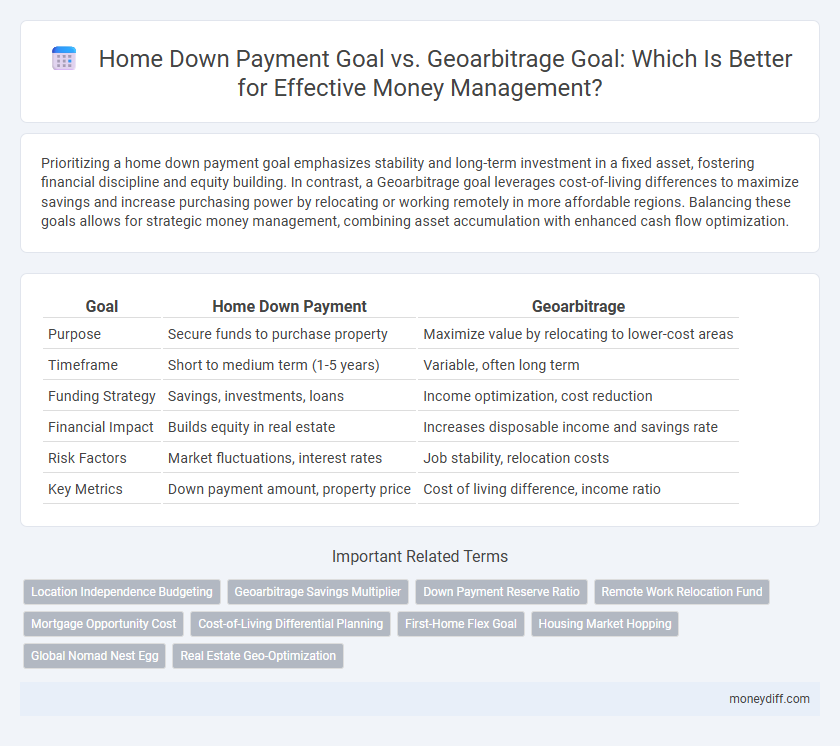

Prioritizing a home down payment goal emphasizes stability and long-term investment in a fixed asset, fostering financial discipline and equity building. In contrast, a Geoarbitrage goal leverages cost-of-living differences to maximize savings and increase purchasing power by relocating or working remotely in more affordable regions. Balancing these goals allows for strategic money management, combining asset accumulation with enhanced cash flow optimization.

Table of Comparison

| Goal | Home Down Payment | Geoarbitrage |

|---|---|---|

| Purpose | Secure funds to purchase property | Maximize value by relocating to lower-cost areas |

| Timeframe | Short to medium term (1-5 years) | Variable, often long term |

| Funding Strategy | Savings, investments, loans | Income optimization, cost reduction |

| Financial Impact | Builds equity in real estate | Increases disposable income and savings rate |

| Risk Factors | Market fluctuations, interest rates | Job stability, relocation costs |

| Key Metrics | Down payment amount, property price | Cost of living difference, income ratio |

Understanding Home Down Payment Goals

Understanding home down payment goals is essential for effective money management, as it determines the required savings target based on property prices and loan options in the desired location. Geoarbitrage goals involve leveraging cost-of-living differences between regions to accelerate savings, potentially reducing the time needed to reach a home down payment. Prioritizing a clear home down payment goal aligned with local real estate markets enables strategic budgeting and investment decisions.

What Is Geoarbitrage in Money Management?

Geoarbitrage in money management involves leveraging differences in cost of living between locations to maximize savings and investment potential. Unlike a home down payment goal, which focuses on accumulating funds for a specific real estate purchase, geoarbitrage emphasizes relocating or earning in higher-income regions while spending in lower-cost areas to increase financial flexibility. This strategy can accelerate wealth building by optimizing income-to-expense ratios across diverse geographic markets.

Comparing Costs: Homeownership vs Geoarbitrage

Homeownership requires saving for a significant down payment, often 20% of the property price, which can strain finances in high-cost areas. Geoarbitrage leverages cost-of-living differences by relocating to regions with lower expenses, enabling more efficient money management and faster wealth accumulation. Comparing costs reveals that geoarbitrage can reduce housing and everyday expenses, offering greater financial flexibility than committing to expensive homeownership markets.

Long-Term Financial Impact of Home Down Payments

Allocating funds toward a home down payment often builds long-term equity and potential property appreciation, serving as a foundation for generational wealth. In contrast, geoarbitrage leverages cost-of-living differences to optimize short-term cash flow but may lack the tangible asset growth associated with real estate investments. Prioritizing a home down payment can lead to increased financial stability and wealth accumulation over time, surpassing the immediate liquidity benefits offered by geoarbitrage strategies.

Geoarbitrage: Pros and Cons for Your Finances

Geoarbitrage leverages the cost-of-living differences between locations to maximize financial efficiency, allowing individuals to stretch income further by living in lower-cost areas while maintaining higher-paying remote jobs. This strategy can accelerate savings and debt repayment compared to a traditional home down payment goal, which often ties funds to local real estate markets and may limit liquidity. However, geoarbitrage can involve challenges such as potential lifestyle adjustments, tax implications, and distance from familiar support networks, requiring careful financial and personal consideration.

