An emergency fund is designed to cover unexpected expenses like medical bills or car repairs, providing financial security during sudden crises. A sinking fund, on the other hand, is a savings strategy for planned future expenses such as vacations, home repairs, or pet care, helping to avoid debt by spreading out costs over time. Differentiating between these two funds ensures effective money management and financial stability by addressing both unforeseen emergencies and anticipated costs.

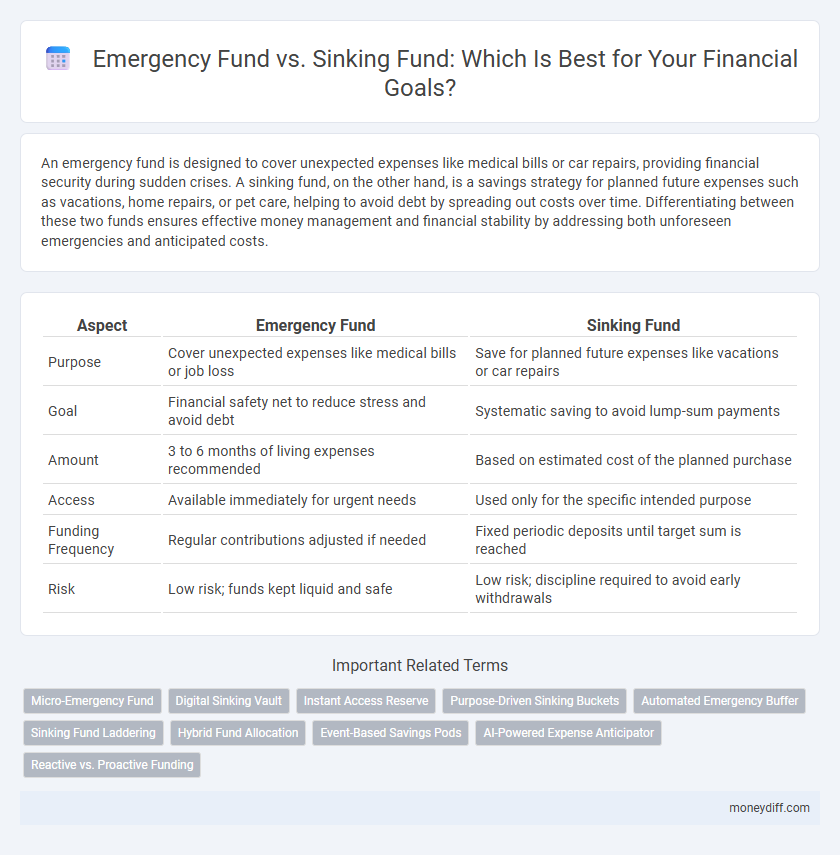

Table of Comparison

| Aspect | Emergency Fund | Sinking Fund |

|---|---|---|

| Purpose | Cover unexpected expenses like medical bills or job loss | Save for planned future expenses like vacations or car repairs |

| Goal | Financial safety net to reduce stress and avoid debt | Systematic saving to avoid lump-sum payments |

| Amount | 3 to 6 months of living expenses recommended | Based on estimated cost of the planned purchase |

| Access | Available immediately for urgent needs | Used only for the specific intended purpose |

| Funding Frequency | Regular contributions adjusted if needed | Fixed periodic deposits until target sum is reached |

| Risk | Low risk; funds kept liquid and safe | Low risk; discipline required to avoid early withdrawals |

Understanding Emergency Funds and Sinking Funds

Emergency funds are savings set aside to cover unexpected expenses such as medical emergencies, car repairs, or sudden job loss, providing financial security during unforeseen situations. Sinking funds, on the other hand, are planned savings allocated for known future expenses like annual insurance premiums, holiday gifts, or home maintenance costs, allowing for systematic money management without debt. Differentiating these funds helps individuals build a resilient financial plan by addressing both unpredictable emergencies and predictable expenses.

Key Differences Between Emergency and Sinking Funds

Emergency funds provide immediate financial backup for unexpected expenses such as medical emergencies or job loss, typically covering three to six months of living costs. Sinking funds are savings allocated for planned expenses like a car replacement or vacation, systematically accumulated over time to avoid debt. The primary difference lies in the purpose and flexibility: emergency funds are liquid and reserved strictly for unforeseen events, while sinking funds are pre-planned and used for predictable future costs.

The Purpose of an Emergency Fund

An emergency fund is specifically designed to cover unexpected expenses such as medical emergencies, car repairs, or sudden job loss, providing financial security and peace of mind. It typically holds three to six months' worth of essential living expenses in liquid assets to ensure quick access during crises. Unlike sinking funds, which are allocated for planned future purchases or bills, an emergency fund safeguards against unforeseen financial setbacks.

Why You Need a Sinking Fund

A sinking fund is essential for managing predictable large expenses by setting aside small, regular amounts to avoid financial strain or debt when payments are due. Unlike an emergency fund that covers unexpected costs, a sinking fund provides a disciplined approach to saving for planned expenses such as home repairs, car maintenance, or insurance premiums. This strategic allocation helps maintain cash flow stability and prevents disruption to your overall budget.

How to Build an Emergency Fund

Start building an emergency fund by calculating three to six months' worth of essential living expenses, such as rent, utilities, groceries, and healthcare costs. Set up automatic monthly transfers to a high-yield savings account dedicated exclusively to this fund to ensure consistent growth. Prioritize liquidity and accessibility in the account choice to cover unexpected financial emergencies without penalties or delays.

