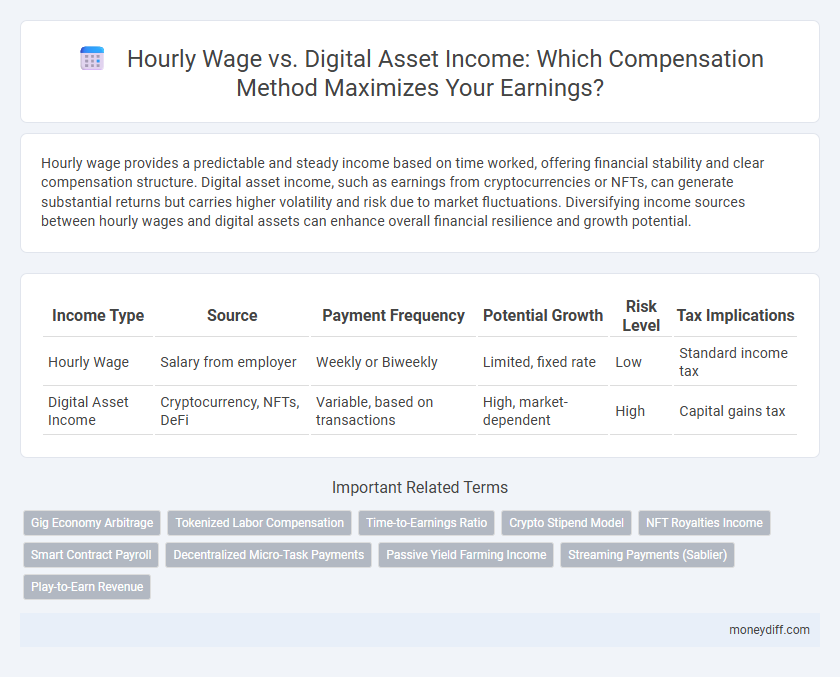

Hourly wage provides a predictable and steady income based on time worked, offering financial stability and clear compensation structure. Digital asset income, such as earnings from cryptocurrencies or NFTs, can generate substantial returns but carries higher volatility and risk due to market fluctuations. Diversifying income sources between hourly wages and digital assets can enhance overall financial resilience and growth potential.

Table of Comparison

| Income Type | Source | Payment Frequency | Potential Growth | Risk Level | Tax Implications |

|---|---|---|---|---|---|

| Hourly Wage | Salary from employer | Weekly or Biweekly | Limited, fixed rate | Low | Standard income tax |

| Digital Asset Income | Cryptocurrency, NFTs, DeFi | Variable, based on transactions | High, market-dependent | High | Capital gains tax |

Understanding Hourly Wage Compensation

Hourly wage compensation provides a predictable income based on fixed pay rates per hour worked, ensuring consistent earnings regardless of market fluctuations. This traditional payment model offers stability and immediate cash flow but may limit scalability compared to digital asset income. Understanding the structure and benefits of hourly wages is essential for evaluating their role in diversified income strategies.

What Is Digital Asset Income?

Digital asset income refers to earnings generated from cryptocurrencies, NFTs, and other blockchain-based assets, distinct from traditional hourly wages tied to labor hours. This income can include dividends, staking rewards, trading profits, or royalties from digital content. Unlike fixed hourly wages, digital asset income often fluctuates based on market performance and asset valuation.

Pros and Cons of Hourly Wage Earnings

Hourly wage earnings offer stable, predictable income based on fixed work hours, ensuring consistent cash flow for budgeting and financial planning. However, this compensation model limits earning potential to the number of hours worked, potentially capping income growth and reducing flexibility compared to digital asset income. Hourly wages also lack scalability and may not provide passive income opportunities, making them less advantageous for long-term wealth accumulation.

Advantages and Risks of Digital Asset Income

Digital asset income offers high scalability and potential for substantial returns compared to a fixed hourly wage, attracting individuals seeking financial growth beyond traditional employment. Advantages include decentralized transactions, global accessibility, and passive income opportunities through asset appreciation and staking. Risks involve market volatility, regulatory uncertainties, and cybersecurity threats that can impact the stability and legality of digital earnings.

Stability: Hourly Wages vs. Digital Asset Volatility

Hourly wages provide predictable and stable income, ensuring consistent cash flow regardless of market fluctuations. Digital asset income, however, is subject to significant volatility, with value often changing dramatically within short periods due to market demand and regulatory news. Employees relying on hourly wages benefit from financial security, while those earning through digital assets face higher risk and potential reward scenarios.

Income Growth Potential in Both Models

Hourly wage offers predictable, incremental income growth tied to fixed pay rates and limited overtime opportunities, often capped by market standards and job role constraints. Digital asset income presents exponential growth potential through scalable, automated revenue streams like royalties, licensing, and appreciation in asset value, driven by market demand and platform reach. Long-term financial gains typically favor digital assets due to their ability to generate passive income and diversify income sources beyond active labor.

