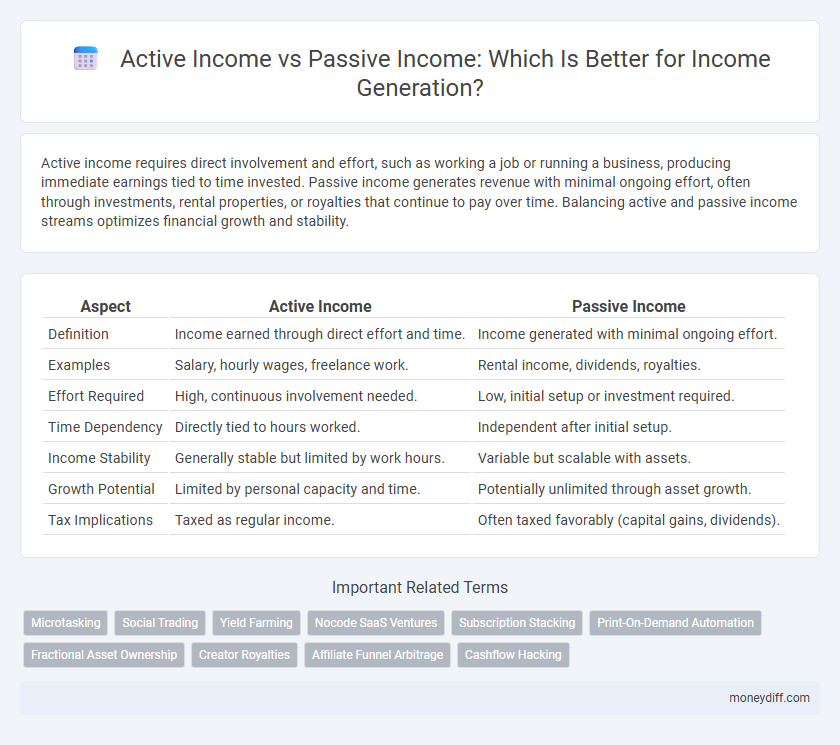

Active income requires direct involvement and effort, such as working a job or running a business, producing immediate earnings tied to time invested. Passive income generates revenue with minimal ongoing effort, often through investments, rental properties, or royalties that continue to pay over time. Balancing active and passive income streams optimizes financial growth and stability.

Table of Comparison

| Aspect | Active Income | Passive Income |

|---|---|---|

| Definition | Income earned through direct effort and time. | Income generated with minimal ongoing effort. |

| Examples | Salary, hourly wages, freelance work. | Rental income, dividends, royalties. |

| Effort Required | High, continuous involvement needed. | Low, initial setup or investment required. |

| Time Dependency | Directly tied to hours worked. | Independent after initial setup. |

| Income Stability | Generally stable but limited by work hours. | Variable but scalable with assets. |

| Growth Potential | Limited by personal capacity and time. | Potentially unlimited through asset growth. |

| Tax Implications | Taxed as regular income. | Often taxed favorably (capital gains, dividends). |

Understanding Active Income: Definition and Examples

Active income refers to earnings generated through direct involvement in work or services, including wages, salaries, tips, and commissions. Examples include income from full-time jobs, freelance projects, consulting fees, and hourly work where active participation is necessary for payment. This type of income is directly tied to the time and effort invested, making it distinct from passive income streams such as rental properties or dividends.

What is Passive Income? Key Concepts Explained

Passive income refers to earnings derived from investments or business ventures that require minimal ongoing effort to maintain. Key concepts include rental income, dividends from stocks, royalties from intellectual property, and income from automated online businesses. Unlike active income, which necessitates continuous labor, passive income enables financial growth through upfront investment and strategic asset management.

Major Differences Between Active and Passive Income

Active income requires continuous effort or labor, such as salaries and freelance work, where earnings stop when work ceases. Passive income involves earning money with minimal ongoing effort, including rental income, dividends, or royalties, allowing income generation without constant active involvement. The major difference lies in the time investment and scalability, with active income often limited by hours worked, while passive income can grow independently of time spent.

Pros and Cons of Active Income Streams

Active income streams provide immediate and consistent earnings through direct work or services, ensuring reliable cash flow and skill development. However, they require continuous effort, time investment, and can limit scalability, as income stops when work ceases. This contrasts with passive income, which demands upfront investment but can generate revenue with minimal ongoing involvement.

Advantages and Disadvantages of Passive Income Sources

Passive income sources provide financial freedom by generating earnings with minimal daily effort, allowing individuals to diversify income streams beyond traditional employment. Advantages include scalability and long-term wealth building, while disadvantages involve initial investment risks, time required to establish reliable income, and potential market fluctuations affecting returns. Successful passive income requires strategic planning and ongoing management to maintain profitability and hedge against economic uncertainties.

