Rental income provides steady, traditional cash flow from physical properties, offering predictable returns tied to real estate market trends. Tokenized asset income, derived from digital fractions of assets on blockchain platforms, enables enhanced liquidity and fractional ownership, broadening access to diverse investment opportunities. Comparing both, tokenized assets offer higher flexibility and transparency, while rental income remains a reliable source with tangible asset backing.

Table of Comparison

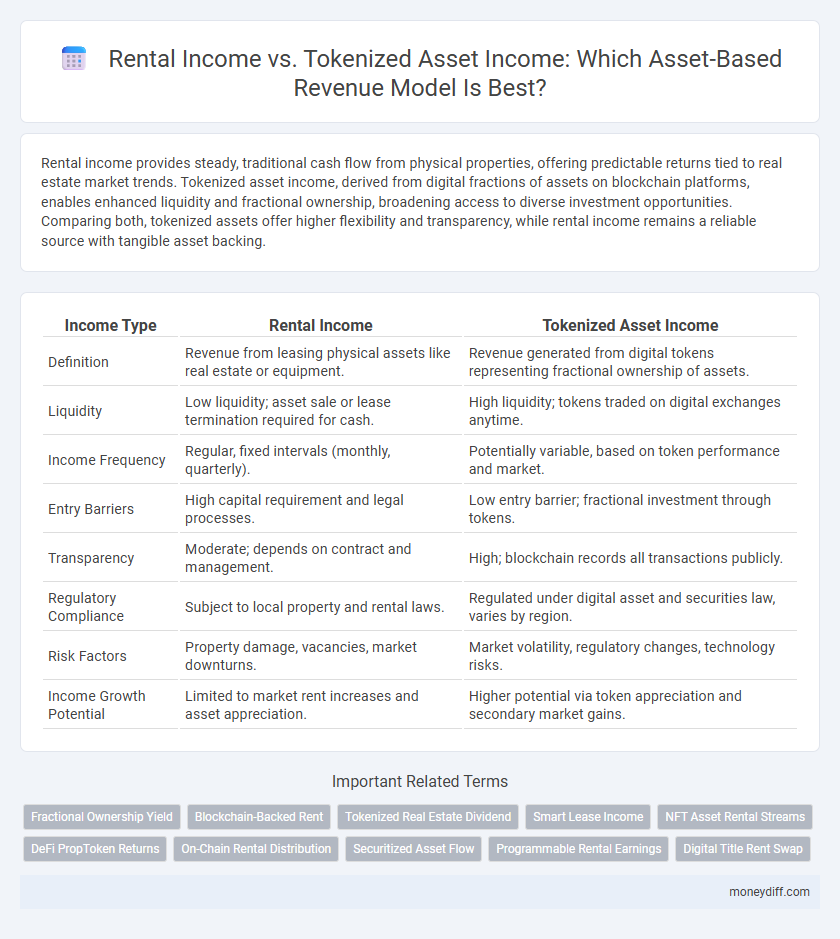

| Income Type | Rental Income | Tokenized Asset Income |

|---|---|---|

| Definition | Revenue from leasing physical assets like real estate or equipment. | Revenue generated from digital tokens representing fractional ownership of assets. |

| Liquidity | Low liquidity; asset sale or lease termination required for cash. | High liquidity; tokens traded on digital exchanges anytime. |

| Income Frequency | Regular, fixed intervals (monthly, quarterly). | Potentially variable, based on token performance and market. |

| Entry Barriers | High capital requirement and legal processes. | Low entry barrier; fractional investment through tokens. |

| Transparency | Moderate; depends on contract and management. | High; blockchain records all transactions publicly. |

| Regulatory Compliance | Subject to local property and rental laws. | Regulated under digital asset and securities law, varies by region. |

| Risk Factors | Property damage, vacancies, market downturns. | Market volatility, regulatory changes, technology risks. |

| Income Growth Potential | Limited to market rent increases and asset appreciation. | Higher potential via token appreciation and secondary market gains. |

Understanding Asset-Based Revenue Streams

Rental income generates consistent cash flow through leasing physical properties, providing predictable revenue tied to real estate assets. Tokenized asset income leverages blockchain technology to fractionalize ownership, enabling liquidity and diversified investment opportunities across digital and physical assets. Understanding asset-based revenue streams involves analyzing stability, scalability, and the intersection of traditional property income with innovative tokenization models enhancing investor access and market efficiency.

