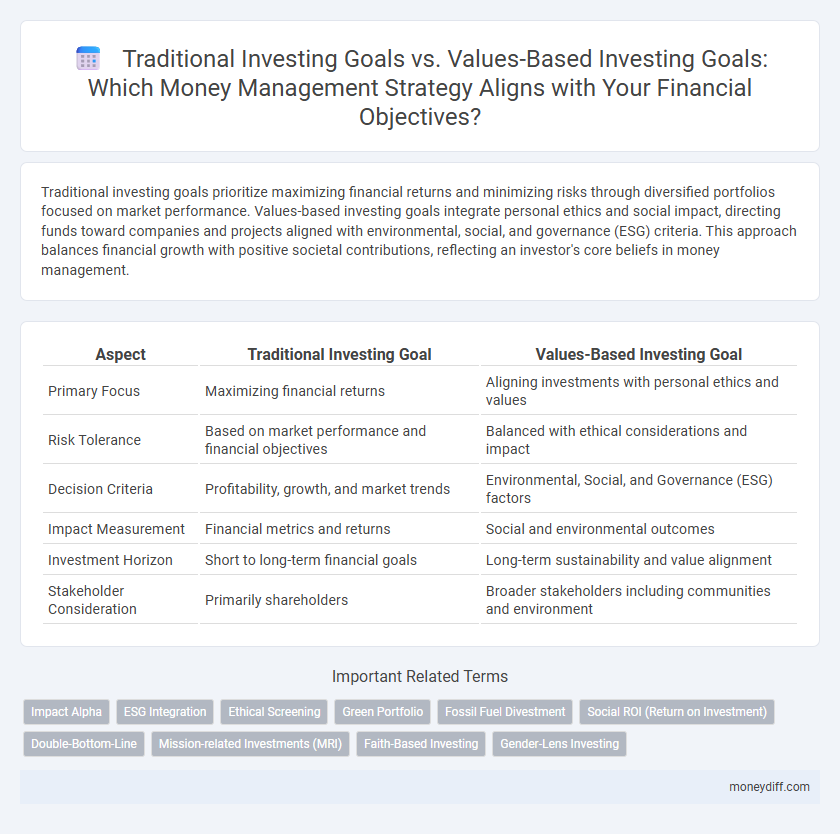

Traditional investing goals prioritize maximizing financial returns and minimizing risks through diversified portfolios focused on market performance. Values-based investing goals integrate personal ethics and social impact, directing funds toward companies and projects aligned with environmental, social, and governance (ESG) criteria. This approach balances financial growth with positive societal contributions, reflecting an investor's core beliefs in money management.

Table of Comparison

| Aspect | Traditional Investing Goal | Values-Based Investing Goal |

|---|---|---|

| Primary Focus | Maximizing financial returns | Aligning investments with personal ethics and values |

| Risk Tolerance | Based on market performance and financial objectives | Balanced with ethical considerations and impact |

| Decision Criteria | Profitability, growth, and market trends | Environmental, Social, and Governance (ESG) factors |

| Impact Measurement | Financial metrics and returns | Social and environmental outcomes |

| Investment Horizon | Short to long-term financial goals | Long-term sustainability and value alignment |

| Stakeholder Consideration | Primarily shareholders | Broader stakeholders including communities and environment |

Defining Traditional Investing Goals

Traditional investing goals primarily focus on maximizing financial returns through risk-adjusted strategies, targeting wealth accumulation, income generation, and capital preservation. These goals emphasize measurable outcomes like portfolio growth, diversification, and achieving specific monetary benchmarks for retirement or major purchases. Investors often prioritize maximizing returns within acceptable risk levels, aligning with long-term financial objectives rather than personal or ethical considerations.

Understanding Values-Based Investing Goals

Values-based investing goals prioritize aligning financial decisions with personal ethics, social responsibility, and environmental impact, contrasting with traditional investing goals focused primarily on maximizing financial returns. This approach integrates values such as sustainability, community support, and corporate governance into portfolio selection, promoting long-term positive change alongside economic growth. Understanding values-based investing goals helps investors create meaningful portfolios that reflect their beliefs while pursuing financial security.

Key Differences Between Traditional and Values-Based Investing

Traditional investing goals prioritize maximizing financial returns through risk-adjusted strategies and market diversification, focusing on metrics like ROI and portfolio growth. Values-based investing goals integrate ethical, social, and environmental criteria, aligning investments with personal or organizational principles to support sustainability and social impact. The key difference lies in the balance between profit maximization and aligning investments with core values, influencing asset selection and risk tolerance.

Risk Tolerance and Reward Expectations

Traditional investing goals emphasize maximizing financial returns based on predefined risk tolerance levels and market performance metrics. Values-based investing goals prioritize aligning investments with personal or societal values, often accepting variable risk tolerance to achieve positive social or environmental impact alongside financial rewards. Risk tolerance in values-based investing may be more flexible, reflecting a balance between expected financial returns and adherence to ethical criteria.

Aligning Investments with Personal Values

Traditional investing goals prioritize maximizing financial returns and minimizing risk, often measured through quantitative benchmarks like ROI or portfolio diversification. Values-based investing goals emphasize aligning investment choices with personal ethics, social responsibility, and environmental sustainability, integrating criteria such as ESG (Environmental, Social, and Governance) factors. This approach fosters intentional money management by ensuring investments reflect individual beliefs while striving for competitive financial performance.

