Salary income provides a consistent and predictable cash flow through fixed periodic payments, making it ideal for regular budgeting and financial planning. Royalty income, although potentially lucrative, often fluctuates based on sales performance or usage rates, leading to irregular cash flow. For individuals seeking stable and reliable income, salary income is generally more suitable than royalty income.

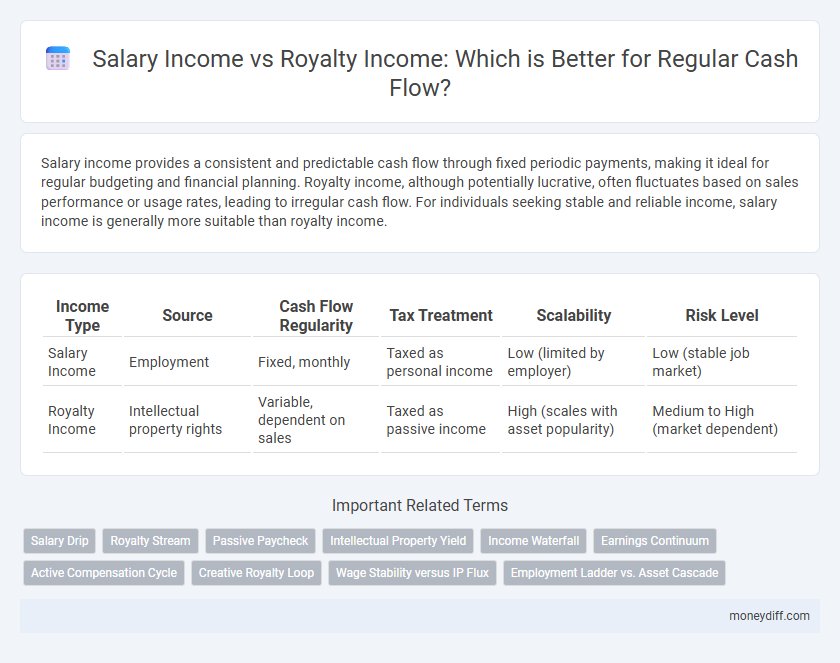

Table of Comparison

| Income Type | Source | Cash Flow Regularity | Tax Treatment | Scalability | Risk Level |

|---|---|---|---|---|---|

| Salary Income | Employment | Fixed, monthly | Taxed as personal income | Low (limited by employer) | Low (stable job market) |

| Royalty Income | Intellectual property rights | Variable, dependent on sales | Taxed as passive income | High (scales with asset popularity) | Medium to High (market dependent) |

Introduction: Understanding Income Streams

Salary income provides a predictable and steady cash flow through regular paychecks, offering financial stability for personal budgeting. Royalty income, derived from intellectual property rights or asset usage, can generate passive earnings but may fluctuate based on market demand and agreements. Understanding the differences between these income streams helps optimize cash flow management and long-term financial planning.

Salary Income: Definition and Characteristics

Salary income refers to a fixed regular payment, typically monthly, that an employee receives from an employer in exchange for labor or services. It is characterized by consistency, predictability, and often includes benefits like health insurance and retirement contributions. Unlike royalty income, salary income provides steady cash flow without dependence on sales performance or intellectual property exploitation.

Royalty Income: How It Works

Royalty income is earned by granting others the right to use your intellectual property, such as patents, copyrights, or trademarks, usually through licensing agreements that provide ongoing payments based on sales or usage. Unlike salary income, which is fixed and periodic, royalty income varies with the performance of the asset and can generate a passive cash flow over time without active involvement. This form of income is particularly valuable for creators and inventors seeking continuous revenue streams from their original work.

Consistency and Reliability of Salary Income

Salary income provides a consistent and reliable cash flow due to fixed pay periods and predetermined amounts, ensuring financial stability. Royalty income, while potentially higher, is subject to fluctuations based on sales, usage, or market demand, making it less predictable for regular budgeting. Monthly salary payments enable steady expense management, critical for long-term financial planning and meeting ongoing obligations.

Scalability and Growth Potential in Royalty Income

Royalty income offers significant scalability and growth potential compared to salary income, as it generates passive earnings from intellectual property, licenses, or royalties that can increase without a linear increase in effort or time. Unlike salary income, which is capped by fixed working hours and employer constraints, royalty income can grow exponentially through expanding distribution channels, market reach, and repeated sales or usage. This scalability makes royalty income a powerful source for long-term wealth accumulation and consistent cash flow growth.

Financial Stability: Salary vs. Royalty Cash Flow

Salary income offers predictable, steady cash flow essential for maintaining financial stability through consistent monthly payments. Royalty income can vary significantly due to fluctuating sales or usage of intellectual property, making it less reliable for regular expenses and budgeting. Diversifying income sources by combining salary with royalties enhances overall cash flow stability and long-term financial security.

