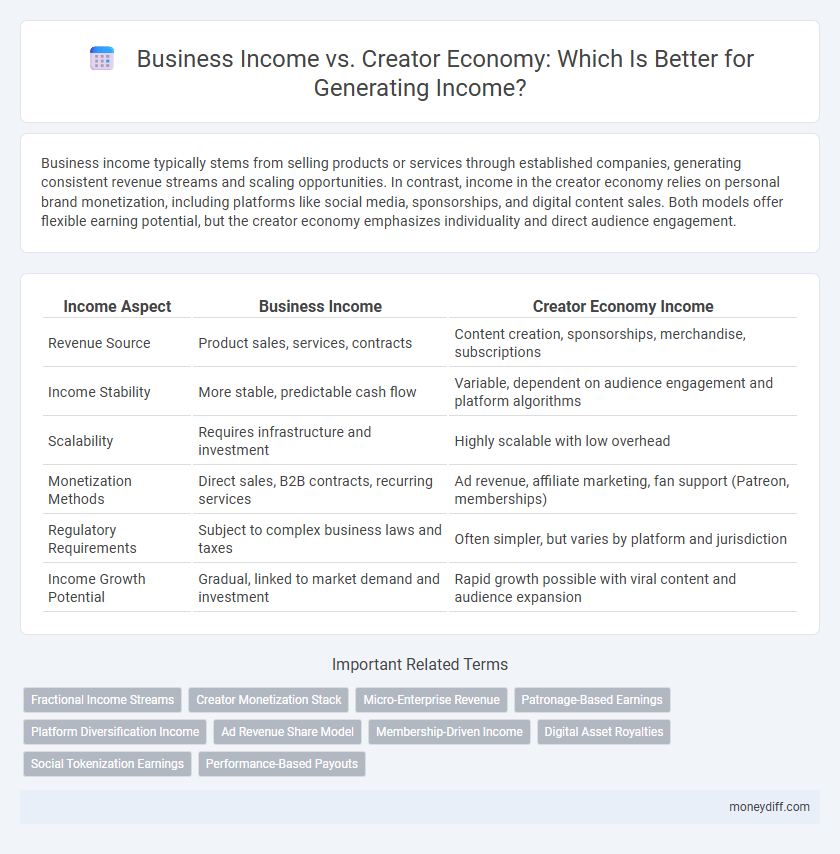

Business income typically stems from selling products or services through established companies, generating consistent revenue streams and scaling opportunities. In contrast, income in the creator economy relies on personal brand monetization, including platforms like social media, sponsorships, and digital content sales. Both models offer flexible earning potential, but the creator economy emphasizes individuality and direct audience engagement.

Table of Comparison

| Income Aspect | Business Income | Creator Economy Income |

|---|---|---|

| Revenue Source | Product sales, services, contracts | Content creation, sponsorships, merchandise, subscriptions |

| Income Stability | More stable, predictable cash flow | Variable, dependent on audience engagement and platform algorithms |

| Scalability | Requires infrastructure and investment | Highly scalable with low overhead |

| Monetization Methods | Direct sales, B2B contracts, recurring services | Ad revenue, affiliate marketing, fan support (Patreon, memberships) |

| Regulatory Requirements | Subject to complex business laws and taxes | Often simpler, but varies by platform and jurisdiction |

| Income Growth Potential | Gradual, linked to market demand and investment | Rapid growth possible with viral content and audience expansion |

Defining Business Income vs Creator Economy Income

Business income typically derives from traditional enterprises involving the sale of goods or services, generating revenue through established commercial models and structured financial reporting. Creator economy income, in contrast, stems from individual content creators who monetize digital platforms via ads, sponsorships, subscriptions, and direct fan support, often leveraging social media and personal branding. Both income types are subject to varying tax regulations and revenue streams, reflecting the evolving landscape of work and entrepreneurship.

Revenue Streams: Traditional Business vs Creator Economy

Traditional business income primarily stems from product sales, service fees, and licensing agreements, generating consistent revenue through established customer bases and supply chains. The creator economy, by contrast, relies on diversified revenue streams such as ad revenue, sponsorships, crowdfunding, merchandise sales, and subscription models like Patreon or OnlyFans. This shift enables individual creators to monetize personal brands directly, often leveraging social media platforms for scalable income generation beyond conventional business structures.

Scalability of Earnings in Both Models

Business income often scales through leveraged resources such as employees, capital investments, and established distribution channels, enabling exponential growth potential. In contrast, the creator economy typically relies on individual productivity and audience engagement, which can limit scalability but allows for direct monetization streams like sponsorships and digital products. Both models benefit from digital platforms, yet businesses can achieve higher scalability due to structured operations and resource aggregation.

Upfront Investment and Startup Costs

Business income typically requires significant upfront investment and higher startup costs due to expenses such as inventory, equipment, and physical infrastructure. In contrast, the creator economy often involves lower initial expenses, primarily focused on digital tools and content creation platforms, making it more accessible for individuals with limited capital. This lower barrier to entry enables faster monetization but may lead to variable income streams compared to traditional businesses.

Passive vs Active Income Opportunities

Business income often generates passive income through scalable systems and automated processes, allowing revenue streams without continuous active involvement. In contrast, the creator economy typically relies on active income by producing content, engaging audiences, and personal branding, requiring ongoing effort and time investment. Passive income opportunities in business, such as licensing and subscription models, contrast with the creator economy's active monetization methods like sponsorships and live engagements.

