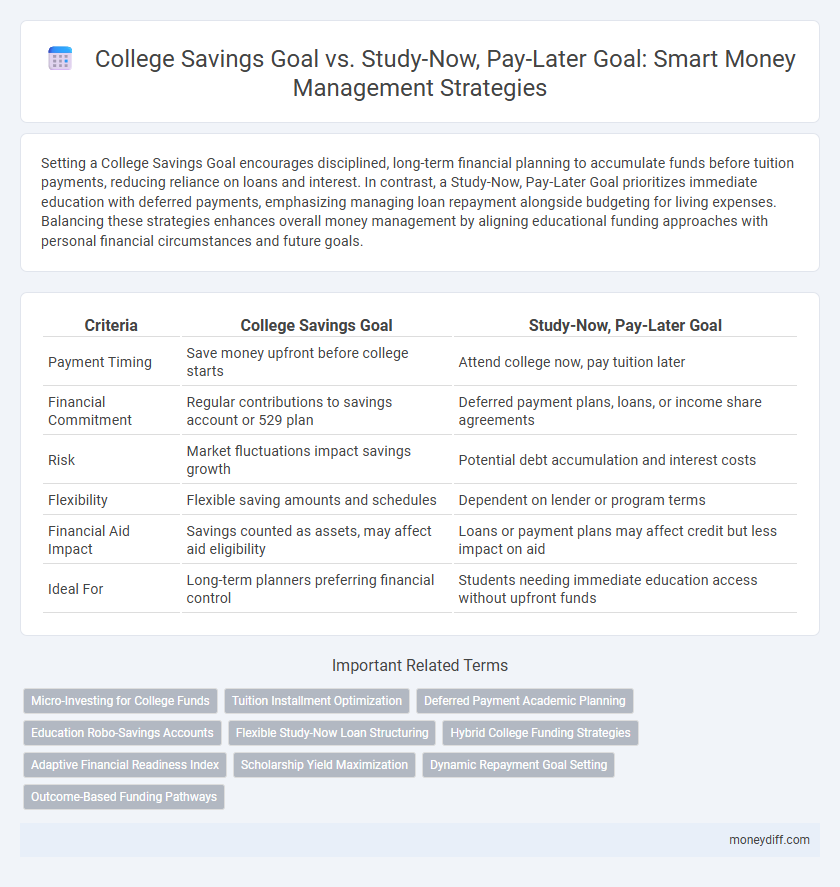

Setting a College Savings Goal encourages disciplined, long-term financial planning to accumulate funds before tuition payments, reducing reliance on loans and interest. In contrast, a Study-Now, Pay-Later Goal prioritizes immediate education with deferred payments, emphasizing managing loan repayment alongside budgeting for living expenses. Balancing these strategies enhances overall money management by aligning educational funding approaches with personal financial circumstances and future goals.

Table of Comparison

| Criteria | College Savings Goal | Study-Now, Pay-Later Goal |

|---|---|---|

| Payment Timing | Save money upfront before college starts | Attend college now, pay tuition later |

| Financial Commitment | Regular contributions to savings account or 529 plan | Deferred payment plans, loans, or income share agreements |

| Risk | Market fluctuations impact savings growth | Potential debt accumulation and interest costs |

| Flexibility | Flexible saving amounts and schedules | Dependent on lender or program terms |

| Financial Aid Impact | Savings counted as assets, may affect aid eligibility | Loans or payment plans may affect credit but less impact on aid |

| Ideal For | Long-term planners preferring financial control | Students needing immediate education access without upfront funds |

College Savings Goal: Building a Financial Safety Net

College savings goals focus on creating a financial safety net by accumulating funds early to cover tuition, books, and living expenses, minimizing the need for high-interest loans. Prioritizing regular contributions to a 529 plan or education savings account maximizes tax advantages and growth potential over time. This proactive approach ensures reduced financial stress and greater flexibility during the college years.

Study-Now, Pay-Later: Understanding Deferred Payment Options

Study-Now, Pay-Later plans allow students to access education immediately while deferring tuition payments through structured loan options or income share agreements. These deferred payment methods offer flexibility in managing cash flow and reduce the immediate financial burden compared to traditional upfront college savings. Understanding interest rates, repayment terms, and eligibility criteria is essential for optimizing financial outcomes and preventing long-term debt challenges.

Weighing the Pros and Cons: Savings vs. Student Loans

College savings goals offer the advantage of reduced debt and interest payments by allowing funds to accumulate over time, while study-now, pay-later approaches rely on student loans that may result in long-term financial burdens due to interest and repayment terms. Prioritizing college savings can build financial security and lower overall education costs, but requires early and consistent contributions that might limit current cash flow. Student loans provide immediate access to education without upfront saving but carry risks of debt accumulation and potential credit impacts, making it crucial to evaluate repayment capacity and interest rates before choosing this route.

The Impact on Future Financial Freedom

Allocating funds toward a college savings goal builds a financial cushion that reduces reliance on loans, preserving future income for other investments and expenses. In contrast, a study-now, pay-later approach can increase debt burden, limiting financial flexibility and delaying wealth accumulation. Prioritizing early savings enhances long-term financial independence and supports smoother cash flow in adulthood.

Risk Assessment: Debt Burden vs. Early Planning

College savings goals emphasize early planning to reduce risk by minimizing future debt burden through consistent contributions to tax-advantaged accounts like 529 plans. Study-now, pay-later goals increase the risk of high debt burdens due to reliance on student loans with variable interest rates and repayment schedules. Effective money management balances these approaches by assessing individual risk tolerance and financial capacity for early savings versus manageable debt levels.