Tax Implications of Salary and Royalty Incomes

Salary income is taxed as ordinary income under progressive tax rates, with mandatory deductions for social security and Medicare, providing predictable tax withholding and a steady after-tax cash flow. Royalty income is classified as passive income, subject to ordinary income tax rates without payroll tax but may allow for offsetting expenses like depreciation, resulting in variable tax liabilities depending on the asset's performance. Understanding these distinctions helps optimize tax planning strategies for consistent cash flow management and minimizing overall tax burden.

Time and Effort Required for Each Income Type

Salary income provides consistent cash flow with minimal effort beyond regular work hours, offering financial stability through predictable paychecks. Royalty income requires significant upfront time and creative effort to develop intellectual property but offers potential passive income over time with less ongoing labor. The trade-off between immediate stability and long-term residual earnings is essential when managing regular cash flow.

Pros and Cons: Salary Income vs. Royalty Income

Salary income provides a predictable and steady cash flow, ensuring financial stability with consistent monthly payments, but it offers limited flexibility and growth potential tied to employer decisions. Royalty income, derived from intellectual property or natural resources, can generate passive earnings with potential for long-term wealth creation, though it is often subject to market fluctuations and can be irregular. Balancing salary and royalty income can optimize cash flow by combining reliability with opportunities for higher returns and diversification.

Choosing the Best Income Stream for Regular Cash Flow

Salary income offers a predictable and stable cash flow through fixed monthly payments, making it ideal for consistent budgeting and financial planning. Royalty income, while potentially higher, is variable and depends on the performance and lifetime of intellectual property or assets, leading to less reliable cash flow. Choosing the best income stream depends on the need for financial stability versus the willingness to accept income fluctuations for higher long-term gains.

Related Important Terms

Salary Drip

Salary income provides a consistent and predictable cash flow through regular paychecks, ideal for managing daily expenses and financial planning. Royalty income varies based on sales or usage metrics, making it less reliable for steady monthly cash flow compared to the stable drip of a salaried income.

Royalty Stream

Royalty income provides a reliable and potentially passive cash flow stream derived from intellectual property, natural resources, or assets, offering long-term financial stability compared to salary income which is typically fixed and dependent on active employment. Leveraging royalty streams can diversify income sources and create sustained revenue beyond the limitations of regular paycheck earnings.

Passive Paycheck

Salary income provides a stable, predictable cash flow essential for budgeting and daily expenses, whereas royalty income, derived from intellectual property or investments, offers a passive paycheck that can accumulate over time with minimal ongoing effort. Balancing salary and royalty income diversifies income streams, enhancing financial security and enabling sustainable wealth growth without constant active work.

Intellectual Property Yield

Salary income provides consistent cash flow through fixed payments, while royalty income from intellectual property offers variable but potentially higher yields based on asset performance and market demand. Leveraging intellectual property assets can diversify income streams and enhance long-term financial growth beyond regular salary earnings.

Income Waterfall

Salary income provides a stable and predictable cash flow consistently prioritized at the top of the income waterfall, ensuring regular monthly payments before any royalty distributions. Royalty income, while potentially lucrative, is variable and typically considered subordinate in the income waterfall, leading to less consistent cash flow compared to salary income.

Earnings Continuum

Salary income offers a stable and predictable cash flow due to regular paychecks, aligning with the lower-risk end of the earnings continuum. Royalty income, while potentially less consistent, provides long-term residual earnings from intellectual property or creative works, positioning it toward the higher-reward end of the earnings continuum.

Active Compensation Cycle

Salary income provides a consistent and predictable cash flow through a structured active compensation cycle, ensuring regular deposits aligned with employment terms, whereas royalty income can be irregular and dependent on variable factors such as sales performance or licensing agreements, making it less reliable for steady financial planning. Active compensation cycles tied to salary income optimize budget management and financial stability for individuals seeking dependable monthly earnings.

Creative Royalty Loop

Salary income provides a predictable and steady cash flow through regular paychecks, while royalty income from creative works generates ongoing revenue tied to intellectual property usage, enabling a passive income stream. The Creative Royalty Loop leverages continuous content exploitation across multiple platforms, amplifying earnings potential beyond fixed salary limitations.

Wage Stability versus IP Flux

Salary income offers predictable wage stability with consistent monthly earnings, making it ideal for regular cash flow management. Royalty income, derived from intellectual property, tends to fluctuate based on market demand and licensing agreements, introducing variability and potential irregularity in cash flow.

Employment Ladder vs. Asset Cascade

Salary income provides consistent, predictable cash flow tied to the employment ladder, offering stability through regular paychecks and career progression. In contrast, royalty income generates ongoing revenue from intellectual property or assets within the asset cascade, enabling passive cash flow without the need for active employment.

Salary income vs Royalty income for regular cash flow. Infographic

moneydiff.com

moneydiff.com