Dividend income provides shareholders with regular, predictable cash returns derived from a company's profits, enhancing immediate financial stability and rewarding investment loyalty. Impact investing income, while potentially less consistent, aligns financial gains with social and environmental outcomes, appealing to shareholders interested in value-driven returns. Each income type offers unique benefits, allowing investors to balance short-term financial rewards with long-term purposeful impact.

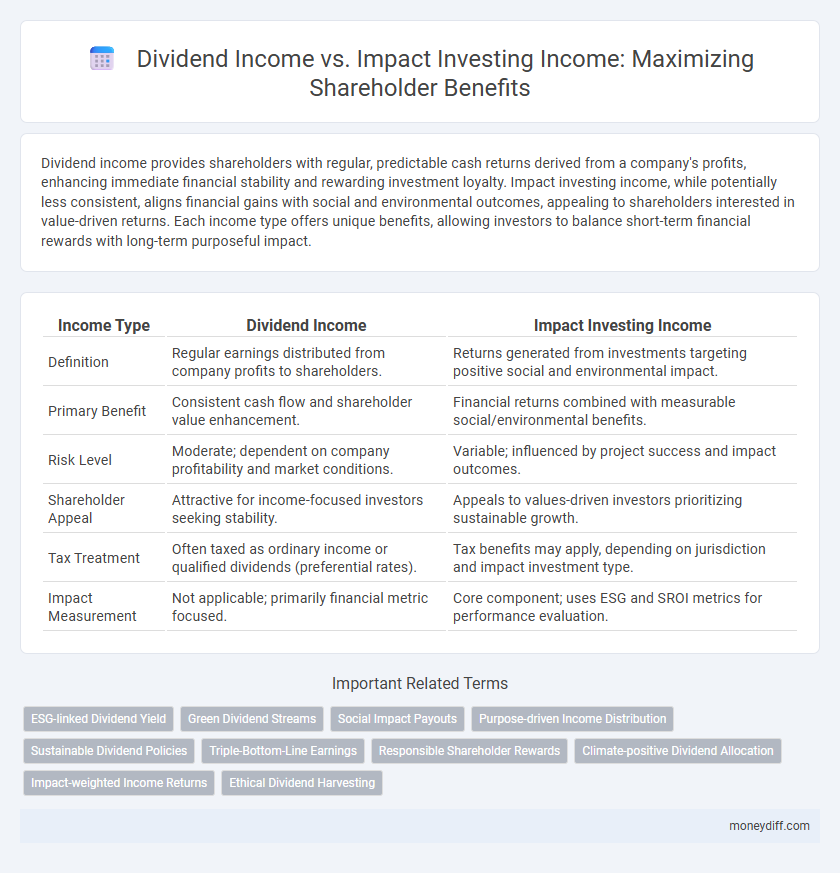

Table of Comparison

| Income Type | Dividend Income | Impact Investing Income |

|---|---|---|

| Definition | Regular earnings distributed from company profits to shareholders. | Returns generated from investments targeting positive social and environmental impact. |

| Primary Benefit | Consistent cash flow and shareholder value enhancement. | Financial returns combined with measurable social/environmental benefits. |

| Risk Level | Moderate; dependent on company profitability and market conditions. | Variable; influenced by project success and impact outcomes. |

| Shareholder Appeal | Attractive for income-focused investors seeking stability. | Appeals to values-driven investors prioritizing sustainable growth. |

| Tax Treatment | Often taxed as ordinary income or qualified dividends (preferential rates). | Tax benefits may apply, depending on jurisdiction and impact investment type. |

| Impact Measurement | Not applicable; primarily financial metric focused. | Core component; uses ESG and SROI metrics for performance evaluation. |

Introduction to Dividend Income and Impact Investing

Dividend income provides shareholders with regular payments derived from a company's profits, enhancing liquidity and offering predictable cash flow. Impact investing income generates financial returns while promoting social or environmental benefits, aligning shareholder values with sustainable growth. Both income types play distinct roles in portfolio diversification and shareholder value creation.

Defining Dividend Income for Shareholders

Dividend income represents the portion of a company's earnings distributed directly to shareholders as a return on their investment, typically paid in cash or additional shares. This form of income provides shareholders with a predictable and regular cash flow, enhancing portfolio stability and generating passive revenue without the need to sell shares. Unlike impact investing income, which may prioritize social and environmental returns alongside financial gains, dividend income remains a fundamental metric for assessing shareholder value and investment performance.

Understanding Impact Investing Income

Dividend income provides shareholders with regular payments derived from a company's profits, reflecting traditional investment returns. Impact investing income, however, generates financial returns alongside measurable social or environmental benefits, aligning shareholder gains with ethical and sustainable outcomes. Understanding impact investing income enables shareholders to assess profitability while supporting positive change, enhancing long-term value and corporate responsibility.

Comparing Financial Returns: Dividend vs. Impact Investing

Dividend income provides shareholders with consistent, predictable cash flow derived from a company's profits, often appealing for short-term financial stability and portfolio income. Impact investing income, while typically less predictable and sometimes lower in immediate returns, offers potential for long-term capital appreciation alongside societal or environmental benefits. Investors prioritizing pure financial returns may favor dividends, whereas those seeking a balance between financial gain and positive impact often accept impact investing's varied income profile.

Risk Factors in Dividend Income and Impact Investing

Dividend income carries risks such as market volatility, company profit fluctuations, and potential dividend cuts, which can impact consistent shareholder returns. Impact investing income faces risks linked to longer time horizons, project execution uncertainties, and social or environmental outcomes affecting financial performance. Shareholders must balance these risk factors to optimize income stability and align with their financial and ethical goals.

