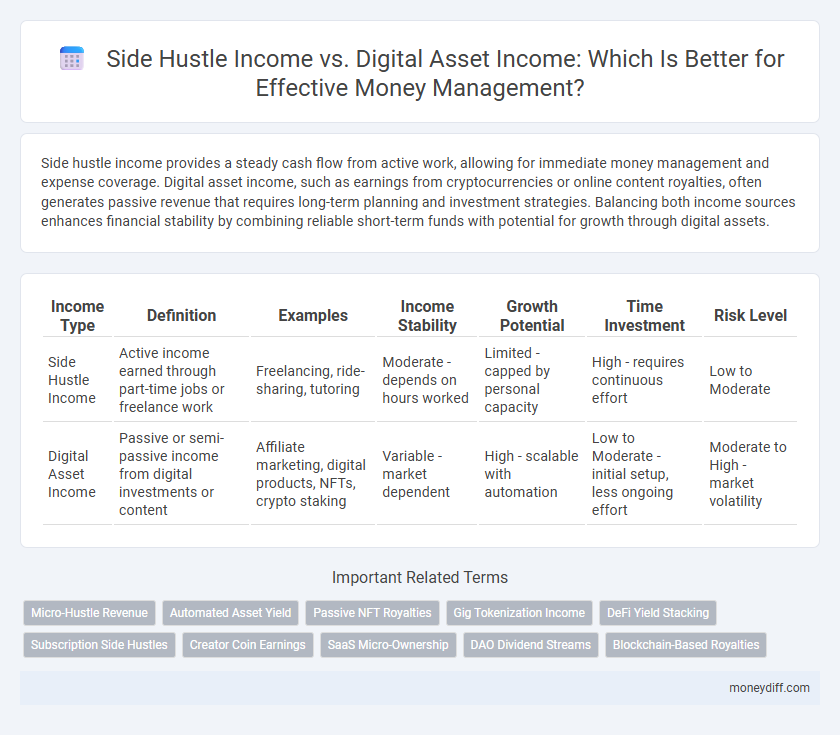

Side hustle income provides a steady cash flow from active work, allowing for immediate money management and expense coverage. Digital asset income, such as earnings from cryptocurrencies or online content royalties, often generates passive revenue that requires long-term planning and investment strategies. Balancing both income sources enhances financial stability by combining reliable short-term funds with potential for growth through digital assets.

Table of Comparison

| Income Type | Definition | Examples | Income Stability | Growth Potential | Time Investment | Risk Level |

|---|---|---|---|---|---|---|

| Side Hustle Income | Active income earned through part-time jobs or freelance work | Freelancing, ride-sharing, tutoring | Moderate - depends on hours worked | Limited - capped by personal capacity | High - requires continuous effort | Low to Moderate |

| Digital Asset Income | Passive or semi-passive income from digital investments or content | Affiliate marketing, digital products, NFTs, crypto staking | Variable - market dependent | High - scalable with automation | Low to Moderate - initial setup, less ongoing effort | Moderate to High - market volatility |

Understanding Side Hustle Income

Side hustle income refers to earnings generated from part-time jobs or freelance work outside of a primary occupation, often providing flexible cash flow to supplement personal finances. This type of income is typically active, requiring ongoing time and effort, which impacts budgeting and financial planning differently than passive income streams. Understanding the consistent variability and tax implications of side hustle income is crucial for effective money management and maximizing overall financial stability.

What is Digital Asset Income?

Digital asset income refers to earnings generated through ownership or trading of digital assets such as cryptocurrencies, NFTs, or tokenized real estate. Unlike side hustle income, which is earned through active work or services, digital asset income can be passive and volatile, depending on market fluctuations and asset appreciation. Effective money management requires understanding the risk profile and liquidity differences between side hustle income and digital asset income.

Comparing Income Stability: Side Hustle vs Digital Assets

Side hustle income typically offers more consistent cash flow through regular hours and client payments, enhancing short-term financial stability. Digital asset income, such as earnings from cryptocurrency or NFTs, tends to be more volatile and market-dependent, presenting higher risk but potential for substantial long-term gains. Effective money management requires balancing the predictable nature of side hustle income with the growth opportunities and fluctuations inherent in digital assets.

Scalability Potential of Side Hustles vs Digital Assets

Side hustle income often relies on active time investment and has limited scalability due to physical or service constraints, making growth incremental and tied to personal effort. Digital asset income, such as earnings from online courses, apps, or cryptocurrencies, can scale exponentially with minimal additional time investment as these assets often generate passive revenue streams. Managing money with digital asset income enables greater financial leverage and scalability compared to the typically linear growth of side hustle income.

Time Investment: Side Hustles vs Digital Assets

Side hustle income requires active time investment and consistent effort to generate immediate cash flow, often involving hours spent on tasks or services. Digital asset income, such as earnings from cryptocurrencies or online content, demands upfront time for creation and setup but can produce passive returns over time with minimal ongoing input. Balancing these income streams effectively maximizes financial growth by leveraging both short-term labor and long-term asset appreciation.

