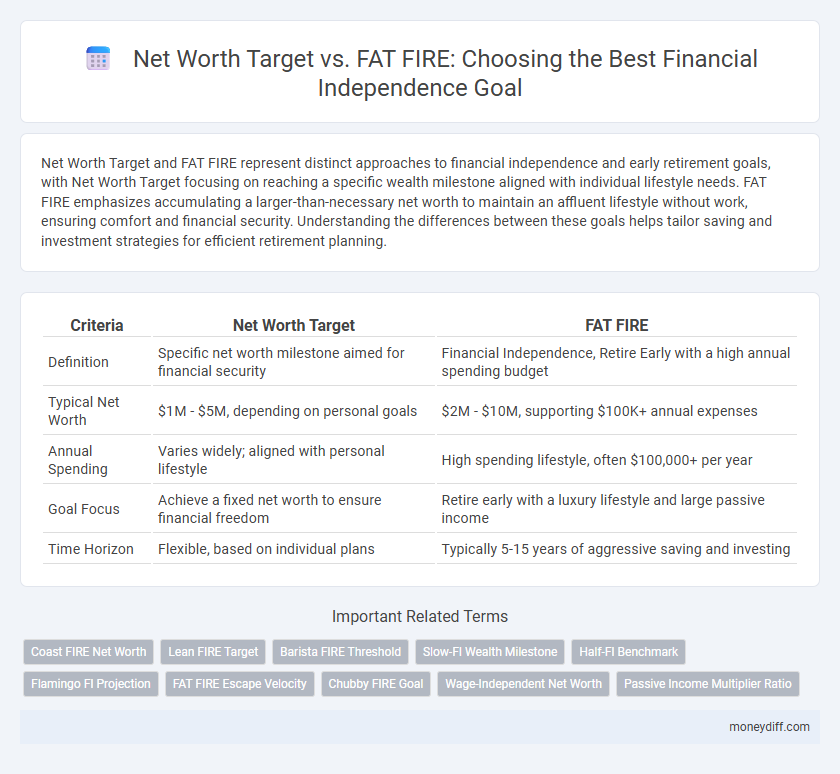

Net Worth Target and FAT FIRE represent distinct approaches to financial independence and early retirement goals, with Net Worth Target focusing on reaching a specific wealth milestone aligned with individual lifestyle needs. FAT FIRE emphasizes accumulating a larger-than-necessary net worth to maintain an affluent lifestyle without work, ensuring comfort and financial security. Understanding the differences between these goals helps tailor saving and investment strategies for efficient retirement planning.

Table of Comparison

| Criteria | Net Worth Target | FAT FIRE |

|---|---|---|

| Definition | Specific net worth milestone aimed for financial security | Financial Independence, Retire Early with a high annual spending budget |

| Typical Net Worth | $1M - $5M, depending on personal goals | $2M - $10M, supporting $100K+ annual expenses |

| Annual Spending | Varies widely; aligned with personal lifestyle | High spending lifestyle, often $100,000+ per year |

| Goal Focus | Achieve a fixed net worth to ensure financial freedom | Retire early with a luxury lifestyle and large passive income |

| Time Horizon | Flexible, based on individual plans | Typically 5-15 years of aggressive saving and investing |

Defining Net Worth Target and FAT FIRE

Defining a Net Worth Target involves establishing a specific financial milestone based on assets, liabilities, and projected expenses to achieve financial security or independence. FAT FIRE (Financial Independence, Retire Early) focuses on accumulating a high net worth that supports a more luxurious lifestyle, typically requiring a net worth much larger than basic FIRE goals. Both concepts emphasize achieving financial freedom, but FAT FIRE sets a more ambitious net worth target to sustain higher annual spending.

