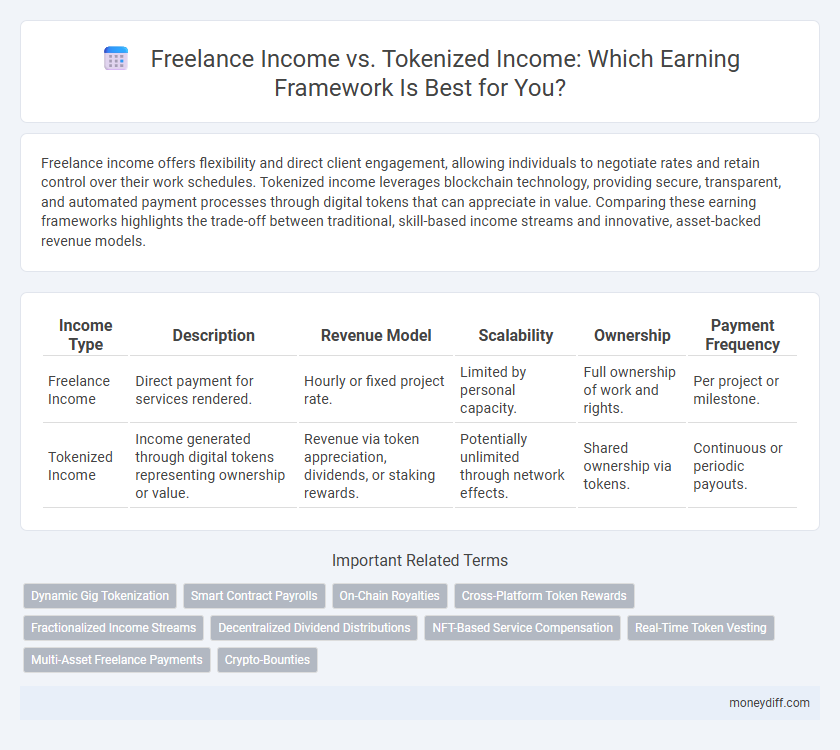

Freelance income offers flexibility and direct client engagement, allowing individuals to negotiate rates and retain control over their work schedules. Tokenized income leverages blockchain technology, providing secure, transparent, and automated payment processes through digital tokens that can appreciate in value. Comparing these earning frameworks highlights the trade-off between traditional, skill-based income streams and innovative, asset-backed revenue models.

Table of Comparison

| Income Type | Description | Revenue Model | Scalability | Ownership | Payment Frequency |

|---|---|---|---|---|---|

| Freelance Income | Direct payment for services rendered. | Hourly or fixed project rate. | Limited by personal capacity. | Full ownership of work and rights. | Per project or milestone. |

| Tokenized Income | Income generated through digital tokens representing ownership or value. | Revenue via token appreciation, dividends, or staking rewards. | Potentially unlimited through network effects. | Shared ownership via tokens. | Continuous or periodic payouts. |

Understanding Freelance Income Structures

Freelance income structures typically involve direct payments from clients based on completed projects or hourly rates, offering immediate cash flow and flexibility. Tokenized income frameworks convert services or products into digital tokens exchanged on blockchain platforms, creating potential for scalable, decentralized revenue streams. Understanding these frameworks helps freelancers optimize earnings by balancing traditional invoice payments with innovative token-based incentives.

What Is Tokenized Income?

Tokenized income refers to earnings generated through blockchain-based digital tokens that represent ownership or revenue rights in various assets or projects. Unlike traditional freelance income, which is typically paid in fiat currency for completed tasks or services, tokenized income allows individuals to earn fractionalized, transparent, and programmable revenue streams linked to specific assets or ecosystems. This decentralized approach enables real-time income tracking, increased liquidity, and potential appreciation of income value through token market dynamics.

Comparing Payment Mechanisms: Freelance Versus Tokens

Freelance income typically involves direct payments in fiat currency based on completed projects or hourly rates, offering predictable cash flow and straightforward tax reporting. Tokenized income, on the other hand, leverages blockchain-based tokens as a form of compensation, enabling fractional ownership, quicker cross-border transactions, and potential value appreciation over time. Comparing these payment mechanisms highlights trade-offs between stability and innovation, with tokenized income providing decentralized financial opportunities while freelance payments ensure immediate liquidity and conventional financial compliance.

Income Predictability: Stability and Volatility

Freelance income often exhibits high volatility due to inconsistent project availability and varying client demand, leading to unpredictable cash flow. Tokenized income frameworks leverage blockchain technology to provide more stable and transparent earnings through smart contracts and recurring revenue streams. This stability enhances income predictability, making tokenized models preferable for long-term financial planning.

Earning Potential: Scaling Freelance and Tokenized Revenue

Freelance income depends largely on individual hours and client acquisition, limiting scalability but allowing direct control over rates and workload. Tokenized income leverages blockchain technology to create scalable, automated revenue streams through digital assets, royalties, or utility tokens that grow independently of active labor. Combining freelance expertise with tokenized frameworks unlocks diversified earning potential, enabling professionals to maximize both immediate project fees and long-term passive income.

