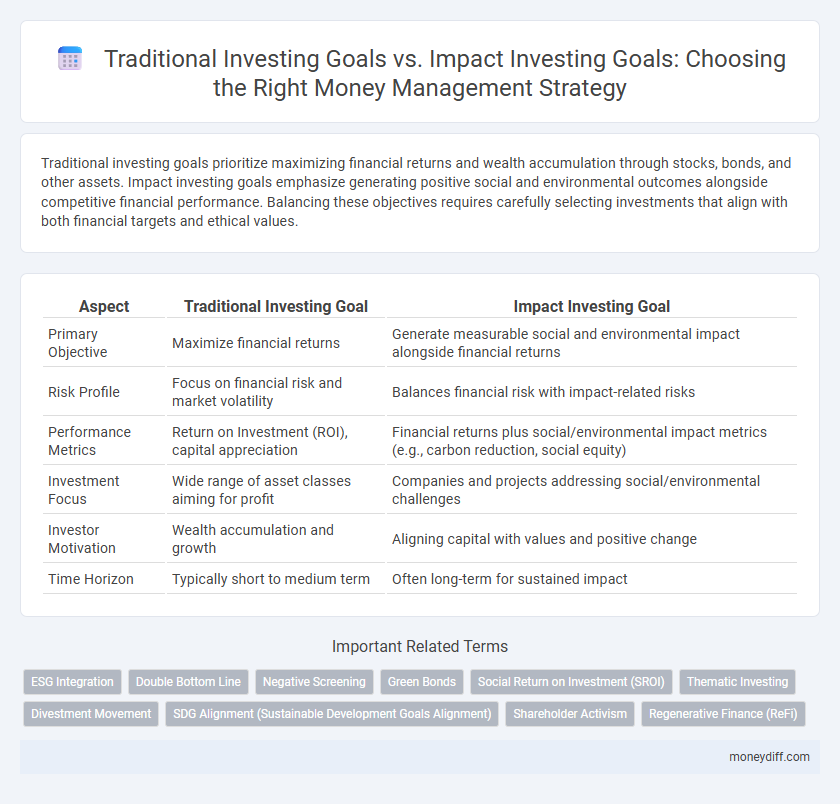

Traditional investing goals prioritize maximizing financial returns and wealth accumulation through stocks, bonds, and other assets. Impact investing goals emphasize generating positive social and environmental outcomes alongside competitive financial performance. Balancing these objectives requires carefully selecting investments that align with both financial targets and ethical values.

Table of Comparison

| Aspect | Traditional Investing Goal | Impact Investing Goal |

|---|---|---|

| Primary Objective | Maximize financial returns | Generate measurable social and environmental impact alongside financial returns |

| Risk Profile | Focus on financial risk and market volatility | Balances financial risk with impact-related risks |

| Performance Metrics | Return on Investment (ROI), capital appreciation | Financial returns plus social/environmental impact metrics (e.g., carbon reduction, social equity) |

| Investment Focus | Wide range of asset classes aiming for profit | Companies and projects addressing social/environmental challenges |

| Investor Motivation | Wealth accumulation and growth | Aligning capital with values and positive change |

| Time Horizon | Typically short to medium term | Often long-term for sustained impact |

Defining Traditional Investing Goals

Traditional investing goals primarily focus on capital preservation, wealth accumulation, and achieving desired financial returns within a specific risk tolerance. Investors aim to maximize monetary gains through diversified portfolios, balancing stocks, bonds, and other asset classes to optimize growth and income over time. These goals emphasize financial metrics such as return on investment, annualized growth rates, and portfolio volatility rather than social or environmental outcomes.

Understanding Impact Investing Goals

Traditional investing goals primarily focus on maximizing financial returns and portfolio growth through risk-adjusted asset allocation. Impact investing goals emphasize generating measurable social and environmental benefits alongside competitive financial performance. Understanding impact investing involves integrating intentionality, additionality, and metrics for positive impact into investment decision-making for sustainable value creation.

Core Principles of Traditional Investing

Traditional investing goals primarily focus on maximizing financial returns while managing risk through portfolio diversification, asset allocation, and market analysis. Core principles emphasize capital preservation, liquidity, and optimizing growth potential to achieve long-term wealth accumulation. This approach relies on quantitative metrics and historical performance to guide investment decisions, prioritizing financial gain over social or environmental outcomes.

Core Principles of Impact Investing

Traditional investing goals prioritize maximizing financial returns through asset growth and risk management, emphasizing profit and market performance. Impact investing goals integrate environmental, social, and governance (ESG) criteria to generate measurable positive social or environmental impact alongside financial returns. Core principles of impact investing include intentionality, measurement of impact outcomes, and additionality, ensuring investments contribute to sustainable change beyond financial gain.

Risk and Return Expectations

Traditional investing goals typically prioritize maximizing financial returns while managing risk through diversification strategies based on historical market performance. Impact investing goals integrate financial return expectations with measurable social or environmental outcomes, often accepting moderate risk levels to achieve both profit and positive societal impact. Risk tolerance in impact investing can vary widely, reflecting the dual objectives of financial sustainability and intentional impact, which may influence return volatility compared to traditional portfolios.