Key Differences Between Net Worth Target and FAT FIRE

Net Worth Target emphasizes a specific financial milestone representing total assets minus liabilities, serving as a quantitative benchmark for wealth accumulation. FAT FIRE focuses on achieving financial independence with a high-income lifestyle, prioritizing sustainable passive income that supports elevated living expenses without employment. The key difference lies in Net Worth Target being a static figure goal, while FAT FIRE centers on maintaining cash flow streams for ongoing financial freedom.

Setting a Net Worth Target: Steps and Strategies

Setting a net worth target involves analyzing current assets, liabilities, and income streams to establish a realistic financial milestone aligned with personal goals. In comparison to FAT FIRE, which prioritizes achieving early financial independence with a high net worth to support an affluent lifestyle, setting a net worth target requires detailed budgeting, investment planning, and risk assessment to ensure steady growth. Employing strategies such as diversified investment portfolios, consistent savings plans, and regular financial reviews enhances the likelihood of meeting or exceeding the set net worth goals within the desired timeframe.

FAT FIRE: Meaning and Core Principles

FAT FIRE stands for Financial Independence, Retire Early with a focus on lavish lifestyle and high spending post-retirement, aiming for a net worth significantly above typical FIRE targets. Core principles include aggressive savings, diversified investments, and substantial passive income streams to maintain a luxurious standard of living without financial stress. Unlike standard net worth targets that prioritize bare minimum needs, FAT FIRE emphasizes wealth accumulation that supports extensive travel, premium housing, and discretionary spending.

Financial Independence: Calculating Your Personal Numbers

Calculating your net worth target involves assessing assets, liabilities, and realistic withdrawal rates, critical for achieving FAT FIRE (Financial Independence, Retire Early, Financial Independence Retire Early) goals. FAT FIRE typically requires a net worth of seven to eight times your annual expenses, often exceeding $2 million, ensuring sustainable passive income streams. Personalizing these numbers demands detailed budgeting, investment growth projections, and contingency planning to secure long-term financial independence.

Risk Management in Net Worth vs. FAT FIRE Approaches

Risk management in Net Worth Target strategies emphasizes preserving capital by setting conservative withdrawal rates and maintaining diversified investment portfolios, reducing exposure to market volatility. FAT FIRE approaches typically involve higher spending goals requiring more aggressive growth strategies, which increases risk but aims for financial independence faster. Balancing these approaches necessitates evaluating personal risk tolerance and adjusting asset allocation to mitigate potential losses while striving to meet long-term financial freedom objectives.

Lifestyle Choices: Traditional FIRE vs. FAT FIRE

Traditional FIRE emphasizes a frugal lifestyle with a lower net worth target, often around $1 million to $2 million, focusing on minimal expenses to achieve early retirement. FAT FIRE targets a significantly higher net worth, typically $2 million or more, enabling a luxurious lifestyle with premium travel, dining, and housing options. Lifestyle choices between these approaches directly impact savings rates, investment strategies, and retirement timelines.

Investment Strategies for Achieving Each Goal

Achieving a Net Worth target requires diversified investment strategies such as balanced portfolios combining equities, bonds, and real estate to ensure steady growth and risk management. FAT FIRE goals demand more aggressive investment approaches, including higher allocations to growth stocks, private equity, and tax-efficient vehicles to accelerate wealth accumulation. Both targets benefit from disciplined contributions, periodic portfolio rebalancing, and leveraging compound interest over time.

Monitoring Progress: Tracking Net Worth vs. FIRE Milestones

Tracking net worth against FAT FIRE milestones provides a clear metric for financial independence progress, allowing individuals to adjust savings rates and investment strategies dynamically. Consistent monitoring of asset growth, debt reduction, and passive income streams ensures alignment with aggressive FAT FIRE targets, typically exceeding a $1 million net worth with annual expenses of at least $100,000. Utilizing financial dashboards and quarterly reviews enhances goal visibility, enabling timely course corrections to meet or surpass net worth thresholds required for FAT FIRE lifestyles.

Choosing the Right Goal: Which Path Fits Your Needs?