Flexibility and Lifestyle: Job Hours vs. Digital Income

Hourly wage jobs typically require fixed schedules with limited flexibility, often restricting personal lifestyle choices and time management. Digital asset income, such as earnings from cryptocurrencies or digital content, offers greater adaptability in work hours, enabling individuals to tailor their income-generating activities around personal priorities. This flexibility supports a more dynamic work-life balance, empowering lifestyle customization beyond traditional job constraints.

Tax Implications: Hourly Wages vs. Digital Assets

Hourly wages are typically subject to standard income tax withholding, Social Security, and Medicare taxes, resulting in predictable tax obligations for employees. Digital asset income, such as cryptocurrency earnings, often requires tracking the fair market value at the time of receipt and may incur capital gains taxes upon disposal, complicating tax reporting and potentially increasing tax liabilities. Tax authorities increasingly scrutinize digital asset transactions, making precise documentation essential to comply with evolving tax regulations and avoid penalties.

Transitioning from Hourly Work to Digital Asset Income

Transitioning from hourly wage to digital asset income involves shifting from fixed, time-based compensation to variable, asset-derived earnings that can scale independently of hours worked. Digital asset income, such as cryptocurrency holdings, NFTs, or tokenized rewards, offers potential for passive revenue streams and portfolio appreciation, contrasting the stable but limited growth of hourly wages. Embracing blockchain technology and decentralized finance enables individuals to diversify income sources, reduce dependence on traditional employment, and capitalize on emerging digital economies.

Long-Term Financial Security: Which Model Wins?

Hourly wage income provides consistent, predictable earnings but is often limited in growth potential, making it challenging to build substantial long-term wealth. Digital asset income, such as profits from cryptocurrencies or NFTs, offers high volatility with the possibility of exponential returns that can significantly enhance financial security over time. For sustained long-term financial security, diversifying income streams to include digital asset income alongside traditional hourly wages typically yields the best outcomes.

Related Important Terms

Gig Economy Arbitrage

Hourly wage offers consistent, predictable earnings based on time worked, while digital asset income in the gig economy leverages platform arbitrage opportunities for potentially higher, variable returns through smart asset allocation and real-time market dynamics. Gig economy arbitrage exploits the differences between hourly wage rates and digital asset valuations, maximizing compensation by converting time-based income into scalable digital revenues.

Tokenized Labor Compensation

Tokenized labor compensation enables workers to receive hourly wage equivalents through digital assets, providing seamless integration with blockchain technology for transparent, instant payments. This model enhances liquidity, reduces transaction costs, and offers customizable compensation packages tied to real-time performance metrics.

Time-to-Earnings Ratio

Hourly wage provides immediate, fixed income based on time worked, resulting in a predictable but limited time-to-earnings ratio. Digital asset income, often passive and scalable, can offer a significantly improved time-to-earnings ratio by generating revenue independent of direct time investment.

Crypto Stipend Model

The Crypto Stipend Model offers a unique compensation structure by combining hourly wage stability with the potential high returns of digital asset income, optimizing employee earnings in volatile markets. Employers can incentivize performance and loyalty while leveraging blockchain transparency and token appreciation, creating a hybrid pay system suited for the evolving gig and remote work economy.

NFT Royalties Income

Hourly wages provide consistent, predictable compensation based on time worked, while NFT royalties offer scalable, passive income derived from blockchain-secured digital asset transactions. NFT royalties enable creators to earn ongoing revenue from secondary sales, maximizing long-term earnings beyond traditional hourly pay structures.

Smart Contract Payroll

Smart Contract Payroll automates hourly wage payments by securely executing predefined contracts on blockchain, ensuring transparent and timely compensation. Digital asset income leverages tokenized earnings within these smart contracts, providing decentralized, instant transactions that reduce intermediaries and enhance financial flexibility.

Decentralized Micro-Task Payments

Decentralized micro-task payments enable individuals to earn digital asset income by completing small online tasks, offering an alternative to traditional hourly wages with potentially faster and more flexible compensation. This model leverages blockchain technology to provide transparent, secure transactions while reducing reliance on centralized employers, enhancing financial inclusion and income diversification.

Passive Yield Farming Income

Hourly wage provides consistent, predictable income based on time worked, whereas digital asset income from passive yield farming offers potential for higher returns through cryptocurrency staking and liquidity provision without continuous active effort. Yield farming leverages decentralized finance (DeFi) protocols to generate compounded interest and rewards, creating scalable, automated income streams beyond traditional labor hours.

Streaming Payments (Sablier)

Streaming payments via platforms like Sablier provide continuous, real-time income from digital assets, offering a flexible alternative to traditional hourly wage compensation. This method enhances cash flow management by enabling instant, programmable salary disbursements aligned with work performed.

Play-to-Earn Revenue

Play-to-Earn revenue generates digital asset income by rewarding players with cryptocurrencies or NFTs, often surpassing traditional hourly wages in profitability, especially in emerging blockchain-based gaming ecosystems. Unlike fixed hourly wages, digital asset income fluctuates with market demand, offering potential passive earnings through asset appreciation and in-game rewards.

Hourly wage vs Digital asset income for compensation. Infographic

moneydiff.com

moneydiff.com