What is Rental Income?

Rental income refers to the earnings generated from leasing or renting out physical assets such as real estate properties, equipment, or vehicles. It provides a steady cash flow based on agreed terms outlined in rental agreements or leases, often accompanied by contractual obligations and maintenance responsibilities. Unlike tokenized asset income, rental income is tied to traditional, tangible assets and involves direct management and physical possession.

What is Tokenized Asset Income?

Tokenized Asset Income refers to earnings generated from digital tokens that represent ownership in real-world assets, allowing fractional investment and increased liquidity compared to traditional asset ownership. Unlike Rental Income, which is derived from leasing physical property, Tokenized Asset Income offers seamless transferability and accessibility on blockchain platforms. This innovative income stream leverages smart contracts to automate revenue distribution, enhancing transparency and efficiency for investors.

Comparing Rental Income and Tokenized Asset Income

Rental income generates steady cash flow through physical property leasing, offering predictable returns and potential tax benefits. Tokenized asset income provides fractional ownership in digital or physical assets, enabling liquidity and diversification with lower entry barriers. Comparing both, rental income suits long-term investors seeking stability, while tokenized assets appeal to those prioritizing flexibility and market-driven gains.

Risk Factors in Rental and Tokenized Assets

Rental income carries risks such as property damage, tenant default, and fluctuating market demand, which can impact consistent cash flow. Tokenized asset income faces risks including platform security vulnerabilities, regulatory uncertainties, and market liquidity constraints that may affect token valuation. Both income types require due diligence to mitigate risks associated with asset management and market dynamics.

Liquidity and Access to Funds

Rental income offers steady cash flow but often involves delays in access to funds due to leasing agreements and tenant payment schedules. Tokenized asset income enhances liquidity by enabling fractional ownership and real-time trading on digital platforms, allowing investors to access funds more quickly. This digital mechanism reduces barriers to capital access compared to traditional rental income streams.

Passive Income Potential: Rental vs Tokenized Assets

Rental income generates steady passive cash flow through traditional real estate investments, benefiting from long-term property appreciation and tenant rent payments. Tokenized asset income offers fractional ownership and liquidity, enabling investors to earn dividends or profit shares from digitalized real-world assets with lower entry barriers. Both income streams provide passive revenue, but tokenized assets enhance diversification and accessibility in asset-based income portfolios.

Tax Implications of Each Income Source

Rental income is typically subject to ordinary income tax rates and may be reduced by allowable expenses such as maintenance, property management fees, and depreciation, impacting the net taxable amount. Tokenized asset income, often generated through blockchain-based platforms, may be classified differently depending on jurisdiction, potentially treated as capital gains or token-specific income with varying tax implications and reporting requirements. Understanding the distinct tax regulations and compliance obligations for each income source is crucial for optimizing after-tax returns and ensuring accurate financial reporting.

Trends in Real Estate vs Tokenized Asset Markets

Rental income from traditional real estate remains a steady revenue source, but the rise of tokenized asset income is reshaping asset-based revenue streams by enabling fractional ownership and increased liquidity. Real estate markets are experiencing slower growth due to regulatory constraints and market saturation, while tokenized asset markets demonstrate rapid expansion driven by blockchain technology adoption and enhanced accessibility. Investors increasingly favor tokenized assets for their transparency, lower entry costs, and diversified income potential compared to conventional rental properties.

