Wealth building focuses on accumulating substantial assets and passive income streams to achieve financial independence, while Barista FIRE emphasizes maintaining a part-time job to cover living expenses with lower savings requirements. Choosing between Wealth Building and Barista FIRE depends on personal goals, risk tolerance, and desired lifestyle flexibility. Both strategies aim to reduce financial stress, but Wealth Building offers greater long-term security and Barista FIRE provides immediate work-life balance.

Table of Comparison

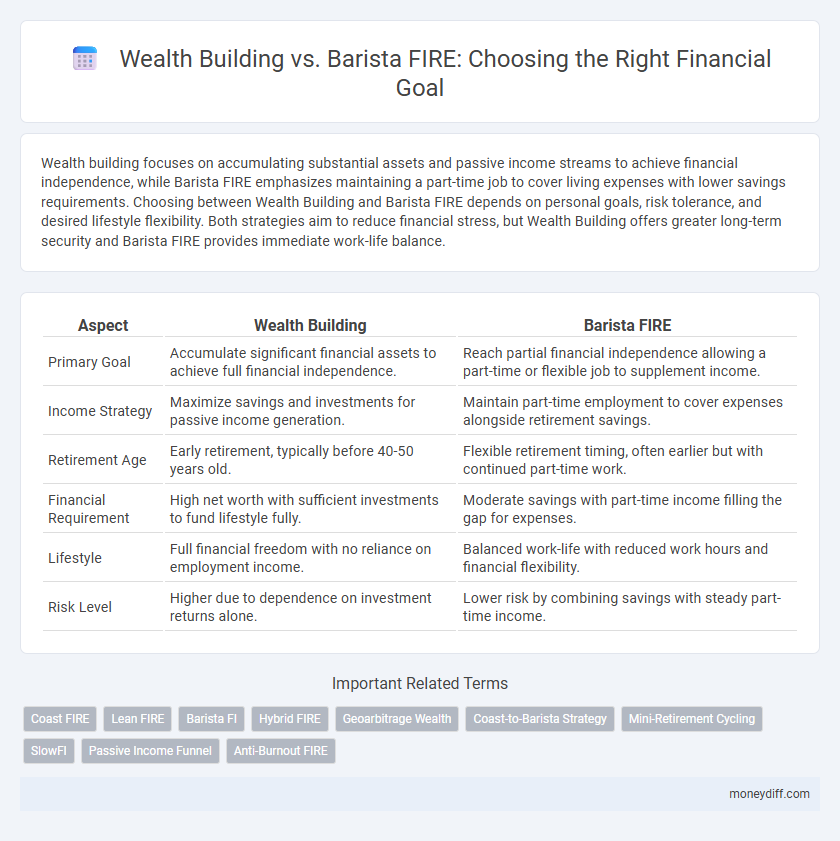

| Aspect | Wealth Building | Barista FIRE |

|---|---|---|

| Primary Goal | Accumulate significant financial assets to achieve full financial independence. | Reach partial financial independence allowing a part-time or flexible job to supplement income. |

| Income Strategy | Maximize savings and investments for passive income generation. | Maintain part-time employment to cover expenses alongside retirement savings. |

| Retirement Age | Early retirement, typically before 40-50 years old. | Flexible retirement timing, often earlier but with continued part-time work. |

| Financial Requirement | High net worth with sufficient investments to fund lifestyle fully. | Moderate savings with part-time income filling the gap for expenses. |

| Lifestyle | Full financial freedom with no reliance on employment income. | Balanced work-life with reduced work hours and financial flexibility. |

| Risk Level | Higher due to dependence on investment returns alone. | Lower risk by combining savings with steady part-time income. |

Defining Wealth Building and Barista FIRE

Wealth building involves accumulating significant assets over time through diversified investments, savings, and income streams to achieve financial independence and long-term stability. Barista FIRE, a subset of the Financial Independence, Retire Early movement, combines part-time work with investment income to maintain a modest lifestyle while reducing full-time employment. Both strategies prioritize financial freedom but differ in the extent of income replacement and lifestyle maintenance goals.

Key Differences in Financial Goals

Wealth building focuses on accumulating substantial assets and investments to achieve long-term financial independence and security. Barista FIRE prioritizes reaching a partial financial independence by combining part-time work income with savings, enabling a more flexible lifestyle with less financial pressure. The key difference lies in the scale and pace of financial goals, where wealth building aims for full retirement funding, while Barista FIRE targets sustainable reduced work.

Investment Strategies Compared

Wealth building focuses on aggressive investment strategies such as diversified stock portfolios, real estate, and retirement accounts aimed at long-term asset growth and financial independence. Barista FIRE relies on a blend of moderate investments combined with part-time work income to maintain financial stability while reducing expenses and preserving lifestyle flexibility. Investment strategies for wealth building emphasize compound growth and risk tolerance, whereas Barista FIRE prioritizes steady cash flow and capital preservation to support a sustainable semi-retired lifestyle.

Required Savings Rate for Each Path

Wealth building requires a higher savings rate, often between 20% to 40% of income, to accumulate sufficient capital for financial independence. Barista FIRE typically demands a lower savings rate, around 10% to 25%, as it combines partial retirement income with part-time work. The savings rate directly impacts the time horizon for achieving financial goals, with higher rates enabling faster wealth accumulation.

Lifestyle Considerations: Wealth Building vs Barista FIRE

Wealth building emphasizes accumulating substantial assets through long-term investments, supporting a lifestyle of financial independence without the need for continued employment. Barista FIRE focuses on achieving partial financial independence by combining modest savings with part-time work, allowing more flexibility but potentially limiting lifestyle choices. Lifestyle considerations hinge on personal priorities: wealth building offers greater security and freedom to pursue ambitions, while Barista FIRE provides balance between income and leisure with less financial pressure.

