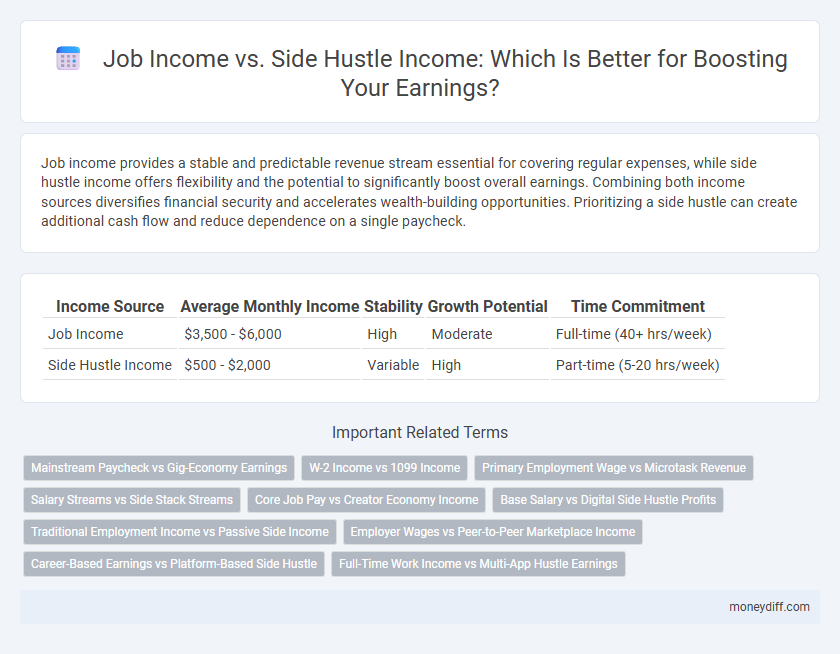

Job income provides a stable and predictable revenue stream essential for covering regular expenses, while side hustle income offers flexibility and the potential to significantly boost overall earnings. Combining both income sources diversifies financial security and accelerates wealth-building opportunities. Prioritizing a side hustle can create additional cash flow and reduce dependence on a single paycheck.

Table of Comparison

| Income Source | Average Monthly Income | Stability | Growth Potential | Time Commitment |

|---|---|---|---|---|

| Job Income | $3,500 - $6,000 | High | Moderate | Full-time (40+ hrs/week) |

| Side Hustle Income | $500 - $2,000 | Variable | High | Part-time (5-20 hrs/week) |

Comparing Job Income and Side Hustle Earnings

Job income typically offers a stable and predictable monthly salary with benefits such as health insurance and retirement plans, providing financial security for individuals. Side hustle earnings vary widely depending on the effort, time invested, and market demand, often serving as supplementary income rather than a primary revenue source. Comparing job income and side hustle income highlights the trade-off between consistent wages and flexible, potentially higher earning opportunities through diversified income streams.

Stability of Job Income versus Flexibility of Side Hustles

Job income offers stability through consistent paychecks, benefits, and predictable schedules, making it a reliable source of financial security. Side hustle income provides flexibility by allowing individuals to choose projects, set their own hours, and diversify their earnings streams. Balancing stable job income with flexible side hustles can optimize overall financial resilience and adaptability.

Diversification Benefits: Why Combine Job and Side Hustle Income

Combining job income with side hustle income enhances financial resilience by diversifying revenue streams, reducing dependency on a single source. This approach mitigates risks associated with job instability and economic downturns, ensuring a steadier cash flow. Diversification through multiple income channels also accelerates wealth-building potential and provides greater financial flexibility for savings and investments.

Job Income Predictability vs. Side Hustle Potential

Job income offers consistent monthly earnings with predictable paychecks and benefits, providing financial stability and easier budget planning. Side hustle income, while less predictable, has higher growth potential and flexibility, allowing individuals to capitalize on market demands and diversify earnings. Balancing job income predictability with side hustle potential can optimize overall financial security and wealth accumulation over time.

Impact on Financial Goals: Job vs. Side Hustle Income

Job income provides a stable and predictable cash flow essential for meeting fixed expenses and long-term financial goals like mortgage payments and retirement savings. Side hustle income, while typically more variable, offers flexibility and the potential for accelerated wealth-building by funding investments or debt repayment beyond the primary salary. Balancing both income streams can optimize financial resilience and expedite progress toward financial independence.

Managing Taxes: Differences Between Job and Side Hustle Earnings

Job income is typically subject to standard payroll tax withholding, simplifying tax management for employees, while side hustle earnings often require self-employment tax payments and quarterly estimated tax filings to avoid penalties. Reporting side hustle income accurately on tax returns is crucial due to less automatic withholding, increasing the importance of maintaining detailed records of expenses and earnings. Understanding these tax differences helps optimize deductions and minimize liabilities, ensuring compliance and maximizing overall net income.

