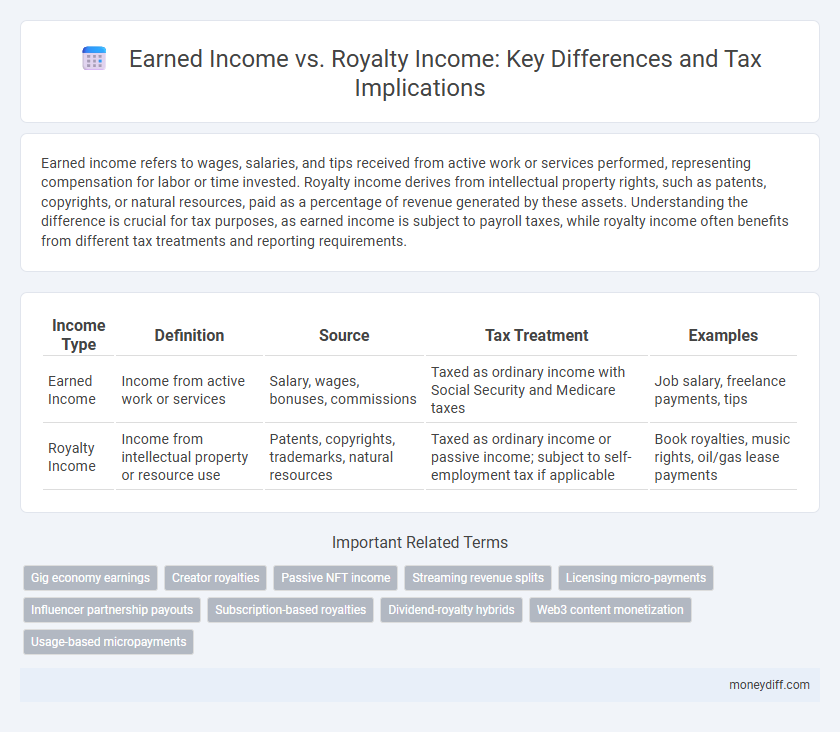

Earned income refers to wages, salaries, and tips received from active work or services performed, representing compensation for labor or time invested. Royalty income derives from intellectual property rights, such as patents, copyrights, or natural resources, paid as a percentage of revenue generated by these assets. Understanding the difference is crucial for tax purposes, as earned income is subject to payroll taxes, while royalty income often benefits from different tax treatments and reporting requirements.

Table of Comparison

| Income Type | Definition | Source | Tax Treatment | Examples |

|---|---|---|---|---|

| Earned Income | Income from active work or services | Salary, wages, bonuses, commissions | Taxed as ordinary income with Social Security and Medicare taxes | Job salary, freelance payments, tips |

| Royalty Income | Income from intellectual property or resource use | Patents, copyrights, trademarks, natural resources | Taxed as ordinary income or passive income; subject to self-employment tax if applicable | Book royalties, music rights, oil/gas lease payments |

Introduction to Income Streams: Earned vs Royalty Income

Earned income stems from active work such as salaries, wages, and tips, directly tied to time and effort invested. Royalty income arises from intellectual property rights, including book sales, music, patents, and trademarks, providing ongoing revenue without continuous labor. Understanding these distinct income streams aids in diverse financial planning and tax strategy optimization.

Defining Earned Income: Wages, Salaries, and Beyond

Earned income includes wages, salaries, bonuses, tips, and net earnings from self-employment, reflecting active work compensation. Royalty income differs as it stems from intellectual property rights, such as patents, copyrights, and natural resources, generating passive revenue. Understanding earned income's scope is essential for accurate tax reporting and financial planning strategies.

Understanding Royalty Income: Passive Earnings Explained

Royalty income represents earnings generated from intellectual property assets such as patents, copyrights, trademarks, or natural resources, providing a passive income stream without active involvement. This contrasts with earned income, which is derived from direct labor, services, or employment compensation, requiring active participation. Understanding royalty income is crucial for leveraging creative or proprietary works into cumulative financial returns over time.

How Earned Income Works: Sources and Examples

Earned income primarily comes from active work, including wages, salaries, commissions, and tips, emphasizing direct labor contributions from employment or self-employment. Common sources include full-time jobs, freelance projects, consulting, and small business operations where income is directly tied to time, effort, or skills provided. Unlike royalty income, earned income requires ongoing personal involvement and active participation in producing goods or services.

The Mechanics of Royalty Income: Rights, Licensing, and Payments

Royalty income is generated through licensing agreements where the owner of intellectual property grants rights to another party to use, reproduce, or sell the creation in exchange for payments. This income stream depends on the terms of contracts that specify the royalty rate, payment schedules, and scope of usage rights, often based on sales, usage metrics, or fixed fees. Unlike earned income, which is compensation for labor or services, royalty income derives from the ongoing exploitation of intangible assets such as patents, copyrights, or trademarks.

Tax Implications of Earned Income vs Royalty Income

Earned income from wages or self-employment is subject to ordinary income tax rates and payroll taxes, including Social Security and Medicare, leading to higher overall tax liability. Royalty income, generated from intellectual property or natural resources, is generally reported as passive income and taxed at ordinary income rates but typically exempt from payroll taxes, resulting in potential tax savings. Understanding these distinctions helps optimize tax strategies by leveraging the differing tax treatments of earned income versus royalty income.

