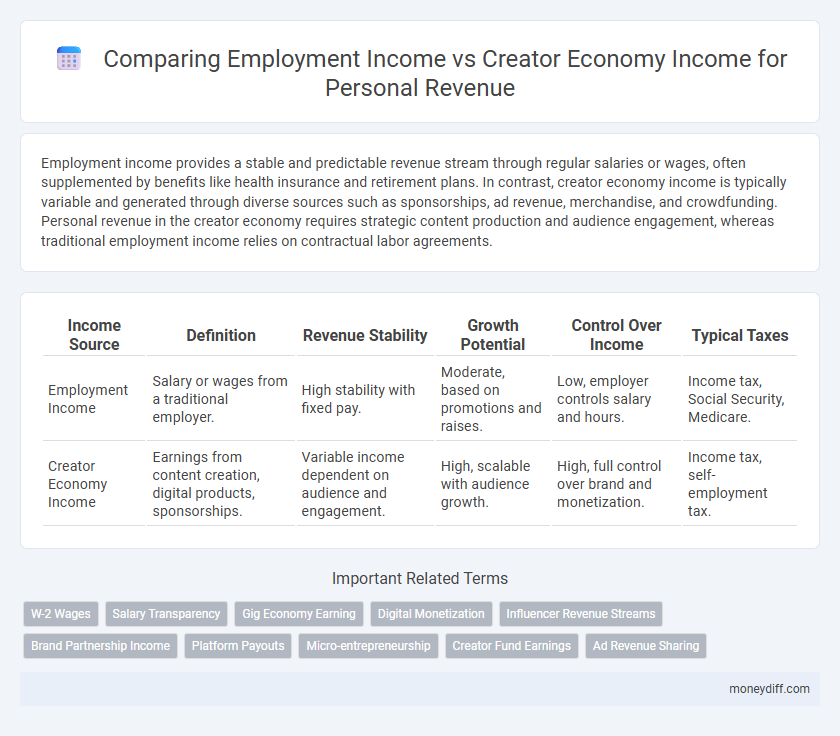

Employment income provides a stable and predictable revenue stream through regular salaries or wages, often supplemented by benefits like health insurance and retirement plans. In contrast, creator economy income is typically variable and generated through diverse sources such as sponsorships, ad revenue, merchandise, and crowdfunding. Personal revenue in the creator economy requires strategic content production and audience engagement, whereas traditional employment income relies on contractual labor agreements.

Table of Comparison

| Income Source | Definition | Revenue Stability | Growth Potential | Control Over Income | Typical Taxes |

|---|---|---|---|---|---|

| Employment Income | Salary or wages from a traditional employer. | High stability with fixed pay. | Moderate, based on promotions and raises. | Low, employer controls salary and hours. | Income tax, Social Security, Medicare. |

| Creator Economy Income | Earnings from content creation, digital products, sponsorships. | Variable income dependent on audience and engagement. | High, scalable with audience growth. | High, full control over brand and monetization. | Income tax, self-employment tax. |

Overview of Employment Income vs Creator Economy Income

Employment income typically consists of fixed wages or salaries, often supplemented with benefits and tax withholdings, providing stable and predictable revenue. Creator economy income, generated through platforms like YouTube, Twitch, or Patreon, is variable and relies heavily on audience engagement, sponsorships, and digital content monetization. The key distinctions lie in income stability, control over revenue streams, and the scalability potential inherent in creator-driven earnings compared to traditional employment compensation.

Defining Employment Income: Traditional Sources and Stability

Employment income primarily derives from wages, salaries, and benefits provided by an employer, offering a stable and predictable revenue stream. Traditional sources of employment income include full-time jobs, part-time positions, and contractual work with consistent pay cycles. This stability is often accompanied by legal protections, social security contributions, and employee benefits, distinguishing it from the variable earnings seen in the creator economy.

What is Creator Economy Income? Modern Earning Channels

Creator Economy Income refers to revenue generated by individuals through digital platforms such as YouTube, TikTok, Patreon, and Instagram, leveraging content creation, brand partnerships, and fan subscriptions. Unlike traditional Employment Income, which is earned through salaried or hourly wages from employers, Creator Economy Income often involves multiple streams including advertising revenue, merchandise sales, and crowdfunding. This modern earning channel empowers individuals to monetize creativity and personal influence directly, reflecting a shift towards decentralized, digital-first revenue models.

Income Predictability: Job Paychecks vs Creator Revenue Streams

Employment income offers consistent, predictable paychecks through fixed salaries or hourly wages, providing financial stability and easier budgeting for individuals. Creator economy income, generated from platforms like YouTube, Patreon, or TikTok, is often variable and dependent on audience engagement, content trends, and monetization algorithms. The unpredictability of creator revenue streams makes long-term financial planning more challenging compared to the regularity of traditional employment pay.

Flexibility and Control: Salaried Roles vs Self-Driven Earnings

Employment income typically offers stable monthly paychecks with predetermined hours and limited flexibility, while creator economy income provides greater control over work schedules and content creation, allowing for personalized revenue streams. Salaried roles often guarantee consistent benefits and job security, whereas self-driven earnings depend on audience engagement and market trends, making income more variable but highly scalable. Flexibility in creator income empowers individuals to prioritize projects, diversify revenue sources, and rapidly adapt to shifting opportunities, enhancing long-term financial autonomy.

