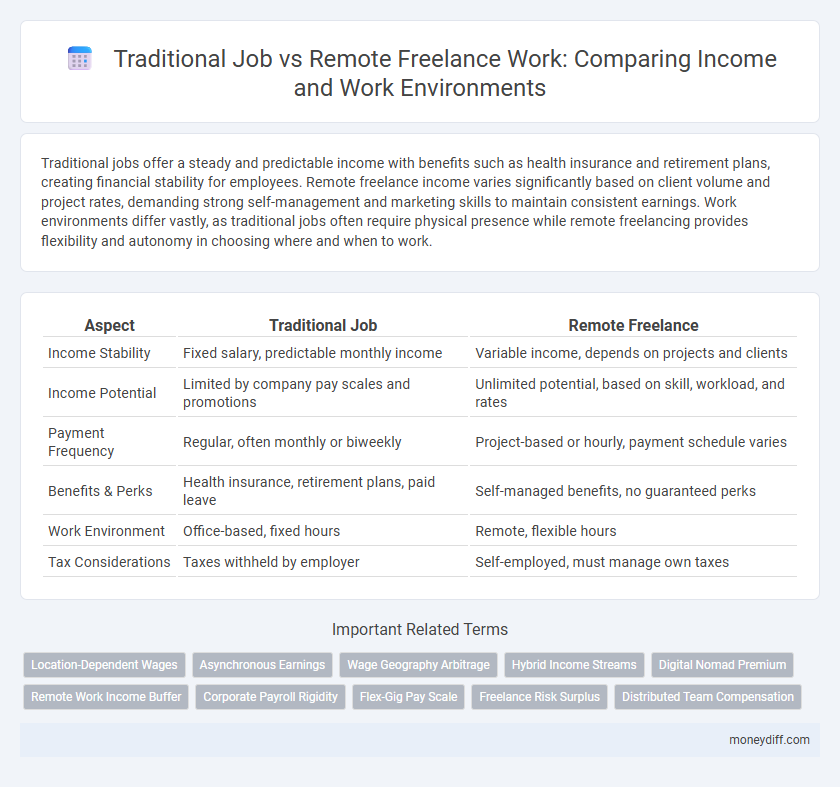

Traditional jobs offer a steady and predictable income with benefits such as health insurance and retirement plans, creating financial stability for employees. Remote freelance income varies significantly based on client volume and project rates, demanding strong self-management and marketing skills to maintain consistent earnings. Work environments differ vastly, as traditional jobs often require physical presence while remote freelancing provides flexibility and autonomy in choosing where and when to work.

Table of Comparison

| Aspect | Traditional Job | Remote Freelance |

|---|---|---|

| Income Stability | Fixed salary, predictable monthly income | Variable income, depends on projects and clients |

| Income Potential | Limited by company pay scales and promotions | Unlimited potential, based on skill, workload, and rates |

| Payment Frequency | Regular, often monthly or biweekly | Project-based or hourly, payment schedule varies |

| Benefits & Perks | Health insurance, retirement plans, paid leave | Self-managed benefits, no guaranteed perks |

| Work Environment | Office-based, fixed hours | Remote, flexible hours |

| Tax Considerations | Taxes withheld by employer | Self-employed, must manage own taxes |

Overview of Traditional Job and Remote Freelance Income

Traditional jobs typically offer stable, predictable income with regular paychecks, benefits, and tax withholdings, providing financial security and consistency. Remote freelance income varies significantly, depending on client volume, project rates, and market demand, which can lead to fluctuating cash flow but greater earning potential. Freelancers must manage invoicing, taxes, and business expenses independently, making income less predictable compared to salaried employment.

Income Stability: Traditional Employment vs Freelance Flexibility

Traditional employment offers consistent income stability through fixed salaries and structured benefits, providing financial predictability for employees. Remote freelance work delivers income flexibility by allowing individuals to control workload and diversify clients but often results in fluctuating earnings and less predictable cash flow. Choosing between these options depends on prioritizing steady financial security or adaptable income streams in dynamic work environments.

Earning Potential: Salaried Jobs vs Remote Freelance Gigs

Salaried jobs offer stable, predictable income with benefits such as health insurance and retirement plans, but often have fixed earning ceilings tied to company structure and role seniority. Remote freelance gigs provide variable income influenced by client demand, skill level, and market rates, offering opportunities for higher earnings through multiple projects and premium services. Freelancers face income volatility but benefit from scalable earning potential without traditional corporate limitations.

Benefits and Perks: Corporate Packages vs Freelance Independence

Traditional jobs often provide structured benefits such as health insurance, retirement plans, paid leave, and corporate bonuses that ensure financial stability and workplace support. Remote freelance income lacks standardized corporate packages but offers independence, flexibility in project selection, and potential for higher earnings through diverse client engagements. Freelancers can tailor their income streams and work schedules to optimize personal productivity and work-life balance, contrasting with the fixed-income and regulated perks of traditional employment.

Tax Implications: W-2 Employees vs Self-Employed Freelancers

W-2 employees face tax withholdings managed by employers, including Social Security and Medicare contributions, resulting in simpler tax filing but limited deductions. Self-employed freelancers must handle quarterly estimated tax payments and cover the full self-employment tax, which includes both employer and employee portions of Social Security and Medicare. Tax deductions for freelancers can be more extensive, including home office expenses, business supplies, and internet costs, potentially reducing overall taxable income.

