Building a vacation fund helps ensure memorable trips without financial stress, allowing for planned getaways that rejuvenate and inspire. Pursuing location independence offers long-term flexibility, enabling you to work and travel freely without being tied to a specific place. Balancing a vacation fund with the goal of location independence creates a sustainable approach to both immediate travel enjoyment and future lifestyle freedom.

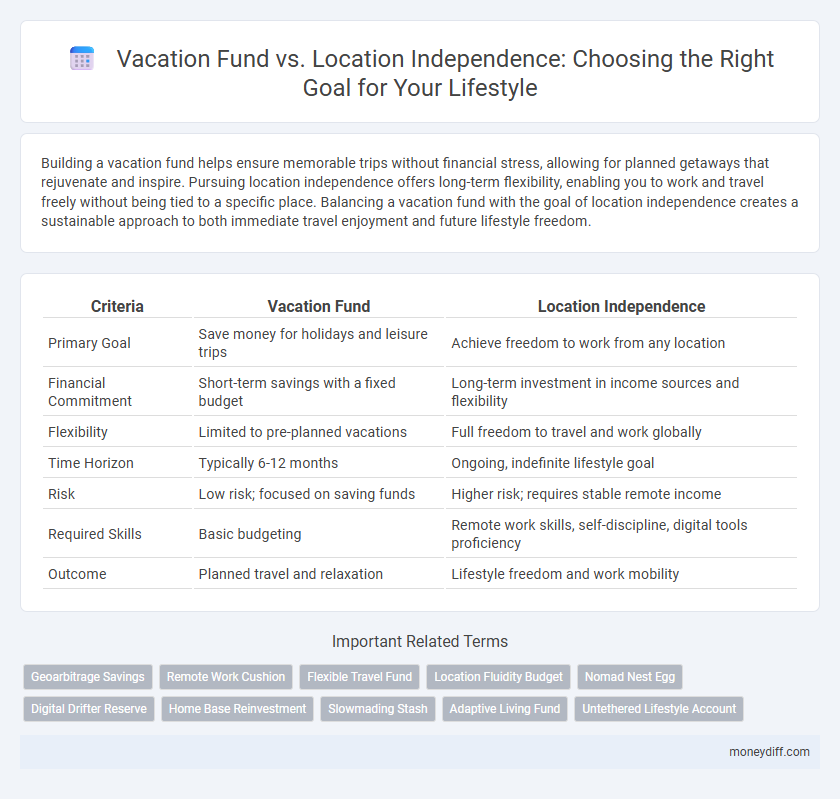

Table of Comparison

| Criteria | Vacation Fund | Location Independence |

|---|---|---|

| Primary Goal | Save money for holidays and leisure trips | Achieve freedom to work from any location |

| Financial Commitment | Short-term savings with a fixed budget | Long-term investment in income sources and flexibility |

| Flexibility | Limited to pre-planned vacations | Full freedom to travel and work globally |

| Time Horizon | Typically 6-12 months | Ongoing, indefinite lifestyle goal |

| Risk | Low risk; focused on saving funds | Higher risk; requires stable remote income |

| Required Skills | Basic budgeting | Remote work skills, self-discipline, digital tools proficiency |

| Outcome | Planned travel and relaxation | Lifestyle freedom and work mobility |

Defining Vacation Fund: Purpose and Benefits

A vacation fund is a dedicated savings account designed to accumulate money specifically for travel expenses, helping individuals plan and afford memorable trips without financial stress. This targeted financial strategy supports goal-oriented saving, enabling better budgeting and preventing the need for credit usage during vacations. By establishing a vacation fund, travelers gain peace of mind and maximize the enjoyment of their trips through careful financial preparation.

Understanding Location Independence: Financial Implications

Location independence requires a strategic financial approach to sustain income streams without a fixed workplace, emphasizing investments in remote-friendly careers or passive income sources. Compared to a vacation fund, which is a short-term savings goal for leisure, location independence demands long-term financial planning and diversification to support ongoing living expenses globally. Understanding these financial implications helps prioritize saving and investment strategies that align with maintaining freedom of movement and lifestyle flexibility.

Comparing Short-Term vs Long-Term Financial Goals

Vacation funds cater to short-term financial goals, allowing individuals to save for immediate enjoyment and experiences within a fixed timeline. Location independence represents a long-term financial goal, requiring sustained investment and planning to achieve freedom from geographical constraints and create a flexible lifestyle. Balancing vacation savings with contributions toward location independence ensures both immediate gratification and future financial security.

Budgeting Strategies for Vacation Savings

Effective budgeting strategies for vacation savings involve prioritizing a dedicated vacation fund separate from the general savings account to ensure clear financial goals and avoid overspending. Tracking monthly expenses and allocating a fixed percentage toward the vacation fund helps build a substantial balance over time, enabling stress-free travel planning. Incorporating automated transfers and leveraging high-yield savings accounts maximizes growth, contrasting with location independence goals that often require more flexible and emergency-focused budgeting.

Building Wealth for Location Independence

Building wealth for location independence requires disciplined saving and strategic investment, prioritizing high-yield assets that generate passive income. Establishing a vacation fund supports short-term relaxation but is secondary to accumulating substantial capital that sustains a flexible lifestyle. Focusing on scalable income streams and diversified portfolios accelerates the path to financial freedom and true location independence.

Opportunity Costs: Travel Now or Freedom Later?