Income Stability and Predictability

Business income typically offers greater stability and predictability due to established revenue streams, contractual agreements, and consistent client bases. In contrast, income from the creator economy often fluctuates significantly, influenced by audience engagement, platform algorithms, and content virality. This variability makes financial planning more challenging for creators compared to traditional businesses with steady cash flows.

Tax Considerations for Businesses and Creators

Business income is subject to corporate tax rates, deductible expenses, and potential payroll taxes, requiring careful accounting to maximize tax efficiency. Creators in the creator economy often report income through self-employment, facing self-employment taxes and having opportunities for deductions on equipment, software, and workspace costs. Understanding differences in tax obligations and eligible deductions is crucial for both businesses and creators to optimize income retention and compliance.

Monetization Platforms and Tools

Business income primarily derives from monetization platforms like Shopify, Amazon, and PayPal, which enable direct sales, subscriptions, and service payments. In contrast, the creator economy relies heavily on platforms such as Patreon, YouTube, and TikTok, leveraging tools like ad revenue sharing, fan donations, and branded content partnerships. Both ecosystems utilize analytics and payment gateways to optimize income streams and enhance financial tracking.

Branding and Market Reach Differences

Business income often relies on established branding strategies and broad market reach through traditional advertising and partnerships, generating steady revenue streams from diverse consumer bases. In contrast, the creator economy prioritizes personal branding and social media influence, enabling direct engagement with niche audiences and monetization through content, sponsorships, and fan support. These differences result in varied income scalability: businesses benefit from institutional credibility, while creators leverage authentic connections and agility in market responsiveness.

Legal and Regulatory Factors Affecting Income

Business income often faces strict legal frameworks including corporate tax regulations, licensing requirements, and compliance with employment laws, which significantly affect net earnings and reporting obligations. In contrast, creators in the creator economy navigate a complex landscape of intellectual property rights, platform-specific content monetization rules, and varying tax classifications for freelance or gig-based income. Both sectors must address evolving regulatory environments, such as digital tax laws and international income reporting standards, influencing income stability and growth potential.

Related Important Terms

Fractional Income Streams

Business income relies on diversified revenue channels such as product sales, services, and subscriptions to create fractional income streams that reduce financial risk. In the creator economy, fractional income streams emerge from multiple platforms like ad revenue, sponsorships, merchandise, and fan memberships, enabling income stability through varied monetization methods.

Creator Monetization Stack

Business income primarily derives from traditional revenue streams such as sales, services, and B2B contracts, while the creator economy income hinges on a diversified Creator Monetization Stack including subscription platforms, ad revenue, brand partnerships, and digital product sales. The Creator Monetization Stack empowers individuals to leverage multiple income channels simultaneously, maximizing earnings through content creation, fan engagement, and personalized experiences.

Micro-Enterprise Revenue

Micro-enterprises in the creator economy generate income primarily through diversified digital platforms, leveraging content monetization, sponsorships, and direct audience engagement. Business income in traditional micro-enterprises often relies on product sales and services, whereas creator economy revenue emphasizes scalable, subscription-based models and digital asset monetization, reflecting a shift in income streams and economic dynamics.

Patronage-Based Earnings

Business income typically relies on product sales, services, and contracts with predictable revenue streams, whereas the creator economy's income often centers on patronage-based earnings through platforms like Patreon and Ko-fi, where audiences directly support creators via subscriptions or donations. This model allows creators to generate sustainable income from a loyal fan base, diversifying their revenue beyond traditional advertising and sponsorships.

Platform Diversification Income

Business income often relies on diversified revenue streams across various platforms such as e-commerce, services, and affiliate marketing, ensuring stability and growth. In the creator economy, income diversification includes multiple channels like sponsored content, merchandise sales, crowdfunding, and subscription models to maximize earnings and reduce dependence on any single platform.

Ad Revenue Share Model

Business income from traditional enterprises often relies on diversified revenue streams, while the creator economy primarily generates income through the Ad Revenue Share Model, where platforms like YouTube and TikTok allocate a percentage of advertising revenue to content creators based on views and engagement metrics. This model incentivizes high-quality, frequent content production, directly linking creator earnings to audience size and advertiser demand within the digital ecosystem.

Membership-Driven Income

Business income from membership-driven models typically generates steady, recurring revenue through subscription fees, enhancing financial predictability and customer loyalty. Creator economy income from memberships relies heavily on digital platforms like Patreon and OnlyFans, where personalized content and community engagement drive consistent cash flow.

Digital Asset Royalties

Business income from digital asset royalties often stems from licensing fees, sales, and subscriptions related to intellectual property, providing steady revenue streams for companies leveraging digital rights management. In the creator economy, income from digital asset royalties is typically generated through platforms like NFTs, streaming services, and content monetization, enabling individual creators to earn revenue directly from audience engagement and digital resale markets.

Social Tokenization Earnings

Business income traditionally relies on product sales, services, and advertising revenue, whereas the creator economy generates income predominantly through social tokenization, enabling fans to invest directly in creators via tokens that represent ownership, access, or rewards. Social tokenization earnings empower creators to monetize their influence through decentralized platforms, creating new income streams independent of conventional business models.

Performance-Based Payouts

Business income typically relies on fixed contracts and predictable revenue streams, whereas the creator economy emphasizes performance-based payouts that fluctuate according to engagement metrics and content monetization. This model incentivizes creators by aligning earnings directly with audience interaction, driving diverse income opportunities through sponsorships, ad revenue, and fan contributions.

Business income vs Creator economy for Income. Infographic

moneydiff.com

moneydiff.com