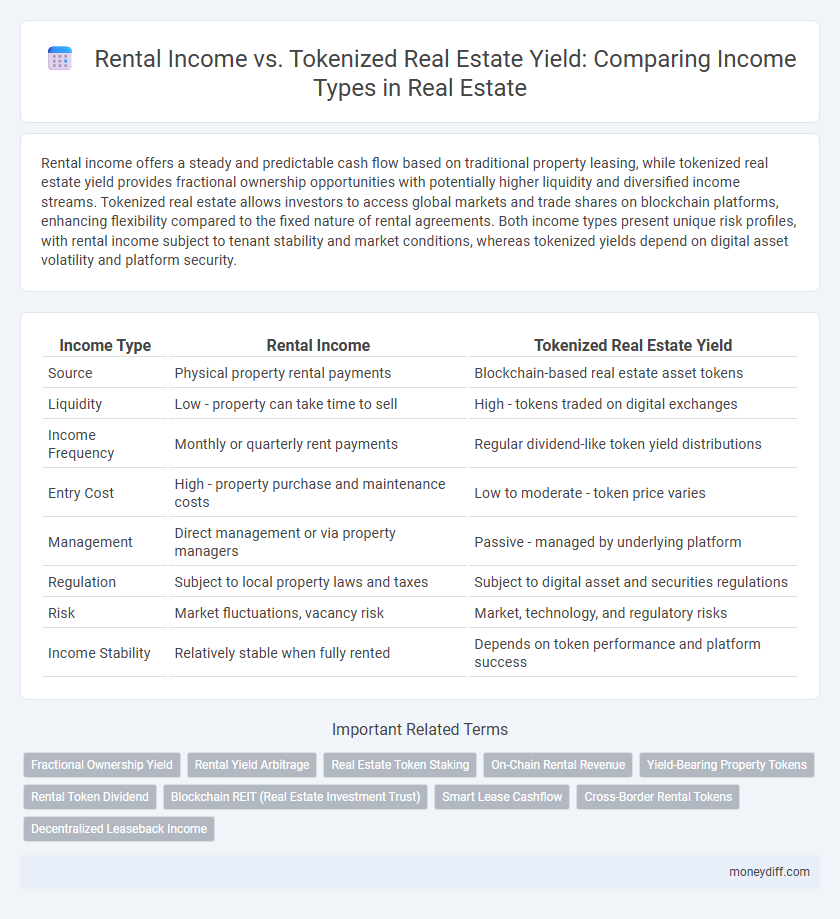

Rental income offers a steady and predictable cash flow based on traditional property leasing, while tokenized real estate yield provides fractional ownership opportunities with potentially higher liquidity and diversified income streams. Tokenized real estate allows investors to access global markets and trade shares on blockchain platforms, enhancing flexibility compared to the fixed nature of rental agreements. Both income types present unique risk profiles, with rental income subject to tenant stability and market conditions, whereas tokenized yields depend on digital asset volatility and platform security.

Table of Comparison

| Income Type | Rental Income | Tokenized Real Estate Yield |

|---|---|---|

| Source | Physical property rental payments | Blockchain-based real estate asset tokens |

| Liquidity | Low - property can take time to sell | High - tokens traded on digital exchanges |

| Income Frequency | Monthly or quarterly rent payments | Regular dividend-like token yield distributions |

| Entry Cost | High - property purchase and maintenance costs | Low to moderate - token price varies |

| Management | Direct management or via property managers | Passive - managed by underlying platform |

| Regulation | Subject to local property laws and taxes | Subject to digital asset and securities regulations |

| Risk | Market fluctuations, vacancy risk | Market, technology, and regulatory risks |

| Income Stability | Relatively stable when fully rented | Depends on token performance and platform success |

Understanding Rental Income: Traditional Revenue Streams

Rental income traditionally stems from leasing physical properties such as residential or commercial real estate, generating steady monthly cash flow based on tenant agreements. This income type is influenced by factors like location, property condition, rental demand, and market rates, offering predictable returns but requiring active management and maintenance. Unlike tokenized real estate yield, rental income depends on tangible assets and often involves higher barriers to entry, including substantial capital investment and regulatory compliance.

