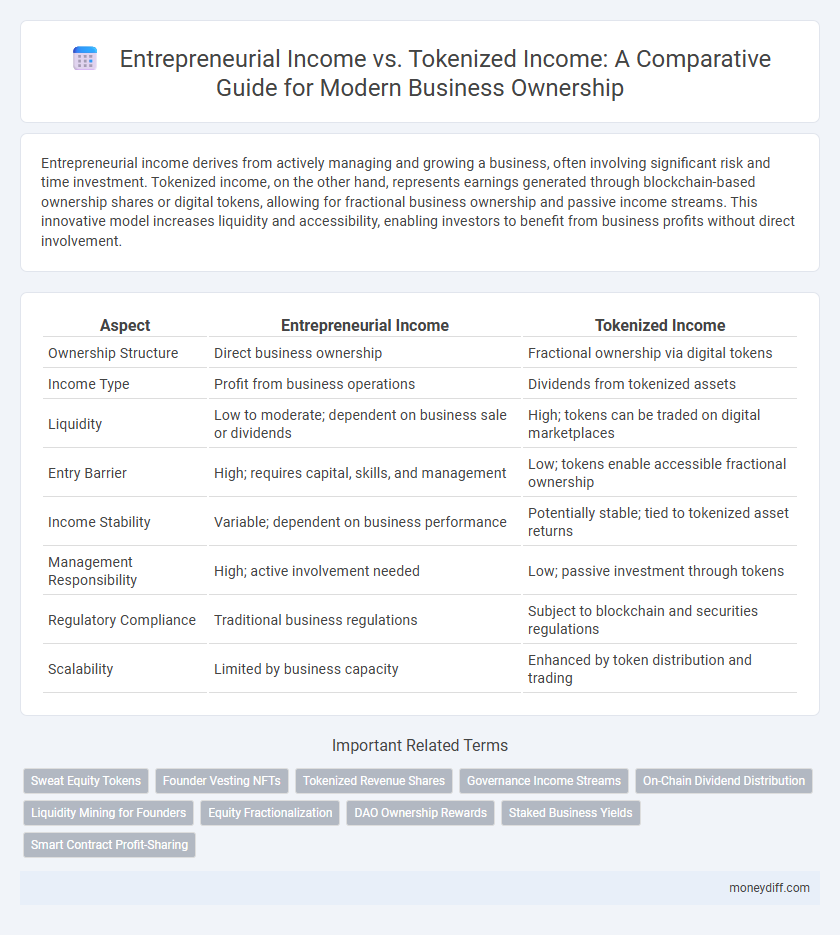

Entrepreneurial income derives from actively managing and growing a business, often involving significant risk and time investment. Tokenized income, on the other hand, represents earnings generated through blockchain-based ownership shares or digital tokens, allowing for fractional business ownership and passive income streams. This innovative model increases liquidity and accessibility, enabling investors to benefit from business profits without direct involvement.

Table of Comparison

| Aspect | Entrepreneurial Income | Tokenized Income |

|---|---|---|

| Ownership Structure | Direct business ownership | Fractional ownership via digital tokens |

| Income Type | Profit from business operations | Dividends from tokenized assets |

| Liquidity | Low to moderate; dependent on business sale or dividends | High; tokens can be traded on digital marketplaces |

| Entry Barrier | High; requires capital, skills, and management | Low; tokens enable accessible fractional ownership |

| Income Stability | Variable; dependent on business performance | Potentially stable; tied to tokenized asset returns |

| Management Responsibility | High; active involvement needed | Low; passive investment through tokens |

| Regulatory Compliance | Traditional business regulations | Subject to blockchain and securities regulations |

| Scalability | Limited by business capacity | Enhanced by token distribution and trading |

Understanding Entrepreneurial Income: Definition and Scope

Entrepreneurial income refers to the profits generated from operating a business or providing services directly through entrepreneurial activities, encompassing earnings from self-employment, partnerships, and sole proprietorships. This income reflects the active engagement and risk-taking inherent in business ownership, distinguishing it from passive income sources. Understanding entrepreneurial income involves recognizing its scope, which includes revenue, costs, and net income derived from managing and growing a business enterprise.

