Rental income provides a steady stream of monthly payments from tenants, offering consistent cash flow with responsibilities such as maintenance and tenant management. Fractional ownership dividends distribute profits from collectively owned properties, allowing investors to benefit from property appreciation and rental yields without direct management duties. Choosing between rental income and fractional ownership dividends depends on the investor's desired level of involvement, risk tolerance, and income stability preferences.

Table of Comparison

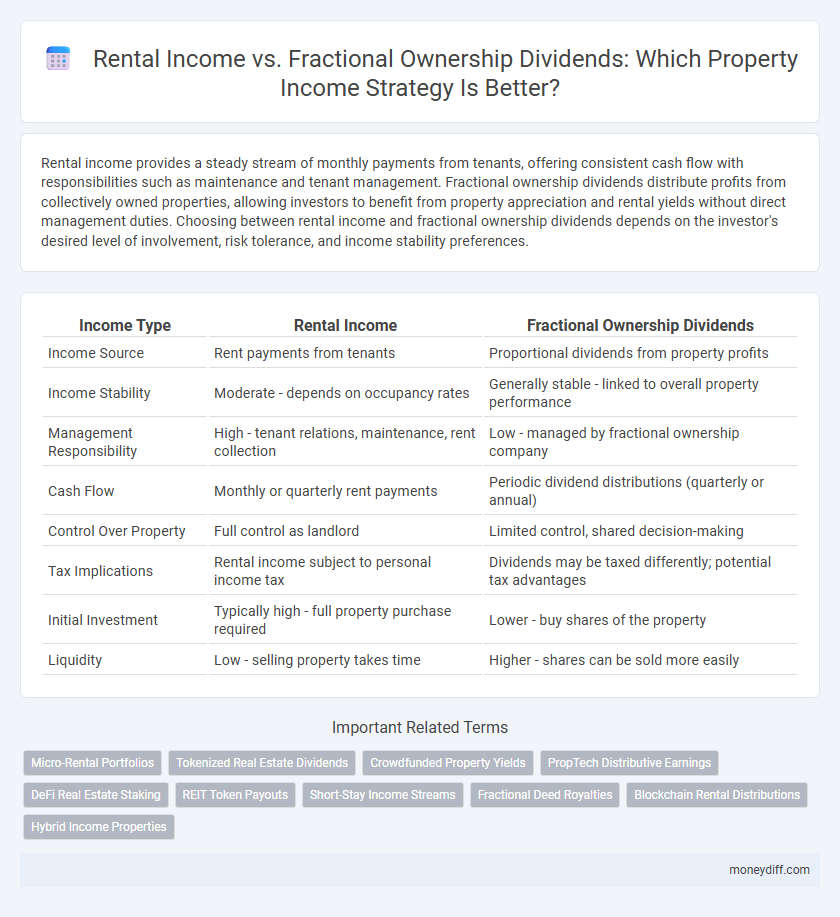

| Income Type | Rental Income | Fractional Ownership Dividends |

|---|---|---|

| Income Source | Rent payments from tenants | Proportional dividends from property profits |

| Income Stability | Moderate - depends on occupancy rates | Generally stable - linked to overall property performance |

| Management Responsibility | High - tenant relations, maintenance, rent collection | Low - managed by fractional ownership company |

| Cash Flow | Monthly or quarterly rent payments | Periodic dividend distributions (quarterly or annual) |

| Control Over Property | Full control as landlord | Limited control, shared decision-making |

| Tax Implications | Rental income subject to personal income tax | Dividends may be taxed differently; potential tax advantages |

| Initial Investment | Typically high - full property purchase required | Lower - buy shares of the property |

| Liquidity | Low - selling property takes time | Higher - shares can be sold more easily |

Introduction to Property Income Streams

Rental income provides a steady cash flow derived from leasing residential or commercial properties, offering predictable monthly earnings based on tenant agreements. Fractional ownership dividends represent profit distributions from shared investments in real estate assets, reflecting collective income generated by property appreciation and operational revenue. Investors seeking consistent liquidity may prefer rental income, while those focused on diversified exposure and potential capital growth often opt for fractional ownership dividends.

Understanding Rental Income Basics

Rental income generates steady cash flow from leasing property to tenants, typically involving monthly payments and long-term agreements that provide predictable income streams. Fractional ownership dividends distribute profits based on shared property stakes, offering variable returns linked to overall property performance and management efficiency. Understanding rental income basics involves analyzing lease terms, tenant reliability, and maintenance costs to maximize consistent earnings from real estate investments.

Fractional Ownership: How Dividends Work

Fractional ownership generates rental income through dividends distributed based on the property's net profit, calculated after deducting expenses like maintenance, property management fees, and taxes. These dividends vary according to each owner's share percentage and property performance, offering potential for passive income without the operational responsibilities typical of direct rental ownership. Investors benefit from diversified real estate exposure and consistent dividend payouts tied to actual property earnings rather than fluctuating rental market conditions.

Comparing Passive Income Potential

Rental income generates steady monthly cash flow through leasing properties to tenants, often providing reliable passive income but requiring ongoing management and maintenance efforts. Fractional ownership dividends offer income based on shared profits from property sales or rentals, typically distributing periodic dividends without daily operational responsibilities. Evaluating passive income potential depends on factors like market demand, occupancy rates, and dividend yield, with rental income favoring consistent returns and fractional ownership offering diversification with varied income timing.