What is Tokenized Real Estate Yield?

Tokenized real estate yield represents income generated from fractional ownership of real estate assets through blockchain-based tokens, enabling investors to earn dividends or rental income proportional to their stake. Unlike traditional rental income, tokenized real estate yield offers enhanced liquidity, transparency, and accessibility by allowing smaller investments and streamlined transactions on decentralized platforms. This model democratizes real estate income, making property returns more scalable and tradable compared to conventional direct rental income streams.

Key Advantages of Earning Rental Income

Earning rental income provides consistent cash flow and long-term asset appreciation through traditional real estate investments, offering landlords tangible property control and potential tax benefits like depreciation and deductible expenses. Tokenized real estate yield, while innovative and accessible, may lack the direct asset management and established legal protections inherent in rental properties. Rental income remains a reliable, hands-on income source with proven stability in diverse market conditions.

Benefits of Tokenized Real Estate for Income Seekers

Tokenized real estate offers income seekers increased liquidity and fractional ownership, enabling access to diversified property portfolios that were previously cost-prohibitive. Unlike traditional rental income, which depends on physical property management and regional market stability, tokenized real estate yields are streamlined through blockchain technology ensuring transparent and timely distributions. This innovative model reduces barriers to entry and provides enhanced flexibility in portfolio management, crucial for maximizing passive income streams.

Liquidity Comparison: Rental Income vs. Tokenized Yield

Rental income typically offers lower liquidity due to lease agreements and tenant turnover, requiring time for rent collection and property management. Tokenized real estate yield provides enhanced liquidity by enabling fractional ownership transfer on blockchain platforms, allowing investors to buy or sell shares with minimal delay. This digital approach significantly reduces entry and exit barriers compared to traditional rental income streams.

Risk Factors in Rental Income and Tokenized Real Estate

Rental income is subject to risks such as tenant default, property damage, and market fluctuations that can reduce occupancy rates and rental prices. Tokenized real estate yield carries risks including regulatory uncertainty, platform security vulnerabilities, and market liquidity constraints that may affect asset valuation and income stability. Both income types require careful risk assessment to balance potential returns with exposure to financial uncertainties and operational challenges.

Tax Implications: Rental Properties vs. Tokenized Assets

Rental income from traditional properties is subject to property taxes, depreciation recapture, and often higher federal and state income tax rates. Tokenized real estate yields may offer enhanced tax efficiency by leveraging blockchain transparency and potentially qualifying for favorable capital gains treatment or reduced withholding taxes in certain jurisdictions. Understanding these tax implications is crucial for maximizing after-tax returns and compliance across diverse income types.

Income Stability: Consistency of Rental vs. Tokenized Returns

Rental income provides relatively stable cash flow due to long-term leases and predictable tenant payments, ensuring consistent monthly revenue. Tokenized real estate yields can exhibit higher volatility as returns depend on market liquidity and token demand, causing fluctuations in income stability. Investors seeking steady income often prefer traditional rental streams, while tokenized assets offer potential for higher but less predictable yields.

Accessibility and Minimum Investment Requirements

Rental income typically requires significant upfront capital and property management efforts, limiting accessibility to high-net-worth individuals. Tokenized real estate yield offers lower minimum investment thresholds and easier market entry through blockchain platforms, democratizing access to real estate income streams. This innovation expands investor diversity by reducing financial and operational barriers commonly associated with traditional rental properties.