Time Investment: Full-Time Job vs. Side Hustle Commitment

Full-time job income typically reflects a consistent salary earned through dedicated 40+ hour workweeks, ensuring financial stability and benefits. Side hustle income varies significantly and often demands flexible time investment, with hours adjusted around primary job commitments. Balancing both requires strategic time management to optimize overall earnings without overextending personal resources.

Risk Factors: Secure Paychecks vs. Entrepreneurial Uncertainty

Job income typically offers secure paychecks with consistent monthly earnings and benefits such as health insurance and retirement plans, reducing financial risk and providing stability. Side hustle income often involves entrepreneurial uncertainty, with fluctuating cash flow, irregular payments, and a higher risk of income volatility due to market demand and client acquisition challenges. Balancing job income and side hustle revenue requires managing these risk factors to ensure overall financial resilience and growth potential.

Building Wealth: Leveraging Both Job and Side Hustle Incomes

Building wealth effectively requires leveraging both job income and side hustle income to maximize cash flow and investment opportunities. A steady job income provides financial stability and consistent savings potential, while side hustle income offers flexibility and the chance to accelerate wealth accumulation through diversified revenue streams. Combining these incomes strategically allows for increased capital to invest in assets, reduce debt, and build long-term financial security.

Choosing the Right Mix: Job, Side Hustle, or Both?

Balancing job income and side hustle income requires evaluating financial goals, time availability, and risk tolerance to determine the optimal income mix. Employment offers stability and benefits, while side hustles provide flexibility and potential for higher earnings but with variable cash flow. Combining both streams can diversify income sources, enhance financial security, and accelerate wealth-building when managed effectively.

Related Important Terms

Mainstream Paycheck vs Gig-Economy Earnings

Mainstream paycheck income offers steady, predictable earnings with benefits such as health insurance and retirement plans, providing financial stability and security. Gig-economy earnings generate flexible, supplementary income but often lack consistent pay and benefits, requiring individuals to manage variable cash flow and self-employment taxes.

W-2 Income vs 1099 Income

Job income from W-2 employment provides regular salary with tax withholding and employer benefits, while side hustle income reported on a 1099 requires self-employment tax payments and lacks traditional benefits. Understanding the differences in tax obligations and income stability between W-2 and 1099 income streams is essential for effective financial planning.

Primary Employment Wage vs Microtask Revenue

Primary employment wage typically provides stable, consistent income through salaried or hourly compensation, while microtask revenue from side hustles offers flexible, supplementary earnings often dependent on task availability and completion speed. Balancing job income with side hustle microtasks enhances overall financial resilience by diversifying income sources and mitigating risks of wage fluctuations.

Salary Streams vs Side Stack Streams

Job income primarily consists of stable salary streams with regular paychecks, while side hustle income generates additional side stack streams through flexible, often gig-based opportunities. Diversifying income sources by combining steady job earnings with side hustle profits enhances overall financial security and growth potential.

Core Job Pay vs Creator Economy Income

Core job pay typically offers stable, predictable income with benefits and tax advantages, providing financial security through a steady salary or hourly wage. In contrast, creator economy income from side hustles fluctuates based on audience engagement and content monetization, often delivering variable revenue without traditional employment protections.

Base Salary vs Digital Side Hustle Profits

Base salary offers stable, predictable income crucial for financial security, while digital side hustle profits provide flexible, scalable earnings that can significantly boost overall income streams and foster entrepreneurial growth. Balancing steady job income with digital side hustle revenue enables diversified financial stability and potential wealth accumulation through multiple income sources.

Traditional Employment Income vs Passive Side Income

Traditional employment income provides consistent monthly earnings through salaried wages and benefits, offering financial stability and predictable cash flow. Passive side income, generated from investments, rental properties, or online ventures, supplements primary income streams by creating earnings with minimal ongoing effort, enhancing overall financial resilience and wealth-building potential.

Employer Wages vs Peer-to-Peer Marketplace Income

Employer wages provide a stable and predictable source of income based on fixed salaries or hourly pay, ensuring consistent cash flow and benefits such as healthcare and retirement plans. Peer-to-peer marketplace income varies with demand and task availability, offering flexible earning potential that can supplement or exceed traditional job income depending on individual effort and market conditions.

Career-Based Earnings vs Platform-Based Side Hustle

Career-based earnings typically provide stable, predictable income through salaried positions or long-term contracts, benefiting from professional growth and employee benefits. Platform-based side hustle income offers flexibility and diverse revenue streams by leveraging gig economy apps and freelance marketplaces, often experiencing variable cash flow and scalability.

Full-Time Work Income vs Multi-App Hustle Earnings

Full-time work income typically provides a steady, predictable salary based on hours worked or a salary contract, offering financial stability and benefits like health insurance and retirement plans. Multi-app hustle earnings vary widely, relying on gig economy platforms such as Uber, DoorDash, or freelance apps, which can supplement income but often lack consistency and employer-provided perks.

Job income vs Side hustle income for Income. Infographic

moneydiff.com

moneydiff.com