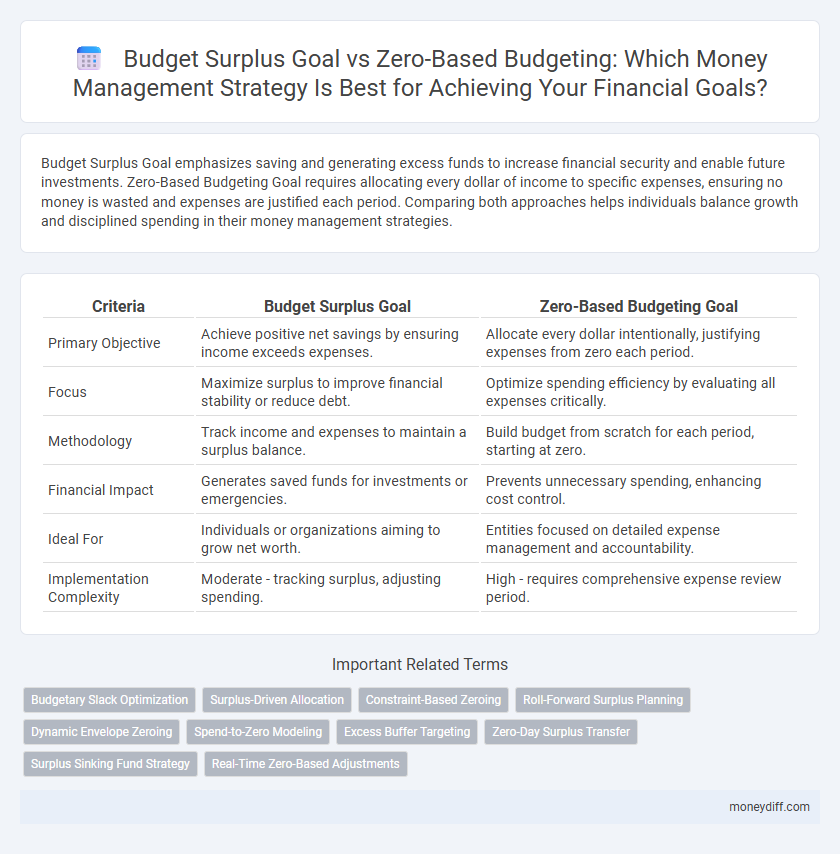

Budget Surplus Goal emphasizes saving and generating excess funds to increase financial security and enable future investments. Zero-Based Budgeting Goal requires allocating every dollar of income to specific expenses, ensuring no money is wasted and expenses are justified each period. Comparing both approaches helps individuals balance growth and disciplined spending in their money management strategies.

Table of Comparison

| Criteria | Budget Surplus Goal | Zero-Based Budgeting Goal |

|---|---|---|

| Primary Objective | Achieve positive net savings by ensuring income exceeds expenses. | Allocate every dollar intentionally, justifying expenses from zero each period. |

| Focus | Maximize surplus to improve financial stability or reduce debt. | Optimize spending efficiency by evaluating all expenses critically. |

| Methodology | Track income and expenses to maintain a surplus balance. | Build budget from scratch for each period, starting at zero. |

| Financial Impact | Generates saved funds for investments or emergencies. | Prevents unnecessary spending, enhancing cost control. |

| Ideal For | Individuals or organizations aiming to grow net worth. | Entities focused on detailed expense management and accountability. |

| Implementation Complexity | Moderate - tracking surplus, adjusting spending. | High - requires comprehensive expense review period. |

Understanding Budget Surplus Goal

A budget surplus goal focuses on ensuring that income exceeds expenses within a specific period, creating extra funds for savings, debt reduction, or investments. It prioritizes financial stability by maintaining positive cash flow and avoiding deficits. Effective money management under this goal promotes long-term fiscal health and increased financial flexibility.

Defining Zero-Based Budgeting Goal

Zero-based budgeting (ZBB) goal focuses on allocating every dollar of income to specific expenses, savings, or investments, ensuring no unassigned funds remain. This approach requires justifying all expenditures from a zero base each budgeting period, promoting efficient resource use and preventing unnecessary spending. Unlike a budget surplus goal, which aims to spend less than income, ZBB emphasizes intentional distribution of funds in line with financial priorities.

Core Principles: Surplus vs. Zero-Based Budgets

A budget surplus goal emphasizes generating excess funds by controlling expenses and increasing revenue to build financial reserves, promoting long-term stability. In contrast, zero-based budgeting requires each expense to be justified from scratch every period, fostering meticulous resource allocation and eliminating waste. Core principles diverge as surplus budgeting prioritizes financial growth, while zero-based budgeting centers on precise expense justification and efficiency.

Advantages of Budget Surplus Approach

A budget surplus approach promotes financial stability by ensuring that revenues exceed expenditures, creating a cushion for unexpected expenses and debt reduction. This method enhances fiscal discipline and strengthens creditworthiness by preventing overspending and accumulating reserves. Surpluses also provide flexibility for future investments and economic downturns without the need to cut essential services.

Benefits of Zero-Based Budgeting

Zero-Based Budgeting (ZBB) enhances money management by requiring every expense to be justified from scratch, promoting greater financial discipline and reducing unnecessary spending. This approach improves resource allocation efficiency compared to traditional Budget Surplus Goals by focusing on actual needs rather than past budgets. ZBB fosters transparent financial planning, enabling organizations and individuals to optimize cash flow and maximize savings opportunities.