What is Tokenized Income? A Modern Approach

Tokenized income represents business ownership through blockchain-based digital tokens, enabling fractional equity and real-time profit sharing. Unlike traditional entrepreneurial income tied to direct business operations and risk, tokenized income allows investors to earn passive revenue streams securely and transparently. This modern approach enhances liquidity, reduces barriers to entry, and democratizes access to business equity.

Core Differences Between Entrepreneurial and Tokenized Income

Entrepreneurial income derives from actively managing and growing a business, reflecting profits, salaries, and reinvested earnings tied to tangible operations and personal involvement. Tokenized income, by contrast, originates from digital asset ownership representing fractional business stakes, enabling passive income streams through blockchain-based dividends or value appreciation. Core differences include liquidity, risk exposure, and operational control--entrepreneurial income demands hands-on management with higher volatility, while tokenized income offers automated, transparent distribution with potentially broader accessibility.

Advantages of Traditional Entrepreneurial Income Streams

Traditional entrepreneurial income streams offer direct control over business operations and decision-making, allowing owners to adapt quickly to market changes and optimize profitability. These income sources typically generate consistent cash flow through sales and services, providing tangible financial stability and reinvestment opportunities. Moreover, traditional business ownership often builds established brand equity and customer loyalty, enhancing long-term revenue potential without reliance on external digital platforms.

Benefits of Tokenized Income for Modern Businesses

Tokenized income offers modern businesses enhanced liquidity by enabling fractional ownership and real-time revenue distribution through blockchain technology. This approach reduces dependence on traditional financial intermediaries, lowering transaction costs and increasing transparency. Entrepreneurs benefit from greater access to diverse investors and flexible capital raising mechanisms compared to conventional entrepreneurial income streams.

Risk Factors: Entrepreneurial Income vs Tokenized Income

Entrepreneurial income is subject to higher volatility and operational risks as business success depends on market conditions, management efficiency, and competitive pressures. Tokenized income, derived from blockchain-based ownership tokens, offers enhanced liquidity and fractional ownership but carries risks related to regulatory uncertainty, cybersecurity threats, and token market fluctuations. Evaluating these risk factors is critical for informed decision-making in selecting between traditional entrepreneurial ventures and emerging tokenized business models.

Liquidity and Accessibility: Comparing Income Types

Entrepreneurial income typically involves lower liquidity due to earnings being tied to business operations and long-term growth, while tokenized income offers enhanced liquidity through tradable digital assets enabling quicker access to funds. Tokenized income provides greater accessibility by allowing fractional ownership and seamless transactions on blockchain platforms, which contrast with traditional entrepreneurial stakes that often require complex legal processes for transfer. Businesses leveraging tokenized income can thus attract diverse investors and improve cash flow management compared to conventional entrepreneurial income models.

Ownership Rights: Equity vs Tokenization

Entrepreneurial income typically arises from equity ownership, granting shareholders legal rights to company profits, voting power, and asset claims. Tokenized income represents ownership rights through digital tokens on a blockchain, enabling fractional and easily transferable stakes without traditional equity structures. This shift from conventional equity to tokenization enhances liquidity, democratizes access, and automates contractual obligations via smart contracts.

Tax Implications of Entrepreneurial and Tokenized Income

Entrepreneurial income is typically subject to self-employment taxes and income tax based on profits reported through traditional business structures, with specific deductions available for operational expenses. Tokenized income, arising from fractional business ownership via blockchain tokens, may be treated as capital gains or dividends depending on jurisdictional regulations and the nature of the tokenized asset. Understanding the tax implications of each income type is crucial for compliance and optimization, as tokenized income could introduce complex reporting requirements and differing tax treatments compared to conventional entrepreneurial earnings.

