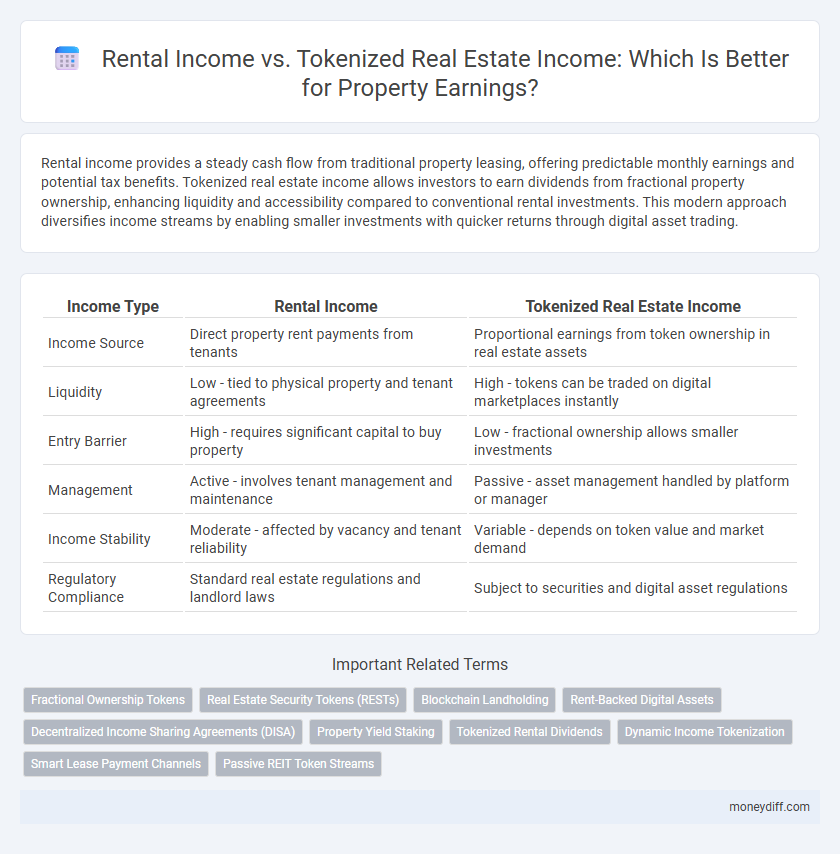

Rental income provides a steady cash flow from traditional property leasing, offering predictable monthly earnings and potential tax benefits. Tokenized real estate income allows investors to earn dividends from fractional property ownership, enhancing liquidity and accessibility compared to conventional rental investments. This modern approach diversifies income streams by enabling smaller investments with quicker returns through digital asset trading.

Table of Comparison

| Income Type | Rental Income | Tokenized Real Estate Income |

|---|---|---|

| Income Source | Direct property rent payments from tenants | Proportional earnings from token ownership in real estate assets |

| Liquidity | Low - tied to physical property and tenant agreements | High - tokens can be traded on digital marketplaces instantly |

| Entry Barrier | High - requires significant capital to buy property | Low - fractional ownership allows smaller investments |

| Management | Active - involves tenant management and maintenance | Passive - asset management handled by platform or manager |

| Income Stability | Moderate - affected by vacancy and tenant reliability | Variable - depends on token value and market demand |

| Regulatory Compliance | Standard real estate regulations and landlord laws | Subject to securities and digital asset regulations |

Introduction to Traditional Rental Income

Traditional rental income generates earnings through leasing physical properties, where landlords collect monthly payments from tenants for residential or commercial spaces. This income stream is predictable and backed by long-standing legal frameworks, offering stability and tangible asset control. Key factors influencing rental income include location, property condition, lease terms, and market demand.

Understanding Tokenized Real Estate Income

Tokenized real estate income allows investors to earn rental revenues by owning digital shares of a property, offering liquidity and fractional ownership that traditional rental income lacks. Unlike conventional rental income, which requires direct property management and tenant handling, tokenized assets generate passive earnings through smart contracts on blockchain platforms. This innovative income stream enhances accessibility, reduces entry barriers, and provides transparent, real-time income distribution compared to conventional property rental earnings.

Key Differences Between Rental and Tokenized Income

Rental income is generated through direct leasing of physical properties, providing steady cash flow but involving tenant management, maintenance, and liquidity constraints. Tokenized real estate income derives from fractional ownership on blockchain platforms, enabling diversified investments, enhanced liquidity through token trading, and lower entry barriers. Key differences include control and management responsibilities, liquidity of assets, and accessibility to a broader investor base.

Earning Potential: Rental vs Tokenized Properties

Rental income from traditional properties offers consistent monthly cash flow based on lease agreements, subject to market demand and tenant reliability. Tokenized real estate income provides fractional ownership benefits, enabling diversified investment and liquidity, with earnings derived from property value appreciation and distributed rental profits. Comparing earning potential, tokenized properties can outperform by leveraging broader market access and reduced entry barriers, though they may involve higher volatility and regulatory considerations.

Liquidity: Selling Traditional vs Tokenized Assets

Rental income from traditional real estate provides steady cash flow but involves illiquid assets that require lengthy selling processes, often taking months to close transactions. Tokenized real estate income benefits from higher liquidity as property shares are traded on blockchain platforms, enabling faster sales and access to capital within minutes or days. This increased liquidity lowers barriers for investors seeking flexible income streams compared to conventional property earnings.

