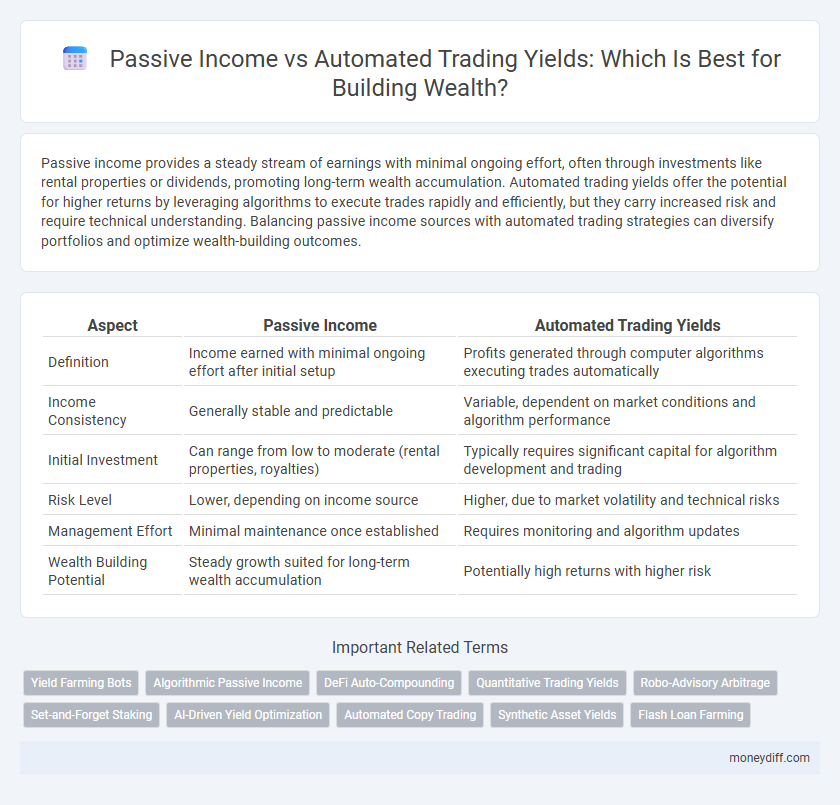

Passive income provides a steady stream of earnings with minimal ongoing effort, often through investments like rental properties or dividends, promoting long-term wealth accumulation. Automated trading yields offer the potential for higher returns by leveraging algorithms to execute trades rapidly and efficiently, but they carry increased risk and require technical understanding. Balancing passive income sources with automated trading strategies can diversify portfolios and optimize wealth-building outcomes.

Table of Comparison

| Aspect | Passive Income | Automated Trading Yields |

|---|---|---|

| Definition | Income earned with minimal ongoing effort after initial setup | Profits generated through computer algorithms executing trades automatically |

| Income Consistency | Generally stable and predictable | Variable, dependent on market conditions and algorithm performance |

| Initial Investment | Can range from low to moderate (rental properties, royalties) | Typically requires significant capital for algorithm development and trading |

| Risk Level | Lower, depending on income source | Higher, due to market volatility and technical risks |

| Management Effort | Minimal maintenance once established | Requires monitoring and algorithm updates |

| Wealth Building Potential | Steady growth suited for long-term wealth accumulation | Potentially high returns with higher risk |

Understanding Passive Income: Foundations for Wealth Building

Passive income generates wealth through consistent revenue streams requiring minimal ongoing effort, such as rental income or dividends, providing financial stability over time. Automated trading yields rely on algorithm-driven market strategies to optimize returns with limited manual intervention, offering scalable but risk-sensitive growth potential. Understanding the fundamental distinctions and risk profiles of these sources is crucial for effective long-term wealth building.

What Is Automated Trading and How Does It Work?

Automated trading utilizes computer algorithms to execute trades based on predefined criteria, eliminating emotional decision-making and enabling high-frequency transactions. This system analyzes market data in real-time to identify opportunities and automatically place buy or sell orders, often leading to more consistent and efficient trading outcomes. By leveraging sophisticated software, automated trading can enhance portfolio diversification and potentially increase passive income through optimized yield strategies.

Comparing Risk Profiles: Passive Income vs Automated Trading

Passive income typically offers lower risk due to stable revenue sources such as rental properties or dividend stocks, providing consistent cash flow with moderate volatility. Automated trading yields, driven by algorithmic strategies and real-time market analysis, expose investors to higher risk levels due to market fluctuations and system errors but can generate faster, larger returns. Understanding these differing risk profiles is crucial for wealth builders aiming to balance steady income stability with aggressive growth opportunities.

Barriers to Entry: Costs, Skills, and Accessibility

Passive income streams often require lower upfront costs and minimal specialized skills, making them more accessible for individuals seeking supplementary earnings. Automated trading yields demand significant investment in technology, advanced trading knowledge, and continuous monitoring to mitigate risks. High entry barriers in automated trading can limit broader participation compared to more scalable passive income opportunities like rental properties or dividend investing.

Scalability: Which Approach Grows Faster?

Passive income streams such as rental properties and dividend investing offer steady growth but often require significant upfront investment and time to scale effectively. Automated trading yields leverage algorithmic strategies to rapidly increase returns through high-frequency trades, providing greater scalability in volatile markets. The faster growth potential of automated trading depends on optimizing risk management and continual strategy refinement to maintain consistent performance.

