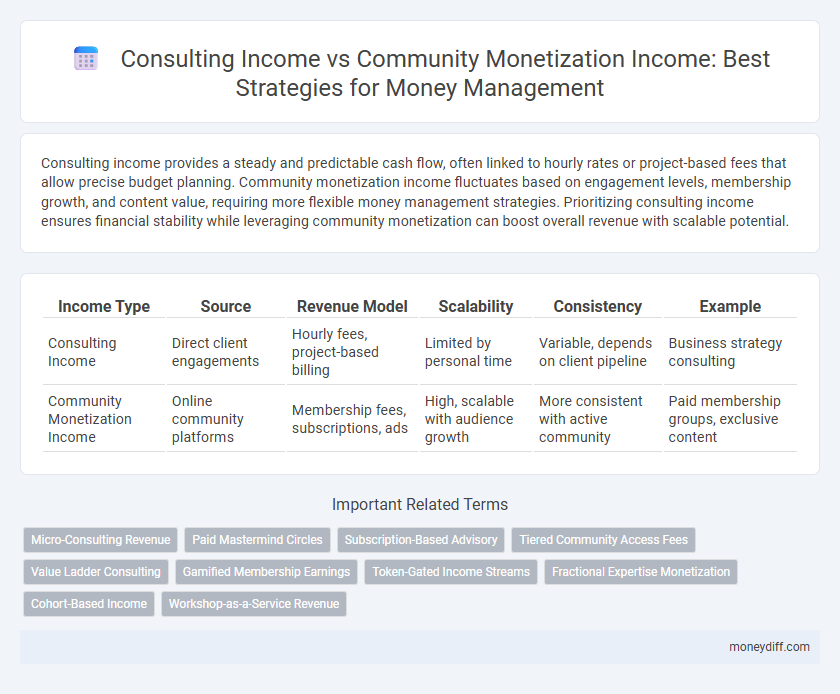

Consulting income provides a steady and predictable cash flow, often linked to hourly rates or project-based fees that allow precise budget planning. Community monetization income fluctuates based on engagement levels, membership growth, and content value, requiring more flexible money management strategies. Prioritizing consulting income ensures financial stability while leveraging community monetization can boost overall revenue with scalable potential.

Table of Comparison

| Income Type | Source | Revenue Model | Scalability | Consistency | Example |

|---|---|---|---|---|---|

| Consulting Income | Direct client engagements | Hourly fees, project-based billing | Limited by personal time | Variable, depends on client pipeline | Business strategy consulting |

| Community Monetization Income | Online community platforms | Membership fees, subscriptions, ads | High, scalable with audience growth | More consistent with active community | Paid membership groups, exclusive content |

Understanding Consulting Income Streams

Consulting income streams primarily derive from providing expert advice, project management, and customized solutions to clients, often billed hourly or per project. These income sources tend to be more predictable and scalable based on client contracts and retainer agreements. Effective money management of consulting income requires tracking billed hours, managing receivables, and forecasting cash flow to maintain financial stability.

Exploring Community Monetization Models

Consulting income offers a direct revenue stream through personalized services and expert advice, often resulting in high-value, one-on-one transactions. Community monetization income leverages scalable models such as membership subscriptions, digital content sales, and affiliate marketing within engaged audiences. Exploring these community monetization models reveals opportunities to create recurring revenue while building sustainable, long-term financial ecosystems.

Key Differences: Consulting vs. Community Monetization Income

Consulting income typically derives from direct client engagements involving specialized expertise and project-based billing, offering predictable and often higher fees. Community monetization income emerges from various avenues such as membership subscriptions, digital content sales, or sponsorships, emphasizing recurring revenue from an engaged audience. Key differences include the stability and scale of income streams, with consulting providing immediate cash flow while community monetization offers long-term growth potential through platform development and audience expansion.

Predictability and Stability of Earnings

Consulting income offers higher predictability and stability due to fixed contracts and recurring client engagements, ensuring consistent cash flow over time. Community monetization income, often reliant on fluctuating audience engagement and platform algorithms, tends to be less stable and harder to forecast. Effective money management strategies prioritize steady consulting revenue while diversifying community monetization to buffer against income volatility.

Scalability Potential of Both Income Types

Consulting income offers high immediate revenue per client but faces limitations in scalability due to time constraints and personalized service demands. Community monetization income, such as subscription fees or digital content sales, provides a scalable model by leveraging a broad audience with minimal incremental effort. Balancing both income types can optimize cash flow while maximizing long-term growth potential through diversified revenue streams.

Time Investment and Passive Income Opportunities

Consulting income typically demands significant time investment due to client meetings, personalized solutions, and ongoing project management, limiting scalability. Community monetization income, such as through memberships or digital products, offers higher passive income potential by leveraging content or networks without continuous active involvement. Effective money management balances the immediate revenue from consulting with the long-term passive gains from community monetization to optimize cash flow and growth.