How to Build Sustainable Active Income

Building sustainable active income involves consistently leveraging skills and time to deliver valuable products or services that generate revenue. Prioritizing client relationships, honing expertise in high-demand fields, and optimizing workflow efficiency can maintain steady cash flow over time. Diversifying income streams through freelancing, consulting, or scalable service offerings also strengthens long-term income stability.

Strategies for Creating Reliable Passive Income

Creating reliable passive income involves diversifying sources such as rental properties, dividend-paying stocks, and online businesses that generate revenue without constant oversight. Strategic investments in high-yield assets and automated systems like affiliate marketing or digital product sales can provide consistent cash flow. Prioritizing scalability and minimal active involvement ensures sustainable income streams beyond traditional active labor.

Balancing Active and Passive Income for Financial Growth

Balancing active income, earned through direct labor or services, with passive income streams like investments or rental properties optimizes financial growth and stability. Allocating resources to diversify income sources reduces reliance on a single revenue stream while maximizing overall returns. Strategic management of both income types supports long-term wealth accumulation and financial resilience.

Tax Implications: Active vs Passive Income

Active income, such as wages and salaries, is typically subject to higher tax rates and payroll taxes including Social Security and Medicare, leading to a larger tax liability each year. Passive income, derived from investments like rental properties, dividends, or royalties, often benefits from favorable tax treatment with lower tax rates and potential deductions or credits. Understanding the different tax implications between active and passive income streams allows individuals to optimize their overall tax strategy and increase after-tax returns.

Which Income Type Is Right for You? Making the Smart Choice

Active income involves trading time for money through work such as employment or freelancing, offering immediate cash flow but limited scalability. Passive income, generated from investments like rental properties, royalties, or dividends, provides ongoing earnings with less time commitment but may require upfront capital and risk tolerance. Choosing the right income type depends on your financial goals, risk appetite, and desired lifestyle balance between time and money.

Related Important Terms

Microtasking

Active income from microtasking requires continuous effort and time, generating revenue through small, paid online tasks such as data entry, surveys, or content moderation. Passive income, conversely, involves creating automated systems or leveraging platforms that generate earnings from these microtasks without ongoing active involvement.

Social Trading

Active income requires continuous effort and time investment, typically earned through direct participation in work or services, while passive income generates revenue with minimal ongoing involvement, often through investments or automated systems. Social trading blends both concepts by allowing individuals to earn income passively by copying expert traders' strategies, leveraging collective market insights without active daily management.

Yield Farming

Active income requires continuous effort and time investment, often through traditional jobs or freelance work, while passive income generates earnings with minimal ongoing involvement, such as through yield farming in decentralized finance (DeFi). Yield farming involves staking or lending cryptocurrencies to earn interest or rewards, maximizing returns by leveraging liquidity pools and automated protocols on blockchain platforms like Ethereum.

Nocode SaaS Ventures

Active income from NoCode SaaS ventures demands continuous management and development efforts, generating revenue through direct user engagement or service delivery. Passive income in NoCode SaaS arises from automating subscription models or licensing, enabling consistent earnings with minimal ongoing input.

Subscription Stacking

Subscription stacking boosts active income by generating multiple recurring revenue streams from diverse subscription services, increasing overall cash flow stability. This strategy blends active labor with passive income elements, optimizing income generation through continuous customer engagement and automated billing cycles.

Print-On-Demand Automation

Active income requires continuous effort and time investment, such as managing a Print-On-Demand (POD) store where you oversee product creation, marketing, and customer service. Passive income through Print-On-Demand automation leverages tools like automated order processing, inventory management, and marketing workflows, enabling earnings with minimal daily input and scalable revenue streams.

Fractional Asset Ownership

Active income requires direct involvement and time investment, whereas passive income from fractional asset ownership enables earning through shared stakes in high-value assets like real estate or businesses with minimal ongoing effort. Fractional ownership diversifies income streams and allows access to lucrative markets without full capital commitment, enhancing financial flexibility and wealth building.

Creator Royalties

Active income requires continuous effort and time investment, while creator royalties generate passive income by earning ongoing payments from intellectual property such as music, books, or digital content. Royalties provide a scalable revenue stream that can persist independently of the creator's day-to-day involvement.

Affiliate Funnel Arbitrage

Active income requires direct effort and time investment, whereas passive income generates revenue with minimal ongoing work; Affiliate Funnel Arbitrage capitalizes on this by leveraging automated sales funnels to drive affiliate sales continuously, maximizing returns without constant active involvement. This strategy balances upfront active labor to set up optimized marketing funnels and passive income flow through scalable affiliate commissions.

Cashflow Hacking

Active income requires continuous effort such as working a job or running a business to generate cash flow, while passive income leverages investments like rental properties, dividends, or royalties for ongoing earnings with minimal daily involvement. Cashflow hacking maximizes financial freedom by strategically balancing active income streams that offer immediate returns with scalable passive income sources that build sustainable wealth over time.

Active Income vs Passive Income for income generation. Infographic

moneydiff.com

moneydiff.com