Passive vs Active Income Explained

Side hustle income typically involves active participation, requiring continuous effort to generate revenue, while digital asset income often represents passive earnings from investments like royalties, dividends, or digital product sales. Managing money between these two sources requires understanding the trade-off between time commitment and income stability. Prioritizing digital asset income can enhance long-term financial growth by leveraging automated revenue streams with minimal ongoing work.

Risk Factors in Side Hustle and Digital Asset Earnings

Side hustle income often involves higher risk due to its dependency on consistent effort, fluctuating demand, and potential market saturation, which can lead to inconsistent cash flow. Digital asset income, while potentially more passive, carries risks tied to market volatility, regulatory changes, and cybersecurity threats that can impact asset value and accessibility. Effective money management requires balancing these risk factors by diversifying income sources and maintaining liquidity to mitigate financial instability.

Tax Implications for Side Hustle and Digital Asset Income

Side hustle income is typically classified as ordinary income and subject to self-employment taxes, requiring quarterly estimated tax payments and detailed record-keeping for deductions. Digital asset income, including cryptocurrencies, is treated as capital gains or ordinary income based on transaction type, with complex reporting requirements due to fluctuating valuations and IRS scrutiny. Proper tax planning for both income types can minimize liabilities and ensure compliance with evolving tax laws.

Diversifying Income Streams for Financial Security

Side hustle income offers immediate cash flow through active effort, while digital asset income generates passive earnings over time, both crucial for diversifying income streams. Balancing these sources enhances financial security by minimizing reliance on a single income and creating multiple revenue channels. Effective money management leverages the stability of passive digital assets with the flexibility of side hustle earnings to build a resilient financial portfolio.

Choosing the Right Income Path for Effective Money Management

Side hustle income offers immediate cash flow and flexibility, making it ideal for short-term financial goals and emergency funds. Digital asset income, generated through platforms like affiliate marketing or online courses, provides scalable, passive revenue streams that enhance long-term wealth building. Effective money management depends on aligning income sources with personal financial objectives and risk tolerance to maximize growth and stability.

Related Important Terms

Micro-Hustle Revenue

Micro-hustle revenue, generated through flexible, small-scale side projects, offers immediate cash flow that supports daily expenses and short-term financial goals, contrasting with digital asset income which often requires longer-term investment and management. Efficient money management balances micro-hustle earnings for liquidity while allocating digital asset income toward scalable financial growth and passive income diversification.

Automated Asset Yield

Side hustle income provides active earnings through extra work, while digital asset income leverages automated asset yield by generating passive revenue from investments such as cryptocurrencies, NFTs, and automated trading platforms. Automated asset yield optimizes money management by continuously compounding returns without requiring constant input, enhancing long-term financial growth.

Passive NFT Royalties

Passive NFT royalties generate ongoing income without active effort, distinguishing them from side hustle income that requires continuous work and time investment. Managing money from digital asset income like NFT royalties involves leveraging automated earnings streams, enabling more stable long-term financial growth compared to the variable nature of side hustle returns.

Gig Tokenization Income

Gig tokenization income offers scalable revenue streams by converting freelance gigs into tradeable digital assets, enhancing liquidity and long-term value beyond traditional side hustle earnings. Managing tokenized gig income requires strategic allocation to maximize portfolio diversification and capitalize on blockchain-driven market opportunities.

DeFi Yield Stacking

Side hustle income provides immediate cash flow for daily expenses, while digital asset income through DeFi yield stacking offers compounded returns by leveraging decentralized finance protocols to maximize passive earnings. Efficient money management integrates stable side hustle revenue with strategic DeFi investments, optimizing liquidity and growth in cryptocurrency portfolios.

Subscription Side Hustles

Subscription side hustles provide a steady stream of side hustle income by offering ongoing products or services through recurring payments, enhancing financial predictability and cash flow management. Compared to digital asset income, which can be volatile and dependent on market trends, subscription-based models offer reliable revenue that simplifies budgeting and long-term money management strategies.

Creator Coin Earnings

Creator coin earnings from digital assets provide scalable, passive income streams that complement active side hustle income, offering greater potential for long-term wealth accumulation and efficient money management. Unlike traditional side hustles requiring continuous effort, creator coins leverage blockchain technology and community-driven value, enhancing portfolio diversification and financial resilience.

SaaS Micro-Ownership

Side hustle income provides immediate cash flow through active effort, while digital asset income, such as SaaS micro-ownership, generates scalable passive revenue streams with long-term growth potential. Managing money effectively requires balancing these income types to maximize stability and compound wealth over time.

DAO Dividend Streams

DAO dividend streams generate automated, decentralized income that grows as the underlying digital assets appreciate, offering a passive revenue model distinct from the active effort required in side hustle income. Managing money through DAO dividends leverages blockchain transparency and smart contracts to reduce risk and increase efficiency compared to the variable, labor-intensive nature of side hustle earnings.

Blockchain-Based Royalties

Blockchain-based royalties generate passive digital asset income by automating payments through smart contracts, enabling creators to earn continuous revenue without active effort. Unlike traditional side hustle income requiring ongoing work, blockchain royalties offer scalable, transparent, and secure cash flow for optimized money management.

Side Hustle Income vs Digital Asset Income for money management. Infographic

moneydiff.com

moneydiff.com