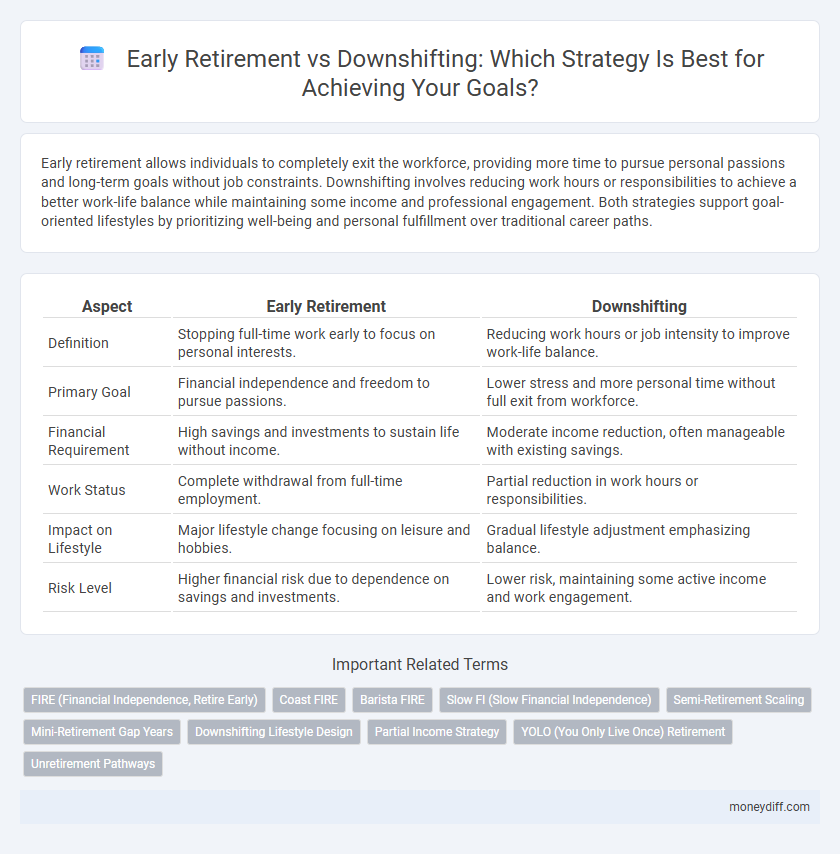

Early retirement allows individuals to completely exit the workforce, providing more time to pursue personal passions and long-term goals without job constraints. Downshifting involves reducing work hours or responsibilities to achieve a better work-life balance while maintaining some income and professional engagement. Both strategies support goal-oriented lifestyles by prioritizing well-being and personal fulfillment over traditional career paths.

Table of Comparison

| Aspect | Early Retirement | Downshifting |

|---|---|---|

| Definition | Stopping full-time work early to focus on personal interests. | Reducing work hours or job intensity to improve work-life balance. |

| Primary Goal | Financial independence and freedom to pursue passions. | Lower stress and more personal time without full exit from workforce. |

| Financial Requirement | High savings and investments to sustain life without income. | Moderate income reduction, often manageable with existing savings. |

| Work Status | Complete withdrawal from full-time employment. | Partial reduction in work hours or responsibilities. |

| Impact on Lifestyle | Major lifestyle change focusing on leisure and hobbies. | Gradual lifestyle adjustment emphasizing balance. |

| Risk Level | Higher financial risk due to dependence on savings and investments. | Lower risk, maintaining some active income and work engagement. |

Understanding Early Retirement and Downshifting

Early retirement involves accumulating sufficient financial resources to stop working entirely, prioritizing maximum leisure and personal freedom. Downshifting focuses on reducing work hours or career intensity to achieve a better work-life balance without fully exiting the workforce. Both strategies require careful financial planning, but early retirement demands more aggressive savings and investment efforts, while downshifting emphasizes lifestyle adjustments and career flexibility.

Defining Your Money Management Goals

Defining your money management goals involves clarifying whether your priority is achieving early retirement or adopting a downshifting lifestyle. Early retirement requires aggressive saving, investment strategies, and debt elimination to accumulate sufficient wealth for financial independence. Downshifting emphasizes reducing expenses, simplifying lifestyle choices, and prioritizing quality of life over wealth accumulation.

Financial Requirements for Early Retirement

Early retirement demands a precise calculation of financial requirements, including a substantial retirement corpus that can sustain living expenses without active income. Essential factors involve estimating annual expenditures, accounting for inflation, and securing reliable investment returns to prevent depletion of funds over a potentially extended retirement period. Effective financial planning also incorporates emergency reserves and healthcare costs to ensure long-term stability and peace of mind.

Downshifting: Balancing Work and Lifestyle

Downshifting involves reducing work hours or responsibilities to achieve a better balance between professional commitments and personal well-being. This approach allows individuals to maintain income streams while gaining more time for hobbies, family, and self-care, aligning with sustainable lifestyle goals. Prioritizing quality of life over career advancement supports mental health and long-term satisfaction without the financial pressure of full early retirement.

Pros and Cons of Early Retirement

Early retirement offers the advantage of financial freedom and more time for personal pursuits, but it requires careful planning to ensure long-term sustainability of savings and healthcare coverage. One significant drawback is the potential loss of steady income and benefits, which can lead to financial insecurity if retirement funds are mismanaged or insufficient. Early retirees may also face challenges in staying socially engaged and maintaining a sense of purpose without the structure of a traditional work environment.