Choosing between a net worth target and FAT FIRE depends on your financial aspirations and lifestyle preferences. A net worth target emphasizes accumulating specific assets and investments, offering flexibility and gradual growth, while FAT FIRE aims for early retirement with a high-expense budget supported by robust passive income streams. Assessing your risk tolerance, spending habits, and long-term vision helps determine which goal aligns best with your personal and financial needs.

Related Important Terms

Coast FIRE Net Worth

Coast FIRE net worth allows individuals to reach their retirement goal by accumulating enough savings early on so their investments grow to a FAT FIRE target without additional contributions. Achieving Coast FIRE net worth means securing financial independence with a passive growth strategy, reducing the pressure to save aggressively while ensuring a luxurious FAT FIRE lifestyle upon retirement.

Lean FIRE Target

A Lean FIRE target typically requires a net worth significantly lower than the FAT FIRE benchmark, focusing on covering essential living expenses with a frugal lifestyle. While FAT FIRE aims for financial independence with luxury spending, Lean FIRE prioritizes sustainability and minimalism to achieve early retirement with reduced financial stress.

Barista FIRE Threshold

The Barista FIRE threshold represents a net worth target that balances moderate passive income with part-time work to cover living expenses, typically set between $250,000 and $500,000 depending on location and lifestyle. This approach contrasts with the FAT FIRE goal, which requires a significantly higher net worth, often exceeding $1 million, to sustain a luxurious lifestyle without any employment income.

Slow-FI Wealth Milestone

Setting a Net Worth Target aligned with Slow-FI principles emphasizes steady, sustainable growth rather than rapid accumulation typical of FAT FIRE goals. Prioritizing long-term wealth milestones through consistent saving and mindful spending supports financial freedom with reduced stress and greater life balance.

Half-FI Benchmark

Net Worth Target benchmarks for FAT FIRE often exceed $2 million, while the Half-FI benchmark, representing a more attainable goal, targets approximately $1 million in investable assets to cover partial financial independence expenses. This Half-FI threshold allows individuals to reduce work hours significantly, offering a practical middle ground between traditional FIRE goals and full FAT FIRE aspirations.

Flamingo FI Projection

Flamingo FI Projection highlights the key differences between a Net Worth Target and FAT FIRE by emphasizing sustainable withdrawal rates and lifestyle inflation control to maximize financial independence. By focusing on accurate expense forecasting and investment growth assumptions, Flamingo FI enables investors to set realistic, tax-efficient goals tailored to long-term wealth preservation and early retirement success.

FAT FIRE Escape Velocity

Achieving FAT FIRE escape velocity requires accelerating net worth growth to surpass a threshold where passive income fully covers lifestyle expenses, enabling financial independence significantly earlier than traditional FIRE goals. This target often exceeds standard net worth milestones by incorporating higher savings rates and investment returns aligned with an elevated cost of living.

Chubby FIRE Goal

Chubby FIRE targets a net worth high enough to support a comfortable yet not ultra-frugal lifestyle, balancing financial independence with lifestyle flexibility. Unlike FAT FIRE, which demands a significantly larger net worth to maintain luxury expenses, Chubby FIRE aims for moderate wealth accumulation that ensures both security and enjoyment without extreme budgeting.

Wage-Independent Net Worth

Wage-independent net worth, a crucial metric for long-term financial freedom, represents assets that generate sufficient passive income to cover living expenses without relying on wages. Comparing net worth targets to FAT FIRE benchmarks highlights the importance of building diversified investments and income streams to achieve sustainable early retirement goals.

Passive Income Multiplier Ratio

Net Worth Target measures financial wealth accumulation, while FAT FIRE emphasizes achieving a high Passive Income Multiplier Ratio to sustain an affluent lifestyle without active work. Focusing on the Passive Income Multiplier Ratio highlights how much passive income generation is required relative to expenses to maintain FAT FIRE standards efficiently.

Net Worth Target vs FAT FIRE for goal. Infographic

moneydiff.com

moneydiff.com