Time Commitment: Effort Required for Each Strategy

Passive income streams typically require an initial time investment to set up but generate earnings with minimal ongoing effort, allowing for more flexible time management. Automated trading yields demand continuous monitoring and occasional strategy adjustments to optimize performance, resulting in a higher time commitment compared to traditional passive income methods. Evaluating time commitment is crucial for investors aiming to balance effort with consistent wealth growth through these strategies.

Diversification Opportunities with Both Methods

Diversifying income streams by combining passive income sources, such as rental properties or dividend stocks, with automated trading yields can enhance portfolio stability and growth potential. Passive income offers steady, long-term cash flow, while automated trading algorithms capitalize on market fluctuations for short-term gains. Integrating both methods reduces overall risk and maximizes wealth-building opportunities through varied financial strategies.

Long-Term Wealth: Sustainability of Passive Income vs Automated Trading

Passive income streams, such as rental properties and dividend stocks, offer consistent, reliable cash flow that contributes to long-term wealth sustainability through steady compounding and minimal active management. Automated trading yields can provide higher short-term gains but often carry increased risks and volatility, making them less predictable as a sustainable wealth-building strategy over time. Prioritizing passive income aligns with durability and steady financial growth, while automated trading requires careful risk management to avoid erosion of capital.

Tax Implications: Profits and Considerations

Passive income from rentals or dividends often benefits from favorable tax treatments such as lower long-term capital gains rates, while automated trading yields are usually taxed as ordinary income due to their short-term nature. Investors must consider that high-frequency trading profits can trigger higher tax brackets and increased reporting requirements. Strategic tax planning, including the use of tax-advantaged accounts or harvesting losses, plays a crucial role in maximizing after-tax wealth accumulation from both income streams.

Choosing the Right Fit: Aligning Strategies with Your Goals

Choosing the right wealth-building strategy depends on aligning passive income sources and automated trading yields with your financial goals and risk tolerance. Passive income offers steady, low-maintenance returns ideal for long-term stability, while automated trading yields can provide higher, but more volatile profits suited for active risk management. Evaluating your investment horizon and comfort with market fluctuations ensures a tailored approach that maximizes growth potential while maintaining financial security.

Related Important Terms

Yield Farming Bots

Yield farming bots optimize passive income by automatically reallocating crypto assets across decentralized finance (DeFi) protocols to maximize returns through liquidity mining and staking rewards. This automated trading yields higher efficiency and compound growth compared to traditional passive income streams, significantly accelerating wealth building in volatile markets.

Algorithmic Passive Income

Algorithmic passive income, generated through automated trading systems, offers a scalable way to build wealth by leveraging data-driven strategies that execute trades without manual intervention. Unlike traditional passive income sources, algorithmic trading yields can adapt to market fluctuations in real-time, optimizing returns while minimizing emotional bias and time commitment.

DeFi Auto-Compounding

DeFi auto-compounding offers higher passive income potential through automated reinvestment of yields, maximizing returns without active management. Automated trading yields provide dynamic market exposure but often require ongoing monitoring, making DeFi protocols with auto-compounding a more hands-off wealth-building strategy.

Quantitative Trading Yields

Quantitative trading yields leverage algorithmic strategies and data-driven models to generate consistent returns, often outperforming traditional passive income sources such as rental income or dividend stocks. Automated trading systems minimize human error and adapt to market dynamics in real-time, enhancing wealth-building potential through optimized liquidity management and risk control.

Robo-Advisory Arbitrage

Robo-advisory arbitrage leverages algorithm-driven automated trading to exploit market inefficiencies, generating consistent yields that often surpass traditional passive income streams like dividends or rental properties. This approach minimizes manual intervention while optimizing portfolio returns, maximizing wealth-building potential through data-driven asset allocation and real-time market analysis.

Set-and-Forget Staking

Set-and-forget staking offers a reliable source of passive income by locking cryptocurrency assets to earn rewards without active management, contrasting with automated trading yields that require continuous strategy adjustments and risk monitoring. This method maximizes long-term wealth building through consistent, low-effort returns and reduced exposure to market volatility inherent in automated trading systems.

AI-Driven Yield Optimization

AI-driven yield optimization enhances passive income through data-driven automated trading strategies that adapt to market fluctuations in real-time, maximizing returns while minimizing risk. Leveraging machine learning algorithms, these systems identify high-probability trades, outperforming traditional passive income streams by continuously optimizing asset allocation and execution.

Automated Copy Trading

Automated copy trading leverages algorithm-driven strategies that replicate top traders' moves, enabling consistent passive income growth with minimal manual intervention. This method often yields higher returns and reduced risk compared to traditional passive income sources by optimizing market timing and portfolio diversification dynamically.

Synthetic Asset Yields

Synthetic asset yields offer a unique passive income advantage by generating returns through algorithmic strategies that mimic traditional asset performance without direct ownership. Automated trading systems optimize these yields by executing high-frequency, data-driven transactions, enhancing wealth-building potential through consistent, low-effort income streams.

Flash Loan Farming

Passive income through flash loan farming leverages decentralized finance protocols to generate high-yield returns with minimal capital risk by exploiting arbitrage opportunities within seconds. Automated trading yields use algorithm-driven strategies for consistent profits but often require ongoing market analysis, whereas flash loan farming can maximize wealth rapidly without holding assets long-term.

Passive Income vs Automated Trading Yields for building wealth. Infographic

moneydiff.com

moneydiff.com