Future Trends: Shifting From Traditional to Tokenized Business Models

Entrepreneurial income traditionally stems from direct ownership or operational roles within a business, generating profits through active management or value creation. Tokenized income introduces a blockchain-based model where business ownership is fractionalized into digital tokens, enabling broader participation and liquidity in revenue streams. Future trends indicate a shift towards tokenized business models, driven by increased transparency, accessibility, and the decentralized nature of digital assets reshaping entrepreneurial income dynamics.

Related Important Terms

Sweat Equity Tokens

Sweat equity tokens represent entrepreneurial income by granting business owners blockchain-based shares proportional to their effort and involvement, enabling transparent ownership without traditional capital investment. Tokenized income transforms sweat equity into liquid assets, allowing entrepreneurs to monetize their contributions and participate in decentralized business models with enhanced liquidity and valuation flexibility.

Founder Vesting NFTs

Founder Vesting NFTs revolutionize entrepreneurial income by enabling tokenized income streams tied directly to business ownership, aligning founder incentives with company growth. This innovative model transforms traditional equity vesting into programmable digital assets, enhancing liquidity and transparency for entrepreneurs.

Tokenized Revenue Shares

Tokenized revenue shares represent a revolutionary approach to entrepreneurial income by enabling fractional business ownership through blockchain technology, allowing investors to earn income proportional to their token holdings. This method enhances liquidity and transparency compared to traditional entrepreneurial income, where earnings are tied directly to business profits or equity without instant tradability.

Governance Income Streams

Entrepreneurial income derives from active business operations and governance decisions, whereas tokenized income from blockchain-based ownership introduces decentralized governance income streams by enabling fractionalized voting rights and profit distribution. Tokenized income models enhance liquidity and transparency in governance income, allowing stakeholders to participate in revenue sharing and strategic decision-making efficiently.

On-Chain Dividend Distribution

Entrepreneurial income from traditional business ownership relies on profits distributed through off-chain mechanisms, whereas tokenized income leverages on-chain dividend distribution, enabling real-time, transparent payouts directly to token holders via blockchain technology. This shift enhances liquidity, reduces administrative costs, and ensures immutable record-keeping for revenue sharing in decentralized business models.

Liquidity Mining for Founders

Entrepreneurial income traditionally derives from active business management and profit generation, whereas tokenized income leverages blockchain technology to fractionalize ownership and distribute earnings through liquidity mining protocols. Founders engaging in liquidity mining gain enhanced liquidity and passive income streams by staking their tokenized business shares, unlocking real-time value and access to decentralized finance ecosystems.

Equity Fractionalization

Entrepreneurial income typically derives from actively managing and growing a business, whereas tokenized income emerges from equity fractionalization through blockchain-based tokens representing business ownership shares. This shift enables increased liquidity, broader investor access, and real-time income distribution from fractionalized equity, transforming traditional ownership models.

DAO Ownership Rewards

Entrepreneurial income typically derives from direct business operations and equity stakes, whereas tokenized income from DAO ownership rewards leverages blockchain technology to distribute earnings through decentralized autonomous organizations, enabling fractional ownership and transparent revenue sharing. DAO ownership rewards create a scalable, liquid income stream by converting business equity into digital tokens, democratizing access and enhancing passive income opportunities for investors globally.

Staked Business Yields

Entrepreneurial income is generated through direct business ownership and active management, whereas tokenized income from staked business yields offers passive earnings by holding digital tokens representing fractional ownership. Staked business yields enable investors to earn proportional profits and dividends without daily operational involvement, leveraging blockchain technology for transparent and efficient income distribution.

Smart Contract Profit-Sharing

Entrepreneurial income typically stems from active management and operational roles within a business, whereas tokenized income is generated through smart contract profit-sharing mechanisms, enabling automated, transparent distribution of earnings to token holders. Smart contracts on blockchain platforms ensure real-time, immutable recording and transfer of profits, enhancing liquidity and fractional business ownership opportunities.

Entrepreneurial income vs Tokenized income for business ownership. Infographic

moneydiff.com

moneydiff.com