Risk Factors: Rental Income vs Fractional Ownership

Rental income involves direct tenant management and property maintenance, exposing owners to vacancy risks, tenant defaults, and fluctuating market demand. Fractional ownership dividends distribute income proportionally among investors but depend on the overall property's performance and management efficiency, potentially reducing individual control and increasing dependency on third-party operators. Risk exposure in rental income is more hands-on and variable, while fractional ownership offers diversified risk at the cost of less personal oversight.

Tax Implications of Each Property Income Source

Rental income is typically taxed as ordinary income, subject to federal and state income taxes, with the possibility of deducting expenses such as mortgage interest, property management fees, and depreciation. Fractional ownership dividends are often treated as passive income, potentially benefiting from favorable tax treatment, including reduced tax rates on qualified dividends and capital gains. Understanding the differing tax implications helps investors optimize after-tax returns from property income sources.

Initial Investment and Ongoing Costs

Rental income requires a significant initial investment in property purchase and often involves ongoing costs such as maintenance, insurance, and property management fees, which can reduce net income. Fractional ownership dividends demand a lower upfront financial commitment since investors buy a share of the property, with ongoing costs typically limited to maintenance fees distributed among owners. The choice impacts cash flow stability and long-term profitability due to the differing scale of initial capital and recurring expenses.

Liquidity and Exit Strategies

Rental income delivers consistent cash flow but often ties capital to long-term leases, limiting immediate liquidity and complicating exit options. Fractional ownership dividends provide periodic income with improved liquidity through share sales on secondary markets or structured buyouts, facilitating quicker exit strategies. Investors seeking flexible exit opportunities typically favor fractional ownership due to its market-traded nature and potential for faster capital recovery.

Time Commitment and Management Required

Rental income typically demands significant time commitment and active management, including tenant screening, maintenance, and rent collection. Fractional ownership dividends require far less hands-on involvement, as property management is handled by a third party, allowing investors to earn passive income without daily responsibilities. The reduced time and effort in fractional ownership make it ideal for investors seeking property income with minimal management.

Choosing the Right Property Income Model

Rental income offers consistent monthly cash flow from tenants, ideal for investors seeking steady revenue and direct property control. Fractional ownership dividends provide passive income through shared property stakes, minimizing management responsibilities while allowing diversified real estate exposure. Selecting the right property income model depends on desired involvement level, income stability, and risk tolerance, with rental income favoring active management and fractional ownership appealing to hands-off investors.

Related Important Terms

Micro-Rental Portfolios

Micro-rental portfolios generate consistent rental income through short-term leases, while fractional ownership dividends provide intermittent, profit-sharing income based on property performance. Investors seeking steady cash flow favor rental income, whereas those preferring passive earnings with potential capital appreciation often opt for fractional ownership dividends.

Tokenized Real Estate Dividends

Tokenized real estate dividends from fractional ownership offer a scalable income stream by distributing profits directly to investors based on property performance, unlike traditional rental income which depends on lease agreements and occupancy rates. These dividends leverage blockchain technology to ensure transparency, liquidity, and automated profit sharing, enhancing investor access and reducing management overhead.

Crowdfunded Property Yields

Crowdfunded property yields often provide investors with fractional ownership dividends, offering passive income streams that can outperform traditional rental income due to diversified asset portfolios and professional management. Rental income requires direct property management and carries higher risks of vacancy and maintenance costs, whereas fractional ownership spreads these risks across multiple properties, enhancing income stability and potential yield growth.

PropTech Distributive Earnings

Rental income provides consistent cash flow from tenant payments, while fractional ownership dividends deliver proportional earnings based on property appreciation and operational profits. PropTech platforms enhance distributive earnings transparency and automation, enabling investors to efficiently track and capitalize on rental yields and equity growth within fractional ownership models.

DeFi Real Estate Staking

Rental income offers steady cash flow through tenant payments, while fractional ownership dividends in DeFi real estate staking provide decentralized, automated income distribution based on blockchain-verified property shares. DeFi real estate staking enhances liquidity and transparency compared to traditional rental income by enabling tokenized property assets and programmable smart contracts for dividend payouts.

REIT Token Payouts

Rental income provides steady monthly cash flow based on tenant payments, while fractional ownership dividends, such as those from REIT token payouts, distribute profits from property portfolios proportionally to token holders. REIT token dividends often offer greater liquidity and diversification benefits compared to traditional rental income streams, enhancing passive income potential.

Short-Stay Income Streams

Short-stay rental income provides property owners with higher nightly rates and flexible occupancy compared to fractional ownership dividends, which yield more consistent but typically lower returns based on shared equity. Optimizing rental platforms and dynamic pricing strategies enhances short-stay income streams, maximizing cash flow beyond the fixed dividends from fractional property investments.

Fractional Deed Royalties

Fractional deed royalties generate consistent rental income through shared property ownership, offering predictable dividends that often exceed traditional rental income yields. These royalties provide investors with passive income streams proportional to their ownership stake, reducing management burdens and increasing financial stability compared to conventional rental agreements.

Blockchain Rental Distributions

Blockchain rental distributions provide transparent and secure tracking of income streams, enabling property owners to receive automated rental income payments directly to their digital wallets. Fractional ownership dividends enhance liquidity by allowing investors to earn proportional rental income shares, reducing traditional management complexities compared to direct rental income collection.

Hybrid Income Properties

Hybrid income properties generate both rental income and fractional ownership dividends, diversifying cash flow sources for investors. Rental income offers steady monthly payments, while fractional ownership dividends provide potential for higher returns through shared property appreciation and profit distribution.

Rental Income vs Fractional Ownership Dividends for property income. Infographic

moneydiff.com

moneydiff.com