Portfolio income, generated from dividends, interest, and capital gains, provides consistent cash flow and potential for compounding returns essential for long-term wealth building. Synthetic asset income, derived from derivatives and structured products, offers tailored risk exposure and leverage opportunities that can enhance portfolio diversification and growth. Combining both income types strategically optimizes risk-adjusted returns and accelerates the wealth accumulation process.

Table of Comparison

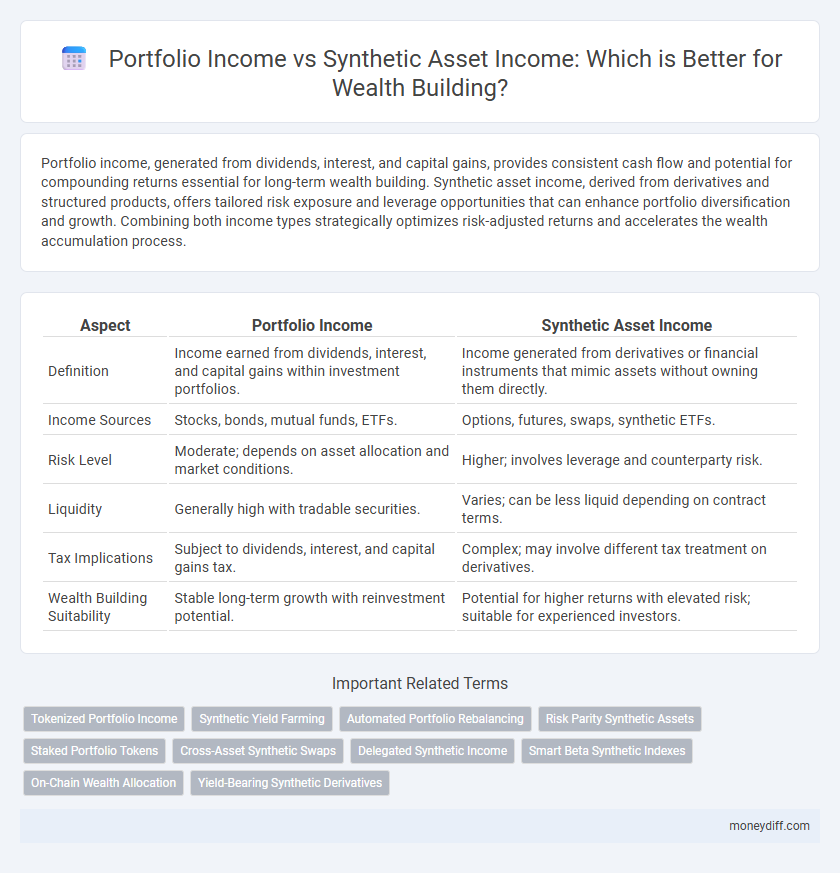

| Aspect | Portfolio Income | Synthetic Asset Income |

|---|---|---|

| Definition | Income earned from dividends, interest, and capital gains within investment portfolios. | Income generated from derivatives or financial instruments that mimic assets without owning them directly. |

| Income Sources | Stocks, bonds, mutual funds, ETFs. | Options, futures, swaps, synthetic ETFs. |

| Risk Level | Moderate; depends on asset allocation and market conditions. | Higher; involves leverage and counterparty risk. |

| Liquidity | Generally high with tradable securities. | Varies; can be less liquid depending on contract terms. |

| Tax Implications | Subject to dividends, interest, and capital gains tax. | Complex; may involve different tax treatment on derivatives. |

| Wealth Building Suitability | Stable long-term growth with reinvestment potential. | Potential for higher returns with elevated risk; suitable for experienced investors. |

Portfolio Income vs Synthetic Asset Income: An Overview

Portfolio income derives from investments such as dividends, interest, and capital gains from stocks, bonds, and mutual funds, offering steady cash flow and potential appreciation for wealth building. Synthetic asset income involves returns generated through derivatives like options and swaps, replicating asset performance without direct ownership, often providing leveraged exposure and diversified income streams. Comparing both, portfolio income delivers stability and long-term growth, while synthetic asset income offers flexibility and higher risk-reward profiles essential for strategic wealth accumulation.