Future Trends in Real Estate Income Types

Rental income remains a stable source of cash flow for traditional real estate investors, but tokenized real estate yield is rapidly gaining traction by offering fractional ownership, increased liquidity, and accessibility to a broader investor base. Future trends indicate a significant shift towards blockchain-based real estate platforms that enable real-time income distribution and lower entry barriers compared to conventional rental agreements. Enhanced transparency, automated smart contracts, and global market integration are expected to drive widespread adoption of tokenized real estate investments as a primary income-generating asset.

Related Important Terms

Fractional Ownership Yield

Fractional ownership yield in tokenized real estate offers investors higher liquidity and diversified income streams compared to traditional rental income, which is often limited by geographic location and property management challenges. Tokenized assets provide seamless dividend distributions and lower entry barriers, enhancing overall income potential through fractional shares of premium real estate portfolios.

Rental Yield Arbitrage

Rental income traditionally offers steady cash flow through tenant payments, while tokenized real estate yield presents higher liquidity and fractional ownership benefits; rental yield arbitrage exploits disparities between rental income and tokenized asset returns to maximize profit. Investors leveraging rental yield arbitrage strategically balance property management costs against blockchain-enabled trading efficiency to enhance overall income streams.

Real Estate Token Staking

Rental income provides steady cash flow through traditional property leasing, while tokenized real estate yield offers fractionalized ownership with potentially higher liquidity and returns via blockchain-enabled real estate token staking. Real estate token staking allows investors to earn passive income by locking tokens in a smart contract, enhancing yield opportunities beyond conventional rental agreements.

On-Chain Rental Revenue

On-chain rental revenue from tokenized real estate offers higher transparency and fractional ownership opportunities compared to traditional rental income, enabling investors to earn passive income through smart contract-distributed yields. Blockchain technology ensures real-time tracking and automated disbursement of rental profits, reducing intermediaries and increasing efficiency in income generation.

Yield-Bearing Property Tokens

Rental income generates steady cash flow through traditional leases, while tokenized real estate yield offers fractional ownership with automated dividend distributions via blockchain technology. Yield-bearing property tokens enhance liquidity and accessibility, enabling investors to earn income from real estate appreciation and rental profits without property management hassles.

Rental Token Dividend

Rental token dividends generate passive income by distributing profits from tokenized real estate properties, offering higher liquidity and fractional ownership compared to traditional rental income. This innovative income type enables investors to earn a steady dividend yield without property management responsibilities while leveraging blockchain technology for transparency and ease of transfer.

Blockchain REIT (Real Estate Investment Trust)

Rental income from traditional real estate offers steady cash flow through lease agreements, whereas tokenized real estate yield from Blockchain REITs provides fractional ownership and liquidity via blockchain technology, enabling investors to earn income from diversified property assets with lower entry barriers. Blockchain REITs enhance transparency, reduce management costs, and facilitate faster transactions compared to conventional rental income models, optimizing passive income streams for modern investors.

Smart Lease Cashflow

Rental income traditionally provides steady monthly cash flow through tenant lease payments, whereas tokenized real estate yield leverages blockchain technology to enable fractional ownership and real-time income distribution. Smart Lease Cashflow optimizes income generation by automating rent collection and profit sharing, enhancing transparency and efficiency in both rental and tokenized asset management.

Cross-Border Rental Tokens

Cross-border rental tokens offer a decentralized approach to generate rental income by enabling investors to earn yields from international real estate markets without physical property ownership, contrasting traditional rental income that requires direct property management and local presence. These tokenized real estate yields provide enhanced liquidity, fractional ownership, and seamless cross-border transactions, optimizing income streams beyond conventional rental investments.

Decentralized Leaseback Income

Rental income traditionally offers steady cash flow through tenant leases, yet tokenized real estate yield maximizes liquidity and accessibility by enabling fractional ownership on blockchain platforms. Decentralized leaseback income leverages smart contracts to automate rental agreements, ensuring transparent, immutable payouts and reducing reliance on traditional property management intermediaries.

Rental income vs Tokenized real estate yield for income types. Infographic

moneydiff.com

moneydiff.com