Drawbacks of Budget Surplus Goal

A budget surplus goal often leads to excessive saving that can limit strategic investments and hinder growth opportunities. Rigid adherence to surplus targets may cause underfunding of essential programs, reducing organizational flexibility and responsiveness. Unlike zero-based budgeting, which requires justification of all expenses, surplus goals risk perpetuating inefficiencies by focusing solely on cutting costs rather than optimizing resource allocation.

Challenges of Zero-Based Budgeting

Zero-Based Budgeting (ZBB) faces challenges such as time-consuming detailed analysis and the need for every expense to be justified from scratch, which can strain organizational resources and delay decision-making. Unlike the Budget Surplus Goal that prioritizes accumulating excess funds, ZBB requires comprehensive scrutiny of all budget items, increasing complexity and potential resistance from departments accustomed to incremental budgeting. These challenges hinder ZBB's implementation efficiency and require strong management commitment and training to overcome.

Choosing the Right Method for Financial Goals

Selecting between a budget surplus goal and zero-based budgeting hinges on specific financial objectives and spending habits. Budget surplus prioritizes saving by ensuring income consistently exceeds expenses, fostering a buffer for future investments or emergencies. Zero-based budgeting demands detailed expense assignment to every dollar, promoting disciplined spending aligned exactly with monetary limits, ideal for precise cash flow control and maximizing resource allocation.

Real-Life Applications: Surplus vs. Zero-Based Budgeting

Budget surplus goals emphasize generating excess income beyond expenditures to build savings or invest in future projects, commonly employed by governments and corporations to ensure financial stability. Zero-based budgeting goals focus on justifying every expense from scratch each period, fostering efficient resource allocation and eliminating unjustified costs, widely used in businesses aiming to optimize operational efficiency. Real-life applications show that budget surpluses enhance long-term financial resilience, while zero-based budgeting drives disciplined spending and accountability.

Recommendations for Effective Money Management

Prioritize a budget surplus goal to ensure consistent financial stability and build savings for future expenses. Incorporate zero-based budgeting to allocate every dollar intentionally, eliminating waste and maximizing spending efficiency. Combine both methods by setting specific surplus targets within a zero-based budget framework to achieve precise control over finances and promote disciplined money management.

Related Important Terms

Budgetary Slack Optimization

Budget surplus goals prioritize maintaining excess funds to cover unexpected expenses, often leading to budgetary slack that reduces financial efficiency. Zero-based budgeting minimizes budgetary slack by requiring all expenses to be justified from scratch, optimizing resource allocation and enhancing fiscal discipline.

Surplus-Driven Allocation

Budget surplus goal emphasizes maintaining excess funds after expenses to enhance financial stability and enable strategic investments, contrasting with zero-based budgeting's focus on justifying all expenses from zero. Surplus-driven allocation prioritizes directing remaining funds to high-impact areas, maximizing resource efficiency and long-term growth potential in money management.

Constraint-Based Zeroing

Constraint-Based Zeroing in zero-based budgeting ensures every dollar is allocated to essential expenses, eliminating waste by requiring justification for each budget item, contrasting with the budget surplus goal that emphasizes saving excess funds without scrutinizing individual expenditures. This method drives disciplined financial management by optimizing resource allocation according to strict constraints, promoting transparency and accountability in money management.

Roll-Forward Surplus Planning

Roll-forward surplus planning in budget surplus goals prioritizes extending previous surpluses into future periods, ensuring consistent financial stability by allocating excess funds toward debt reduction or investment. In contrast, zero-based budgeting goals reset all expenses to zero each cycle, requiring justification for every expenditure without assuming prior surpluses, promoting detailed cost control and resource optimization.

Dynamic Envelope Zeroing

Dynamic Envelope Zeroing enhances money management by allocating every dollar a purposeful role, aligning with the Zero-Based Budgeting Goal to eliminate waste and increase financial control. Unlike the traditional Budget Surplus Goal that emphasizes excess funds, Dynamic Envelope Zeroing ensures precise, need-based spending while maintaining neutral balances across expense categories.

Spend-to-Zero Modeling

Spend-to-zero modeling aligns closely with zero-based budgeting goals by ensuring every dollar is allocated purposefully, eliminating unnecessary expenditures and avoiding surplus accumulation. This method contrasts with budget surplus goals, which prioritize underspending, potentially leading to inefficient capital allocation and reduced financial agility.

Excess Buffer Targeting

Budget surplus goals prioritize accumulating excess funds by consistently spending less than income, creating a financial buffer for future needs or unexpected expenses. Zero-based budgeting goals focus on allocating every dollar purposefully with no surplus, optimizing resource use but limiting excess buffer targeting.

Zero-Day Surplus Transfer

Zero-Day Surplus Transfer in zero-based budgeting ensures every dollar is allocated precisely, eliminating unspent funds at the end of the period and maximizing financial efficiency. Unlike a budget surplus goal that allows leftover money, this approach drives disciplined spending aligned strictly with planned expenses and objectives.

Surplus Sinking Fund Strategy

A Budget Surplus Goal focuses on generating excess funds to allocate toward a Surplus Sinking Fund Strategy, ensuring debt reduction and future expense coverage without new borrowing. Zero-Based Budgeting Goal requires justifying every expense annually, optimizing resource allocation but may limit consistent surplus generation for sinking funds.

Real-Time Zero-Based Adjustments

Real-time zero-based adjustments enable precise allocation of every dollar by continuously reviewing and justifying expenses, promoting dynamic financial control beyond static budget surplus goals. This method fosters agile money management that aligns outflows directly with current priorities, optimizing cash flow without relying solely on surplus accumulation.

Budget Surplus Goal vs Zero-Based Budgeting Goal for money management. Infographic

moneydiff.com

moneydiff.com