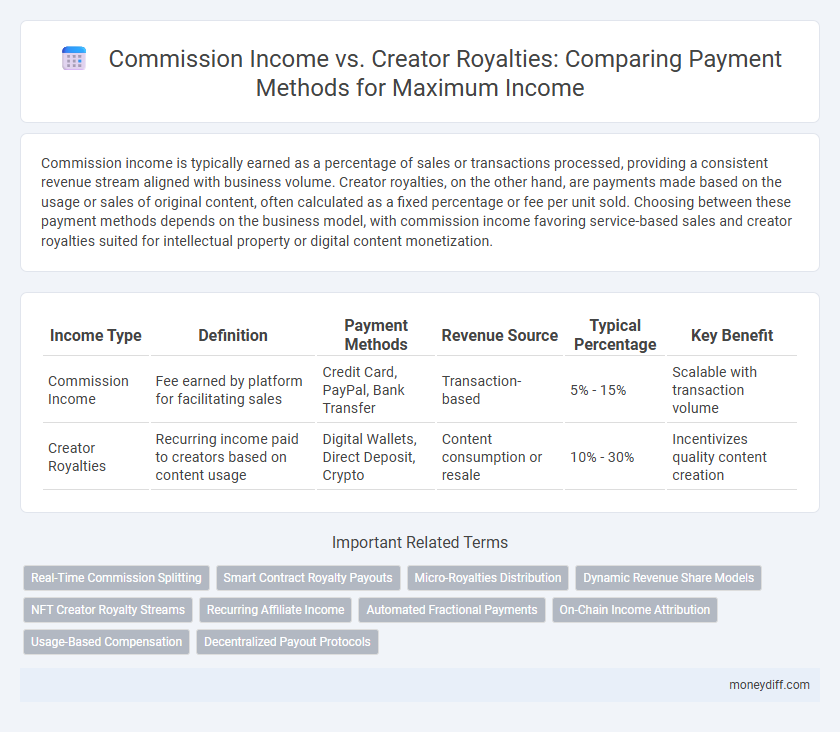

Commission income is typically earned as a percentage of sales or transactions processed, providing a consistent revenue stream aligned with business volume. Creator royalties, on the other hand, are payments made based on the usage or sales of original content, often calculated as a fixed percentage or fee per unit sold. Choosing between these payment methods depends on the business model, with commission income favoring service-based sales and creator royalties suited for intellectual property or digital content monetization.

Table of Comparison

| Income Type | Definition | Payment Methods | Revenue Source | Typical Percentage | Key Benefit |

|---|---|---|---|---|---|

| Commission Income | Fee earned by platform for facilitating sales | Credit Card, PayPal, Bank Transfer | Transaction-based | 5% - 15% | Scalable with transaction volume |

| Creator Royalties | Recurring income paid to creators based on content usage | Digital Wallets, Direct Deposit, Crypto | Content consumption or resale | 10% - 30% | Incentivizes quality content creation |

Understanding Commission Income vs Creator Royalties

Commission income is earned as a percentage of sales or transactions facilitated by an intermediary, reflecting a business model where payment is tied to successful referrals or services rendered. Creator royalties represent ongoing earnings paid to content creators or artists based on the sale, usage, or licensing of their original work, typically calculated as a fixed percentage of revenue. Distinguishing between these two payment methods is essential for accurately tracking income streams, tax reporting, and financial planning within digital and creative industries.

Key Differences Between Commissions and Royalties

Commission income is earned as a percentage of sales or transactions facilitated by an agent or intermediary, typically generating revenue through direct sales efforts. Creator royalties are recurring payments based on the ongoing use or sale of intellectual property, such as music, books, or patents, reflecting a share in the long-term value generated by the original creator. The key difference lies in commissions being transactional and often one-time payments, while royalties represent continuous income tied to the exploitation of creative works.

Payment Methods for Commission Income

Commission income typically involves direct payments through methods such as bank transfers, PayPal, or credit card processing, ensuring timely and secure fund transfers. Payment methods for commission income are often integrated with sales platforms and affiliate marketing networks to automate tracking and disbursing earnings. These methods prioritize transparency, accuracy, and ease of reconciliation for both payers and recipients.

Payment Options for Creator Royalties

Creator royalties offer flexible payment options including direct bank deposits, digital wallets, and cryptocurrency transfers, enabling seamless global transactions. These methods provide faster access to earnings compared to traditional commission income payouts typically processed through standard banking systems. Optimizing payment options enhances financial control and transparency for creators, ensuring timely and secure royalty disbursements.

Pros and Cons of Commission-Based Payments

Commission-based payments provide scalable income by directly linking earnings to sales volume, motivating creators to boost performance; however, reliance on fluctuating sales can lead to inconsistent revenue streams. Unlike fixed royalties, commissions encourage active marketing but may disadvantage new creators with limited initial exposure. While commissions offer flexibility in payment amounts, their variability demands careful financial planning to sustain stable income.

Advantages and Disadvantages of Royalty Payments

Royalty payments offer creators ongoing income based on sales performance, providing long-term revenue potential and incentivizing quality work. However, royalty structures can result in unpredictable cash flow and delayed earnings compared to fixed commission income. Creators relying solely on royalties may face financial uncertainty, especially during market fluctuations or product demand shifts.