Managing Taxes for Consulting and Community Monetization

Consulting income is typically classified as earned income, subject to self-employment tax and requiring quarterly estimated tax payments to manage cash flow and avoid penalties. Community monetization income, often generated through platforms like Patreon or YouTube, may be treated as business or passive income, necessitating careful documentation of expenses to maximize deductions and reduce taxable income. Effective tax management for both income types involves leveraging deductions, tracking all revenue streams, and consulting with a tax professional to optimize strategies based on evolving IRS guidelines.

Skills and Resources Required for Each Income Stream

Consulting income requires advanced expertise in a specialized field, strong communication abilities, and tailored problem-solving skills to deliver personalized client solutions. Community monetization income depends on building and managing engaged audiences, content creation skills, and proficiency in digital marketing platforms to foster ongoing interaction and revenue generation. Efficient money management for consulting involves tracking billable hours and project expenses, while community monetization demands analysis of user engagement metrics and diverse income channels such as subscriptions or sponsorships.

Risk Factors and Financial Planning Strategies

Consulting income offers predictable cash flow but carries risks such as client dependency and project variability, requiring diversified contracts and emergency funds for financial stability. Community monetization income can fluctuate significantly due to platform changes and audience engagement, necessitating flexible budgeting and multiple revenue streams to mitigate volatility. Effective money management involves balancing these income types with tailored strategies like setting aside reserves, monitoring market trends, and continuous financial planning adjustments.

Choosing the Right Income Model for Your Financial Goals

Consulting income offers predictable, project-based revenue ideal for clients seeking expert guidance, while community monetization income generates recurring earnings through memberships, content, or events, leveraging audience engagement. Selecting the right income model depends on financial goals: prioritize consulting income for stability and high-ticket earnings, or community monetization for scalable, passive income streams. Diversifying both sources optimizes cash flow management and long-term wealth building.

Related Important Terms

Micro-Consulting Revenue

Micro-consulting revenue generates targeted income through specialized, short-term advisory services, offering higher profit margins compared to broader community monetization strategies that rely on scalable, recurring payments such as subscriptions or memberships. Effective money management requires prioritizing micro-consulting income for its predictable cash flow and direct client value, while using community monetization income as a supplementary, growth-driven revenue stream.

Paid Mastermind Circles

Consulting income typically generates higher immediate revenue through personalized services, while community monetization income from paid mastermind circles offers scalable, recurring revenue streams by fostering ongoing peer-to-peer engagement and exclusive expert access. Effective money management involves balancing these income sources to optimize cash flow stability and long-term growth potential.

Subscription-Based Advisory

Subscription-based advisory generates consistent consulting income through recurring fees, offering predictable cash flow and scalable client management. Community monetization income, driven by member engagement and value, varies significantly but can complement consulting by diversifying revenue streams and increasing overall financial stability.

Tiered Community Access Fees

Consulting income provides a predictable revenue stream based on direct client engagements and project fees, while community monetization income leverages tiered community access fees to create scalable, recurring revenue through different levels of membership benefits. Tiered community access fees optimize money management by segmenting income sources, increasing client retention, and allowing flexible pricing strategies to maximize overall profitability.

Value Ladder Consulting

Consulting income typically generates higher revenue per client through personalized services and premium packages within the Value Ladder Consulting framework, while community monetization income relies on scalable membership fees, digital products, and recurring subscriptions offering steady cash flow. Effective money management balances these income streams by leveraging consulting's high-ticket sales for immediate capital and community monetization's recurring revenue for long-term financial stability.

Gamified Membership Earnings

Consulting income offers a one-on-one, high-value revenue stream based on expert advice, while community monetization income from gamified memberships generates recurring earnings through engagement-driven rewards and subscription models. Gamified membership earnings leverage behavioral incentives and tiered access to foster active participation, making them a sustainable source of income in money management strategies.

Token-Gated Income Streams

Token-gated income streams enhance consulting income by offering exclusive access to premium advice and personalized services, increasing client retention and value per engagement. Community monetization income thrives through subscription-based models and token-exclusive content, creating recurring revenue while fostering active, loyal user bases in decentralized finance and blockchain ecosystems.

Fractional Expertise Monetization

Consulting income typically derives from providing specialized fractional expertise on a project basis, allowing precise, high-value engagements with clients seeking targeted solutions. Community monetization income, while often recurring through memberships or subscriptions, generally requires broader audience interaction and engagement strategies that may dilute the focus on elite fractional expertise value.

Cohort-Based Income

Cohort-based income from consulting offers predictable revenue through tailored, high-value client engagements, while community monetization income generates scalable earnings by leveraging collective membership fees and digital content access. Effective money management balances these income streams by forecasting client retention rates and optimizing community growth metrics to maximize overall financial stability.

Workshop-as-a-Service Revenue

Workshop-as-a-Service revenue generates higher consulting income by offering personalized expertise and tailored solutions, leading to increased client retention and premium pricing opportunities. Community monetization income typically involves scalable, subscription-based models that yield steady cash flow but often at lower per-client revenue compared to individualized consulting services.

Consulting Income vs Community Monetization Income for money management. Infographic

moneydiff.com

moneydiff.com