Advantages and Drawbacks of Downshifting

Downshifting offers advantages such as reduced stress, improved work-life balance, and increased personal fulfillment by prioritizing well-being over income. However, drawbacks include potential income reduction, limited career advancement, and challenges in maintaining financial security. This approach contrasts with early retirement by allowing continued engagement in meaningful work while simplifying lifestyle choices.

Budgeting Strategies for Both Paths

Early retirement requires precise budgeting strategies, including aggressive saving rates often exceeding 50% of income and strict expense tracking to ensure sustainable withdrawal rates. Downshifting focuses on reducing living costs by simplifying lifestyle choices, prioritizing essential spending, and creating flexible budgets that allow for gradual income reduction. Both paths benefit from detailed cash flow analysis, debt elimination, and emergency fund establishment to maintain financial stability during transitions.

Impact on Long-Term Wealth Accumulation

Early retirement often requires aggressive saving and investing strategies to build substantial wealth before exiting the workforce, potentially maximizing long-term financial freedom. Downshifting, which involves reducing work hours or responsibilities without fully retiring, allows continued income streams and less financial pressure, supporting steady wealth accumulation over time. Balancing cash flow and lifestyle adjustments in either approach significantly influences the overall growth and sustainability of long-term assets.

Lifestyle Adjustments for Each Goal

Early retirement requires significant financial planning and saving to maintain lifestyle without regular income, emphasizing investment growth and expense management. Downshifting focuses on simplifying daily routines and reducing work-related stress, often involving partial income reduction but increased personal satisfaction. Both lifestyles demand intentional changes in spending habits and time allocation to align with long-term goals.

Choosing the Right Path for Your Financial Future

Early retirement offers the goal of financial independence by maximizing savings and investment returns for a rapid exit from the workforce. Downshifting prioritizes lifestyle changes and reduced expenses, allowing more freedom and balance without complete financial independence. Choosing the right path depends on your risk tolerance, current financial resources, and long-term aspirations for security and fulfillment.

Related Important Terms

FIRE (Financial Independence, Retire Early)

Achieving FIRE (Financial Independence, Retire Early) emphasizes accumulating sufficient passive income to cover living expenses, allowing for early retirement without dependence on active employment. Downshifting focuses on reducing lifestyle costs and work hours to improve life balance without full financial independence, often serving as a gradual transition towards FIRE.

Coast FIRE

Early retirement aims to accumulate enough investments to stop working altogether, while downshifting focuses on reducing expenses and work hours to achieve financial freedom sooner. Coast FIRE specifically targets building a retirement fund early to let it grow passively until traditional retirement age, minimizing the need for additional savings while maintaining a balanced lifestyle.

Barista FIRE

Barista FIRE combines early retirement with part-time work to maintain financial independence while reducing work stress, offering a practical middle ground between full Early Retirement and Downshifting. This approach enables individuals to enjoy lifestyle flexibility, preserve health benefits, and gradually transition away from traditional career demands.

Slow FI (Slow Financial Independence)

Slow Financial Independence (Slow FI) emphasizes a gradual approach to financial freedom by balancing income, savings, and lifestyle adjustments over time, unlike Early Retirement which aims for rapid wealth accumulation to exit the workforce quickly. Downshifting supports Slow FI by intentionally reducing work hours or career intensity to improve quality of life while steadily building financial security.

Semi-Retirement Scaling

Semi-retirement scaling offers a flexible approach to achieving early retirement goals by gradually reducing work hours while maintaining income stability and financial security. This strategy balances lifestyle preferences and long-term savings growth, addressing the risks of sudden income loss inherent in traditional early retirement or complete downshifting.

Mini-Retirement Gap Years

Mini-retirement gap years offer a flexible alternative to early retirement, allowing individuals to pause work periodically without permanently exiting their careers. This approach supports sustained income and career growth while enabling meaningful travel and personal development during strategic breaks.

Downshifting Lifestyle Design

Downshifting lifestyle design emphasizes reducing work hours and simplifying daily commitments to enhance personal well-being and achieve a balanced life without fully retiring. This approach fosters sustainable goal attainment by prioritizing meaningful activities and financial flexibility over complete withdrawal from the workforce.

Partial Income Strategy

Early retirement often requires a significant accumulation of savings to sustain a full income replacement, whereas downshifting leverages a partial income strategy by reducing expenses and supplementing with part-time work or passive income streams. This approach balances financial security with lifestyle flexibility, enabling gradual transition without complete dependence on retirement funds.

YOLO (You Only Live Once) Retirement

YOLO Retirement emphasizes prioritizing life enjoyment now by choosing early retirement to maximize freedom and experiences rather than incremental career steps. Downshifting, in contrast, reduces work intensity while maintaining employment income, balancing financial stability with increased personal time.

Unretirement Pathways

Early retirement and downshifting both offer flexible unretirement pathways by enabling individuals to pursue meaningful work or passion projects post-career, fostering financial independence without full withdrawal from the workforce. Strategic planning of income streams and lifestyle adjustments in these approaches maximizes long-term satisfaction and purpose beyond traditional retirement.

Early Retirement vs Downshifting for goal. Infographic

moneydiff.com

moneydiff.com