Steps to Establish a Sinking Fund

Identify specific future expenses and assign a monetary target for each sinking fund category to ensure precise budgeting. Divide the total amount needed by the number of months until the expense is due, establishing a consistent monthly contribution that aligns with your financial plan. Monitor and adjust contributions regularly to accommodate changes in expenses or timelines, optimizing fund availability without disrupting overall cash flow.

When to Use Your Emergency Fund

Use your emergency fund exclusively for unexpected, urgent expenses such as job loss, medical emergencies, or urgent car repairs to maintain financial stability. Avoid dipping into this fund for planned or predictable costs, which are better managed through a sinking fund designed for non-emergency goals like vacations or home improvements. Maintaining a clear distinction ensures your emergency fund remains a reliable safety net during true financial crises.

Ideal Situations for Sinking Fund Usage

A sinking fund is ideal for planned expenses such as property taxes, annual insurance premiums, or large home repairs, enabling smooth, manageable payments over time without disrupting your budget. Unlike emergency funds, which cover unexpected costs, sinking funds allocate money systematically for predictable financial obligations. This approach ensures financial stability by preventing reliance on credit or dipping into critical reserves during routine, foreseeable payments.

Prioritizing Emergency vs Sinking Fund in Your Budget

Prioritizing an emergency fund over a sinking fund ensures immediate financial security by covering unexpected expenses such as medical emergencies or sudden job loss, typically aiming to save three to six months' worth of living costs. A sinking fund, used for planned future expenses like vacations or large purchases, becomes relevant once the emergency fund is adequately established. Allocating budget first to the emergency fund reduces financial risks and provides a safety net before diverting resources to sinking funds for strategic savings.

Integrating Both Funds for Effective Money Management

Integrating an emergency fund and a sinking fund enhances financial stability by addressing both unexpected expenses and planned future costs, ensuring readiness without disrupting long-term goals. Allocating a portion of income to each fund systematically builds reserves, reducing reliance on credit and preventing financial stress during emergencies or large purchases. Employing a structured approach with clear contribution targets and regular reviews optimizes fund growth and alignment with evolving financial priorities.

Related Important Terms

Micro-Emergency Fund

A Micro-Emergency Fund targets small, unexpected expenses like minor car repairs or urgent medical needs, providing quick financial relief without impacting monthly budgets. Unlike a Sinking Fund, which is allocated for known future expenses such as vacations or large purchases, a Micro-Emergency Fund prioritizes immediate accessibility and financial stability.

Digital Sinking Vault

A Digital Sinking Vault offers a secure and automated way to allocate funds specifically for planned future expenses, contrasting with an Emergency Fund that covers unexpected financial crises. This targeted savings approach enhances money management by ensuring dedicated reserves for known obligations while maintaining liquidity for emergencies.

Instant Access Reserve

An Emergency Fund provides instant access reserve for unexpected expenses like medical emergencies or urgent repairs, ensuring financial stability without incurring debt. A Sinking Fund, while valuable for planned future purchases, typically lacks the liquidity of an emergency fund and is less suited for immediate access needs.

Purpose-Driven Sinking Buckets

Emergency funds provide immediate financial security for unexpected expenses like medical emergencies or job loss, while sinking funds are purpose-driven saving buckets tailored for planned future expenses such as vacations, home repairs, or annual insurance premiums. Allocating money into sinking buckets helps manage cash flow effectively, preventing debt accumulation by spreading out large anticipated costs over time.

Automated Emergency Buffer

An Automated Emergency Buffer serves as an essential component of an Emergency Fund by ensuring quick access to cash for unexpected expenses without manual intervention, enhancing financial security and stress reduction. Unlike a Sinking Fund, which is designated for planned future expenses, the Automated Emergency Buffer dynamically adjusts contributions based on spending patterns to maintain optimal fund levels.

Sinking Fund Laddering

Sinking fund laddering involves creating multiple sinking funds with staggered target dates and amounts to cover future expenses systematically, improving cash flow management and reducing financial stress. This strategy contrasts with a single emergency fund by allocating resources for specific planned costs like car repairs or vacations, ensuring liquidity without depleting reserves meant for unexpected emergencies.

Hybrid Fund Allocation

A hybrid fund allocation strategically combines an emergency fund with a sinking fund to optimize financial preparedness by balancing immediate liquidity and planned savings for future expenses. This approach enhances money management by ensuring quick access to cash for unexpected events while systematically accumulating funds for anticipated costs, improving overall financial stability and goal achievement.

Event-Based Savings Pods

Emergency funds provide immediate financial security for unexpected expenses like medical emergencies or urgent repairs, while sinking funds are targeted savings pools allocated for planned, event-based expenses such as vacations, car maintenance, or holiday gifts. Organizing money into event-based savings pods through sinking funds enables precise budgeting and prevents overspending by setting aside specific amounts for future predictable costs.

AI-Powered Expense Anticipator

The AI-Powered Expense Anticipator enhances money management by distinguishing between an emergency fund, designed for unexpected, high-priority expenses, and a sinking fund, allocated for planned future purchases with predictable costs. Utilizing predictive analytics, this technology optimizes fund allocation, ensuring liquidity for emergencies while systematically saving for recurring obligations.

Reactive vs. Proactive Funding

An emergency fund serves as a reactive financial buffer, covering unexpected expenses like medical bills or urgent repairs, while a sinking fund represents proactive saving for planned future costs such as vacations, car replacements, or home improvements. Prioritizing both funds ensures comprehensive money management, balancing immediate financial shocks with strategic spending goals.

Emergency Fund vs Sinking Fund for money management. Infographic

moneydiff.com

moneydiff.com