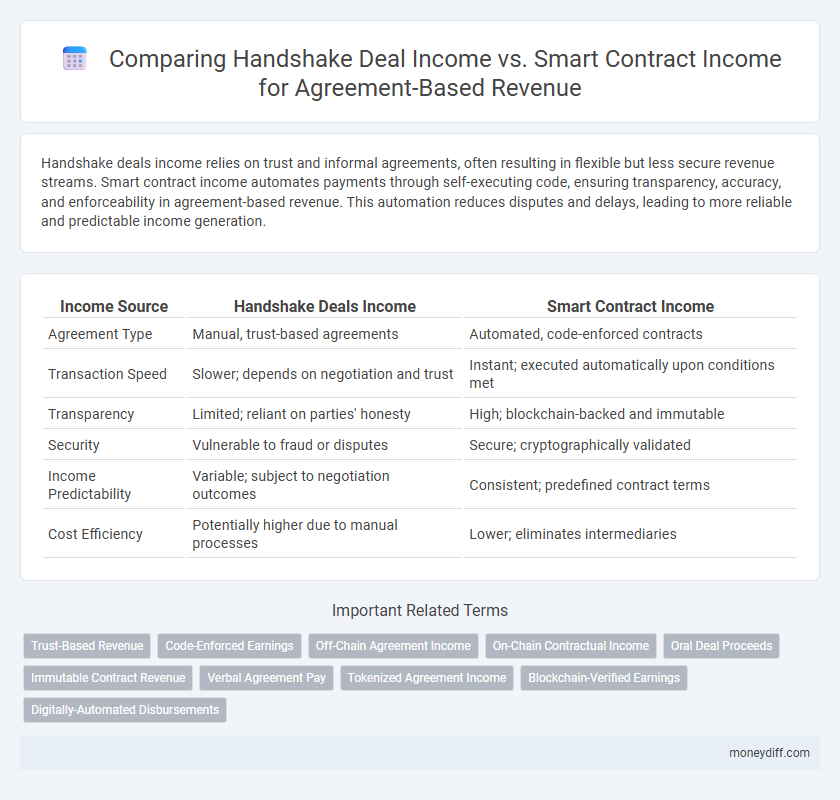

Handshake deals income relies on trust and informal agreements, often resulting in flexible but less secure revenue streams. Smart contract income automates payments through self-executing code, ensuring transparency, accuracy, and enforceability in agreement-based revenue. This automation reduces disputes and delays, leading to more reliable and predictable income generation.

Table of Comparison

| Income Source | Handshake Deals Income | Smart Contract Income |

|---|---|---|

| Agreement Type | Manual, trust-based agreements | Automated, code-enforced contracts |

| Transaction Speed | Slower; depends on negotiation and trust | Instant; executed automatically upon conditions met |

| Transparency | Limited; reliant on parties' honesty | High; blockchain-backed and immutable |

| Security | Vulnerable to fraud or disputes | Secure; cryptographically validated |

| Income Predictability | Variable; subject to negotiation outcomes | Consistent; predefined contract terms |

| Cost Efficiency | Potentially higher due to manual processes | Lower; eliminates intermediaries |

Understanding Handshake Deals Income

Handshake Deals income relies on mutual trust and direct negotiation, enabling faster agreement-based revenue without intermediaries. This model reduces transaction costs and fosters long-term partnerships, providing flexible revenue recognition tied to specific agreements. Understanding Handshake Deals income highlights the importance of relationship-driven contracts compared to automated, code-enforced Smart Contract income.

Exploring Smart Contract Income

Exploring smart contract income reveals a transparent and automated revenue stream, reducing reliance on handshake deals that often lack enforceability. Smart contracts ensure precise execution of agreement-based payments, eliminating ambiguity and minimizing disputes. This technology enhances trust and efficiency in generating consistent income from digital agreements.

Key Differences Between Handshake and Smart Contract Agreements

Handshake deals income relies on direct peer-to-peer agreements where terms are negotiated and enforced through trust and mutual consent, leading to flexible but less automated revenue collection. Smart contract income automates agreement enforcement using blockchain technology, ensuring transparent, tamper-proof transactions and reducing the need for intermediaries. Key differences include automation level, enforcement reliability, and transaction transparency, with smart contracts providing programmable, self-executing revenue streams compared to the manually managed handshake deals.

Trust Factors in Agreement-Based Revenue

Handshake deals income relies heavily on personal trust and mutual reputation, which can introduce variability and risk in agreement-based revenue streams. Smart contract income leverages blockchain technology to ensure transparency, automated enforcement, and reduced counterparty risks, enhancing confidence in revenue collection. Trust factors in agreement-based revenue are significantly bolstered by the immutable and self-executing nature of smart contracts compared to the subjective trust dynamics of handshake deals.

Risk Assessment: Traditional vs. Digital Contracts

Handshake deals income relies heavily on personal trust and informal agreements, increasing exposure to risks such as misunderstandings and enforcement challenges. Smart contract income automates enforcement through blockchain technology, reducing disputes and enhancing transaction transparency. Risk assessment favors smart contracts for agreement-based revenue due to their immutability and predefined conditions, limiting revenue leakage and fraud.