Defining Portfolio Income: Sources and Characteristics

Portfolio income originates from investments such as dividends, interest, and capital gains generated by holding securities like stocks, bonds, and mutual funds. This type of income typically offers relatively passive returns and can provide tax advantages depending on the asset class and holding period. Understanding the stable cash flow and growth potential of portfolio income is essential for effective wealth building compared to synthetic asset income, which often involves derivatives or structured products with different risk profiles.

What Are Synthetic Assets? Understanding the Basics

Synthetic assets replicate the value of traditional financial instruments using derivatives and algorithms, allowing investors to gain exposure without owning the actual asset. Unlike portfolio income generated from dividends, interest, or capital gains, synthetic asset income arises from the price movements and contracts tied to these engineered financial products. This innovative approach to wealth building offers diversification by simulating real asset returns, reducing direct market ownership risks while enabling customized investment strategies.

Risk Profiles: Traditional Portfolios vs Synthetic Assets

Traditional portfolios generate portfolio income primarily through dividends and interest from stocks and bonds, offering moderate risk profiles aligned with market volatility. Synthetic assets, such as derivatives and structured products, deliver synthetic asset income by replicating asset returns without owning the underlying, exposing investors to higher leverage and counterparty risks. Understanding risk profiles helps investors balance steady income streams from traditional holdings against potentially higher but more complex synthetic asset income for diversified wealth building.

Income Consistency: Predictability and Volatility

Portfolio income, derived primarily from dividends, interest, and capital gains, offers relatively steady and predictable cash flow, enhancing income consistency for wealth building. Synthetic asset income, generated through derivatives like options or swaps, tends to exhibit higher volatility, posing challenges to income stability. Balancing portfolio income with synthetic asset strategies can optimize predictability while capturing potential upside in wealth accumulation.

Accessibility and Barriers to Entry

Portfolio income, generated from dividends, interest, and capital gains, offers broad accessibility with relatively low barriers to entry through traditional brokerage accounts and retirement plans. Synthetic asset income, derived from derivatives and structured products, typically requires advanced knowledge, larger capital, and access to sophisticated financial platforms, creating higher entry barriers. Wealth builders often find portfolio income more approachable, while synthetic assets provide complex opportunities that demand greater expertise and resources.

Tax Implications of Portfolio and Synthetic Asset Income

Portfolio income, derived from dividends, interest, and capital gains, is typically taxed at varying rates depending on asset type and holding period, often benefiting from favorable long-term capital gains rates. Synthetic asset income, generated through derivatives like options and swaps, may be taxed as ordinary income or under complex rules that can result in different timing and character of income recognition. Understanding these tax implications is crucial for optimizing after-tax returns and effective wealth building strategies.

Diversification Strategies for Wealth Building

Portfolio income derived from dividends, interest, and capital gains offers predictable cash flow, while synthetic asset income, generated through derivatives like options and swaps, provides tailored risk-return profiles that enhance diversification. Incorporating synthetic assets into a portfolio mitigates market volatility by accessing non-traditional income streams and optimizing asset allocation across uncorrelated sectors. Effective wealth building employs a balanced mix of portfolio income and synthetic asset strategies to increase resilience and sustain long-term financial growth.

Growth Potential: Comparing Long-Term Gains

Portfolio income, generated through dividends, interest, and capital gains from stocks and bonds, typically offers steady growth with moderate risk, benefiting from market appreciation over time. Synthetic asset income, created through derivatives and structured products, can amplify returns via leverage but carries higher volatility and complexity, impacting long-term wealth accumulation. Evaluating growth potential requires balancing the stability of traditional portfolio income against the aggressive, risk-adjusted returns possible with synthetic asset income strategies.