Tax Implications: Commission Income vs Creator Royalties

Commission income is typically classified as ordinary income and subject to standard income tax rates, often requiring self-employment tax payments for independent contractors. Creator royalties are usually treated as passive income or intellectual property income, which may qualify for different tax treatments such as reduced rates or specific deductions under copyright law. Understanding the distinction between these income types influences tax reporting, withholding requirements, and eligibility for deductions, significantly impacting overall tax liability for creators and freelancers.

Managing Cash Flow: Commissions vs Royalties

Commission income provides predictable cash flow through fixed percentages on sales, enabling easier budgeting and financial planning. Creator royalties often fluctuate based on usage or performance metrics, introducing variability that requires careful cash flow management. Businesses must balance the stability of commissions with the potential upside and timing uncertainties inherent in royalty payments to optimize liquidity.

Best Practices for Setting Up Payment Methods

Commission income typically involves a percentage fee earned from sales transactions facilitated by a platform, while creator royalties are recurring payments awarded based on the ongoing use or resale of creative works. Best practices for setting up payment methods include selecting platforms that support direct deposit and digital wallets, ensuring transparent fee structures for both commissions and royalties, and automating payment schedules to enhance reliability and reduce administrative overhead. Implementing multi-currency support and real-time transaction tracking further optimizes income flow and accuracy for creators and affiliate partners.

Choosing the Right Payment Model for Your Income

Selecting the right payment model between commission income and creator royalties depends on your revenue goals and business structure. Commission income provides a fixed percentage per sale, ensuring predictable earnings, while creator royalties offer ongoing payments based on content usage, ideal for long-term income streams. Evaluating your product lifecycle, audience engagement, and cash flow needs is essential to optimize income through the appropriate payment method.

Related Important Terms

Real-Time Commission Splitting

Real-time commission splitting enhances payment accuracy by instantly allocating commission income and creator royalties during transactions, ensuring transparent and timely revenue distribution. This method optimizes cash flow management for platforms by automating the division of earnings between affiliates and content creators based on predefined agreements.

Smart Contract Royalty Payouts

Commission income typically involves a fixed percentage earned from transactions, while creator royalties via smart contract royalty payouts enable automated, transparent, and immutable distribution of earnings directly to content creators based on predefined blockchain rules. Smart contract royalty payouts reduce intermediaries, ensuring timely and secure payment flows that enhance trust and scalability in digital content monetization.

Micro-Royalties Distribution

Commission income typically arises from a percentage fee charged on sales transactions, whereas creator royalties represent ongoing payments based on the use or resale of creative works. Micro-royalties distribution enables precise, scalable payment of small royalty amounts to numerous creators, optimizing income streams through blockchain and smart contract technologies for transparent, automated settlements.

Dynamic Revenue Share Models

Dynamic revenue share models optimize income streams by tailoring commission income and creator royalties based on performance metrics and engagement rates. These adaptive payment methods enhance monetization efficiency by aligning incentives with actual content value and consumer interaction data.

NFT Creator Royalty Streams

NFT creator royalty streams provide ongoing passive income by automatically generating payments from secondary sales, unlike one-time commission income which is limited to initial transactions. Blockchain technology ensures transparency and traceability in royalty payments, optimizing revenue flow for creators in decentralized marketplaces.

Recurring Affiliate Income

Recurring affiliate income generates stable cash flow by earning commissions on repeat sales, leveraging customer loyalty and ongoing promotional efforts. Creator royalties, typically tied to intellectual property usage, offer passive income but may lack the consistent monthly revenue streams provided by affiliate marketing programs.

Automated Fractional Payments

Commission income arises from a percentage cut on transactions, whereas creator royalties represent recurring payments based on content usage or sales, optimized through automated fractional payments to ensure precise, real-time revenue distribution. Automated fractional payments streamline income allocation by breaking down commissions and royalties into accurate, instantaneous shares, enhancing payment transparency and reducing manual errors for creators and platforms.

On-Chain Income Attribution

Commission income is typically recorded as direct earnings from services or sales, whereas creator royalties represent ongoing revenue streams attributed through smart contracts on-chain, ensuring transparent and automated payments. On-chain income attribution enables accurate tracking and verification of payments, reducing disputes and enhancing trust in decentralized payment methods.

Usage-Based Compensation

Commission income derives from a percentage of sales or transactions processed, commonly used by platforms facilitating third-party sales, while creator royalties are recurring earnings based on the usage or resale of original content, ensuring ongoing revenue for creators. Usage-based compensation models align payments directly with performance metrics, optimizing income distribution by rewarding actual consumption or engagement rather than fixed fees.

Decentralized Payout Protocols

Decentralized payout protocols enable creators to receive commission income and royalties directly through blockchain-based smart contracts, ensuring transparent, immutable, and instantaneous payment settlements without intermediaries. These protocols enhance income accuracy and reduce delays by automating revenue distribution across decentralized platforms, optimizing financial flows for artists and affiliate marketers alike.

Commission Income vs Creator Royalties for payment methods. Infographic

moneydiff.com

moneydiff.com