Long-Term Growth Potential for Shareholders

Dividend income offers shareholders a steady cash flow derived from company profits, providing immediate financial returns and signaling company stability. Impact investing income, though potentially less predictable in the short term, aligns with sustainable business practices that can drive long-term value appreciation and resilient growth. Prioritizing impact investing income fosters shareholder benefits through enhanced corporate responsibility, innovation, and access to emerging markets, supporting sustainable long-term growth potential.

Tax Implications: Dividend Income vs. Impact Investing

Dividend income is typically subject to ordinary income tax rates or qualified dividend tax rates, depending on the holding period and type of dividend, which can significantly affect net returns for shareholders. Impact investing income, often generated through interest, capital gains, or distributions from socially responsible funds, may benefit from tax incentives such as credits or deductions aimed at promoting sustainable and socially beneficial projects. Shareholders should evaluate the specific tax treatments of dividend income versus impact investing income to optimize after-tax returns and align financial goals with social impact objectives.

Social and Environmental Impact Benefits

Dividend income provides shareholders with a steady financial return based on company profits, while impact investing income aligns shareholder benefits with measurable social and environmental improvements. Impact investing generates financial gains alongside positive outcomes such as reduced carbon emissions, enhanced community development, and improved social equity. This approach attracts investors seeking to balance profit generation with contributions to sustainable development goals and corporate social responsibility.

Portfolio Diversification with Dividend and Impact Strategies

Dividend income provides shareholders with steady cash flow through regular payouts from established companies, enhancing portfolio stability and predictable returns. Impact investing income, derived from companies prioritizing social and environmental goals, offers potential for long-term capital appreciation alongside positive societal contributions. Combining dividend and impact strategies diversifies portfolios by balancing immediate income generation with growth aligned to sustainable development objectives.

Choosing the Right Approach for Shareholder Benefits

Dividend income provides shareholders with regular, predictable cash flow derived from company profits, offering stability and immediate financial returns. Impact investing income focuses on generating both financial returns and positive social or environmental outcomes, appealing to shareholders interested in ethical and sustainable growth. Selecting the right approach depends on balancing consistent income streams with the desire to support purposeful business practices that align with shareholder values and long-term goals.

Related Important Terms

ESG-linked Dividend Yield

ESG-linked dividend yield integrates environmental, social, and governance performance metrics, offering shareholders sustainable income with potential for long-term value appreciation. Unlike traditional dividend income, impact investing income prioritizes measurable social and environmental returns alongside financial gains, enhancing stakeholder benefits through responsible corporate practices.

Green Dividend Streams

Green dividend streams from impact investing generate sustainable shareholder income by prioritizing environmentally-focused companies that yield consistent financial returns alongside positive ecological impact. This contrasts with traditional dividend income, which may lack environmental considerations and long-term sustainability in shareholder benefits.

Social Impact Payouts

Dividend income provides shareholders with regular cash returns based on company profits, while impact investing income emphasizes social impact payouts that reinvest earnings to generate measurable community benefits alongside financial returns. Social impact payouts enhance shareholder value by aligning financial gains with tangible improvements in social and environmental outcomes, fostering sustainable growth and stakeholder engagement.

Purpose-driven Income Distribution

Dividend income provides shareholders with regular, predictable cash returns based on company profits, aligning with traditional financial gain priorities. Impact investing income, while potentially less predictable, channels earnings toward social and environmental goals, offering shareholders purpose-driven benefits that combine financial returns with positive societal impact.

Sustainable Dividend Policies

Sustainable dividend policies balance consistent dividend income with the long-term growth potential from impact investing income, enhancing shareholder benefits by aligning financial returns with environmental, social, and governance (ESG) goals. Companies prioritizing stable dividend payouts while integrating impact investments attract socially conscious investors seeking both reliable income and positive societal impact.

Triple-Bottom-Line Earnings

Dividend income provides shareholders with steady financial returns, typically reflecting the company's profitability, while impact investing income emphasizes generating measurable social and environmental benefits alongside financial gains. Prioritizing triple-bottom-line earnings, impact investing fosters sustainable growth by balancing profit, people, and planet, enhancing long-term shareholder value through responsible business practices.

Responsible Shareholder Rewards

Dividend income provides shareholders with direct, regular financial returns, enhancing liquidity and immediate wealth accumulation. Impact investing income, derived from socially responsible ventures, offers sustainable long-term benefits by aligning shareholder rewards with positive environmental and social outcomes.

Climate-positive Dividend Allocation

Dividend income from traditional investments provides steady cash flow, while impact investing income, especially through climate-positive dividend allocation, aligns shareholder benefits with environmental sustainability by reinvesting profits into renewable energy and green technologies. This approach not only generates financial returns but also advances carbon reduction goals, enhancing long-term value for socially conscious investors.

Impact-weighted Income Returns

Impact investing income generates not only financial returns but also measurable social and environmental benefits, aligning shareholder value with sustainable development goals. Impact-weighted income returns provide a holistic assessment of profitability by integrating positive externalities, contrasting with traditional dividend income that primarily reflects financial gain.

Ethical Dividend Harvesting

Ethical Dividend Harvesting maximizes shareholder benefits by prioritizing dividend income from socially responsible companies committed to sustainable practices. Impact investing income, while aligned with ethical goals, often focuses on long-term social returns rather than immediate dividend payouts, making dividend income a preferred strategy for consistent shareholder value in ethical portfolios.

Dividend income vs Impact investing income for shareholder benefits. Infographic

moneydiff.com

moneydiff.com