Choosing the Right Income Approach for Your Financial Goals

Portfolio income, derived from dividends, interest, and capital gains, offers steady cash flow and potential tax advantages for wealth building. Synthetic asset income involves using derivatives or structured products to replicate asset returns, often providing customizable risk exposure and income streams. Selecting the right approach depends on your financial goals, risk tolerance, and investment horizon to optimize income generation and portfolio growth.

Related Important Terms

Tokenized Portfolio Income

Tokenized portfolio income generates consistent, diversified cash flow through blockchain-based asset ownership, enabling fractional investments in real estate, stocks, or funds that yield dividends or interest. Synthetic asset income replicates traditional financial instruments' returns using smart contracts but lacks the tangible dividend streams that tokenized portfolios provide, making the latter more reliable for wealth building through passive income.

Synthetic Yield Farming

Synthetic yield farming generates portfolio income by leveraging decentralized finance protocols to create synthetic assets that mimic traditional investment returns without owning the underlying assets. This innovative approach enhances wealth building by providing higher liquidity, greater diversification, and automated compounding yields compared to conventional portfolio income sources.

Automated Portfolio Rebalancing

Automated portfolio rebalancing enhances portfolio income by systematically adjusting asset allocations to maintain targeted risk and return profiles, maximizing dividend yields and capital gains in traditional investments. Synthetic asset income, generated through derivatives like options and swaps, benefits from dynamic rebalancing strategies that optimize exposure and leverage without the need for direct asset ownership, accelerating wealth accumulation.

Risk Parity Synthetic Assets

Portfolio income traditionally derives from dividends, interest, and capital gains across diversified asset classes, while synthetic asset income, especially through Risk Parity Synthetic Assets, leverages algorithmic strategies to balance risk exposures and optimize returns evenly across volatility regimes. This approach enhances wealth building by minimizing drawdowns and improving risk-adjusted performance, offering a smoother and more predictable income stream compared to conventional portfolio income methods.

Staked Portfolio Tokens

Staked Portfolio Tokens generate synthetic asset income by pooling diverse assets into a single token, enabling compounded returns and streamlined management compared to traditional portfolio income from individual holdings. This method enhances wealth building through increased liquidity and continuous yield without constant active trading.

Cross-Asset Synthetic Swaps

Cross-Asset Synthetic Swaps enable investors to generate portfolio income by replicating the returns of diverse asset classes without direct ownership, enhancing diversification and liquidity. This synthetic asset income often provides more tax-efficient and flexible wealth-building opportunities compared to traditional portfolio income derived from dividends or interest payments.

Delegated Synthetic Income

Delegated Synthetic Income leverages synthetic assets created through derivatives or contracts to generate consistent, portfolio-like returns without direct ownership of underlying assets, enabling efficient wealth building by reducing market exposure and increasing diversification. This income type contrasts with traditional portfolio income by offering customizable risk profiles and enhanced capital efficiency through delegation to specialized platforms or protocols.

Smart Beta Synthetic Indexes

Portfolio income from traditional assets like dividends and interest often provides steady returns, while synthetic asset income generated through Smart Beta Synthetic Indexes leverages advanced algorithms to optimize risk-adjusted performance and enhance wealth building. These indexes use derivatives and factor-based strategies to replicate market exposure with potentially higher diversification and efficiency compared to conventional portfolio income sources.

On-Chain Wealth Allocation

Portfolio income derives from traditional investments like stocks and bonds, generating dividends and interest, whereas synthetic asset income, created through blockchain protocols, offers programmable exposure to assets without direct ownership. On-chain wealth allocation enables real-time transparency and automated rebalancing, optimizing returns and risk management for decentralized portfolio income streams.

Yield-Bearing Synthetic Derivatives

Portfolio income derives from dividends, interest, and capital gains on traditional assets, while synthetic asset income, particularly through yield-bearing synthetic derivatives, offers enhanced leverage and diversification by replicating underlying asset returns without direct ownership. Yield-bearing synthetic derivatives optimize wealth building by generating consistent cash flow through tokenized futures and options, providing higher potential yields and risk management compared to conventional portfolio income.

Portfolio income vs Synthetic asset income for wealth building. Infographic

moneydiff.com

moneydiff.com