Choosing the Right Asset-Based Income for Your Portfolio

Evaluating rental income versus tokenized asset income involves analyzing liquidity, risk, and return profiles to optimize portfolio performance. Rental income offers steady cash flow and tangible asset backing, while tokenized assets provide increased liquidity and fractional ownership access in diverse markets. Selecting the right asset-based income depends on individual investment goals, risk tolerance, and market conditions to balance income stability and growth potential.

Related Important Terms

Fractional Ownership Yield

Rental income generates steady cash flow through direct property leasing, while tokenized asset income offers fractional ownership yield by enabling investors to earn proportional returns on diversified, blockchain-backed real estate assets. Fractional ownership yield enhances liquidity and accessibility, allowing smaller investors to benefit from asset appreciation and rental cash flows without full property acquisition.

Blockchain-Backed Rent

Blockchain-backed rent transforms traditional rental income by enabling secure, transparent transactions recorded on a decentralized ledger, enhancing trust and reducing intermediaries. Tokenized asset income leverages digital tokens representing shares in physical properties, allowing fractional ownership and increased liquidity compared to conventional rental agreements.

Tokenized Real Estate Dividend

Tokenized real estate dividends provide a more liquid and accessible form of rental income by enabling fractional ownership and seamless dividend distribution through blockchain technology. This method enhances transparency and reduces traditional barriers, offering investors consistent passive income streams from real estate assets.

Smart Lease Income

Smart Lease Income leverages blockchain technology to transform traditional rental income into tokenized asset revenue, enabling fractional ownership and real-time profit distribution. This approach enhances liquidity and transparency compared to conventional rental models, offering asset owners increased flexibility and diversified income streams.

NFT Asset Rental Streams

Rental income from physical assets provides steady cash flow through traditional leases, while tokenized asset income, particularly via NFT asset rental streams, offers enhanced liquidity and fractional ownership benefits on blockchain platforms. NFT asset rentals enable asset holders to monetize digital collectibles or real estate by granting temporary access rights, creating innovative, secure revenue models in decentralized finance ecosystems.

DeFi PropToken Returns

Rental income generates steady cash flow from physical asset leasing, while tokenized asset income through DeFi PropToken returns offers fractional ownership and liquidity on blockchain platforms. DeFi PropToken returns leverage decentralized finance protocols to provide enhanced yield opportunities, reduced transaction costs, and global market access compared to traditional rental revenue streams.

On-Chain Rental Distribution

On-chain rental distribution enables transparent and automated income flows for tokenized assets through blockchain technology, ensuring real-time tracking and secure payments directly to asset holders. Compared to traditional rental income, tokenized asset income reduces intermediaries and enhances liquidity by allowing fractional ownership and seamless transfer of rental revenue rights.

Securitized Asset Flow

Rental income generates steady cash flow through traditional property leases, whereas tokenized asset income leverages blockchain technology to create fractional ownership and enhanced liquidity of securitized assets, enabling more efficient capital flow and broader investor access. Securitized asset flow via tokenization transforms illiquid real estate assets into tradable tokens, increasing transparency and potentially higher yields compared to conventional rental revenue streams.

Programmable Rental Earnings

Programmable rental earnings generate automated, blockchain-secured cash flow by tokenizing physical assets, enabling real-time revenue distribution and enhanced transparency. This method surpasses traditional rental income by reducing intermediaries and enabling fractional ownership, boosting liquidity and investor accessibility.

Digital Title Rent Swap

Rental income from traditional properties provides steady cash flow, while tokenized asset income through Digital Title Rent Swap enables fractional ownership and liquidity in digital real estate markets. This innovative platform leverages blockchain technology to facilitate seamless revenue sharing and secure asset-based revenue streams, enhancing profitability and market accessibility for investors.

Rental Income vs Tokenized Asset Income for asset-based revenue. Infographic

moneydiff.com

moneydiff.com