Long-Term Cost Comparison: Saving Ahead vs. Borrowing

Saving ahead for college significantly reduces the long-term financial burden by minimizing interest payments and loan fees associated with borrowing. College savings plans, such as 529 accounts, offer tax advantages that enhance investment growth over time compared to the higher total cost of study-now, pay-later loans. Borrowing often leads to repayment amounts that exceed initial tuition costs by 20% to 40%, emphasizing the economic benefit of advance saving strategies.

Flexibility and Accessibility of Each Approach

College savings goals offer structured flexibility through dedicated accounts like 529 plans, allowing funds to grow tax-free and be used specifically for education expenses, but they often restrict accessibility to qualified costs only. Study-now, pay-later approaches provide immediate access to education with financing options such as student loans or income-share agreements, enhancing availability but potentially limiting long-term financial flexibility due to repayment obligations. Balancing these approaches involves weighing the tax benefits and targeted use of savings against the immediate funding and broader access provided by deferred payment methods.

Psychological Effects: Security of Savings vs. Loan Anxiety

Setting a college savings goal fosters a sense of financial security by accumulating funds ahead of time, reducing stress associated with future expenses. In contrast, relying on a study-now, pay-later approach can trigger loan anxiety due to the uncertainty of debt repayment and interest accumulation. Prioritizing savings cultivates peace of mind and disciplined money management, while deferred payment plans may increase psychological pressure throughout and beyond the academic journey.

Parental Involvement and Financial Guidance

Parental involvement plays a critical role in achieving College Savings Goals by instilling disciplined financial habits and long-term planning in children. In contrast, the Study-Now, Pay-Later approach requires parents to provide clear financial guidance on managing debt and understanding loan responsibilities. Effective money management combines early savings education with ongoing parental support to balance immediate educational needs and future financial stability.

Choosing the Best Strategy for Your Educational Path

Choosing the best strategy for your educational path requires evaluating the benefits of a College Savings Goal, which builds funds upfront through tax-advantaged accounts like 529 plans, versus a Study-Now, Pay-Later Goal that leverages loans and income-driven repayment options to manage costs during or after college. College Savings Goals reduce debt burden and provide greater financial stability, while Study-Now, Pay-Later Goals enable immediate enrollment but may increase long-term liabilities. Assessing your family's financial situation, risk tolerance, and education timeline helps determine the optimal balance between saving early and financing education later.

Related Important Terms

Micro-Investing for College Funds

Micro-investing platforms enable consistent, small contributions toward a college savings goal, leveraging compound growth for long-term fund accumulation. In contrast, a study-now, pay-later approach shifts financial responsibility to student loans, increasing debt risk without the benefit of pre-invested assets.

Tuition Installment Optimization

Optimizing tuition installment plans through a study-now, pay-later approach offers flexible cash flow management compared to traditional college savings goals that require upfront lump-sum funding. Strategic use of installment options can reduce immediate financial strain while aligning payments with future income streams, enhancing overall tuition cost efficiency.

Deferred Payment Academic Planning

Deferred Payment Academic Planning enables students to manage college tuition costs by opting for study-now, pay-later plans, reducing immediate financial burden while aligning payments with future income streams. This approach contrasts with traditional college savings goals that require upfront fund accumulation, offering enhanced cash flow flexibility and access to education without large initial investments.

Education Robo-Savings Accounts

Education Robo-Savings Accounts automate contributions toward College Savings Goals by leveraging algorithm-driven adjustments based on spending patterns and financial milestones, ensuring consistent growth dedicated to higher education expenses. In contrast, Study-Now, Pay-Later Goals emphasize immediate access to funds through income-share agreements or deferred loans, which may lack the proactive saving discipline provided by robo-savings technology.

Flexible Study-Now Loan Structuring

Flexible study-now loan structuring allows borrowers to customize repayment schedules based on future income projections, offering greater adaptability compared to rigid college savings goals. This approach supports timely education funding without the need for upfront capital, optimizing cash flow management and reducing financial strain during college years.

Hybrid College Funding Strategies

Hybrid college funding strategies combine the benefits of College Savings Goals and Study-Now, Pay-Later Goals to optimize financial flexibility and reduce student debt. By balancing upfront savings with manageable loan options, families can better adapt to fluctuating education costs while maintaining fiscal responsibility.

Adaptive Financial Readiness Index

The College Savings Goal prioritizes long-term financial planning by contributing steadily to dedicated education accounts, enhancing an individual's score on the Adaptive Financial Readiness Index through consistent asset growth and reduced debt reliance. In contrast, the Study-Now, Pay-Later Goal impacts the index differently by increasing short-term liquidity needs and potential debt, which may lower financial readiness due to higher borrowing and repayment pressures.

Scholarship Yield Maximization

Maximizing scholarship yield is crucial when comparing College Savings Goals versus Study-Now, Pay-Later strategies, as securing scholarships reduces overall debt and financial burden. Prioritizing early savings builds a stronger financial foundation, while leveraging scholarships through timely applications enhances the effectiveness of both approaches.

Dynamic Repayment Goal Setting

Dynamic repayment goal setting enhances college savings strategies by tailoring payment plans to fluctuating financial circumstances, improving flexibility compared to traditional study-now, pay-later approaches. This method optimizes fund allocation and minimizes debt accumulation through adaptive, personalized repayment schedules aligned with income variability and savings growth.

Outcome-Based Funding Pathways

College savings goals prioritize accumulating funds upfront to cover tuition and expenses, ensuring full financial coverage at enrollment. Study-now, pay-later goals leverage income-share agreements or deferred payment plans, enabling students to manage education costs without immediate cash, aligning repayment with post-graduation income outcomes.

College Savings Goal vs Study-Now, Pay-Later Goal for money management. Infographic

moneydiff.com

moneydiff.com