Efficiency and Transparency in Income Agreements

Handshake deals generate income through direct peer-to-peer agreements, enhancing efficiency by reducing intermediaries and enabling faster transaction settlements. Smart contract income automates revenue distribution with transparent, immutable terms coded on blockchain, ensuring accurate and trustless execution of payment agreements. Combining handshake deals with smart contracts optimizes income agreements by maximizing operational transparency and minimizing disputes or delays in revenue sharing.

Legal Enforceability: Handshake Deals vs. Smart Contracts

Handshake Deals rely heavily on mutual trust and verbal or informal agreements, which can pose challenges in legal enforceability due to the lack of tangible evidence or formal documentation. In contrast, Smart Contract Income generated through blockchain technology ensures automatic execution and clear terms, significantly enhancing legal enforceability by providing immutable, time-stamped records. Courts increasingly recognize smart contracts as legally binding, reducing disputes and offering stronger protection for agreement-based revenue streams.

Income Security and Fraud Prevention

Handshake deals income leverages direct peer-to-peer agreements, increasing transparency but relying heavily on trust, which can expose parties to fraud risks. Smart contract income automates agreement enforcement on blockchain networks, ensuring income security through immutable, tamper-proof transaction records and minimizing fraud potential. The integration of smart contracts into income agreements significantly enhances fraud prevention and guarantees secure, reliable revenue streams.

Adapting Money Management to New Agreement Methods

Handshake deals income often relies on informal, trust-based agreements that can lack transparency and enforceability, posing challenges for accurate financial tracking and risk assessment. Smart contract income, governed by automated, blockchain-based protocols, ensures real-time revenue recognition, immutable records, and streamlined compliance with agreement terms. Adapting money management to smart contracts enhances precision in income allocation and minimizes disputes in agreement-based revenue models.

Choosing the Best Approach for Agreement-Based Revenue

Handshake deals income relies on trust and direct negotiation, often leading to faster agreement execution but increased risk of non-compliance or disputes. Smart contract income automates revenue distribution with transparent, code-enforced terms, ensuring accuracy and reducing administrative overhead but requiring technical setup and integration. Choosing the best approach for agreement-based revenue depends on balancing trust levels, operational complexity, and the need for automation to optimize income reliability and scalability.

Related Important Terms

Trust-Based Revenue

Trust-based revenue from handshake deals relies heavily on personal relationships and mutual understanding, often resulting in flexible payment terms but increased risk of disputes. In contrast, smart contract income automates agreement enforcement using blockchain technology, ensuring transparent, immutable, and timely payments that enhance trust and minimize revenue loss.

Code-Enforced Earnings

Handshake deals income depends on mutual trust and manual enforcement, often leading to delays and disputes in agreement-based revenue collection. Smart contract income leverages automated, code-enforced execution on blockchain platforms, ensuring instant, transparent, and tamper-proof earnings distribution.

Off-Chain Agreement Income

Off-chain agreement income from handshake deals often provides greater flexibility and faster reconciliation compared to smart contract income, as it relies on mutual consent without the need for on-chain validation or gas fees. While smart contract income ensures automated and transparent revenue distribution, off-chain handshake deals allow tailored negotiation outcomes and reduced transaction costs in agreement-based revenue models.

On-Chain Contractual Income

On-chain contractual income generated through smart contracts ensures transparent, automatic revenue distribution based on predefined agreement terms, reducing disputes and enhancing trust in digital transactions. Compared to handshake deals income, smart contract income provides verifiable, immutable records on the blockchain, optimizing accuracy and security for agreement-based revenue streams.

Oral Deal Proceeds

Oral deal proceeds often generate handshake deals income, which lacks the automation and enforceability features characteristic of smart contract income in agreement-based revenue. This traditional income stream depends heavily on trust and manual enforcement, contrasting sharply with smart contracts that secure funds through coded terms and instant execution.

Immutable Contract Revenue

Immutable contract revenue from smart contracts ensures automated, tamper-proof income streams that eliminate disputes common in handshake deals. This solidity in agreement-based revenue enhances trust and guarantees precise, real-time payment execution without manual intervention.

Verbal Agreement Pay

Handshake deals income relies heavily on verbal agreement pay, which often lacks enforceability and clarity compared to smart contract income that automates and ensures transparent, self-executing payment terms. Smart contract income provides precise, real-time tracking of revenue flows in agreement-based models, minimizing disputes and enhancing trust between parties.

Tokenized Agreement Income

Tokenized agreement income derived from handshake deals offers increased transparency and reduced transaction costs compared to traditional smart contract income, which often involves higher gas fees and rigid coding constraints. By leveraging tokenized agreements, parties benefit from more flexible, scalable, and verifiable revenue streams that enhance trust and efficiency in decentralized finance ecosystems.

Blockchain-Verified Earnings

Blockchain-verified earnings from handshake deals provide immediate trust and reduce dispute risk by recording agreement-based revenue on a decentralized ledger. Smart contract income automates payment execution with programmable conditions, ensuring transparent, tamper-proof revenue distribution without intermediaries.

Digitally-Automated Disbursements

Handshake deals income relies on manual agreement-based revenue distribution, often resulting in delays and reconciliation challenges, whereas smart contract income leverages digitally-automated disbursements to enhance accuracy and real-time transaction execution. Employing blockchain-enabled smart contracts ensures transparent, immutable records and instantaneous revenue allocation, significantly optimizing cash flow management for all parties involved.

Handshake Deals Income vs Smart Contract Income for agreement-based revenue. Infographic

moneydiff.com

moneydiff.com