Work-Life Balance: Office Hours vs Freelance Autonomy

Traditional jobs offer fixed office hours that provide a structured routine, ensuring consistent income but limiting personal time flexibility. Remote freelance income varies based on project workload and client demand, granting autonomy to set schedules and prioritize work-life balance according to individual preferences. Freelancers often experience greater control over their time, enabling customized environments that can enhance productivity and overall well-being.

Career Growth: Climbing the Ladder vs Diversifying Skills

Traditional jobs often provide a structured career path with clear opportunities for climbing the corporate ladder, supported by consistent income and benefits that contribute to long-term financial stability. Remote freelance income offers the potential for diverse skill development across various projects and clients, enhancing adaptability and marketability in a rapidly changing job market. Balancing steady advancement with diversified expertise can maximize career growth and income potential in evolving work environments.

Financial Security: Retirement Plans and Savings Options

Traditional jobs typically offer structured retirement plans such as 401(k)s or pensions, providing predictable and often employer-matched contributions that enhance long-term financial security. Remote freelance income lacks built-in retirement benefits, requiring individuals to actively manage savings through IRAs, SEP IRAs, or solo 401(k)s to ensure sufficient retirement funds. Consistent income stability in traditional roles supports steady savings accumulation, while freelancers must address income variability to maintain reliable retirement planning.

Expense Management: Commuting Costs vs Home Office Setup

Traditional job income often includes significant commuting costs such as fuel, public transportation, and parking fees, which can reduce overall take-home pay. Remote freelance income allows for savings on these commuting expenses but requires investment in a home office setup, including equipment, internet, and utilities. Effective expense management balances reduced travel costs against home office investments to maximize net income in either work environment.

Choosing the Best Income Path: Factors to Consider

Evaluating income stability, growth potential, and flexibility is crucial when choosing between a traditional job and remote freelance work. Traditional jobs often provide consistent salaries, benefits, and job security, while remote freelancing offers variable income and the opportunity to diversify clients for higher earnings. Consider personal financial goals, risk tolerance, skill set, and market demand to determine the best income path.

Related Important Terms

Location-Dependent Wages

Traditional job income often varies significantly based on geographic location, with metropolitan areas offering higher wages due to increased living costs and local market demand. Remote freelance income tends to be more location-independent, allowing professionals to set competitive rates aligned with global standards rather than local wage constraints.

Asynchronous Earnings

Remote freelance income generates asynchronous earnings by allowing work to be completed on flexible schedules across different time zones, unlike traditional jobs which typically require synchronous, fixed hours. This flexibility leads to diversified income streams and potential for higher overall earnings as freelancers can manage multiple projects simultaneously.

Wage Geography Arbitrage

Remote freelance income leverages wage geography arbitrage by enabling professionals to earn higher wages from lower-cost living areas, unlike traditional jobs typically tied to local salary standards. This income model maximizes earning potential and cost efficiency by tapping into global markets and varying economic conditions.

Hybrid Income Streams

Combining traditional job salaries with remote freelance income creates hybrid income streams that enhance financial stability and flexibility. This diversified approach leverages steady wages from conventional employment alongside variable freelance earnings, optimizing overall earning potential in evolving work environments.

Digital Nomad Premium

Traditional jobs often provide steady monthly income with structured benefits and job security, while remote freelance income offers variable earnings influenced by project availability and client demand. Digital Nomad Premium services enhance freelance income opportunities by connecting professionals to high-paying international clients and exclusive remote work platforms.

Remote Work Income Buffer

Remote freelance income offers a flexible buffer against economic fluctuations by allowing professionals to diversify clients and projects, reducing reliance on a single employer. Traditional jobs typically provide steady paychecks but lack the income adaptability and growth potential found in remote freelance opportunities.

Corporate Payroll Rigidity

Traditional jobs often feature corporate payroll rigidity, limiting income flexibility with fixed salaries and standardized pay cycles, while remote freelance income offers variable earnings driven by project volume and client diversity. This contrast highlights how corporate payroll systems can constrain financial growth compared to the dynamic, performance-based income models in freelancing.

Flex-Gig Pay Scale

Traditional jobs often provide a fixed salary with regular benefits, offering stable yet limited income growth tied to company performance and role hierarchy. Remote freelance income leverages a flex-gig pay scale, enabling professionals to increase earnings through diverse projects and variable rates based on skill demand and client budgets.

Freelance Risk Surplus

Remote freelance income often presents a risk surplus compared to traditional jobs due to fluctuating client demand, inconsistent payment schedules, and lack of employer benefits like health insurance and retirement plans. Freelancers must manage financial instability by diversifying income sources and maintaining emergency savings to offset unpredictable cash flow gaps.

Distributed Team Compensation

Traditional job compensation typically includes fixed salaries, benefits, and structured bonuses tied to in-office performance metrics, whereas remote freelance income varies based on project scope, client acquisition, and flexible hourly rates within distributed teams. Distributed team compensation models increasingly incorporate outcome-based pay and digital nomad allowances to balance earning potential and work environment flexibility.

Traditional Job vs Remote Freelance Income for work environment. Infographic

moneydiff.com

moneydiff.com