Skill Requirements: Professional Credentials vs Creative Talents

Employment income typically depends on professional credentials such as degrees, certifications, and formal training that validate specialized skills in fields like finance, healthcare, or engineering. Creator economy income hinges on creative talents including content creation, digital marketing, and personal branding, which leverage social media platforms and audience engagement. Both income sources demand continuous skill development, but traditional employment emphasizes standardized qualifications while creator roles prioritize originality and adaptability to market trends.

Scalability: Limited Salary Growth vs Viral Income Potential

Employment income typically offers limited salary growth tied to fixed roles and incremental raises, restricting scalability over time. In contrast, creator economy income has viral potential, allowing revenue to scale exponentially through digital content, sponsorships, and audience growth. This dynamic enables creators to leverage platforms for continuous income expansion beyond traditional employment constraints.

Job Security: Employment Contracts vs Creator Platform Risks

Employment income provides job security through formal contracts that guarantee steady wages, benefits, and legal protections, reducing financial uncertainty. In contrast, creator economy income relies on platform algorithms and audience engagement, introducing higher volatility and unpredictable earnings without long-term contractual safety. Understanding these differences helps individuals assess their risk tolerance and choose between stable employment or entrepreneurial income streams.

Tax Implications: Reporting Paychecks vs Managing Freelance Earnings

Employment income is typically reported on W-2 forms, with taxes automatically withheld by employers, simplifying tax filing and reducing the risk of underpayment. In contrast, creator economy income, often earned through freelance gigs or platform-based work, requires individuals to track earnings, manage expenses, and pay estimated taxes quarterly to avoid penalties. Understanding these differences is crucial for accurate tax reporting and optimizing personal revenue management.

Choosing Your Path: Aligning Income Type with Personal Goals

Employment income provides predictable stability with regular paychecks and benefits, ideal for individuals valuing financial security and structured growth. Creator economy income offers flexibility and creative freedom, attracting those who prioritize entrepreneurial opportunities and personal brand development. Aligning your income type with personal goals requires assessing risk tolerance, desired work-life balance, and long-term financial objectives.

Related Important Terms

W-2 Wages

Employment income reported on W-2 wages offers stable, predictable earnings with tax withholding and employer benefits, while creator economy income, often classified as self-employment revenue, requires managing variable cash flow and self-employment taxes. Understanding the distinction between W-2 wages and creator economy profits is crucial for accurate tax filing and optimizing personal revenue streams.

Salary Transparency

Employment income traditionally provides stable, predictable salary figures based on industry standards and role responsibilities, facilitating clearer salary transparency and benchmarking. In contrast, creator economy income varies widely due to factors like platform algorithms, audience engagement, and multiple revenue streams, creating challenges for transparent income comparisons and consistent financial forecasting.

Gig Economy Earning

Employment income offers consistent wages with benefits tied to traditional job roles, while creator economy income relies heavily on gig economy earning models that provide variable revenue streams through freelance projects, content creation, and digital platform monetization. Gig economy earnings emphasize flexibility and diversification, enabling individuals to leverage multiple income sources such as sponsored content, ad revenue, and freelance gigs, which can significantly impact overall personal revenue.

Digital Monetization

Employment income offers stable salaries and benefits, while creator economy income relies on digital monetization methods like sponsorships, ad revenue, and subscription platforms. Digital monetization empowers creators with diversified revenue streams through social media, content platforms, and direct audience engagement.

Influencer Revenue Streams

Employment income typically provides a stable salary with predictable paychecks, while creator economy income from influencer revenue streams depends on diverse sources such as brand partnerships, ad revenue, sponsored content, and merchandise sales. Influencers often experience variable earnings influenced by audience engagement metrics, platform algorithms, and market trends within digital marketing.

Brand Partnership Income

Brand partnership income in the creator economy often surpasses traditional employment income by leveraging personal audiences and niche markets to negotiate lucrative deals and sponsorships. Unlike fixed salaries, this revenue stream fluctuates based on engagement metrics, audience growth, and brand alignment, offering scalable financial potential for creators.

Platform Payouts

Employment income typically offers consistent platform payouts through salaries and bonuses, providing predictable personal revenue streams. In contrast, creator economy income relies on variable platform payouts from ad revenue, subscriptions, and sponsorships, resulting in fluctuating earnings.

Micro-entrepreneurship

Employment income provides stable wages with predictable tax obligations, while creator economy income from platforms like YouTube, Etsy, or Patreon offers micro-entrepreneurs flexible revenue streams driven by content monetization and audience engagement. Micro-entrepreneurs navigating the creator economy must manage fluctuating cash flow and complex tax reporting, emphasizing diversified income sources and strategic financial planning for sustainable personal revenue growth.

Creator Fund Earnings

Employment income typically offers a stable salary with predictable tax deductions, whereas creator economy income, including Creator Fund earnings, fluctuates based on content engagement and platform algorithms. Maximizing Creator Fund revenue requires strategic publication, consistent audience growth, and leveraging platform-specific monetization tools to enhance personal revenue streams.

Ad Revenue Sharing

Employment income typically offers a stable salary with predictable tax implications, while creator economy income from ad revenue sharing can fluctuate based on audience engagement and platform algorithms. Leveraging ad revenue sharing in the creator economy requires understanding monetization strategies and diverse income streams to maximize personal revenue potential.

Employment Income vs Creator Economy Income for personal revenue. Infographic

moneydiff.com

moneydiff.com