Opportunity Cost: Real Estate vs Relocation

Allocating funds toward a home down payment ties capital to a fixed asset in a specific location, potentially limiting liquidity and mobility. In contrast, pursuing a geoarbitrage goal by relocating to a lower-cost area can reduce living expenses and increase disposable income, creating opportunities for investment diversification. Understanding the opportunity cost between real estate equity buildup and enhanced cash flow through geoarbitrage is critical for optimizing long-term financial growth.

Building Wealth: Equity vs Savings Growth

Home down payment goals focus on building equity by investing in real estate, providing long-term asset appreciation and financial stability. Geoarbitrage goals prioritize maximizing savings growth by leveraging lower living costs in different regions, allowing faster accumulation of liquid funds. Balancing equity-building through property investment with strategic savings growth ensures diversified wealth management and enhances overall financial security.

Risk Factors: Market Stability and Mobility

Home down payment goals face significant risk factors related to market stability due to real estate price fluctuations and local economic conditions, potentially delaying savings progress. Geoarbitrage goals carry mobility risks, as relocating to a lower cost-of-living area depends on job opportunities and personal adaptability to new environments. Balancing these goals requires evaluating the volatility of housing markets against the flexibility and uncertainties of geographic mobility.

Lifestyle Considerations: Roots or Freedom?

Choosing a home down payment goal often reflects a desire for stability, community roots, and long-term investment in a specific location. Geoarbitrage goals prioritize financial freedom and lifestyle flexibility by leveraging cost-of-living differences across regions to maximize savings and income potential. Understanding these lifestyle considerations helps tailor money management strategies to either build a secure foundation or pursue geographic and financial independence.

Choosing the Right Goal: Personal Finance Scenarios

Selecting between a home down payment goal and a geoarbitrage goal depends on individual financial priorities and lifestyle aspirations. A home down payment goal targets long-term asset building and stability in a chosen location, while geoarbitrage focuses on maximizing purchasing power by relocating to lower-cost areas. Evaluating factors such as housing market trends, cost of living differentials, and career opportunities is essential to align money management strategies with personal finance objectives.

Related Important Terms

Location Independence Budgeting

Home down payment goals require accumulating a substantial, localized savings amount tied to specific real estate markets, often limiting financial flexibility and geographic mobility. In contrast, geoarbitrage goals prioritize maximizing income and minimizing expenses by leveraging cost-of-living differences across global locations, enabling efficient location-independent budgeting and faster wealth accumulation.

Geoarbitrage Savings Multiplier

Geoarbitrage savings multiplier significantly accelerates wealth accumulation by leveraging lower living costs in target locations compared to high-cost home down payment goals, maximizing disposable income and investment potential. Prioritizing geoarbitrage enables a strategic boost in savings rate, often doubling or tripling capital growth speed versus traditional local home purchase strategies.

Down Payment Reserve Ratio

The Down Payment Reserve Ratio measures the proportion of funds allocated specifically for a home down payment compared to savings aimed at geoarbitrage opportunities, directly impacting financial flexibility and leverage in property acquisition versus geographic investment strategies. Optimizing this ratio ensures balanced liquidity for securing real estate assets while maintaining capital for cost-of-living arbitrage, maximizing overall wealth growth potential.

Remote Work Relocation Fund

Allocating funds between a home down payment goal and a geoarbitrage goal for a Remote Work Relocation Fund optimizes financial flexibility and cost efficiency by leveraging lower living expenses in target locations. Prioritizing geoarbitrage savings supports remote workers in maximizing disposable income, accelerating the relocation process without compromising long-term homeownership plans.

Mortgage Opportunity Cost

Prioritizing a home down payment goal accelerates equity building but may limit liquidity compared to geoarbitrage strategies that optimize cost of living by relocating to lower-expense areas. Evaluating mortgage opportunity cost reveals that investing savings through geoarbitrage can yield higher returns than early mortgage payments, enhancing long-term financial growth.

Cost-of-Living Differential Planning

Allocating funds between a home down payment and geoarbitrage goals requires precise cost-of-living differential planning to maximize financial leverage and optimize purchasing power. Prioritizing investments in lower-cost regions can accelerate savings growth while balancing long-term equity building through property acquisition.

First-Home Flex Goal

The First-Home Flex Goal balances building a home down payment with leveraging geoarbitrage strategies to maximize savings and investment potential. Prioritizing flexible financial planning allows individuals to adapt spending based on regional cost differences while steadily accumulating funds for a property purchase.

Housing Market Hopping

Prioritizing a home down payment goal provides stability in securing real estate equity, while a geoarbitrage strategy leverages regional cost differences to maximize disposable income and savings rates. Housing market hopping enables investors to capitalize on lower-price markets for affordable entry points and then relocate to higher-value areas, optimizing wealth growth and financial flexibility.

Global Nomad Nest Egg

Prioritizing a Global Nomad Nest Egg aligns with geoarbitrage goals by leveraging lower living costs abroad to maximize savings growth and investment opportunities. In contrast, a traditional home down payment goal often requires capital concentrated in one location, limiting financial flexibility and potential global income diversification.

Real Estate Geo-Optimization

Home down payment goals prioritize saving a specific amount to secure property ownership, while Geoarbitrage goals focus on leveraging geographic cost-of-living differentials to maximize investment potential and affordable living. Real estate geo-optimization strategically balances property market conditions with regional economic factors to optimize financial outcomes and accelerate wealth building.

Home down payment goal vs Geoarbitrage goal for money management. Infographic

moneydiff.com

moneydiff.com