Balancing Financial and Social Outcomes

Traditional investing goals primarily target maximizing financial returns through portfolios focused on stocks, bonds, and other assets with established market performance metrics. Impact investing goals balance financial profitability with measurable social or environmental benefits, integrating criteria that assess positive outcomes alongside monetary gains. Effective money management strategies increasingly emphasize aligning investment choices with both financial objectives and social responsibility metrics to achieve sustainable value.

Time Horizons in Traditional vs Impact Investing

Traditional investing goals often prioritize short- to medium-term financial returns, typically aiming for portfolio growth within 3 to 5 years. Impact investing goals emphasize longer time horizons, usually spanning 7 to 10 years or more, to allow measurable social or environmental outcomes to materialize alongside financial returns. This extended timeframe reflects the dual objective of achieving sustainable impact while maintaining financial viability.

Measuring Success: Profit vs Purpose

Traditional investing goals prioritize maximizing financial returns and portfolio growth as the primary measures of success. Impact investing goals evaluate success by the positive social and environmental outcomes generated alongside financial performance. Measuring success in traditional investing focuses on profit metrics like ROI and CAGR, whereas impact investing integrates qualitative and quantitative impact assessments to align investments with broader purpose-driven objectives.

Aligning Personal Values with Investing Goals

Traditional investing goals prioritize maximizing financial returns and managing risk to grow wealth over time, often without explicit consideration of ethical or social factors. Impact investing goals integrate personal values by targeting investments that generate measurable social or environmental benefits alongside financial gains. Aligning personal values with investing encourages a more purpose-driven portfolio, fostering long-term satisfaction and responsible capital allocation.

Choosing the Right Strategy for Your Money Management

Traditional investing goals prioritize maximizing financial returns through growth and income, focusing primarily on portfolio diversification and risk-adjusted performance. Impact investing goals seek measurable social and environmental benefits alongside financial gains, aligning investment choices with personal values and sustainability criteria. Choosing the right strategy involves evaluating your priorities between financial objectives and social impact, balancing risk tolerance, time horizon, and desired outcomes.

Related Important Terms

ESG Integration

Traditional investing goals primarily emphasize maximizing financial returns through diversified portfolios, while impact investing goals prioritize generating measurable social and environmental benefits alongside financial gains. ESG integration in impact investing involves systematically evaluating environmental, social, and governance factors to align investments with sustainable and ethical outcomes.

Double Bottom Line

Traditional investing goals prioritize maximizing financial returns, while impact investing goals integrate measurable social and environmental benefits alongside profit generation, embodying the double bottom line approach that balances economic performance with positive societal impact. This dual focus enables investors to achieve competitive financial growth while actively contributing to sustainable development and social responsibility.

Negative Screening

Traditional investing goals prioritize maximizing financial returns and minimizing risk, often relying on negative screening to exclude industries like tobacco or fossil fuels solely for ethical or regulatory compliance. Impact investing goals employ negative screening not just to avoid harm but to actively align portfolios with social and environmental values, aiming for measurable positive change alongside competitive financial performance.

Green Bonds

Traditional investing goals primarily emphasize maximizing financial returns and capital preservation, often prioritizing market performance and risk-adjusted gains. Impact investing goals, particularly through green bonds, focus on generating measurable environmental benefits by funding sustainable projects while still providing competitive financial returns.

Social Return on Investment (SROI)

Traditional investing goals prioritize maximizing financial returns and capital growth, often overlooking social or environmental impact. Impact investing goals integrate Social Return on Investment (SROI) metrics to measure and optimize both financial performance and positive societal outcomes, aligning money management with sustainable development objectives.

Thematic Investing

Traditional investing goals primarily focus on maximizing financial returns and wealth accumulation through diversified portfolios, while impact investing goals emphasize generating positive social or environmental outcomes alongside financial gains. Thematic investing leverages targeted sectors such as renewable energy, healthcare innovation, or sustainable agriculture to align investment strategies with specific impact objectives, integrating both profit and purpose.

Divestment Movement

Traditional investing goals prioritize maximizing financial returns and minimizing risk over a set investment horizon, often without explicit consideration of social or environmental outcomes. Impact investing goals integrate financial performance with intentional investments aimed at generating measurable positive social or environmental impact, with the Divestment Movement specifically targeting the withdrawal of funds from fossil fuels to drive climate action and sustainable economic transition.

SDG Alignment (Sustainable Development Goals Alignment)

Traditional investing goals primarily focus on maximizing financial returns and managing risks, whereas impact investing goals prioritize aligning investment portfolios with Sustainable Development Goals (SDGs) to generate positive social and environmental outcomes. Emphasizing SDG alignment in impact investing encourages capital deployment toward projects promoting clean energy, poverty reduction, and quality education, integrating purpose-driven objectives alongside financial performance.

Shareholder Activism

Traditional investing goals prioritize maximizing financial returns and shareholder value, often focusing on short-term profits and market performance. Impact investing goals emphasize generating positive social and environmental outcomes alongside financial returns, with shareholder activism playing a critical role in influencing corporate policies for sustainable change.

Regenerative Finance (ReFi)

Traditional investing goals prioritize financial returns and portfolio growth, emphasizing risk-adjusted performance metrics. Impact investing goals in Regenerative Finance (ReFi) focus on generating positive environmental and social outcomes alongside competitive financial returns, promoting ecosystem restoration and sustainable development.

Traditional Investing Goal vs Impact Investing Goal for money management. Infographic

moneydiff.com

moneydiff.com