Risk Tolerance and Asset Allocation

Wealth building strategies prioritize higher risk tolerance through diversified asset allocation, including stocks, real estate, and alternative investments to maximize long-term growth potential. Barista FIRE focuses on lower risk tolerance by emphasizing stable income streams and conservative asset allocation, often blending bonds and dividend-paying stocks to ensure steady cash flow while maintaining part-time work. Understanding individual risk tolerance is crucial for selecting asset allocations that align with either aggressive wealth accumulation or the balanced, income-focused approach of Barista FIRE.

Career Choices and Income Streams

Wealth building focuses on maximizing income streams through strategic career choices such as entrepreneurship, investments, and passive income generation to achieve long-term financial independence. Barista FIRE emphasizes sustainable income by maintaining part-time or flexible jobs combined with minimal living expenses, allowing for early retirement with partial financial support. Prioritizing high-earning career paths accelerates wealth accumulation, while Barista FIRE balances income stability and lifestyle flexibility for financial goals.

Time Horizon to Financial Independence

Wealth building for financial independence typically requires a longer time horizon, leveraging compounding returns and disciplined investing over decades to accumulate significant assets. Barista FIRE, by contrast, aims for a shorter time horizon by combining part-time work income with reduced expenses to achieve partial financial independence sooner. Choosing between these approaches depends on individual goals, risk tolerance, and desired lifestyle flexibility.

Pros and Cons of Each Approach

Wealth building emphasizes long-term financial growth through diversified investments and compound interest, offering potential for substantial passive income but requiring patience and market risk tolerance. Barista FIRE focuses on achieving partial financial independence by maintaining part-time work, providing steady income and benefits while reducing the pressure to fully retire early. Choosing between the two depends on individual risk appetite, lifestyle preferences, and the desired balance between work and leisure.

Choosing the Right Path for Your Money Goals

Wealth building emphasizes long-term accumulation through diversified investments, maximizing compound growth for financial independence over decades. Barista FIRE combines partial financial independence with part-time work, providing reduced financial pressure and a flexible lifestyle earlier in life. Selecting the right path depends on your risk tolerance, desired work-life balance, and timeline to achieve financial goals.

Related Important Terms

Coast FIRE

Coast FIRE enables individuals to reach Wealth Building goals by allowing investments to grow passively until retirement without additional contributions, contrasting with Barista FIRE's reliance on part-time work income. This strategy maximizes compound interest benefits early on, optimizing long-term financial independence while minimizing ongoing labor.

Lean FIRE

Lean FIRE emphasizes achieving financial independence with a minimalist lifestyle, prioritizing low expenses over broad wealth accumulation. Wealth building aims for large asset growth, while Lean FIRE focuses on sustainable, frugal living to reach financial freedom earlier without requiring substantial income streams.

Barista FI

Barista FIRE focuses on achieving financial independence with a sustainable, part-time income that covers essential expenses while maintaining a balanced lifestyle, contrasting with Wealth Building's emphasis on accumulating substantial assets for complete financial freedom. This approach prioritizes steady cash flow from part-time work and moderate savings, enabling early retirement with lower financial targets but increased lifestyle flexibility.

Hybrid FIRE

Hybrid FIRE combines the aggressive savings and investment strategies of Wealth Building with the flexibility and lifestyle balance of Barista FIRE, allowing individuals to achieve financial independence while maintaining part-time work. This approach optimizes portfolio growth through diversified income streams, balancing risk and stability to reach long-term financial goals more sustainably.

Geoarbitrage Wealth

Geoarbitrage wealth leverages cost-of-living differences to accelerate asset accumulation, making it a strategic advantage over the Barista FIRE approach that prioritizes part-time income with moderate saving. By maximizing returns through investing in low-cost regions while generating passive income, geoarbitrage enables faster achievement of traditional wealth-building goals.

Coast-to-Barista Strategy

The Coast-to-Barista strategy blends wealth building with Barista FIRE by focusing on early financial independence through disciplined investing, then transitioning to low-stress, part-time work that covers living expenses. This approach optimizes long-term growth while maintaining lifestyle flexibility, minimizing the risk of depleting savings during early retirement.

Mini-Retirement Cycling

Mini-retirement cycling balances the high-growth focus of wealth building with the lifestyle flexibility emphasized in Barista FIRE, allowing individuals to alternate periods of intensive work and extended breaks. This approach supports sustained financial independence while integrating recurring rest phases that rejuvenate motivation and prevent burnout.

SlowFI

SlowFI advocates for steady wealth building through disciplined savings and mindful spending, contrasting with the Fast FIRE pursuit of early retirement. Emphasizing financial independence without extreme sacrifice, SlowFI aligns well with Barista FIRE, where part-time work supports a balanced lifestyle while gradually growing assets.

Passive Income Funnel

Wealth building through a passive income funnel involves systematically creating diverse revenue streams that grow independently, accelerating financial freedom beyond traditional employment. Barista FIRE focuses on achieving partial financial independence by maintaining a flexible, low-stress job while supplementing income with smaller passive returns, prioritizing lifestyle balance over rapid wealth accumulation.

Anti-Burnout FIRE

Wealth Building strategies prioritize long-term asset accumulation to achieve financial independence without compromising career growth, whereas Barista FIRE emphasizes maintaining part-time work to reduce stress and prevent burnout while covering essential expenses. Anti-Burnout FIRE blends sustainable income streams and mindful work-life balance to ensure continuous motivation and financial security, promoting mental health alongside wealth accumulation.

Wealth Building vs Barista FIRE for goal. Infographic

moneydiff.com

moneydiff.com