Risk Factors in Rental and Tokenized Investments

Rental income faces risks such as tenant default, property damage, and market vacancy fluctuations, which directly impact cash flow stability. Tokenized real estate income introduces liquidity risk, regulatory uncertainties, and smart contract vulnerabilities, potentially affecting asset accessibility and income regularity. Both investment types require thorough due diligence to mitigate risks associated with property management and digital asset security.

Accessibility and Minimum Investment Requirements

Rental income requires significant upfront capital and often involves property management challenges, limiting accessibility for many investors. Tokenized real estate income allows fractional ownership with lower minimum investments, enabling broader participation in property earnings. Digital platforms facilitate seamless transactions and offer liquidity, enhancing accessibility compared to traditional rental income streams.

Tax Implications for Rental and Tokenized Real Estate

Rental income is typically subject to standard income tax rates and may allow deductions for mortgage interest, property management, and maintenance expenses. Tokenized real estate income, classified as capital gains or dividends depending on the token structure, often benefits from favorable tax treatment but may incur complex reporting requirements due to blockchain transactions. Understanding the specific tax implications and compliance obligations is crucial for maximizing after-tax returns in both traditional rental and tokenized real estate investments.

Portfolio Diversification: Rental vs Tokenized Income

Rental income provides steady cash flow from physical properties but requires active management and higher entry costs, limiting diversification opportunities. Tokenized real estate income allows investors to access fractional ownership in multiple properties, enhancing portfolio diversification with lower capital requirements. Combining traditional rental income with tokenized assets can balance risk and improve overall yield stability.

Choosing the Right Income Stream for Your Goals

Rental income provides a steady cash flow from traditional property leasing, ideal for investors seeking consistent monthly earnings and direct property management control. Tokenized real estate income offers fractional ownership and liquidity, enabling diversification and potentially higher returns through blockchain-enabled transactions. Selecting the right income stream depends on your goals for liquidity, risk tolerance, and long-term wealth accumulation.

Related Important Terms

Fractional Ownership Tokens

Fractional ownership tokens enable investors to earn proportional rental income from real estate assets without direct property management, offering liquidity and diversification benefits compared to traditional rental income. This blockchain-based model allows seamless trading of property shares, enhancing income opportunities and reducing barriers to entry in real estate markets.

Real Estate Security Tokens (RESTs)

Rental income generates steady cash flow from physical property leases, whereas Tokenized Real Estate Income through Real Estate Security Tokens (RESTs) offers fractional ownership with liquidity and blockchain-based transparency. RESTs enable investors to earn dividends from real estate assets while benefiting from simplified transactions, reduced barriers to entry, and enhanced portfolio diversification.

Blockchain Landholding

Rental income from traditional property earnings offers steady cash flow through tenant payments, whereas tokenized real estate income leverages blockchain technology to fractionalize ownership, enabling increased liquidity and diversified investment opportunities. Blockchain Landholding platforms enhance transparency and security in property transactions, optimizing rental income distribution via smart contracts.

Rent-Backed Digital Assets

Rental income from traditional properties offers consistent cash flow through tenant payments, while tokenized real estate income represents fractional ownership in rent-backed digital assets, enabling diversification and liquidity on blockchain platforms. Rent-backed digital assets provide investors with transparent, automated earnings distributions and reduced entry barriers compared to conventional real estate investments.

Decentralized Income Sharing Agreements (DISA)

Rental income generates steady earnings through traditional lease agreements, while tokenized real estate income leverages blockchain technology for fractional property ownership and liquidity. Decentralized Income Sharing Agreements (DISA) enable investors to receive proportional earnings directly from property cash flows, enhancing transparency and reducing intermediaries in real estate income distribution.

Property Yield Staking

Rental income traditionally generates steady cash flow from tenants, while tokenized real estate income leverages blockchain technology to enable fractional ownership and liquidity, enhancing property yield staking opportunities. Property yield staking in tokenized assets offers scalable returns by distributing rental profits and capital appreciation through smart contracts to a broader investor base.

Tokenized Rental Dividends

Tokenized rental dividends offer increased liquidity and fractional ownership compared to traditional rental income, allowing investors to earn proportional earnings from real estate assets through blockchain-based tokens. These digital dividends provide faster distribution and enhanced transparency, optimizing cash flow management for property investors.

Dynamic Income Tokenization

Rental income from traditional real estate provides steady cash flow based on lease agreements, whereas tokenized real estate income leverages dynamic income tokenization to allow fractional ownership and real-time revenue distribution. This innovative approach enhances liquidity and diversifies earnings by converting property profits into tradable digital tokens on blockchain platforms.

Smart Lease Payment Channels

Smart Lease Payment Channels enhance rental income efficiency by enabling secure, transparent transactions directly on blockchain platforms, reducing intermediaries and lowering costs. Tokenized real estate income offers fractional ownership benefits and liquidity, allowing investors to earn proportional rental yields through decentralized payment systems integrated with smart lease contracts.

Passive REIT Token Streams

Rental income typically offers steady cash flow from physical properties, while tokenized real estate income enables fractional ownership and enhanced liquidity through blockchain technology. Passive REIT token streams diversify earnings by allowing investors to earn real estate income without direct property management, increasing accessibility and reducing traditional barriers.

Rental income vs Tokenized real estate income for property earnings. Infographic

moneydiff.com

moneydiff.com