Administrative Overhead: Managing Payments and Taxes

Freelance income often involves higher administrative overhead due to manual tracking of payments, invoicing, and tax filings, increasing time spent on financial management. Tokenized income leverages blockchain technology to automate payment processing and tax reporting, significantly reducing administrative burdens. This streamlined approach minimizes errors and improves transparency in managing earnings and compliance.

Diversification: Balancing Freelance and Tokenized Streams

Balancing freelance income with tokenized income creates a diversified earning framework that mitigates risk and enhances financial stability. Freelance income provides immediate cash flow from skill-based services, while tokenized income leverages blockchain assets and digital tokens for long-term passive gains. Combining both streams ensures flexibility and resilience in fluctuating market conditions.

Security and Risk Factors in Payment Models

Freelance income often faces security challenges such as payment delays, chargebacks, and inconsistent cash flow, which increase financial risk for independent workers. Tokenized income leverages blockchain technology to provide transparent, immutable transaction records and automated smart contracts, significantly reducing the risk of fraud and payment disputes. Security in tokenized payment models is enhanced through cryptographic protocols that ensure secure, real-time settlements and minimize reliance on intermediaries.

Opportunities for Passive Income in Tokenized Frameworks

Tokenized income frameworks enable passive income opportunities by allowing individuals to earn through asset-backed digital tokens that appreciate or generate dividends without active involvement. Unlike freelance income, which requires continuous service delivery, tokenized assets provide revenue streams from decentralized finance (DeFi) platforms, staking, or revenue-sharing models embedded in blockchain ecosystems. This shift offers scalable, automated earning potential, diversifying income sources beyond traditional gig-based labor.

Choosing the Right Earning Model for Financial Goals

Freelance income offers flexibility and control over projects, making it ideal for those seeking diversified and immediate cash flow. Tokenized income, generated through blockchain-based assets or digital tokens, provides passive earning potential and capital appreciation aligned with long-term financial goals. Selecting the right earning model depends on risk tolerance, liquidity needs, and investment horizon to optimize overall revenue streams and financial growth.

Related Important Terms

Dynamic Gig Tokenization

Dynamic Gig Tokenization revolutionizes freelance income by converting earnings into tradeable digital tokens, enhancing liquidity and financial flexibility. This tokenized income framework enables freelancers to access instant cash flow and investment opportunities without waiting for traditional payment cycles.

Smart Contract Payrolls

Freelance income often relies on traditional invoicing and delayed payments, whereas tokenized income leverages blockchain technology to enable real-time, transparent transactions through smart contract payrolls. Smart contracts automate payment distribution based on predefined terms, reducing intermediaries and ensuring instant, secure earnings for freelancers within decentralized finance frameworks.

On-Chain Royalties

Freelance income relies on direct client contracts and project-based payments, often lacking transparency and automation in tracking earnings. Tokenized income leverages on-chain royalties encoded in smart contracts, ensuring real-time, immutable, and automated revenue distribution for creators across decentralized platforms.

Cross-Platform Token Rewards

Freelance income typically relies on project-based payments through traditional platforms, while tokenized income leverages blockchain technology to offer cross-platform token rewards that enhance earning flexibility and liquidity. Cross-platform token rewards enable freelancers to accumulate and exchange digital assets seamlessly across multiple ecosystems, maximizing income opportunities beyond conventional currency limitations.

Fractionalized Income Streams

Freelance income typically involves direct payment for specific services rendered, whereas tokenized income leverages blockchain to create fractionalized income streams by distributing ownership of assets or projects among multiple investors. This fractionalized approach enhances liquidity and accessibility, enabling earners to generate diversified revenue through micropayments and shared asset dividends.

Decentralized Dividend Distributions

Freelance income typically relies on direct client payments and hourly rates, while tokenized income leverages blockchain technology to enable decentralized dividend distributions through smart contracts. This framework ensures transparent, automated earnings where stakeholders receive proportional dividends in real-time, enhancing trust and efficiency in income streams.

NFT-Based Service Compensation

NFT-based service compensation revolutionizes freelance income by enabling creators to monetize digital assets through tokenized ownership, offering transparency and automated royalty streams. This emerging earning framework leverages blockchain technology for secure, decentralized payments, contrasting traditional freelance payments tied to fixed fees or hourly rates.

Real-Time Token Vesting

Freelance income offers flexible payment schedules based on completed tasks, while tokenized income leverages blockchain technology to enable real-time token vesting, allowing instant access to earnings tied to smart contracts. Real-time token vesting frameworks enhance liquidity and transparency, reducing payment delays and providing continuous income streams aligned with project milestones and performance metrics.

Multi-Asset Freelance Payments

Multi-asset freelance payments enhance earning frameworks by integrating traditional freelance income with tokenized income, enabling seamless transactions across cryptocurrencies and fiat currencies. This hybrid approach optimizes financial flexibility, reduces transaction fees, and expands global market access for freelancers.

Crypto-Bounties

Freelance income from traditional projects offers direct payments and steady cash flow, while tokenized income through crypto-bounties leverages blockchain-based rewards that provide transparency, traceability, and potential appreciation in token value. Crypto-bounties enable decentralized earning frameworks where contributors receive tokens for specific tasks, aligning incentives with project success and creating novel financial opportunities beyond conventional freelancing.

Freelance income vs Tokenized income for earning frameworks. Infographic

moneydiff.com

moneydiff.com