Performance Metrics: Financial Returns vs. Social Impact

Traditional investing goals prioritize financial returns measured through performance metrics such as ROI, Sharpe ratio, and annualized growth rates. Values-based investing goals emphasize social impact alongside financial performance, incorporating metrics like ESG scores, carbon footprint reduction, and community development outcomes. Investors balancing these approaches seek a portfolio that both generates competitive financial returns and advances measurable social or environmental benefits.

Portfolio Diversification Strategies

Traditional investing goals prioritize maximizing returns and minimizing risk through portfolio diversification strategies that allocate assets across stocks, bonds, and alternative investments based on market performance and volatility metrics. Values-based investing goals integrate ethical, environmental, and social criteria into diversification, selecting assets that align with investors' personal beliefs while aiming for competitive financial returns. Combining both approaches involves balancing financial objectives with ESG factors, resulting in a diversified portfolio that supports sustainable impact without sacrificing growth potential.

Measuring Success in Different Investing Approaches

Traditional investing goals prioritize quantifiable financial metrics such as return on investment (ROI), portfolio growth, and risk-adjusted performance measured through benchmarks like the S&P 500 or Sharpe ratio. Values-based investing goals emphasize alignment with personal or ethical principles, evaluating success by social impact metrics, environmental, social, and governance (ESG) scores, and the fulfillment of investor-driven causes alongside financial returns. Measuring success in these approaches requires integrating financial performance data with qualitative assessments of social and environmental outcomes to reflect the investor's comprehensive objectives.

Challenges and Barriers to Values-Based Investing

Traditional investing goals prioritize maximizing financial returns, often relying on quantitative metrics and market trends, which can overshadow personal values and social impact. Values-based investing faces challenges such as limited availability of comprehensive ESG data, potential trade-offs between financial performance and ethical considerations, and a lack of standardized criteria for measuring impact. Investors also encounter barriers including higher costs, complexity in assessing non-financial factors, and skepticism from traditional financial advisors.

Choosing the Right Strategy for Your Money Management Goals

Traditional investing goals prioritize maximizing financial returns and growing wealth through diversified asset allocation and risk management. Values-based investing goals emphasize aligning investments with personal ethics, such as environmental sustainability or social responsibility, while still seeking competitive returns. Choosing the right strategy depends on balancing financial objectives with individual values to optimize both portfolio performance and personal fulfillment.

Related Important Terms

Impact Alpha

Traditional investing goals prioritize maximizing financial returns and capital growth through diversified asset allocation, while values-based investing goals focus on aligning portfolios with personal ethics and social impact criteria. Impact Alpha highlights this shift by showcasing how values-based investors seek measurable social and environmental outcomes alongside competitive financial performance.

ESG Integration

Traditional investing goals prioritize maximizing financial returns and managing risk through diversified portfolios, often emphasizing short-term performance metrics. Values-based investing goals incorporate ESG integration, aligning investment decisions with environmental, social, and governance criteria to achieve positive societal impact alongside competitive financial outcomes.

Ethical Screening

Traditional investing goals prioritize maximizing financial returns and minimizing risk through diversified portfolios, often without explicit consideration of social or environmental impacts. Values-based investing goals emphasize ethical screening by selecting investments that align with personal or organizational values, such as environmental sustainability, social responsibility, and corporate governance standards, thereby integrating moral principles into money management decisions.

Green Portfolio

Traditional investing goals prioritize maximizing financial returns and minimizing risks through diversified asset allocation, while values-based investing goals emphasize aligning investments with personal ethics and sustainability principles. A green portfolio specifically targets environmentally responsible companies, aiming to generate positive ecological impact alongside competitive financial performance.

Fossil Fuel Divestment

Traditional investing goals prioritize maximizing financial returns and managing risk through diversified asset allocation, often without regard to the social or environmental impact of the investments. Values-based investing goals, particularly fossil fuel divestment, focus on aligning portfolios with ethical considerations by excluding investments in fossil fuel companies to promote sustainability and combat climate change while still seeking competitive financial performance.

Social ROI (Return on Investment)

Traditional investing goals primarily focus on maximizing financial returns and growing wealth over time, emphasizing quantitative metrics like ROI and portfolio diversification. Values-based investing goals prioritize generating a positive Social ROI by aligning investments with ethical principles, environmental sustainability, and social impact to create meaningful change alongside financial growth.

Double-Bottom-Line

Traditional investing goals primarily focus on maximizing financial returns and portfolio growth, emphasizing metrics like ROI and capital appreciation; values-based investing goals integrate social and environmental impact alongside financial performance, reflecting a double-bottom-line approach that balances profit with purpose. This approach enables investors to align capital allocation with personal or organizational ethics while pursuing sustainable long-term value creation.

Mission-related Investments (MRI)

Mission-related investments (MRI) align financial returns with social or environmental objectives, contrasting traditional investing goals focused primarily on maximizing financial gain. MRI integrates core values into money management, driving positive impact while sustaining economic performance.

Faith-Based Investing

Faith-based investing prioritizes aligning financial goals with spiritual values, seeking to generate social impact alongside competitive financial returns. Traditional investing goals emphasize maximizing profits and portfolio growth without necessarily incorporating ethical or religious considerations.

Gender-Lens Investing

Traditional investing goals prioritize maximizing financial returns and capital growth, often without considering social impacts, while values-based investing goals integrate financial success with ethical considerations such as Gender-Lens Investing, which aims to promote gender equality and empower women through targeted investment strategies. Gender-Lens Investing supports companies that advance women's economic participation, leadership, and rights, aligning portfolio performance with broader social change objectives.

Traditional investing goal vs Values-based investing goal for money management. Infographic

moneydiff.com

moneydiff.com