Choosing between investing in a vacation fund or pursuing location independence involves weighing opportunity costs: spending savings on immediate travel sacrifices potential long-term freedom, while prioritizing location independence delays gratification but offers sustainable flexibility. Vacation fund expenditures provide instant leisure experiences, yet location independence investments cultivate a lifestyle enabling remote work and continuous travel. Evaluating personal goals, financial stability, and career flexibility is essential to determine if immediate enjoyment outweighs the strategic benefits of eventual location freedom.

Risk Management for Vacation and Independence Goals

Vacation funds require strict risk management to ensure dedicated savings are not depleted by unforeseen expenses, maintaining the integrity of short-term travel goals. Location independence demands robust financial planning and contingency strategies to mitigate income volatility and unexpected costs associated with remote living. Balancing risk management between these two goals ensures consistent progress, protecting both immediate leisure plans and long-term lifestyle freedom.

Measuring Success: Metrics for Each Money Goal

Measuring success for a Vacation Fund involves tracking savings progress against target trip costs and monitoring monthly contributions to ensure timely goal achievement. For Location Independence, key metrics include passive income streams, ongoing remote work opportunities, and expenses covered without relying on a fixed location. Evaluating these financial indicators provides clear benchmarks to gauge progress and adjust strategies for each money goal.

Tools and Apps for Managing Competing Goals

Tools like Mint and You Need a Budget (YNAB) help manage competing goals such as Vacation Fund and Location Independence by tracking expenses and allocating savings efficiently. Apps like Trello and Asana enable seamless goal prioritization and progress monitoring, ensuring balanced focus on both short-term travel plans and long-term location independence strategies. Integrating automation features in apps like Digit can optimize savings distribution, maintaining steady growth for each goal without manual intervention.

Choosing the Right Path: Aligning Goals with Values

Vacation fund planning emphasizes short-term relaxation and destination experiences, aligning with goals centered on periodic enjoyment and mental recharge. Location independence prioritizes long-term lifestyle flexibility and freedom, reflecting values that prioritize autonomy and continuous exploration. Choosing the right path involves assessing personal values and long-term vision to ensure goal alignment with meaningful life priorities.

Related Important Terms

Geoarbitrage Savings

Vacation fund goals enable short-term relaxation by allocating savings specifically for travel expenses, while location independence prioritizes ongoing geoarbitrage savings through living in lower-cost regions to maximize financial freedom. Geoarbitrage leverages discrepancies in living costs to boost savings rates, making location independence a sustainable strategy for long-term wealth accumulation compared to intermittent vacation spending.

Remote Work Cushion

Building a vacation fund provides financial security for planned breaks, while prioritizing location independence through remote work offers ongoing flexibility and the ability to extend travel without depleting savings. Establishing a remote work cushion ensures consistent income flow, making location-independent living a sustainable alternative to relying solely on traditional vacation savings.

Flexible Travel Fund

A Flexible Travel Fund offers a strategic alternative to traditional Vacation Funds by enabling location independence and spontaneous trips without strict budgeting constraints. Prioritizing this goal enhances financial flexibility, supporting a lifestyle where travel decisions align with emerging opportunities rather than fixed vacation schedules.

Location Fluidity Budget

A Location Fluidity Budget emphasizes the importance of financial flexibility to support frequent relocations, making Location Independence a more viable goal than simply accumulating a Vacation Fund. Prioritizing ongoing expenses and variable living costs empowers individuals to sustain their lifestyle while adapting to diverse environments seamlessly.

Nomad Nest Egg

Allocating savings to a Vacation Fund offers short-term enjoyment and planned leisure expenses, while investing in Location Independence, particularly through building a Nomad Nest Egg, provides long-term financial freedom and flexibility to work remotely from anywhere. Prioritizing the Nomad Nest Egg supports sustainable income streams, enabling continuous travel and lifestyle autonomy beyond temporary vacation periods.

Digital Drifter Reserve

The Digital Drifter Reserve prioritizes building a comprehensive Vacation Fund to ensure financial security during leisure time while gradually progressing toward Location Independence, which requires a more substantial and flexible income source. Balancing immediate travel savings with long-term remote work capabilities allows for sustained mobility without compromising financial stability.

Home Base Reinvestment

Prioritizing a vacation fund supports short-term relaxation and periodic escapes, while location independence fosters long-term freedom to work and live anywhere, enhancing life flexibility. Reinvesting savings from a stable home base into travel opportunities maximizes both goal achievement by balancing financial security with experiential growth.

Slowmading Stash

Slowmading Stash emphasizes building a Vacation Fund as a tangible step toward achieving Location Independence by ensuring financial security during travel. Prioritizing a robust Vacation Fund maximizes flexibility and supports long-term mobility, essential for sustaining a location-independent lifestyle.

Adaptive Living Fund

The Adaptive Living Fund prioritizes flexibility and financial security by balancing savings for a vacation fund with investments aimed at achieving location independence, ensuring funds grow while allowing spontaneous travel. This approach supports long-term goal alignment by enabling seamless transitions between lifestyles without compromising immediate leisure plans.

Untethered Lifestyle Account

The Untethered Lifestyle Account prioritizes location independence by enabling flexible access to funds while traveling, contrasting traditional Vacation Funds that allocate money for specific trips. This approach supports seamless financial management across multiple destinations, fostering long-term freedom from fixed residences.

Vacation Fund vs Location Independence for goal. Infographic

moneydiff.com

moneydiff.com