Financial Stability: Predictability of Earned and Royalty Income

Earned income, derived from salaries or wages, offers greater financial stability due to its regular and predictable nature, typically paid on a fixed schedule. Royalty income, generated from intellectual property like patents or copyrights, tends to be variable and less predictable, influenced by market demand and consumption patterns. Understanding the stability differences helps individuals and businesses plan cash flow and manage financial risks more effectively.

Wealth Building Potential: Scaling Earned vs Royalty Income

Earned income is directly tied to time and effort, limiting scalability and capping wealth-building potential as income plateaus without increased work hours. Royalty income generates continuous revenue from intellectual property or creative work, allowing income to scale exponentially without additional active involvement. This passive nature of royalty income offers greater wealth-building opportunities through long-term residual earnings compared to the linear growth of earned income.

Pros and Cons: Comparing Earned and Royalty Income Sources

Earned income, derived from active work such as salaries or wages, provides consistent cash flow and greater control over earnings but requires ongoing effort and time commitment. Royalty income, generated from intellectual property like patents or creative works, offers passive revenue streams with potential for long-term returns but can be unpredictable and dependent on market demand. Balancing earned and royalty income allows diversification, mitigating risks associated with employment stability and fluctuating royalty royalties.

Choosing the Right Income Stream for Long-Term Money Management

Choosing the right income stream between earned income and royalty income significantly impacts long-term money management strategies. Earned income, derived from active labor, provides consistent cash flow but depends on continuous work, while royalty income offers passive earnings from intellectual property or investments, potentially yielding higher returns with less ongoing effort. Balancing these income types enhances financial stability and growth, allowing for diversified income sources and optimized tax planning.

Related Important Terms

Gig economy earnings

Earned income in the gig economy typically stems from active work such as freelance projects, ride-sharing, or delivery services, where individuals exchange labor for direct payment. Royalty income arises from passive earnings linked to intellectual property rights, including royalties from creative content or software licenses, distinguishing it from the immediate compensation characteristic of earned income.

Creator royalties

Earned income from active work contrasts with royalty income, which represents passive earnings generated from intellectual property such as music, books, or digital content. Creator royalties provide ongoing revenue streams based on the usage or sales of their original work, often resulting in long-term financial benefits without additional labor after the initial creation.

Passive NFT income

Earned income from active work contrasts with royalty income generated passively, such as through NFT royalties that provide ongoing revenue from secondary sales on blockchain platforms. This form of passive NFT income leverages smart contracts to automate payments, creating a sustainable income stream without continuous effort.

Streaming revenue splits

Earned income from streaming platforms typically involves a fixed percentage of subscription fees paid to artists based on the number of streams, whereas royalty income is generated from ongoing rights management and licensing agreements. Streaming revenue splits often allocate around 70% to rights holders as royalty income, with the remaining 30% covering platform fees and distribution costs, emphasizing the distinction between direct earnings and residual royalties.

Licensing micro-payments

Earned income derives from active work or services performed, while royalty income originates from licensing agreements that provide micro-payments based on usage or sales of intellectual property. Licensing micro-payments generate ongoing royalty income streams without continuous active involvement, offering a scalable revenue model distinct from earned income's labor-dependent nature.

Influencer partnership payouts

Earned income from influencer partnership payouts typically includes salaries, commissions, and bonuses directly tied to active work or promotions, while royalty income arises from ongoing payments based on content usage or brand licensing agreements. Influencers earning royalties receive continuous income streams from their intellectual property, whereas earned income requires consistent, active participation in campaigns or collaborations.

Subscription-based royalties

Earned income refers to wages or salaries received from employment, while royalty income is generated from intellectual property licenses, such as subscription-based royalties earned from ongoing access to digital content or software. Subscription-based royalties provide a recurring revenue stream, differentiating them from one-time earned income payments by leveraging consistent user engagement over time.

Dividend-royalty hybrids

Dividend-royalty hybrids combine features of earned income and royalty income, allowing investors to receive periodic payments similar to dividends while benefiting from rights linked to intellectual property or natural resources. These hybrids optimize tax efficiency by blending active involvement characteristic of earned income with the passive nature and preferential tax treatment typical of royalty income streams.

Web3 content monetization

Earned income in Web3 content monetization typically arises from direct services, such as freelance writing or programming, whereas royalty income stems from ongoing digital asset usage like NFTs or blockchain-based creative works. Royalty income leverages smart contracts to ensure automatic, transparent payment distribution each time content is accessed or sold, differentiating it from traditional earned income models.

Usage-based micropayments

Earned income derives from active labor or services rendered, typically received as wages or salaries, whereas royalty income is generated from intellectual property rights, such as copyrights or patents, based on usage-based micropayments. Usage-based micropayments allow precise revenue tracking for digital content creators by linking royalty income directly to actual consumer consumption or usage events.

Earned income vs Royalty income for Income. Infographic

moneydiff.com

moneydiff.com